Evergrande default implicationsEvergrande Has Finally Defaulted: Here's What Happens Next | ZeroHedge My Comment : I think this should be considered a very big deal and yet the markets are not reacting.

Excerpts:

For now, Chinese authorities are signaling that they plan to ring-fence Evergrande and limit contagion rather than orchestrate a rescue as they’ve done during past crises. Whether and how they can do that, will determine if 2022 is a year of recovery and normalization - as JPMorgan wrote in its year ahead outlook - or a global depression. So far, containment efforts haven’t assuaged investors. While pain has so far largely been contained to China’s smaller offshore credit market, that’s little consolation for developers that have relied heavily on international investors to raise funds. Borrowing costs have spiked for companies with the weakest balance sheets, including Kaisa and Fantasia Holdings Group Co.

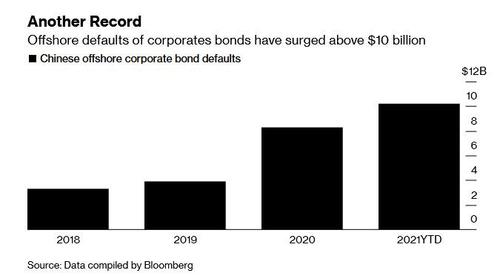

In total, Bloomberg calculates that Chinese borrowers have defaulted on a record $10.2 billion of offshore bonds this year, with real estate firms making up 36% of that.

“There is extreme stress in the market,” with about half the developers in the country in deep financial distress and pricing in high default risk, said Jenny Zeng, co-head of Asia Pacific fixed-income at Alliance Bernstein.

But most importantly, as noted earlier, China is desperate to limit the fallout on the broader housing market, in a country where real estate accounts for about a quarter of economic output and as much as 75% of household wealth as we have noted for half a decade. China’s housing slump has intensified in recent months after sales plunged and home prices fell for the first time in six years.

Contract sales by the country’s top 100 developers plunged 38% in November from a year earlier to 751 billion yuan, sharper than the 32% drop in the previous month, according to preliminary data from China Real Estate Information Corp.

As we explained in detail recently, any slowdown in real estate could have a ripple effect not only on China’s economy but on global growth. China’s growth slowed in the third quarter, with signs there will be more pain to come.

The Federal Reserve last month warned that fragility in China’s commercial real-estate sector could spread to the U.S. if it deteriorates dramatically. China’s real estate sector makes up almost half of the world’s distressed dollar-denominated debt.

The bottom line, however, was summarized best by China Beige Book: "while direct fallout from the Evergrande bankruptcy - which has been telegraphed for months - won't be the problem, the problem is having a billion Chinese watch this play out, then expecting them to spend afterward."