While the oil prices fluctuated and COVID-19 continued to wreak havoc, many notable oil and gas players in the Canadian market managed to note significant returns this year. Some even recorded year-to-date (YTD) returns of over 100 per cent.

The S&P/TSX Capped Energy Index, for one, has risen by over 71 per cent so far this year.

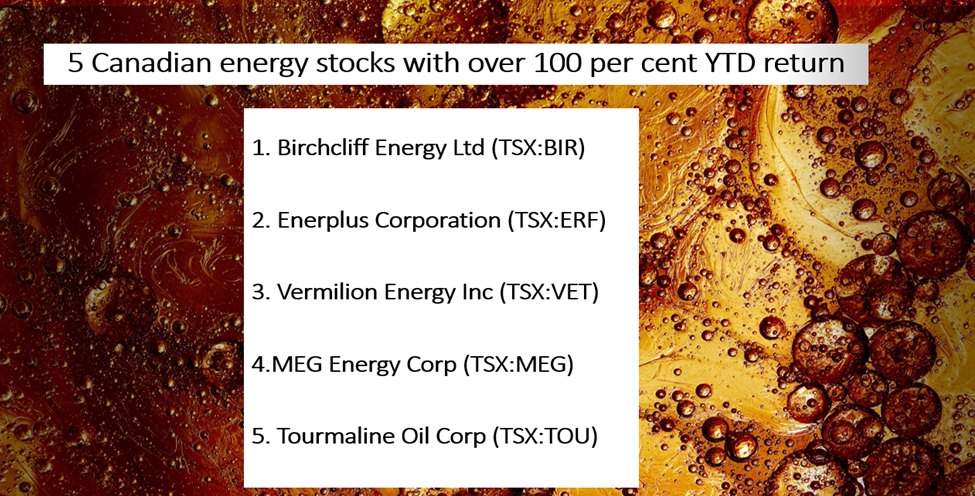

Let us look at some Canadian energy stocks that rose over 100 per cent in 2021.

Image source:© 2021 Kalkine Media®

1. Birchcliff Energy Ltd (TSX: BIR)

Birchcliff Energy Ltd recorded an average production of 84,924 barrels of oil equivalent per day (boe/d) in Q3 FY2021, up by eight per cent year-over-year (YoY).

Its adjusted funds flow (AFF) rose 183 per cent YoY to C$ 168.1 million in the latest quarter.

The oil and gas producer also announced a 100 per cent increase in its quarterly dividend. It is now scheduled to pay a dividend of C$ 0.01 on December 31.

BIR stock soared by roughly 262 per cent YTD and closed at C$ 6.40 apiece on Thursday, December 16.

2. Enerplus Corporation (TSX: ERF)

Enerplus Corporation posted an AFF of C$ 255.7 million in Q3 FY2021, while its average production increased by 36 per cent YoY to 123,454 boe/d.

The Calgary, Alberta-based energy producer also hiked its dividend to C$ 0.041 apiece, a quarter-over-quarter (QoQ) rise of eight per cent.

The energy stock delivered a YTD return of almost 214 per cent and closed at C$ 12.49 apiece on December 16.

3. Vermilion Energy Inc (TSX: VET)

Canadian oil and gas company Vermillion Energy Inc recorded a growth of 52 per cent in its funds flow of C$ 263 million in Q3 FY2021.

Vermillion Energy, which held a market capitalization of C$ 2.24 billion, saw its stock close at C$ 13.86 apiece on December 16.

VET stock swelled by about 144 per cent this year.

4. MEG Energy Corp (TSX: MEG)

Oil production firm MEG Energy Corp reported an AFF of 239 million and net earnings of C$ 54 million in Q3 FY2021.

It produced 91,506 barrels per day in the latest quarter at a steam oil ratio of 2.56.

MEG stock surged by nearly 143 per cent YTD and closed at C$ 10.81 apiece on December 16.

Also read: Top 4 penny dividend stocks of 2021

5. Tourmaline Oil Corp (TSX: TOU)

Natural gas and crude oil company Tourmaline Oil Corp posted a cash flow of C$ 761.3 million in Q3 FY2021, notably up from C$ 279.9 million a year ago.

Tourmaline’s increased quarterly dividend of C$ 0.18 is due on December 31.

TOU stock jumped by over 136 per cent YTD and closed at C$ 39.85 apiece on December 16.

Also read: How to buy the best dividend stocks in Canada?

Bottom line

While fluctuating oil prices can impact energy stocks, robust players of the sector are generally strong enough to weather such scenarios.

However, investors ought to consider essential factors like climate concerns, which can hamper the demand for such energy products in the long run.