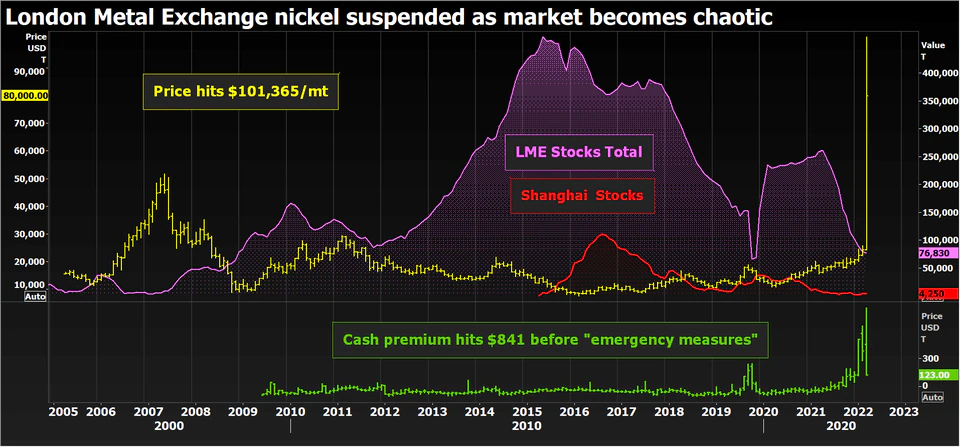

The 145-year-old exchange responded by halting trade and in a later update announced the cancellation of all trades executed on or after 00:00 UK time on March 8 and deferring delivery of all physically settled contracts. The contract was suspended at $80,000 per tonne.

The LME said the move followed a close monitoring of the ongoing impacts of Russia’s invasion of Ukraine, as well as the recent “low-stock environment and high pricing volatility environment observed in various LME base metals, and in particular nickel.”

The move, BMO analyst Colin Hamilton said, will see questions resurface as to the efficacy of the LME to act as the market of last resort after the short squeeze in copper seen late last year.

“It is unlikely this is the last of extreme volatility we see in commodity markets,” Hamilton wrote.

Big Shot’s short

Bloomberg reports Chinese entrepreneur Xiang Guangda — known as “Big Shot” — has for months held a large short position on the LME through his company Tsingshan Holding Group Co according to people familiar with the matter.

Source: Reuters

Source: Reuters Tsingshan, the world’s largest nickel and stainless steel producer, has been under growing pressure from its brokers to meet margin calls on that position and, according to Bloomberg, was given additional time by the LME to pay hundreds of millions of dollars of margin calls it missed Monday.

Payment was received on Tuesday a person familiar with the matter told Bloomberg on Tuesday. According to some estimates Big Shot is in for a potential $5 billion hit in order to cover his positions.

Bloomberg reported in February on the squeeze in the nickel market suggesting a single mystery stockpiler had amassed over 50% of all LME nickel inventories representing around 43,000 tonnes, nominally worth some $3.4 billion at $80,000 per tonne. Nickel was trading in the low $20,000s in January.

The debacle brings back memories of one of the bourses’ darkest periods, known as the “Tin Crisis” of 1985, which saw the LME stopping tin trading for four years and pushed many brokers out of business.

Fate of sulfate

“Although no such suspension like this has happened since the tin crisis in 1985-86, the move in LME three-month prices to $100,000 per tonne, from Friday’s close at $29,130 per tonne, is likely to be a spike,” Will Adams, head of Battery and Base Metals research at FastMarkets said in an emailed statement.

The analyst believes that most of the buying pressure likely came from distressed shorts having to cover their positions on the exchanges, boosted by fears about supply from Russia and low levels of visible inventory on the LME. But Adams sees prices falling back “before too long.”

Nickel prices have steadily climbed over the past year as battery makers try to secure steady sources of the metal, which has quadrupled its value over the past week on fears of further curbs on supply.

“We can expect nickel users in the growing market for batteries will be watching this volatility uneasily, particularly while the market is closed,” Adams said.

[Click here for an interactive chart of nickel prices dating back to 1989]

Rystad Energy, a Norwegian energy market research company, said spot nickel sulfate prices inside China tracked the metal price higher last week but “due to the tremendous futures price hikes yesterday and this morning, suppliers have stopped making offers, waiting for clarity in the market since current nickel prices can’t be justified purely on market fundamentals.”

Rystad points out that the price gap between LME and SHFE is likely to remain wide given SHFE platform has restricted the daily price increase at 15%:

“On top of all this, due to the accelerated lithium price upturn since late last year, cathode producers and battery manufacturers have found it increasingly difficult to absorb the prices hikes in the battery upstream minerals. As such, it is estimated that the nickel sulfate price will continue to follow nickel metal prices up, but in a slower manner even after the recent price jumps.”

Norilsk risk

Russia not only is responsible for about 10% of the world’s production, but Moscow-based Norilsk Nickel (MCX: GMKN) is the biggest provider of battery- grade nickel at 15% to 20% of global supply.

Demand for high-grade nickel was already set to outstrip supply this year because of the increasing popularity of electric vehicles.

Goldman Sachs has forecast the nickel market to be in a 30,000-tonne deficit in 2022, up from their August forecast of a 13,000-tonne deficit.

Tesla boss Elon Musk has identified the shortage of nickel as one of the biggest hurdles to ramping up production of EV batteries. He promised in 2020 millionaire contracts to miners able to provide the EV maker with sustainable nickel.