peshkov/iStock via Getty Images

When I first began covering Baytex Energy (OTCPK:BTEGF), the company was listed on the NYSE and it was a heavy oil producer with a tremendous debt load from buying the Eagle Ford properties just before the big oil price crash. It turned out that the company used too much debt for the purchase. The oil price crash quickly proved that by showing all the financial handicaps. Since then, the lower debt and now the heavy oil production are proving to be assets that are causing the market to revisit this stock for the first time in a few years. The market is going to like what it sees.

(Canadian Dollars Unless Otherwise Specified)

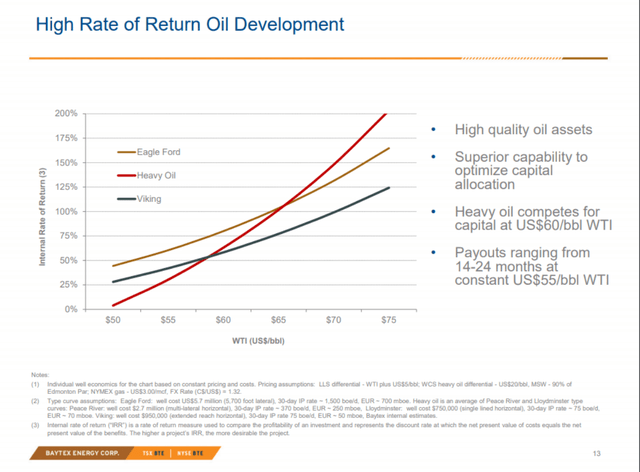

Baytex Energy Comparison Of Various Oil Product Returns By Basin (Baytex Energy May 2019, Corporate Presentation)

This is from an older article because the presentation is no longer available on the website. But the current price environment has moved the heavy oil production from an anchor position to being the most profitable in the company portfolio. Heavy Oil usually has a higher breakeven point (the key is usually). That makes it very hard to make money producing heavy oil during industry downturns as this management found out after the big oil price crash in 2015.

The Clearwater play is a whole different ballgame because Clearwater has unusually low breakeven points when compared to the heavy oil legacy production shown above. Nonetheless, that legacy production is likely to remain material for the foreseeable future. The Clearwater production will not replace that higher cost production overnight just due to the sheer quantity of production.

Now, it is an advantage to produce heavy oil. This company is likely to report "extra" cash flow because current prices make that product more profitable.

(Canadian Dollars Unless Otherwise Specified)

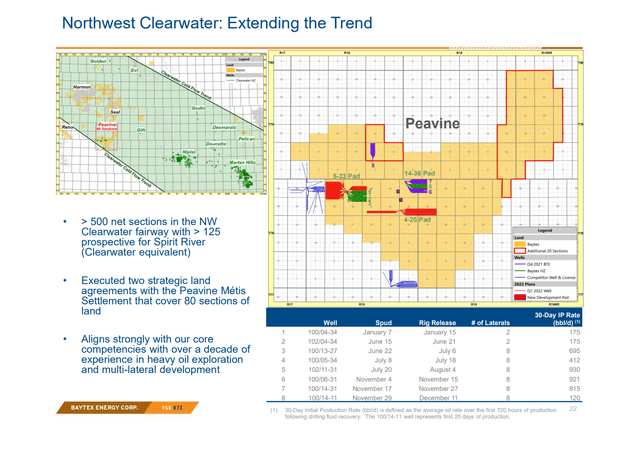

Baytex Energy Clearwater Heavy Oil Characteristics (Baytex Energy April 2022, Corporate Presentation)

Baytex Energy management recently improved the narrative by finding a heavy oil play with some incredibly low breakeven prices for the typically discounted product. The result is heavy oil production that successfully competes with the Eagle Ford for capital because the breakeven point of these wells is so low. The returns in the current environment are around 500% which is an incredible profit.

Now management is well aware that they assume a relationship between the WTI pricing and the heavy oil pricing. That relationship often changes to the disadvantage of heavy oil producers during downturns. Therefore, there is definitely a need for light oil production that commands the best price.

However, the returns shown in other slides would indicate that profitability will improve by increasing this heavy oil production at the expense of some of the legacy acreage. Therefore, this company will likely grow profits for several years even if overall production does not grow simply by improving the production mix. That is a rather unique one among the industry message of limited production growth while returning cash to shareholders.

(Canadian Dollars Unless Otherwise Specified)

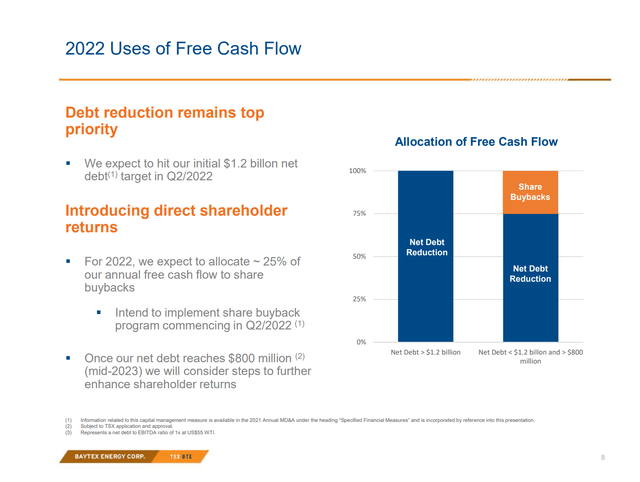

Baytex Energy Debt Reduction Guidance (Baytex Energy April 2022, Corporate Presentation)

Meanwhile the debt levels are reasonable for the first time in years. Cash flow was so good that management could actually annualize the cash flow to report a debt ratio less than 2. For as long as I have followed this company, that is the best number I have seen (sometimes by a mile) since I began covering the company.

Now management still wants to have a great debt ratio at lower prices. So, there is still an emphasis to bring the debt levels down while there is a lot of cash flow to reduce that debt level. It has taken this company years to recover from the debt incurred to purchase the Eagle Ford properties followed by the oil price crash in 2015. But the above chart shows that this will be one of very few companies to dig its way out of a huge debt load.

Investors should also note that the United States dollar denominated debt can be largely matched against the United States dollar denominated profits from the Eagle Ford. Currently, the Eagle Ford is the single largest free cash flow generator in the company portfolio. Clearwater has the potential to change that in the future though. This makes any currency swings shown on the income statement and potentially elsewhere irrelevant.

Given the currently very strong pricing environment for commodities produced and the ability to hedge to protect cash flow, management has some excellent chances to get that debt to the levels they are comfortable with. The company appears to have reached the point where lower debt levels will begin to attract more and more investors. That kind of attraction will likely include institutions. Attracting institutions usually results in a far better stock price than is the case right now.

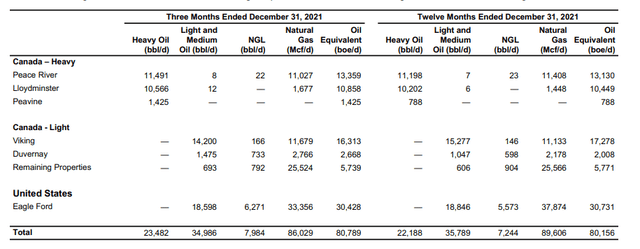

Baytex Energy Production By Product Type and Basin Fourth Quarter 2021. (Baytex Energy Fourth Quarter 2021, Earnings Press Release, February 2022.)

The amount of the Clearwater production (shown as Peavine above) can increase quite a bit to influence cash flow and drop the corporate breakeven point. Further speculative potential is available from the Duvernay discovery as management is working on that discovery to bring the costs into line with other light oil plays.

This company potentially has years of profitable growth ahead of it even if management never finds another discovery to expand operations. That possibility is highly unlikely. This producer of heavy oil, a discounted product, is transforming into a robust competitor with low costs.

This also means the company performance during industry downturns will change for the better in the future. That improved performance should result in a higher stock price throughout the industry cycle. Cash flow will be improving at the different pricing levels due to the development of Clearwater.

For investors, that likely means the stock is still cheap even at current prices. The chances of the stock price revisiting the lows of fiscal year 2020 dim every time this company participates in another low-cost discovery. Clearwater is a big game changer for company profitability. Mr. Market usually wants proof of increased profitability. That increased profitability will be easy to demonstrate as long as the returns on the Clearwater wells continues to hold for future wells coming on production.

The debt levels that turn off a fair number of institutional investors and conservative investors are rapidly declining in the current environment. Management has an excellent chance of reaching its near-term debt goals because of the ability to hedge to protect cash flow.

Notice also that production edge up due to unexpectedly strong performance of new wells. Investors can probably expect some more growth in the future from unexpectedly strong well performance as technology continues to advance throughout the industry.

Baytex Energy has a profit improvement story to go with the strong commodity price story investors already know about. That should enable Baytex stock to outperform the industry throughout the coming industry cycle.