Nordroden/iStock via Getty Images

We're nearing the beginning of the Q4 Earnings Season for the Gold Miners Index (GDX), and one of the first companies to report its preliminary Q4 results is K92 Mining (OTCQX:KNTNF). While it was a difficult year for this junior producer due to multiple headwinds out of its control (lower productivity due to COVID-19, shortage of bulk emulsion explosives), K92 finished the year strong, reporting record production of ~36,100 gold-equivalent ounces [GEOs]. Given K92 Mining's industry-leading growth profile combined with very attractive margins, I would not be surprised to see the stock hit new highs in the next 12 months.

Kainantu Mine

Company Website

K92 Mining released its Q4 results last week, reporting quarterly production of ~36,100 GEOs, translating to a more than 21% increase in production year-over-year and a 53% increase from pre-COVID-19 levels (Q4 2019). This strong performance helped push annual production to ~104,200 GEOs, translating to 5% growth year-over-year despite a very slow start related to COVID-19 headwinds, an incident involving an underground loader, and a shortage of bulk emulsion explosives. However, the growth is not done here, and K92 should see a return to high double-digit production growth in 2022. Let's take a closer look at the recent results below:

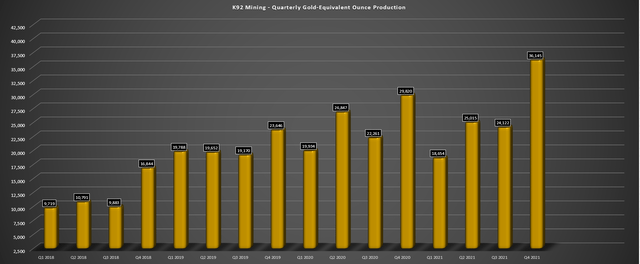

K92 Mining Quarterly Production

Company Filings, Author's Chart

As shown in the chart above, K92 Mining has continued to grow its production at an enviable pace since production began at its Kainantu Mine in Papua New Guinea. This is because production has grown at a compound annual growth rate of ~29% since Q4 2018, a higher growth rate than many miners have posted on an absolute basis (not compound annual growth rate basis) in the same period. The recent growth was driven by the successful commissioning of its Stage 2 Expansion, which increased annual throughput to 400,000 tonnes per annum. The great news is that the plant appears to have no problem handling these throughput rates, operating at an average of 1,146 tonnes per day in Q4 and enjoying throughput of 1,300+ tonnes per day for 21 days during the quarter.

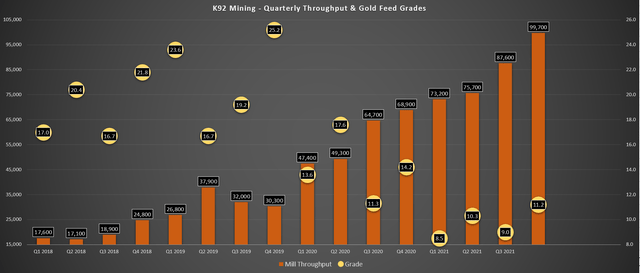

K92 Quarterly Operating Metrics

Company Filings, Author's Chart

The chart above shows that this much higher throughput rate of ~99,700 tonnes in Q4 2021 was a new record by a wide margin and was achieved despite five consecutive days of downtime. So, despite the lower grades on a year-over-year basis (11.2 grams per tonne gold-equivalent vs. 14.2 grams per tonne gold-equivalent), production rose significantly. It's worth noting that while grades were lower, K92 is still processing some of the highest grades sector-wide, with Kainantu being one of the top-5 highest grade gold mines globally. Also noteworthy is that the company enjoyed grade outperformance in Q4 and continues to see positive reconciliation vs. its resource and grade control model.

View From Top Of Stope At Judd

Company News Release

The other major news in the quarter was that the company mined its first stope at Judd (#1 Vein), and this met expectations from a geotechnical, drill & blast characteristics, and grade standpoint. The first stope had very impressive characteristics with a 40-meter strike, 30-meter height, and a ~4.5-meter thickness, with a stoping single blast record of 4,100 tonnes in December. Not only does the addition of Judd boost operational flexibility and material movements to help fill the plant at a higher throughput rate, but it lies right next to existing infrastructure, making it a very attractive second mining area.

Stage 2A Expansion

Given the impressive performance at the plant and the addition of a second mining area, K92 has approved a Stage 2A Expansion, with the goal to commission this expansion in Q3 2022. Assuming the company is successful, the plant will have a capacity of 500,000 tonnes per annum starting in Q4 2022, a 25% increase from where the plant entered 2022. Assuming an average head grade of 10.5 grams per tonne gold-equivalent and similar recovery rates to what we've seen, this could support a production rate of close to 155,000 tonnes per annum.

This would set up K92 Mining for nearly 50% growth medium-term while it prepares for the likely approval of its Stage 3 Expansion. So, while 2021 was an unusual year with higher operating costs and limited production growth (at least by K92's historical standards), there is significant growth on the horizon if K92 Mining can increase its mining rates and fill the plant at 500,000+ tonnes per annum. So far, mining rates are certainly trending in the right direction, with just below 109,000 tonnes moved in Q4.

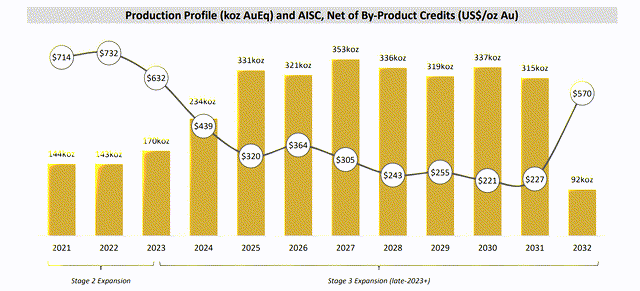

The bigger opportunity for those familiar with the K92 Mining story is the Stage 3 Expansion, a few years away, with a plant capable of processing 1.0 million to 1.2 million tonnes per annum. This would more than triple production from FY2021 levels, with all-in sustaining costs likely to come in below $550/oz. So, while K92 Mining might seem like a relatively insignificant producer today, it is one of the best growth stories by a mile sector-wide. This growth is even more attractive given that it will be coupled with meaningful margin expansion (costs to drop 20% from ~$700/oz to $550/oz or lower).

Stage 3 Expansion Plans

Company Website

Valuation

Based on the company's Phase 3 Study completed in mid-2020, the After-Tax NPV (5%) came in at ~$1.70 billion at a $1,700/oz gold price and $3.00/lb copper price, which both look like conservative assumptions. I think it's more than reasonable to add up to $200 million in exploration upside given the potential of this land package, especially with K92 on track to add meaningful incremental resources at Judd. After subtracting out corporate G&A, I see a fair value for K92 Mining of ~$1.84 billion, or US$7.75 per share based on ~237 million shares fully diluted.

It's worth noting that there could end up being some upside to the previous NPV (5%) figure, with K92 exploring a processing rate of 1.2 million tonnes per annum vs. the previously contemplated throughput rate of 1.0 million tonnes per annum. At a head grade of 10 grams per tonne gold-equivalent, this could push production closer to 350,000 GEOs per annum, from a previously estimated run rate of ~320,000 GEOs. Having said that, there could be some offsets to the NPV (5%) due to slightly higher CapEx related to inflationary pressures. Hence, I have chosen to be more conservative and assumed a project NPV (5%) + exploration upside fair value of ~$1.9 billion.

So, is the stock a Buy?

While it's clear that there is significant upside from current levels to a conservative fair value of US$7.75, I prefer to buy at a minimum 30% discount to fair value when it comes to single-asset producers. This is done to bake in a meaningful margin of safety, given that issues can be magnified when there's only one asset in the portfolio. We saw this in 2021, even if the minor hiccups were out of the company's control (lower productivity due to COVID-19). If we apply a 30% discount to fair value, K92 Mining's low-risk buy point comes in at US$5.40 or lower, which is right near current levels. Let's see if this lines up with a low-risk buy point on the stock's chart:

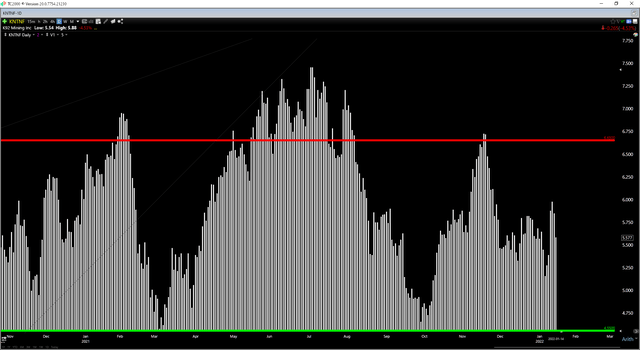

KNTNF Technical Chart

TC2000.com

Looking at K92's technical chart above, we can see that the stock has strong resistance at US$6.65, and its next strong support level doesn't come in until US$4.55. At a current share price of $5.58, this leaves the stock in the middle of its trading range, which does not leave the stock in a low-risk buy position. So, while the stock trades at a very reasonable valuation, a further pullback is required to trigger a technical buy signal. For K92 Mining to see an improved reward/risk ratio, the stock would need to dip to US$5.05 per share, where it would have more than 30% upside to its next resistance level.

In a sector where it's hard to find growth, and certainly a combination of both resource and production growth, K92 Mining stands head and shoulders above most of its peers. This growth profile is made even more attractive because this is a relatively simple and manageable expansion from a CapEx standpoint that can be funded with no share dilution. Hence, it will translate to a massive increase in production per share. Given the enormous transformation investors should see over the next three years, K92 Mining is a name to keep a very close eye on, and I would not be surprised to see the stock hit new highs in the next 12 months. Given this solid investment thesis, I would view any pullbacks to $5.05 as low-risk buying opportunities.