guvendemir/E+ via Getty Images

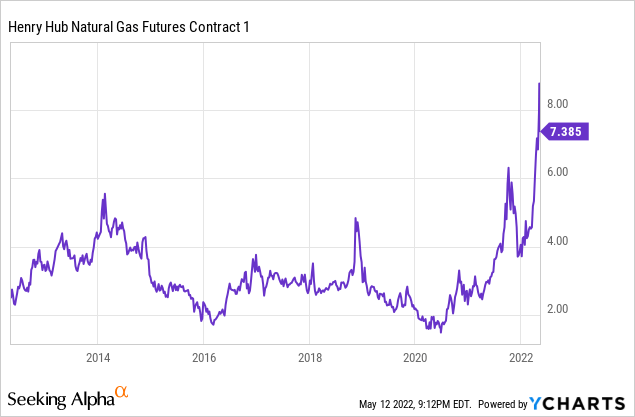

Natural Gas (NG1:COM) prices surged recently and then pulled back slightly amid a combination of bullish factors I discussed previously, including lower than expected supply growth, export increases, supportive weather and low coal and natural gas inventories. This brought the price close to $9/mmbtu, the highest in over a decade, before it pulled back to a still eye-watering $7.67/MMBtu:

Data by YCharts

Data by YCharts

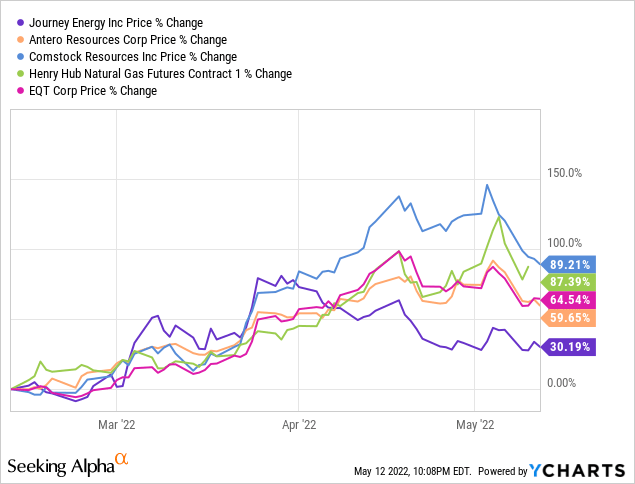

Natural gas equities re-rated higher along with the commodity, with natural gas (UNG), Comstock (CRK), EQT (EQT) and Antero (AR) up 59-89% in the past three months.

Data by YCharts

Data by YCharts

Incidentally, some of these companies have significant natural gas price hedging at lower levels, limiting their near-term cash flow upside to the rising natural gas price. One company in that set was only up 30%, despite natural gas representing over 50% of its volumes and despite no hedging exposure: Journey Energy (OTCQX:JRNGF).

Journey May 2022 Presentation

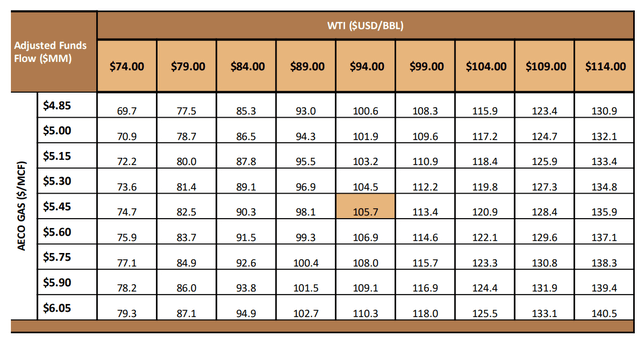

As Journey helpfully displays in their recent corporate presentation, the company has significant near-term upside to improving natural gas prices. A $1 move in natural gas increases cash flow by over $8 million. Today's natural gas price is $3-4 higher than it was 3 months ago, implying about $24-32 million of cash flow upside to Journey in 2022 if natural gas prices were to stay over $7/mcf. This would represent a meaningful 20-30% of the overall company's cash flow and 10-15% of its market capitalization in just one year!

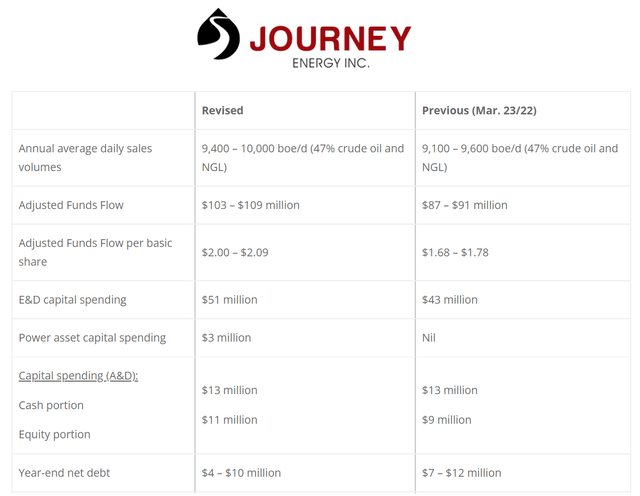

This cash flow increase could compound as well, as Journey grows production substantially. It recently raised guidance by 300-400 boe/d, while also ramping up high return, long-lived power infrastructure spending and bumping cash flow expectations to $2 - 2.09 / share - versus a current share price of $4.70!

Journey Energy Q1 2022 PR

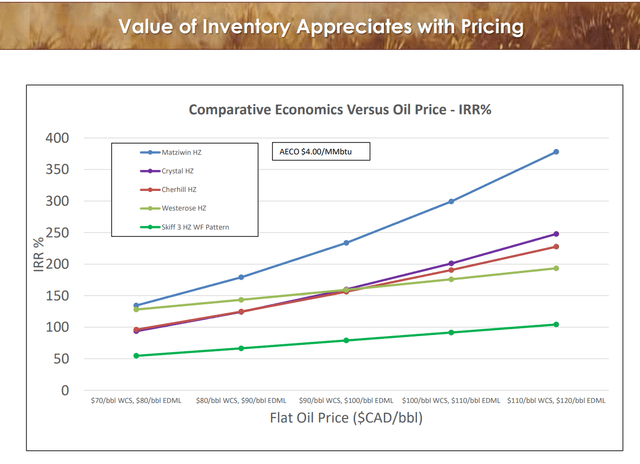

I previously identified the potential for this re-rate, discussing recent highly accretive acquisitions and the associated guidance revisions. I argued that Journey could outperform their then-updated guidance at the time. This has been validated by their strong Q1 performance and their second update to their guidance in two months, with a meaningful revision higher. This updated guidance still sandbags cash flow and production, propelled by buoyant commodity prices and high return projects. These projects are economic and in some cases over 100% IRR at $70 oil:

Journey May 2022 Presentation

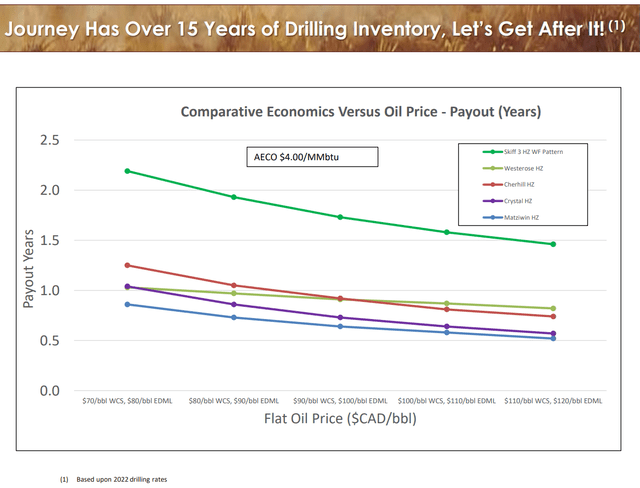

With over 15 years of inventory and paybacks of less than a year at current commodity prices, Journey's accelerated development and above-guidance cash flow from high oil and gas prices could compound to much higher production and cash flow levels over time:

Journey Energy May 2022 Presentation

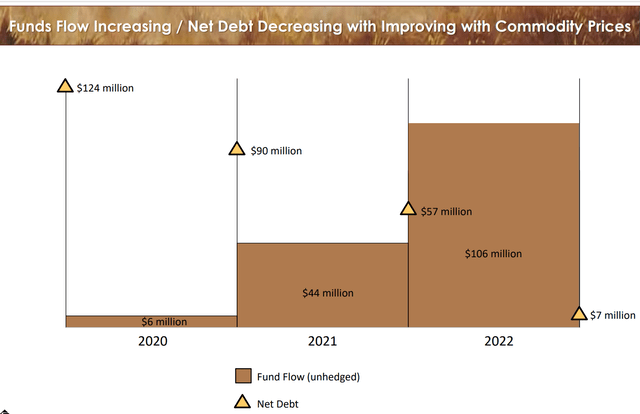

It is not easy to find companies that are growing this rapidly, with this much room to grow, while generating this much excess cash flow. Note the projected reduction in net debt to $7 million by year end 2022, from $57 million at the start of the year:

Journey Energy May 2022 Presentation

It is even harder to find these factors in a company trading at just over 2x projected cash flow for the current year! We saw this above with the $2+ / share guidance for cash flow vs. the $4.70 share price. There are a few reasons why Journey is still so cheap:

- As seen in the image above, Journey used to have $124 million of net debt, at the start of 2020. It generated less cash flow at the time and was perceived to be over-levered. It is now on track to have almost no net debt by the end of the year, which could change that now misperception.

- As a mixed oil and natural gas producer, Journey has not been the go-to stock for oil exposure or for gas exposure. However, as can be seen in the cash flow matrix, Journey has significant unhedged upside to improvements in both oil and natural gas prices. As cash flow shows up in its financials, this may be noticed and rectified.

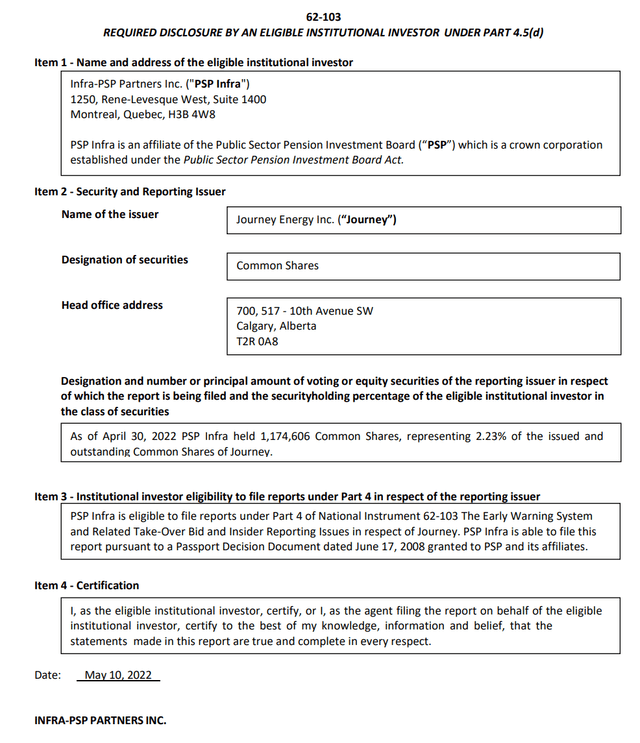

- Journey has been under intense selling pressure as a major shareholder has sold almost all of its stock in the last few months as a part of an ESG divestment campaign.

This form was filed on Sedar recently, indicating Infra-PSP had reduced their ~5.6 million share ownership in Journey to ~1.2 million shares. These forms are filed monthly, meaning that since April 1st, PSP had sold 4.4 million shares of Journey! With 500,000 shares traded a day on average, this represents 9 days trading volume, and likely exerted significant pressure on the stock.

Sedar

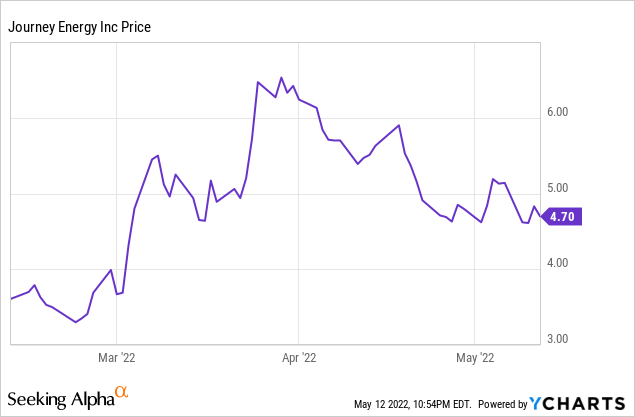

Looking at Journey's chart, it is not hard to tell when this selling started - shares peaked near $7 in late March and saw subsequent persistent selling and price pressure lower. This filing indicates that PSP has few remaining shares to sell into the market, perhaps offering relief going forward.

Data by YCharts

Data by YCharts

As Journey delivers on their growth + debt paydown program, their upside exposure and deeply discounted valuation will become even more apparent in their financials. There could be significant upside from here, especially as the selling pressure of a top holder dissipates.