BalkansCat/iStock Editorial via Getty Images

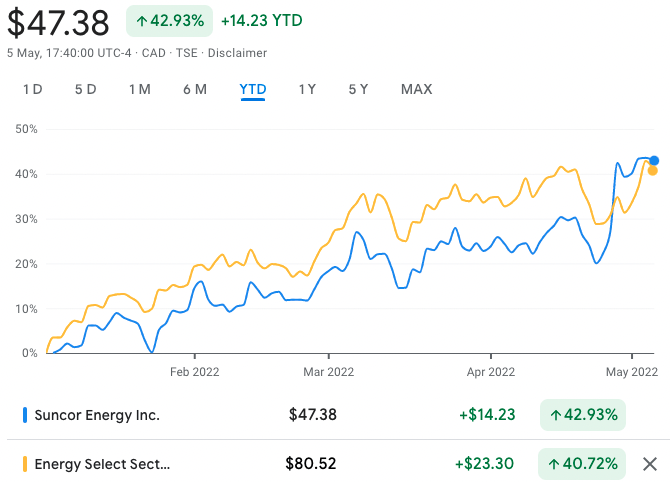

Suncor Energy Inc (NYSE:SU) stock has had an amazing run this year. In a period when both the NASDAQ and the TSX have fallen, SU has risen 42.93%. Suncor is no different from other oil stocks in this regard. The combination of economic re-opening, supply chain issues and the war in Ukraine have led to oil prices rallying dramatically. Many oil stocks are rallying. However, Suncor has risen a little more than the average energy stock, as measured by the Energy Select SPDR Fund (XLE).

Suncor Energy beats the energy index (google finance)

At this point, it’s natural to wonder whether the gains can continue. A 43% rally in five months is well ahead of the average stock’s one-year return. If Suncor were to revert to the mean, then its return for the remainder of the year would be negative. Stocks generally don’t rise 43% every five months indefinitely.

All that being said, there are reasons to believe that Suncor Energy could keep rising this year. As I will show shortly, Suncor stock is currently cheaper than it was in periods when oil prices were much higher than they are now. Additionally, there are reasons to think that oil prices will remain relatively strong for the rest of the year. In this article I will expand on these points to develop a bullish thesis on Suncor Energy Stock.

Competitive Landscape

One big thing Suncor Energy has going for it is its competitive position. It has the most gas stations of any domestic Canadian company, and it also has a valuable refinery in Colorado. It is in the process of bolstering its Colorado operations with a pipeline project. And finally, it is involved in natural gas supply and trading.

Suncor owns, wholly or partially, a number of lucrative oil sands projects. It is the lead partner (“operator”) of Syncrude, an oil sands mining operation. It operates a number of other projects in Canada, such as the Terra Nova offshore oil field.