Bet_Noire/iStock via Getty Images

Crestwood Equity Partners LP (CEQP) is a midsized midstream master limited partnership that has sizable operations in the Bakken shale and Powder River basins. The second of these in particular is an area in which we do not often see midstream operations so Crestwood could give us exposure to regions that few other companies will. Crestwood weathered through the extremely challenging market last year much better than many of its peers did so it can certainly be included in the ranks of those midstream firms that did not have to cut their distributions. When we combine this with one of the strongest balance sheets in the industry and fairly strong growth potential, we can clearly see that this company is a solid way to obtain an eye-popping 9.92% yield.

About Crestwood Equity Partners

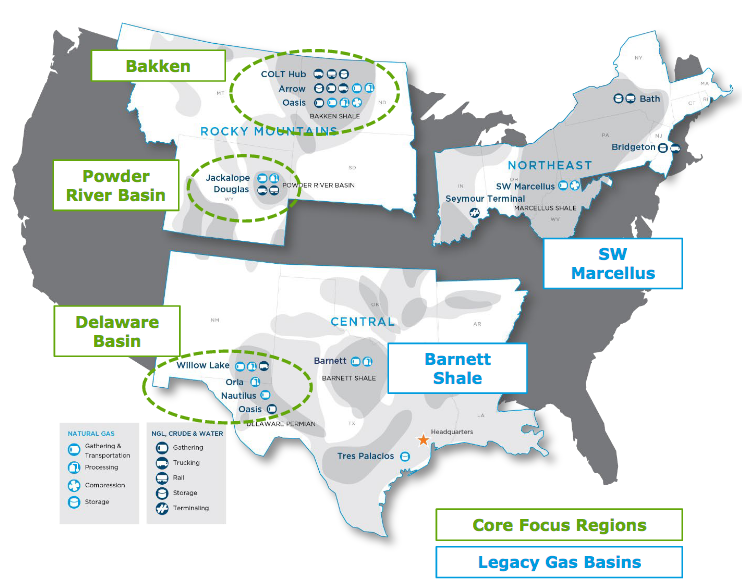

As noted in the introduction, Crestwood Equity Partners is a midsized midstream company with sizable operations in the Bakken shale and Powder River basins. These are not the company’s only areas of operations, however. In fact, the company has smaller ancillary operations in three other areas:

Source: Crestwood Equity Partners

This is nice to see because each of these basins has different fundamental dynamics. For example, it is more expensive to produce oil in the Bakken shale than it is in the Permian basin. In addition, some basins are targeted for the production of different resources. For example, the Permian basin is targeted for the production of crude oil whereas the Marcellus is targeted for the production of natural gas. This proved to be important last year as natural gas prices held up much better than crude oil prices did in the face of the COVID-19 lockdowns. As a result, the production of resources in the Marcellus also held up much better than it did in some other areas. As Crestwood Equity Partners has operations in multiple basins, the company has exposure to all of these different fundamentals, which provides it with a great deal of diversification benefits.

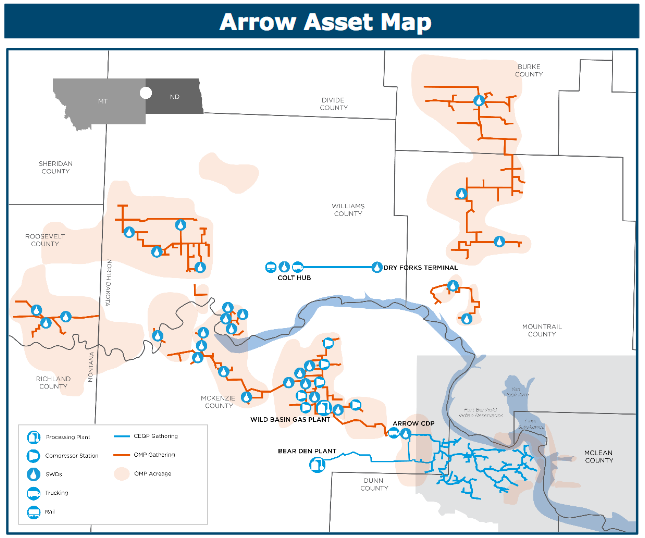

Although the company has operations in many different basins, one of the company’s largest operations is the Arrow system in the Bakken shale. This is a gathering and processing system located primarily on the Fort Berthold Indian Reservation in Mckenzie and Dunn counties of North Dakota:

Source: Crestwood Equity Partners

A gathering pipeline is a relatively short pipeline that grabs the produced resources at the well where they are extracted from the ground and carries them to the first stop on their journey to the end-user, which is typically a long-haul pipeline or some type of processing facility. As with many other types of midstream infrastructure, the cash flows generated by these pipelines are relatively insulated from fluctuations in commodity prices because of the business model that they utilize. In short, Crestwood Equity Partners secures a long-term contract with a customer for the use of these pipelines. In this case, the contracts are ten years in length, which should be sufficient to outlast and short-term economic problems. Crestwood Equity Partners receives compensation under these contracts that is based on the volume of the resources being transported, not on the value of them. In addition, these contracts include what are called minimum volume commitments, which specify a certain minimum quantity of resources that must be sent through the company’s pipelines or paid for anyway. This business model allows for remarkably stable cash flows no matter what resource prices do.

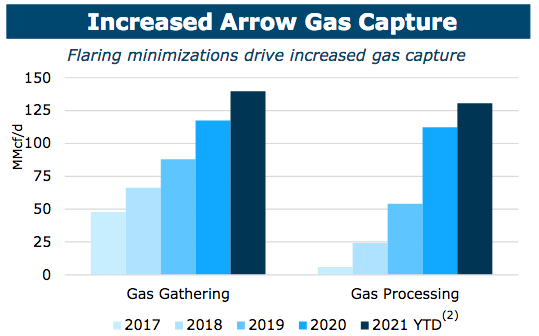

The company’s business model also means that when the volume of resources moving through its system increases, cash flows also increase. This is fortunately exactly what is happening on the Arrow system:

Source: Crestwood Equity Partners

One of the biggest reasons for this is that upstream producers in the region have been reducing the amount of flaring that they conduct. Gas flaring is the practice of igniting the natural gas that is often found along with crude oil in a hydrocarbon reservoir due largely to the fact that it was often uneconomical to extract and sell the natural gas. The expansion of natural gas gathering and processing infrastructure, such as the Arrow system, have greatly improved the economics of actually producing the gas so producers have begun to favor that solution over flaring. This preference has also allowed Crestwood to generate additional cash flows from its own operations.

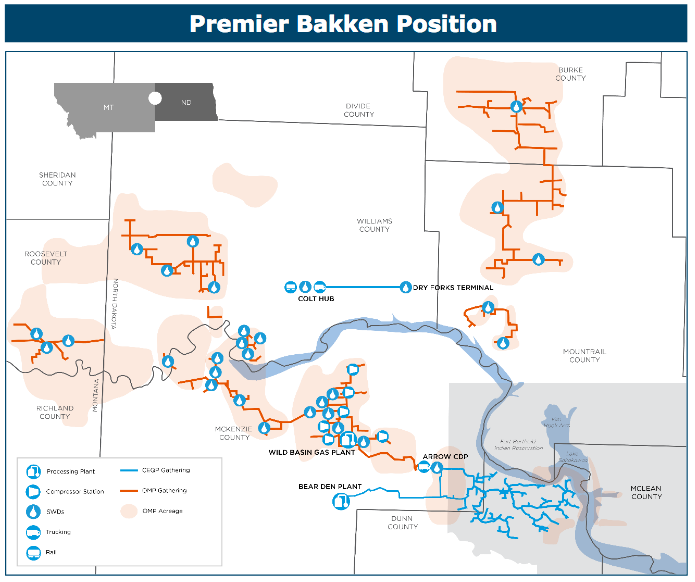

Crestwood Equity Partners recently announced a plan to substantially increase its presence in the Bakken shale through the acquisition of Oasis Midstream Partners (OMP) for $1.8 billion. I have written about Oasis Midstream before (see here) and was not particularly impressed due to problems with its general partner and management being potentially too optimistic about the company’s growth potential. Crestwood’s management on the whole is much more conservative, which could help to solve the second problem. The first problem not only involves the bankruptcy of Oasis Petroleum (OAS) but also a lawsuit that was brought by Miranda Energy against both Oasis Petroleum and Oasis Midstream Partners, which claimed $100 million in damages. It is uncertain how exactly this lawsuit will end up playing out as well as weather or not it will follow Oasis Midstream after the acquisition. As such, this acquisition may somewhat increase Crestwood Equity Partners’ risks in the near-term.

This acquisition also has the effect of substantially increasing Crestwood’s presence in the Bakken shale. In particular, it will triple Crestwood’s natural gas processing capacity in the region. The processing of natural gas is a function performed by many midstream companies that is critical to bring the gas to market. This is because natural gas contains a number of impurities when it is removed from the ground and these impurities must be removed before the gas can be used. The gas processing plant removes these impurities and of course the midstream company makes money by doing this. Oasis Midstream also has a sizable pipeline network so adding this to Crestwood’s infrastructure will greatly expand the company’s footprint in the Bakken shale:

Source: Crestwood Equity Partners

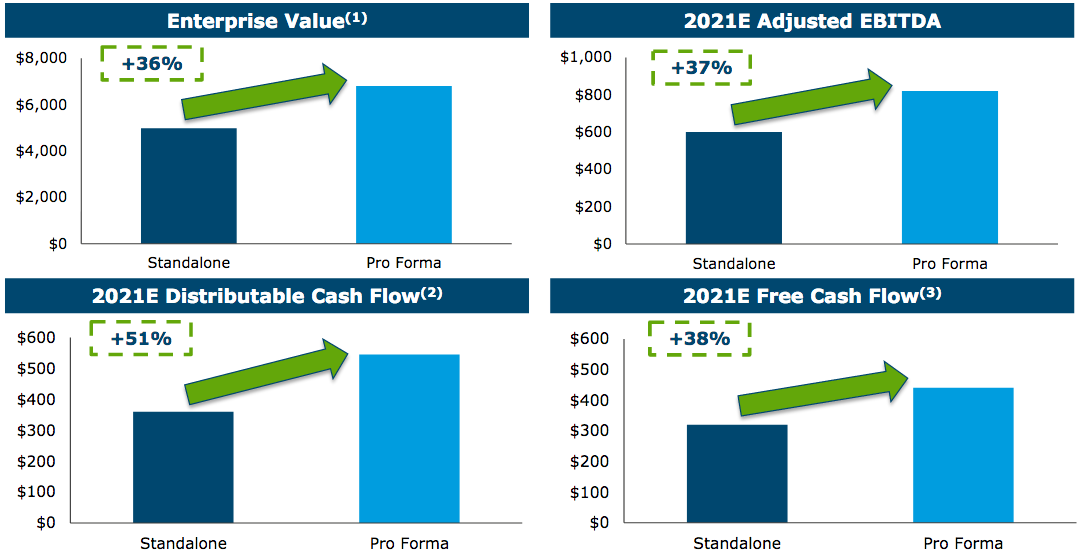

As may be expected, this acquisition will greatly increase Crestwood Equity Partners’ volumes in the Bakken shale. As we have already discussed, midstream companies make their money based on the volume of resources that they handle so we can expect this acquisition to have a positive impact on the company’s cash flows. This is of course the case, with the company’s adjusted EBITDA expected to increase by 37% and its distributable cash flow expected to increase by a whopping 51% following the acquisition:

Source: Crestwood Equity Partners

This acquisition is expected to close sometime in the first quarter of 2022 so we can expected this improved performance to show itself in the company’s results at around that time.

Fundamentals Of Midstream

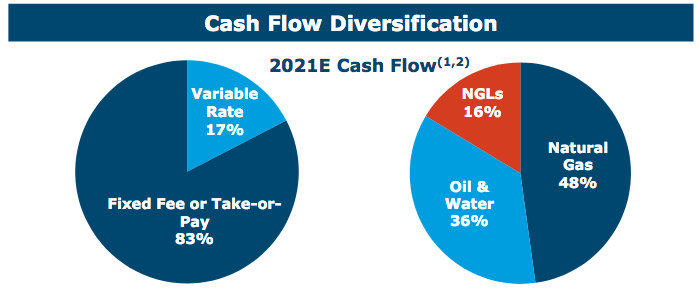

Crestwood Equity Partners’ cash flow is fairly well diversified across the various types of hydrocarbons:

Source: Crestwood Equity Partners

With that said though, we can still see that natural gas accounts for the largest single portion of the company’s cash flow. This is nice because natural gas has some of the strongest fundamentals of any fossil fuel. With that said though, crude oil does not exactly have terrible fundamentals. According to the International Energy Agency, the global demand for natural gas will increase by 29% while the global demand for crude oil will increase by a much smaller 7% over the next twenty years:

Source: International Energy Agency, Pembina Pipeline

Surprisingly, the growth in natural gas demand will be driven by the international concerns about climate change. These concerns have caused governments all over the world to enact a variety of policies that are intended to reduce the carbon emissions of their respective nations. One of the most popular strategies is to encourage the retirement of old coal-fired power plants, which are replaced by natural gas-burning ones. This is because natural gas burns much cleaner than coal and is more reliable than renewables given today’s technology. Thus, this strategy allows for the reduction of emissions while still being able to maintain the reliability that is expected from a modern electric grid.

The cash for crude oil demand growth may be somewhat more difficult to understand, particularly since many governments in developed nations are actively working to reduce the consumption of crude oil in their countries. The case for growth however comes from the various emerging nations around the world, which will likely see tremendous economic growth over the period. This economic growth will lift the citizenry out of poverty and into the middle class. Naturally then, they will begin to desire a lifestyle that is closer to what their counterparts in the Western nations than what they have now. This will result in growing energy consumption, including energy derived from crude oil. As the populations of these nations exceed the populations of the developed ones, the growing crude consumption in emerging markets will more than offset the stagnant to declining demand elsewhere.

This will benefit midstream companies like Crestwood Equity Partners even though they do not actually produce any resources. This is because the United States is one of the few regions of the world that has the ability to significantly increase its production of crude oil and natural gas due to the wealth of the various basins around the country. It seems logical then that the nation’s upstream producers will indeed increase their production to profit off this rising demand despite governmental pressure to do otherwise. These incremental resources will need to be transported to the market where they can be sold, however. This is exactly the job that midstream companies perform and since these companies make their money based on volumes, this should result in rising cash flows across the midstream sector.

Financial Considerations

As mentioned in the introduction, Crestwood Equity Partners has an incredibly strong balance sheet with a fairly low level of debt. This is nice because debt is a riskier way to finance a business than equity. This is because debt must be repaid and the company must make regular payments on its debt. Thus, a decline in cash flows could push a highly levered company into financial trouble. While midstream companies do typically enjoy reasonably stable cash flows, bankruptcies are certainly not unheard of so we still want to make sure that a company that we are investing in has a very strong balance sheet.

The most important thing here is the company’s ability to make the payments on its debt. The metric that we use to judge this is the net debt-to-adjusted EBITDA ratio, also known as the leverage ratio. In short, this ratio tells us the length of time (in years) that it would take a company to completely repay all of its debt if it were to devote all of its pre-tax cash flow towards that task. As of September 30, 2021, Crestwood Equity Partners’ leverage ratio stood at 3.45x, which is substantially better than the 5.0x that analysts generally consider to be reasonable. I am more conservative though and like to see this ratio below 4.0x in order to add a margin of safety. As we can clearly see, Crestwood Equity Partners meets both requirements and in fact has one of the lowest ratios in the entire midstream industry. This is a clear indication that the company has more than enough financial capability to carry its debt, which is exactly what we want to see.

Distribution Analysis

One of the biggest reasons that investors purchase units of a midstream company is because of the incredibly high yields that they typically boast. Crestwood certainly does not disappoint here as the company boasts a very impressive 9.92% yield at the current price. It is, of course, critical to ensure that the company can actually afford the distribution that it pays out. We determine this by looking at the company’s distributable cash flow, which is a non-GAAP metric that theoretically tells us the amount that was generated by the company’s ordinary operations that is available to be paid out to the limited partners. In the third quarter of 2021, reported a distributable cash flow of $85.8 million, which is enough to cover its distribution 2.18 times over. Analysts generally consider anything higher than 1.20x to be reasonable and sustainable. I am once again more conservative and prefer to see this ratio over 1.30x to be comfortable. Clearly, Crestwood does substantially better than this. Therefore, the distribution appears to be quite safe at the current level.

Conclusion

In conclusion, Crestwood Equity Partners is easily one of the best companies in the midstream sector despite not being one of the most well known. The company boasts an incredibly strong balance sheet, a very high and sustainable distribution, and some significant growth prospects in the near-term. Overall, this one could be worth considering purchasing today.