Euro Natural Gas Shortage https://www.zerohedge.com/commodities/european-natural-gas-prices-triple-perfect-storm

European Natural Gas Prices To Triple In "Perfect Storm"

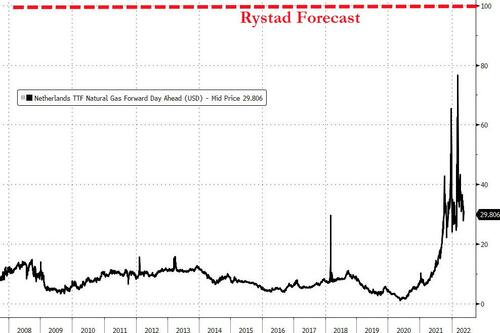

A top commodity research firm in Norway warns a "perfect storm" is brewing as European energy security worsens following Russia's invasion of Ukraine, which could result in the tripling of natural gas prices.

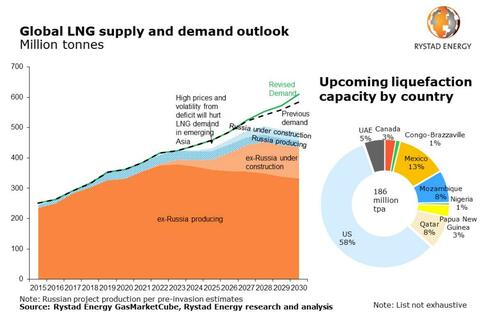

"There simply is not enough LNG around to meet demand. In the short term, this will make for a hard winter in Europe.

"For producers, it suggests the next LNG boom is here, but it will arrive too late to meet the sharp spike in demand. The stage is set for a sustained supply deficit, high prices, extreme volatility, bullish markets, and heightened LNG geopolitics," Kaushal Ramesh, a senior analyst for Gas and LNG at Rystad Energy, wrote.

Rystad Energy said the EU has an "ambitious target to reduce dependence on Russian gas by 66% within this year – an aim that will clash with the EU's goal of replenishing gas storage to 80% of capacity by 1 November."

The firm said shunning Russian natgas from the continent destabilizes the entire global natgas market, which had a turbulent 2021 year-end with prices skyrocketing across Europe because of the lack of supplies. EU is currently reducing reliance on Russian natgas and has unveiled the possibility of banning Russian fossil fuels. This will only lead to more trouble for the EU, where prices could rise even higher.

Learn more with Rystad Energy’s GasMarketCube.

According to the report, 155 billion cubic meters of Russian natgas flowed into Europe in 2021, representing about 31% of the continent's natgas supply.

"Replacing a significant portion of this will be exceedingly difficult, with far-reaching consequences for Europe's population, economy, and for the role of gas in the region's energy transition," Rystad Energy noted.

In one apocalyptic scenario, the energy firm cautioned about the severe economic implications if Russian natgas flows were immediately halted. They said it would come at a time when natgas stocks (only 35% full) would be depleted by the end of the year, resulting in a tripling of natgas prices from current levels to $100 per million British thermal units (MMBtu).

Such a dramatic price move in natgas would have tremendous implications on the economy, such as "industrial curtailments," Rystad Energy said, adding, "in an extreme scenario of a severely cold winter, not even the residential sector would be safe."

EU officials have discussed for weeks a potential fossil fuels embargo on Russia. The eurozone is searching for alternative suppliers of both crude oil and natgas to wean itself off Russian energy.

Weaning Europe off Russian energy will only mean elevated energy prices are here to stay. Europe's largest manufacturing hub, Germany, has warned of stagflation risks due to the conflict in Ukraine and resulting Western sanctions on Russian fossil fuels.

EU's ambitions to replace Russian fossil fuel dependence with another source will come at a cost that Rystad Energy warns could jeopardize the continent's energy security.