Western Copper and Gold (NYSE:WRN) experienced numerous important events since my last article back in August. The works on the feasibility study for the Casino project have started, the government awarded construction contracts for the access road to Casino, more positive drill results were reported, and some progress was recorded also in the permitting process. All of this helped to push Western Copper and Gold's share price nearly 50% higher. However, over the recent days, a steep decline related to the current market conditions pushed the share price back below $2, creating new buying opportunity at attractive prices.

Source: Western Copper and Gold

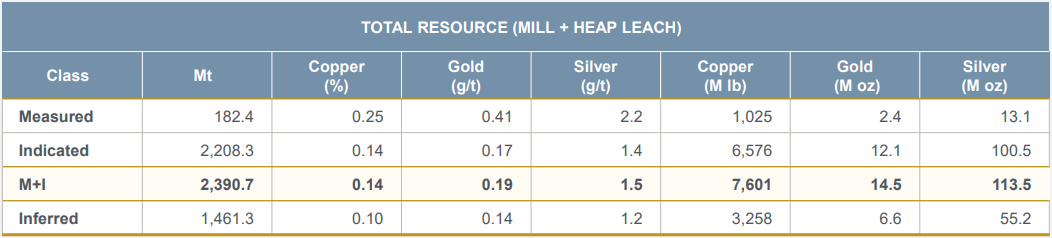

It is important to remind that Casino is a world-class copper-gold-silver-molybdenum project. The deposit contains measured and indicated resources of 7.6 billion lb copper, 14.5 million toz gold, 113.5 million toz silver, and 811.6 million lb molybdenum. The inferred resources contain further 3.3 billion lb copper, 6.6 million toz gold, 55.2 million toz silver, and322.8 million lb molybdenum. According to the June 2021 PEA, the mine should be able to produce 178 million lb copper, 231,000 toz gold, 16.6 million lb molybdenum, and 1.36 million toz silver per year on average over 25-year mine life. The gold and molybdenum credits should push the cash costs to -$1.19/lb copper, and the AISC to approximately -$1/lb copper, positioning Casino at the very bottom of the copper industry cost curve. The main problem is the initial CAPEX estimated at $2.6 billion.

Source: Western Copper and Gold

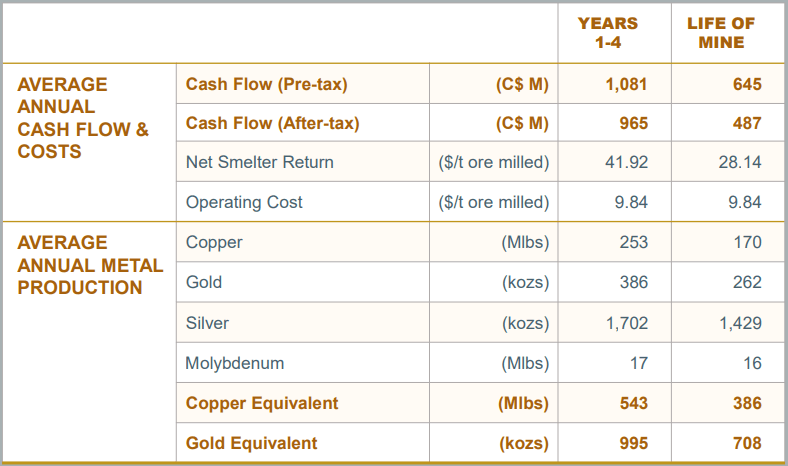

At base-case metals prices of $1,600/toz gold, and $3.35/lb copper, and CAD/USD exchange rate of 0.8, the after-tax NPV (5%) equals $3.12 billion, and the after-tax NPV (8%) equals $1.86 billion. The after-tax IRR equals 19.5%. Each $0.5 growth in copper prices adds approximately $440 million to the after-tax NPV (8%), and each $100 growth in gold prices adds approximately $150 million. It means that at the current metals prices of approximately $1,900/toz gold and $4.5/lb copper, the after-tax NPV(8%) should be around $3.3 billion.

Source: Western Copper and Gold

The permitting process is underway. Western Copper and Gold hiredenvironmental consultancy firm Hemmera to prepare an Environmental and Socio-economic Statement that should be submitted in Q2 2023. What is important, the project clearly has a strong support of the government. The Yukon government has already contracted a company to realize the first phase of the construction of the access road to Casino. The first phase will cost C$29.6 million and it will be focused on the construction of a bypass of the village of Carmacks. It should be completed in 2024.

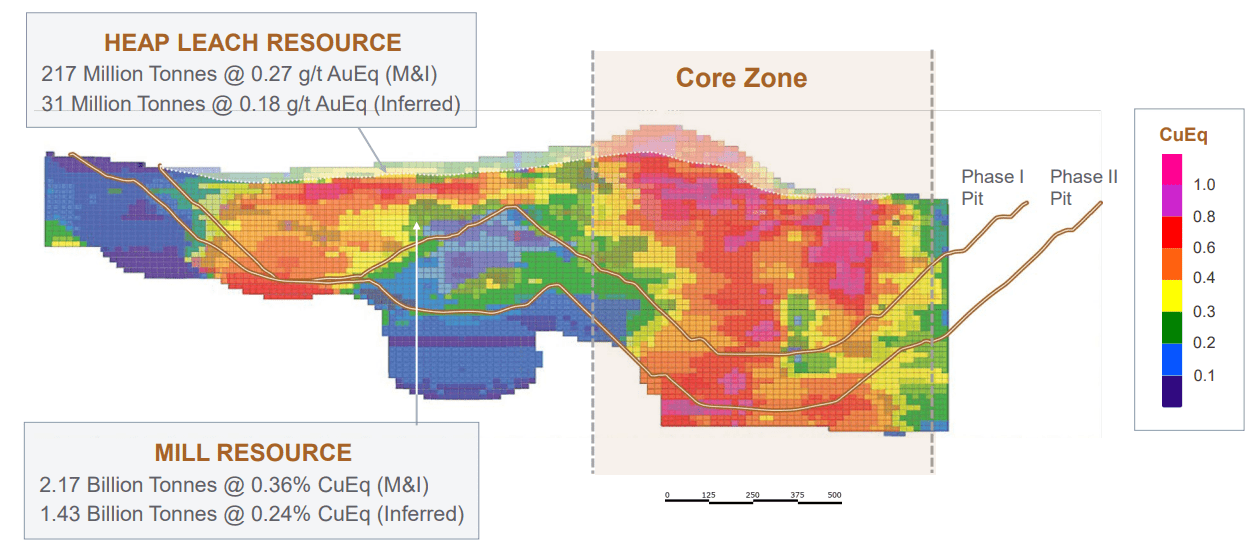

Meanwhile, positive drill results keep on coming. On November 29, Western Copper and Gold released some great drill results. In the Core Zone, hole DDH21-02 intersected 240.3 meters grading 0.86 g/t of gold equivalent. And DDH21-04 intersected 234.6 meters grading 0.97 g/t of gold equivalent. And in the Sulphide Zone, to the est of the Core Zone, DDH21-07 intersected 289.6 meters grading 1.01% of copper equivalent, starting at depth of only 36.6 meters. Very interesting is also hole DDH21-09 which intersected 65.8 meters grading 2.53% of copper equivalent, from a depth of 10.6 meters. Additional very good drill results were released also on March 24.

Source: Western Copper and Gold

As can be seen in the picture above, the Core Zone is really important, as it contains copper equivalent grades higher than the resource grades. Moreover, it is still open at depth which opens the potential for further expansion of the deposit.

And the news flow should continue. Some interesting things may happen soon. The results of the feasibility study are expected in Q2. It means over the next two months. The study, if positive, will mean a major de-risking of the project. The big players usually prefer to acquire new projects at this development stage. And in the case of Casino, four big players are at play. The front-runner is Rio Tinto (RIO). Rio Tinto acquired a 7.8% equity interest in Western Copper and Gold last year, on May 31, only several weeks before the PEA results were released. As a part of the deal, Rio agreed, over the next 12 months, not to acquire any securities of Western Copper and Gold, subject to certain exceptions. The 12-month period is about to expire on May 31.

Source: Western Copper and Gold

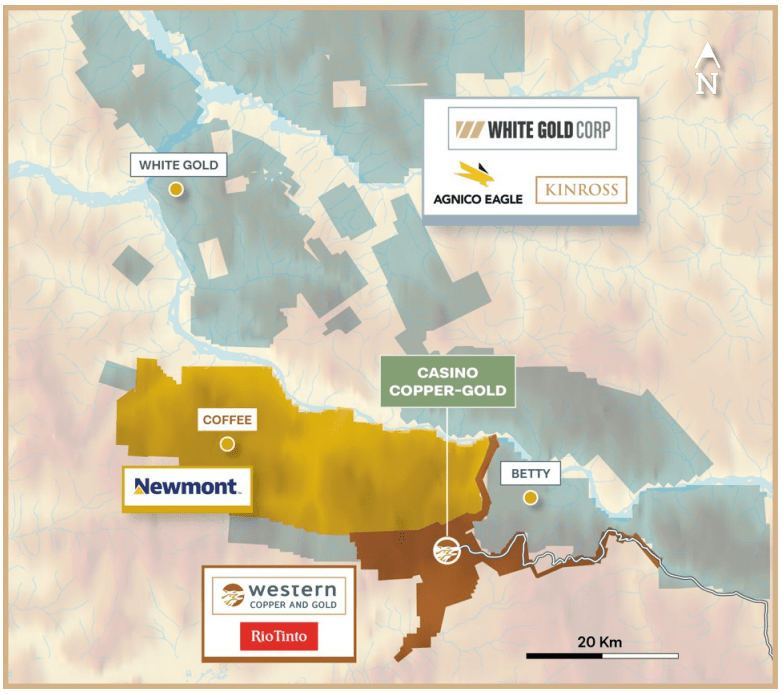

If Rio likes the results of the feasibility study, it is possible, that it will try to gain control over Western Copper and Gold as soon as possible. The reason is that there is another potential acquirer. Newmont (NEM) owns a large land package right to the north and north-west of Casino. The Coffee gold project lying on the property cleared an important permitting hurdle only recently. By the way, also Newmont hired Hemmera to manage the environmental process.

And also Agnico Eagle Mines (AEM) is present in the area. To the north-east of Casino lies a large land package controlled by White Gold Corp (OTCPK:WHGOF). Its main shareholder is Agnico Eagle Mines which owns a 19.7% equity stake. And Kinross Gold (KGC) is the second-biggest shareholder, holding a 15.8% equity stake. However, in my opinion, given the fact that Agnico only recently completed the merger with Kirkland Lake Gold, and Kinross only recently acquired Great Bear Resources, these two companies are less probable acquirers than Rio Tinto or Newmont.

But it is important to remember the high initial CAPEX which was estimated at $2.6 billion. Moreover, it was nearly a year ago. In the current inflationary environment, the feasibility study will probably present an even higher price tag. This may mean that the big players in the Casino area will join their forces. Rio Tinto is primarily interested in copper, while Newmont, Agnico Eagle Mines, and Kinross are primarily gold producers. Therefore, some form of a JV between Rio Tinto and one or even several of the gold miners would make sense. Each of the partners would gain interest in a multi-decade world-class copper-gold project located in a safe jurisdiction, and the development risks, from the standpoint of individual companies, would be more acceptable.

Conclusion

The recent market weakness hit Western Copper and Gold's share price hard. On Monday, April 18, the share price peaked at $2.39, only to close the week 20% lower, at $1.91. The bad news is that from a technical standpoint, the decline may continue. The share price declined below the 10-day, as well as the 50-day moving average. And the RSI hasn't reached the oversold levels yet. The next support is in the $1.8 area. If it doesn't hold, the next one is near $1.4.

Source: TradingView

From the fundamental point of view, except for the recent copper and gold price weakness, the company looks very good. There is a major catalyst in the form of the feasibility study that should be released soon. Although it is probable that the CAPEX and production costs will increase, there should be a lot of profits left for Western Copper and Gold.

The market capitalization of the company is $317 million. As of the end of Q4, it had no debt and held cash, cash equivalents, and short-term investments of nearly $40 million, which leads to an enterprise value of around $280 million. This compares very favorably to the after-tax NPV (8%) of $3.3 billion, valid for the current metals prices. Looking at Western Copper and Gold's valuation from another angle, the metals contained in resources have a market value of over $118 billion. It means that at the current enterprise value, the market attributes a value of only $4.5 to 1 toz of gold equivalent contained in the resources. Yes, there is some uncertainty regarding the cost estimates that will be presented by the upcoming feasibility study, but at the current share price, the upside outweighs the downside considerably. The current share price decline offers an interesting buying opportunity.

This article was written by