“Prices of copper are likely to remain supported as China speeds up fiscal stimulus and ease monetary conditions, while interest rate hikes in the United States would be slow with the Fed still believing inflation to be transitory,” a Singapore-based trader said, requesting anonymity.

Bullish outlook

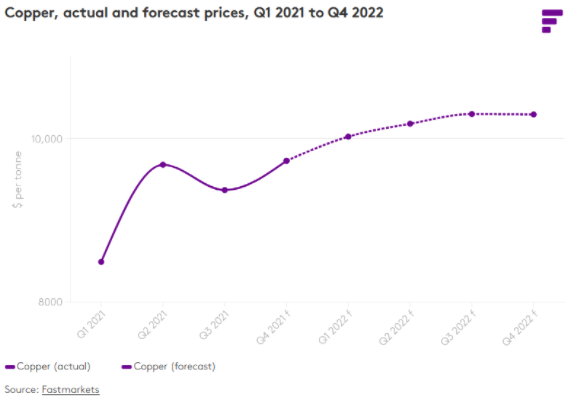

Fastmarkets expects copper prices to perform well in the months ahead.

According to the agency, the deficit in the global refined copper market is set to prevail in 2022.

“Total world copper mine production growth could surge to 7% in 2022 from just 2% in 2021. Such strong growth will bring the global concentrate market back to balance in 2022 after two deep deficit years. However, we expect a higher rate of supply disruptions next year given so much new and expanded capacity due to come online or ramp up,” said Fastmarkets in a note.

The agency expects a bigger deficit of refined copper of 571,000 tonnes for 2021 as a whole, assuming 2.2% growth in refined output and 2.5% growth in refined usage.

“Even though the Omicron variant constitutes a potential bearish risk to our overall copper outlook, we continue to think that the bull market is not over yet.”

(With files from Reuters)