JPM: Forcasts Gas Draw Down and $6.20/gal https://www.zerohedge.com/markets/jpmorgan-sees-gas-prices-hitting-620-august

Moments ago we reported that for the first time in US history, gasoline in every single state is above $4/gallon, while the national average US retail gasoline price just topped $4.50 a gallon today, also for the first time. That’s up about 50 cents from a month ago, and a massive jump from $3.04 per gallon on the same day in 2021. While shocking, in just a few months, these numbers may seem quaint and quite low.

With expectations of strong driving demand — the US summer driving season starts on Memorial Day, which lands this year on May 30, and lasts until Labor Day in early September — JPMorgan's commodity strategist Natasha Kaneva warns that US retail prices could surge another 37% by August to a $6.20/gal national average.

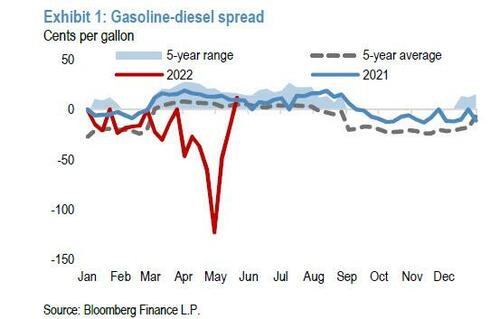

How is this possible? Well, as peak US summer driving season begins, record diesel pieces are about to take a back seat to gasoline. Toward the end of April, as the May NYMEX diesel contract climbed into expiry, US diesel prices peaked at a $1.63/gal premium to US gasoline, the highest diesel premium ever. Over the following two weeks, US gasoline prices climbed to close that gap and today gasoline is trading at a 15 cents per gallon premium to diesel

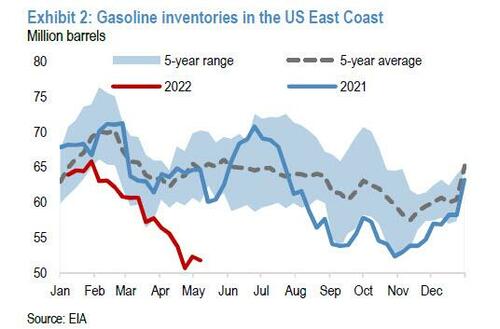

Why does this matter? As Kaneva explains, typically, refiners produce more gasoline ahead of the summer road-trip season, building up inventories. But this year, since mid-April, US gasoline inventories have fallen counter seasonally and today sit at the lowest seasonal levels since 2019 (thank diesel production). Gasoline balances on the East Coast have been even tighter, drawing to their lowest levels since 2011.

It's not just diesel: thank a rush to export US energy output too.

According to JPM, a major driver in these counter-seasonal draws in gasoline is higher-than-normal exports. Preliminary EIA data suggest that gasoline exports, mostly to Mexico and the rest of Latin America, are averaging about 0.9 mbd since March, about 100

kbd above seasonal norms and nearly 300 kbd above summer rates.

The punchline: if exports persist at this elevated pace and refinery runs, already near the top of the range for reasonable utilization rates, fall within JPM's expectations, gasoline inventories could continue to draw to levels well below 2008 lows and retail gasoline prices could climb to $6/gal or even higher, according to JPMorgan.

Some more details from the JPM forecast, starting with assumptions:

- The bank expects US refinery runs to peak at 16.8 mbd in August, which, with an average gasoline yield of 49%, means that US refiners will produce about 8.2 mbd of gasoline. Assuming gasoline imports of 0.7 mbd and 10% ethanol blending, the bank expects total finished motor gasoline supply to average 9.9 mbd. If exports continue just below current levels—about 0.8 mbd—that leaves the US with just 9.1 mbd of gasoline supply available for consumption at peak demand this summer.

- Because US gasoline demand is expected to average 9.7 mbd in August, the result is an average draw of 0.6 mbd from gasoline inventories in August, about 200 kbd tighter than normal.

- Holding those assumptions on refinery yields and flows for gasoline from today through August, total US gasoline inventories could fall below 160 mb by the end of August, the lowest inventory level since the 1950s.

A regression analysis on the relationship between gasoline inventory changes and NYMEX gasoline prices "suggests that a drop of about 60 mb in gasoline stocks between now and August would result in a 37% increase in prices which translates to a $6.20/gal average US retail price", according to Kaneva.

To be sure, while it is highly unlikely that exports persist at these levels in this price environment, continued draws would likely drive US gasoline prices high enough to discourage any exports, dropping exports down to seasonally-normal levels only slows the pace of draws. Already-low diesel inventories will keep refiners from pushing gasoline yields too much higher than seasonal norms and the chance of unexpected outages skews supply risk for both gasoline and diesel to the downside.

Even if exports do drop off, and they likely will, US gasoline inventories could end driving season at or below levels we haven’t seen in a decade.

JPM's dismal conclusion is that unless refiners shift yields toward gasoline and cut exports immediately to rebuild stocks before the driving season picks up, US consumers should not expect much in the way of relief in prices at the pump until the end of the year.

It's just as bad elsewhere: even though Brazil has pushed its refinery runs to eight-year highs so far in 2022, Latin America will likely remain short gasoline supply through North American driving season and US gasoline prices will need to stay high to keep more barrels from flowing south to Mexico.