ArtbyBart/iStock via Getty Images

The Thesis:

On October 12th, 2021, Newcrest Mining Limited released the results of the Red Chris Block Cave Pre-Feasibility Study. Newcrest acquired a 70% ownership stake in the asset in August 2019, is the operator of the property, and has advanced significant exploration and technical work on the property. Red Chris is currently operating as an open-pit mine with plans to transition to a block cave in the near future.

The study highlighted a 31-year mine life with production of 316,000 gold ounces per annum and 80,000 tons of copper per annum between 2029 and 2034. The asset is expected to produce over an initial 31-year mine life. With an ore reserve of 8.1 million ounces of gold and 2.2 million tons of copper, Red Chris is one of the largest operating mines in Canada from a contained metal perspective.

The economics of the project were assessed using long term metal prices of US$1,500/oz Au and US$3.30/b Cu; significantly lower than spot prices which, at the time of the writing of this article, are US$1,797/oz Au and US$4.37/lb Cu.

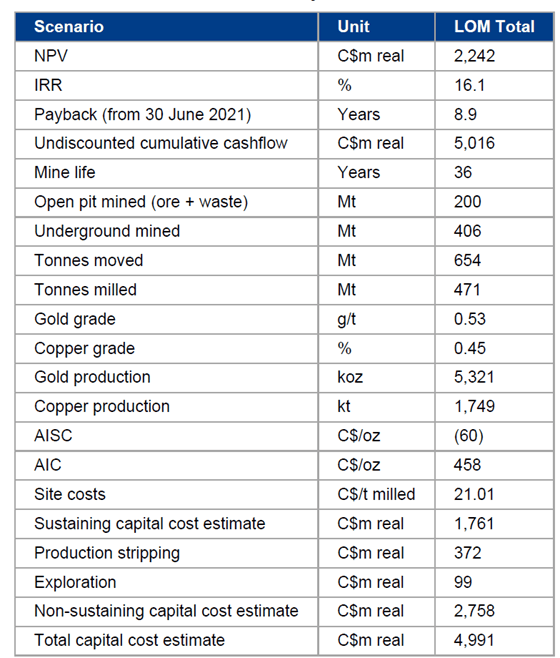

A summary of Red Chris' operating parameters and financial outputs are presented in the following table.

Red Chris Technical Report (2021)

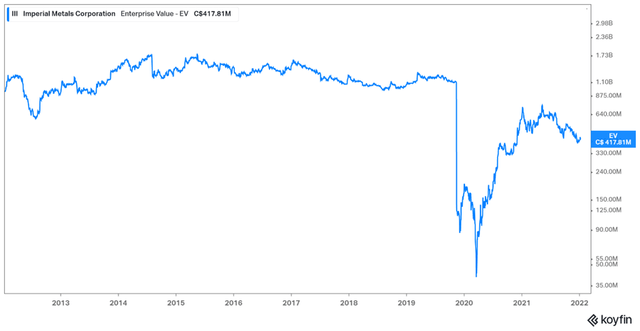

Despite significant forward progress on Red Chris and elevated commodity prices, Imperial Metals (OTCPK:IPMLF) has not seen any enterprise value appreciation since the release of the study. The author's thesis is that as the Red Chris block cave advances through engineering, permitting, and construction, Imperial Metals will rerate to a higher multiple of the project's intrinsic value.

Koyfin

Upcoming Catalysts:

Significant engineering and construction activities are required to bring the block cave online (current estimates show block cave production meaningfully commencing in Newcrest's fiscal year 2026). Newcrest is currently advancing an exploration decline towards the orebody which will allow for significant infill drilling which is required to support engineering. The next catalyst which will inform the market on the direction of the operation is the feasibility study which is due to be released in the second half of Newcrest's fiscal 2023.

Impacts Of Higher Metal Prices:

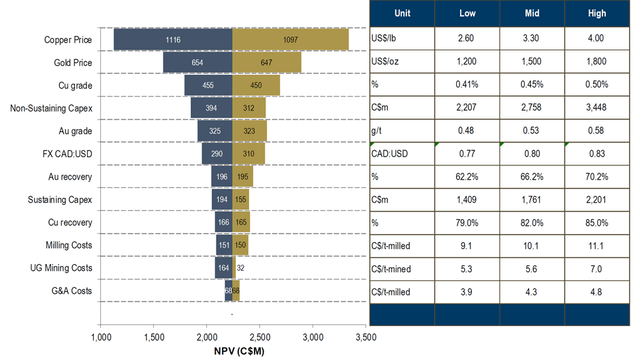

As previously noted, the Red Chris technical report utilized metal prices that are materially lower than current spot prices. The technical report provides a sensitivity assessment with respect to NPV impacts from higher metal prices. As presented in the image below, the project's NPV4.5% increases from C$2.24B to C$3.98B with the use of US$4.0/lb Cu and US$1,800/oz Au.

Red Chris Technical Report (2021)

Imperial Metals Valuation:

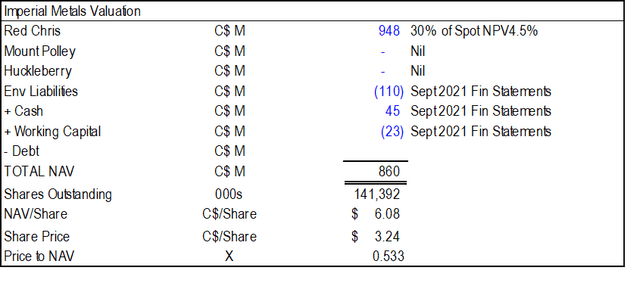

With an updated Red Chris valuation for higher metal prices, we can compare the enterprise value of the company to the intrinsic value associated with the assets. Imperial Metals share of the US$4.0/lb Cu and US$1,800/oz Au Red Chris valuation is C$948M. For conservatism, we've assumed that Imperial Metals' other assets (Mount Polley and Huckleberry) are valued at zero dollars. This is a conservative assumption given the recent commentary from Imperial Metals regarding a potential restart of Mount Polley.

After adjusting for the cash, working capital, and environmental liabilities, we arrive at a net asset value of C$860M or C$6.08/share. This compares favorably to the company's current share price of C$3.24/share.

Author's Analysis

A Precedent Transaction To Consider:

Viewed in isolation, it can be challenging to infer whether or not Imperial Metals is fairly valued relative to the intrinsic value of the business. Given Newcrest's recent purchase of 70% of the Red Chris mine, however, we can form some views on the market price of Imperial Metals. In August of 2019, Newcrest purchased 70% of Red Chris for US$806 million. The implied value for Red Chris, based on this purchase price, is US$1,151M. Imperial Metal's share of the asset, therefore, was valued at US$345M or, in Canadian dollar terms, C$438M or C$3.1/share. Despite significant exploration, engineering, and advancement, Imperial Metals' share price trades at a comparable implied value to the valuation supported by the original Newcrest transaction. We believe that this provides strong support for the company's share price.

Conclusion:

Imperial Metals is in the favorable position of owning 30% of an asset that is operated by one of the largest and most successful mining companies in the world. Red Chris is located in a first-tier jurisdiction (British Columbia, Canada) and is quickly advancing towards material production growth. Over the preceding three years, Red Chris has seen significant forward progress in terms of engineering and design. Despite this point and higher commodity prices, Imperial Metals has not seen meaningful share price appreciation. We believe that readers should further investigate Imperial Metals from a fundamental perspective as our analysis indicates value in excess of the current share price.

Company-Specific Risks:

Readers should also be cognizant of the fact that this is mining. Pit walls can fail, people can get hurt, and mines can get shut down for a plethora of reasons. Imperial Metals' future returns could be adversely impacted by metal price changes, political regimes, and operational environments.