Introduction

After suspending their dividends early in 2020 amidst the turmoil of the rapidly onsetting Covid-19 pandemic, Vermilion Energy (VET) was seeing a recovery throughout 2021, as my previous article discussed. When looking ahead, they appear poised to enter a new era of dividend growth starting during 2022 that has the potential to see a very high 10%+ yield to follow during 2023 and beyond.

Executive Summary & Ratings

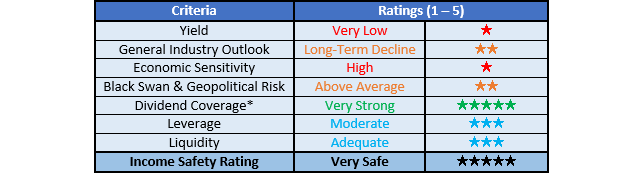

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

Author

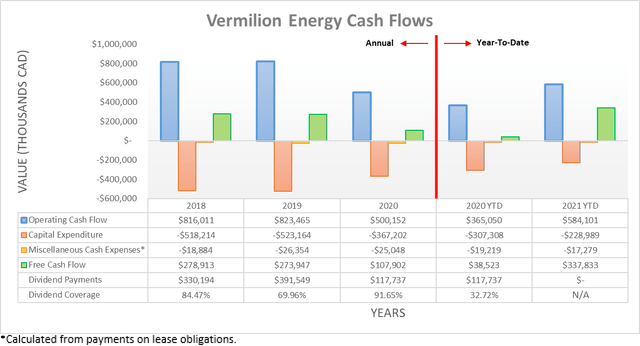

Following the strong oil price environment during the third quarter of 2021 that even saw oil prices trading north of $80 per barrel at times, it was no surprise to see their cash flow performance continue powering ahead versus their downturn-inflicted 2020 results. This saw their operating cash flow rise to C$584.1m for the first nine months of 2021, which stands a massive 60.01% higher year-on-year versus their equivalent result of C$365.1m during 2020 and even already surpasses their full-year result of C$500.2m during 2020. Despite being positive, virtually every oil and gas company is enjoying this same recovery and thus in this situation, the far more interesting development is the impending reinstatement of their dividends, as per the commentary from management included below.

"We plan to reinstate a $0.06 per share quarterly dividend commencing in Q1 2022. Our return of capital framework will be a staged approach that will increase over time as further debt targets are achieved while retaining the flexibility to adjust when necessary."

-Vermillion Energy November 29th, 2021, Announcement.

Apart from switching to a quarterly basis instead of their previous monthly basis, this sees their new era of dividend growth starting from a very conservative base point. If annualizing their new quarterly dividends of C$0.06 per share, it equals C$0.24 per share or $0.19 per share once converting at the current CAD to USD exchange rate of $0.79, which thereby implies a very low dividend yield of only 1.35% on their current share price of $14.03.

Whilst this very low dividend yield sounds rather lackluster, thankfully they are also flagging higher shareholder returns once they reach their subsequently discussed leverage target. When it comes to this aspect, the sky is the limit given their current positive outlook for oil and gas prices with management estimating to generate a massive C$1b of free cash flow during 2022, as per their previously linked November 29th, 2021, announcement. Admittedly oil and gas prices are notoriously volatile but unless there is a sudden downturn, this foretells an insanely high estimated free cash flow yield of circa 35% given their current market capitalization of approximately C$2.86b. Needless to explain in detail, this easily provides scope for a very high 10%+ dividend yield on current cost with a margin of safety, although the timing to see this very desirable income hinges upon reaching their leverage targets and thus by extension, their financial position.

Author

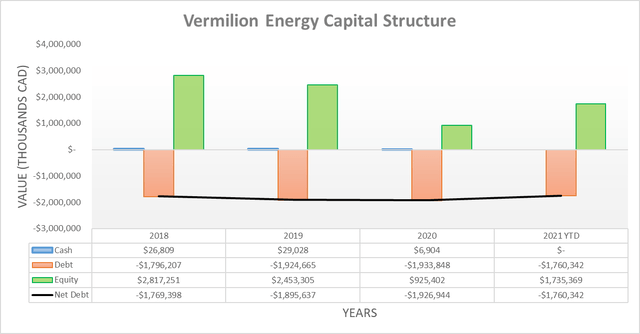

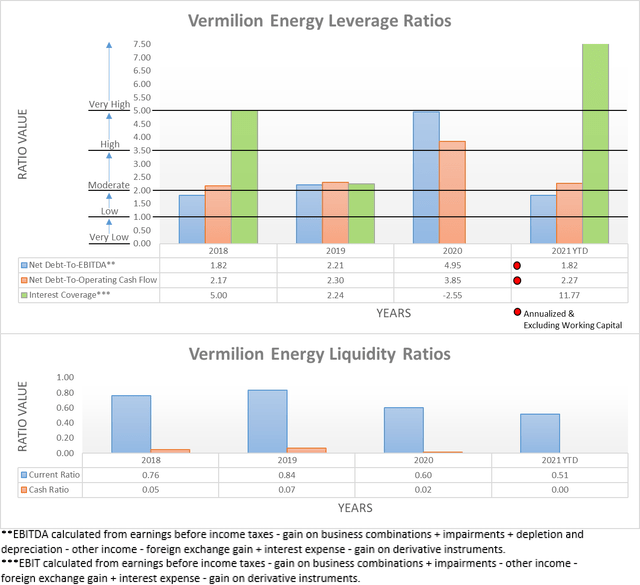

When reviewing their capital structure, their net debt of C$1.76b has remained essentially unchanged since the previous analysis at the end of the second quarter of 2021, despite their strong cash flow performance, which was mostly due to C$92.2m of various acquisitions during the third quarter. Given this lack of change, it would be rather redundant to reassess their only moderate leverage or their adequate liquidity since their cash balance also remains unchanged. The two relevant graphs have still been included below to provide context for any new readers and if interested in further details regarding these two topics, please refer to my previously linked article. At the moment, the far more important topic is their deleveraging target that sees their net debt decreasing to approximately C$1.2b, as per the commentary from management included below.

"Our next leverage target is 1.5 times net debt to trailing FFO at mid-cycle pricing which implies an absolute net debt level of approximately $1.2 billion."

-Vermillion Energy November 29th, 2021, Announcement (previously linked).

If they are to reduce their net debt to circa C$1.2b from its current level of C$1.76b, they will need to generate C$560m of excess free cash flow after dividend payments. Thankfully their quarterly dividends of C$0.06 per share should only cost a mere C$38.9m per annum given their latest outstanding share count of 161,957,000, which is essentially insignificant considering the natural volatility of oil and gas prices. The other aspect to consider is their upcoming Corrib acquisition that will cost $434m or C$549m at the current CAD to USD exchange rate, as per their previously linked November 29th, 2021, announcement. Thankfully this will boost their financial performance, which was included within their estimated C$1b of free cash flow during 2022, thereby simplifying this situation.

When this acquisition cost is combined with their existing deleveraging requirement, it effectively means that they will need to generate approximately C$1.1b to reach their deleveraging target. This is very close to their estimated C$1b of free cash flow during 2022 and thus despite initially appearing to be a rather lackluster start, if investors look further ahead into 2023 and beyond, they can have the potential to line up a very high 10%+ dividend yield on current cost after as little as one year wait.

Author

Conclusion

Despite sounding rather lackluster on the surface, their impending dividend reinstatement actually marks a new era of dividend growth. Whilst 2022 will likely end up being a year of deleveraging, if looking further ahead into 2023 and beyond, their insanely high estimated free cash flow yield has the potential to propel their very low circa 1% yield to a very high 10%+ yield on current cost in the coming years. Following this positive outlook, it should be no surprise that I believe maintaining my bullish rating is appropriate.