We have repeatedly warned that Cushing balances would be tight in coming months due to limited crude oil production growth and strong refinery and export demand...

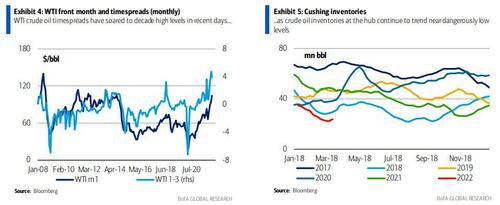

... and now, the Ukraine conflict clearly presents the risk of even greater tightness as report after report from various bullish Wall Street banks warn. Indeed, as BofA's commodities team writes in a must read note titled "Cushing's Cushion Wears Thin" published today (available to professional subs), WTI timespreads soared to decade highs ($11.70 for WTI 1-3 spread) recently and have since settled down at still elevated levels, discouraging oil storage. As a result, inventories at Cushing hub have drawn roughly 13 million bbl ytd, reaching 24mn bbl last week, the lowest seasonal level in the shale era. Now, storage levels are likely near operational minimum levels, or "tank bottoms."

According to BofA, given current backwardation levels, a good portion of these inventories are likely used for blending operations and as a backstop for pipeline flows. Thus, they may not be eligible for delivery against the WTI contract.

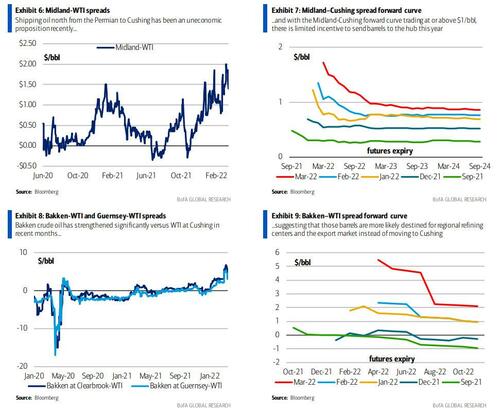

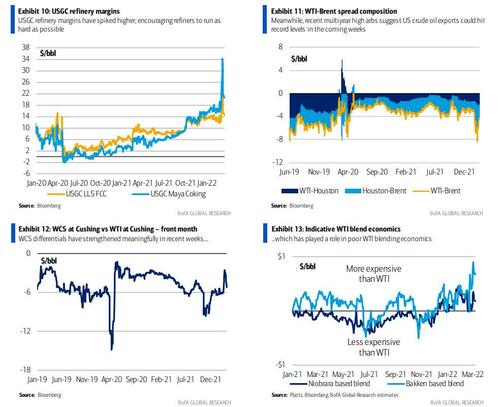

Making matter worse, as inventories trend near operational minimum levels, nearly every price signal is discouraging oil flows to Cushing and will likely limit resupply. To wit: Midland WTI is fetching a $1.50/bbl premium over Cushing, limiting northbound flows to Cushing. Meanwhile, Bakken-WTI spreads of $5/bbl suggest that Bakken barrels may be more likely to bypass Cushing and flow directly to the USGC market. Recent strength in WCS (Cushing) vs WTI spreads, coupled with rich Bakken and Niobrara differentials should also discourage blending to WTI spec.

Finally, WTI-Brent spreads hit multi-year lows of -$9.20/bbl recently and are currently trading near -$5/bbl, which should encourage higher, "potentially record" crude oil exports over the coming weeks.

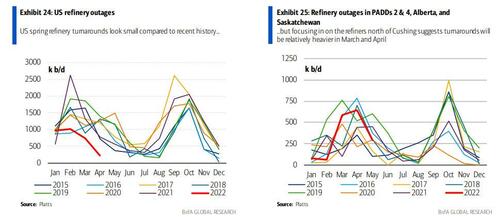

While refinery turnarounds should offer Cushing some short term relief...

Refining turnarounds globally are expected to be light this spring, with outages averaging 4.3mn b/d during March and April, compared 6.8mn b/d on average for the same period during 2015-19. In the US, outages are expected to be even lighter (Exhibit 24), averaging about 500k b/d in March and April versus 1.3mn b/d during the same period in 2015-19 (Exhibit 25). However, refining outages north of Cushing (PADD 2, PADD 4, Alberta, and Saskatchewan), which should affect inbound flows to the hub, are expected to average 600k b/d in March and April versus about 475k b/d during the 2015- 19 (Exhibit 25). All else equal, these turnarounds suggests that more barrels will be making their way south, either to Cushing or to the USGC this month and next, which should help lift Cushing inventory levels over the near term.

... balances will likely still be tight post maintenance.

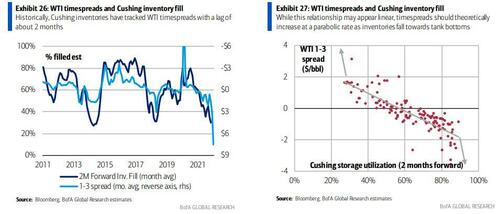

Historically, Cushing inventories have tracked WTI timespreads with a lag of about 2 months (Exhibit 26). While this relationship may appear linear during periods of normal inventory levels, timespreads should theoretically increase at a parabolic rate (more backwardation) as inventories fall towards tank bottoms and fall at a parabolic rate (more contango) as Cushing nears tank tops (Exhibit 27).

All this means that "front month WTI at risk of a melt-up in 1H22", similar to what was observed on April 20, 2020 when WTI traded down to negative $40/bbl as there was no place to store the deliverable contract amid the global economic shutdown, and when holders of the front contract were willing to pay others to take the obligation of delivery (which is what sent the price negative). Only in the opposite direction.

As a reminder, unlike Brent, the WTI contract has a physical delivery mechanism, which forces convergence between the physical market and futures market every month. In April 2020, this convergence was on full display ahead of the May WTI contract expiry, as longs with no ability to take delivery were forced to liquidate their positions at negative prices. Now, BofA cautions, "the market setup has reversed."

In other words, with inventories at very low levels there is likely a reduced ability to make delivery against the WTI contract. As a result of limited US supply growth over 1H22 and limited incentives to send barrels to Cushing, inventories will likely scrape along at low levels.