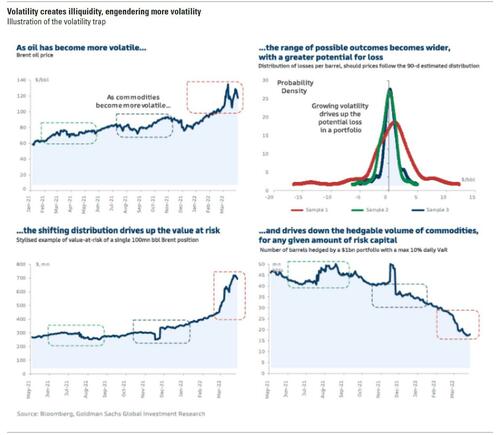

After sliding yesterday in what is an increasingly bitter feud between traders of bullish traders of physical oil and bearish hedge funds, on Thursday oil gained as growing challenges to supply eclipsed concern about the fading threat to energy demand from lockdowns in China. WTI traded near $103 in a week that has seen futures swing sharply in a range of about $10 and where volatility is only set to keep rising as Goldman explained last week by highlighting the "vol trap".

Meanwhile, as reported earlier this week, EU members are moving to cut dependence on Russian oil - and are waiting for the outcome of the French election this weekend before making it official over fears the price shock will sway more votes for Le Pen - with German Foreign Minister Annalena Baerbock saying the country plans to stop imports by year-end.

Until then, the EU has called on citizens to play their part in breaking the continent’s dependence on Russian energy. In partnership with the IEA, the bloc outlined nine steps that consumers can take: from turning down heating and lowering car speeds to remote working. “We are facing the first global energy crisis,” IEA Executive Director Fatih Birol said in a joint webinar with EU officials.

At the same time, Russian output has fallen, and protests in Libya have hurt supply and repairs to a key Kazakh export route are dragging on.

“The oil market continues to be characterized by a tug-of-war between concerns about demand and concerns about supply outages,” said Carsten Fritsch, an analyst at Commerzbank AG. “This is also evident from the constant fluctuations in oil prices.”

There has been some easing of concerns about China demand, as more businesses in the commercial hub of Shanghai have resumed operations although there is still a long way to go before normalcy returns. Strict curbs have hurt mobility, including for the nation’s fleet of trucks, and banks are reducing their forecasts from the nation’s expansion this year. President Xi Jinping told a local forum that while economic fundamentals remain strong, “we have yet to walk from the shadow”of the pandemic.

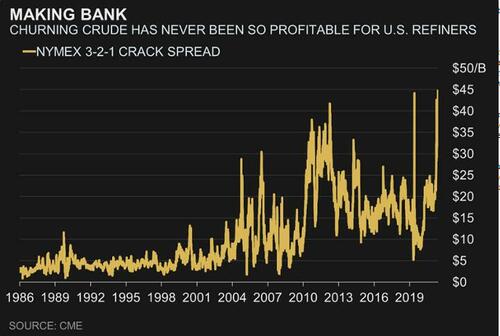

Other corners of the globe are seeing indications of robust fuel demand though, with France’s oil-product sales rising above pre-Covid levels in March. On Wednesday the 3-2-1 futures crack spread in the U.S. -- a measure of the profitability of turning crude into gasoline and diesel -- shot up to the highest level in records going back to 1986, surging above $45. That exceeded the one-day blip in April 2020 when WTI futures briefly dipped below zero. Gulf Coast refiners have been running at above 94% since returning from maintenance, the highest rate for this time of year in records going back more than a decade, but still can’t keep inventories from falling amid strong demand.

Meanwhile, as Bloomberg's Javier Blas writes, "the lights are dimming over the Russian oil industry."

While the Kremlin is doing its best to conceal the full impact of formal and informal energy sanctions after its invasion of Ukraine, "Moscow can’t hide from the satellites above Siberia that measure the amount of light its oilfields emit as unwanted gas is burned, or flared: The higher the production, the more flaring and the more light – and vice versa."

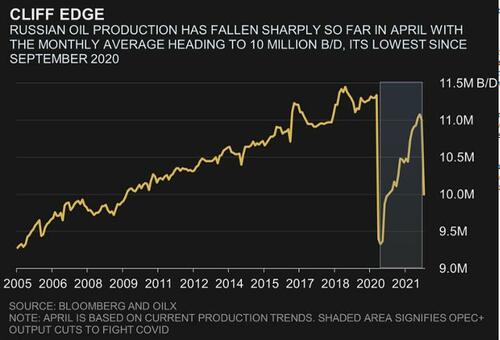

According to Blas, the flaring data combined with anecdotal information from traders and leaks of official Russian statistics, suggest that eight weeks into the war, Moscow is finally succumbing to the impact of government-imposed penalties and companies’ self-sanctions. "On average, Russian oil output is down 10% from its pre-war level" Bloomberg reports, even though that conflicts with a recent report from JPMorgan which found that Russian crude exports are actually averaging 360 kbd above pre-invasion volumes.

One thing is certain: the longer sanctions endure, the more production losses are likely as Western refiners and traders walk away from Russia upon the expiry of supply contracts in coming weeks, especially once the EU begins reducing its purchases of Russian oil, despite German opposition to the measures. “We are currently developing smart mechanisms so that oil can also be included in the next sanctions package," EU Commission President Ursula von der Leyen told the Bild am Sonntag.

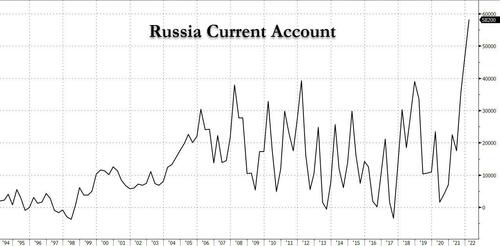

For consumers – and central banks in inflation-fighting mode – Blas warns that "declining Russian production signals the beginning of a second, and likely longer lasting, wave of oil price increases." For Vladimir Putin, the stakes are even higher: revenue from oil and gas sales has so far helped cushion the blow of international sanctions, stabilizing the ruble and financing his military machine, culminating in a record current account!

However, a lasting decline in production that outweighs any price increase would be a longer-term headwind for Russia’s economy on top of the direct costs of the war.

Meanwhile, as Bloomberg notes, "the first phase of the oil-price shock from Putin’s invasion was as intense as it was brief. Russian output proved more resilient than expected; China’s Covid lockdowns reduced demand, and the U.S. and its allies released millions of barrels from their strategic petroleum reserves. Brent, the global oil benchmark, initially surged to $139.13/bbl on March 7 in the first days of the Russian military campaign but retreated nearly 30% to a low of $97.57/bbl by April 11."

However, the second phase is likely play out in slow motion over a longer period, risking more economic havoc. Brent has already climbed back to near $110/bbl, and prices will probably rise gradually as the market absorbs the supply losses. Seasonal peak demand is still two-and-a-half months away, with the summer holiday period of the northern hemisphere, and retail gasoline prices are sure to climb.

Russian oil production is likely to drop further in coming months, judging by statistics from OilX, a consultancy that uses imaging data from NASA satellites to measure flaring. It estimates that output fell earlier this month to a low of 9.76 million b/d. On average, Russia pumped about 10.2 million b/d in the first two weeks of April. While the losses appear to have stabilized in recent days, April represents a big drop from the 11.1 million of February, before the impact of the invasion of Ukraine, and the 11 million of March.

The behavior of the Russian oil companies themselves highlights the declining international demand for their product. State-controlled Rosneft is trying to sell millions of barrels of crude in Europe and Asia via tenders that close on Thursday. Typically, Rosneft sells via long-term deals with commodity traders like Vitol, Trafigura and Glencore. But Western traders face a deadline of May 15 from the EU that restricts their dealings with Rosneft and several other Russian companies to “essential” activity needed to supply the EU. What essential means is open to interpretation, and for now many traders are simply reducing their dealings.

Looking at markets, brent has averaged $99.20/bbl so far this year. In 2008, when prices hit an all-time high, the average price year-to-date at this time of year was $98.40/bbl. To be sure, the only potential relief is bad economic news: a recession in the U.S. and Europe is the clearest obstacle to $100-plus oil (back in 2008, the Lehman collapse was the catalyst that sent oil prices lower).

As for price, If the production losses so far in April continue and deepen in May - as many industry experts if not hedge funds expect - the laws of supply and demand will take over. Oil markets are like the proverbial tanker: they take time to turn. But turning they are. And that means prices are heading higher, again, and sure enough Brent has recovered all recent losses and is set to move sharply higher.