M&A VET + Leucrotta XI Technologies: M&A Spotlight – Vermilion Energy Inc. and Leucrotta Exploration Inc.

April 6, 2022 EnergyNow Media

English Franais

Each week, XI Technologies scans its unique combination of enhanced industry data to provide trends and insights that have value for professionals doing business in the WCSB. If you’d like to receive our Wednesday Word to the Wise in your inbox, subscribe here.

With commodity prices still a focus of the industry and merger and acquisitions heating up again we thought we’d refresh our M&A spotlight. This week we’ll focus on the deal announced last week of Vermilion Energy Inc. (Vermilion) acquiring Leucrotta Exploration Inc. (Leucrotta) by taking a high-level look at each company prior to the merge. What did the companies look like before they merged? Does a comparison between the two offer insights and what does one area of interest look like holistically after the merger?

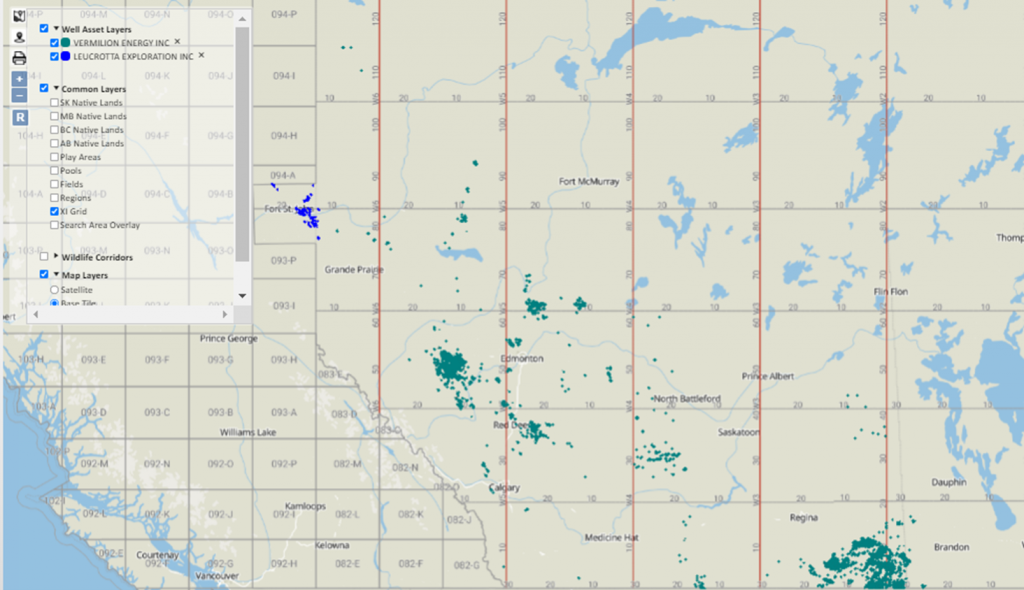

We’ve provided images to look at the companies pre-merger to provide some insight:

Figure 1 – Company Books for Vermilion and Leucrotta prior to the sale.

Click here to download a pdf report of the above data along with land and drilling history data.

Core Areas

Figure 2 – Core Areas of Vermilion (in green) and Leucrotta (in blue).

Vermilion’s press release was very clear that the deal was to increase their Montney assets in Northeast British Colombia and Northwest Alberta.

Primary Zone — When looking at Vermilion and Leucrotta we can see that this transaction significantly deepens their exposure to the Montney – top 10 boe/day zones.

Figure 3 – Vermilion pre-sale

Figure 4- Vermilion post-sale

Decline reserves — This merger has added a nice spot of colour to the Peace River Arch area of the map when looking at a heat map of BOE Reserve.

Figure 5 – Heat map of decline reserves post-sale.

Looking at XI’s Merger Book, we can quickly see where the assets fall below a percentage that would be considered core to the company. A company in the market to pick up assets could approach Vermilion to see if they were looking to divest these assets rather than manage them outside of their true core interests. In this case, there is very little overlap between the two companies so there may be little opportunity for purchasing non-core assets.

Figure 6 – Sample of the Merger Book for Vermilion and Leucrotta.

Click here to download the complete Merger Book report from AssetBook.

Recent Development & Drilling Activity

Using data pulled from OffsetAnalyst, our comprehensive source of digital drilling information, shows that with this purchase, Vermilion is acquiring some drilling experience in the Montney region, but not a significant amount (particularly in recent years). As suggested by their press release, we can expect Vermilion to expand drilling operations in the region.

Figure 7 – Drilling history for Vermilion and Leucrotta.

Click here to view dashboards on Vermilion and Leucrotta’s drilling activity, including a look at their main areas of focus over the past three years.

With XI’s AssetSuite tools you can dig into pools, undeveloped land holdings and other parameters to help you find deals and examine risk with inactive wells, ARO obligations, and emissions to ensure there are no surprises. OffsetAnalyst helps to explore best practices in drilling and analyze drill curves to predict and optimize your costs. If you’d like to learn more about how XI’s software can analyze potential mergers and acquisitions, contact XI Technologies.

Share This: