Source... HFI Research - Natural Gas fundamentals are tight. "It appears that in the case of natural gas, there is one fundamental problem the market won't be able to resolve anytime soon: not enough production."

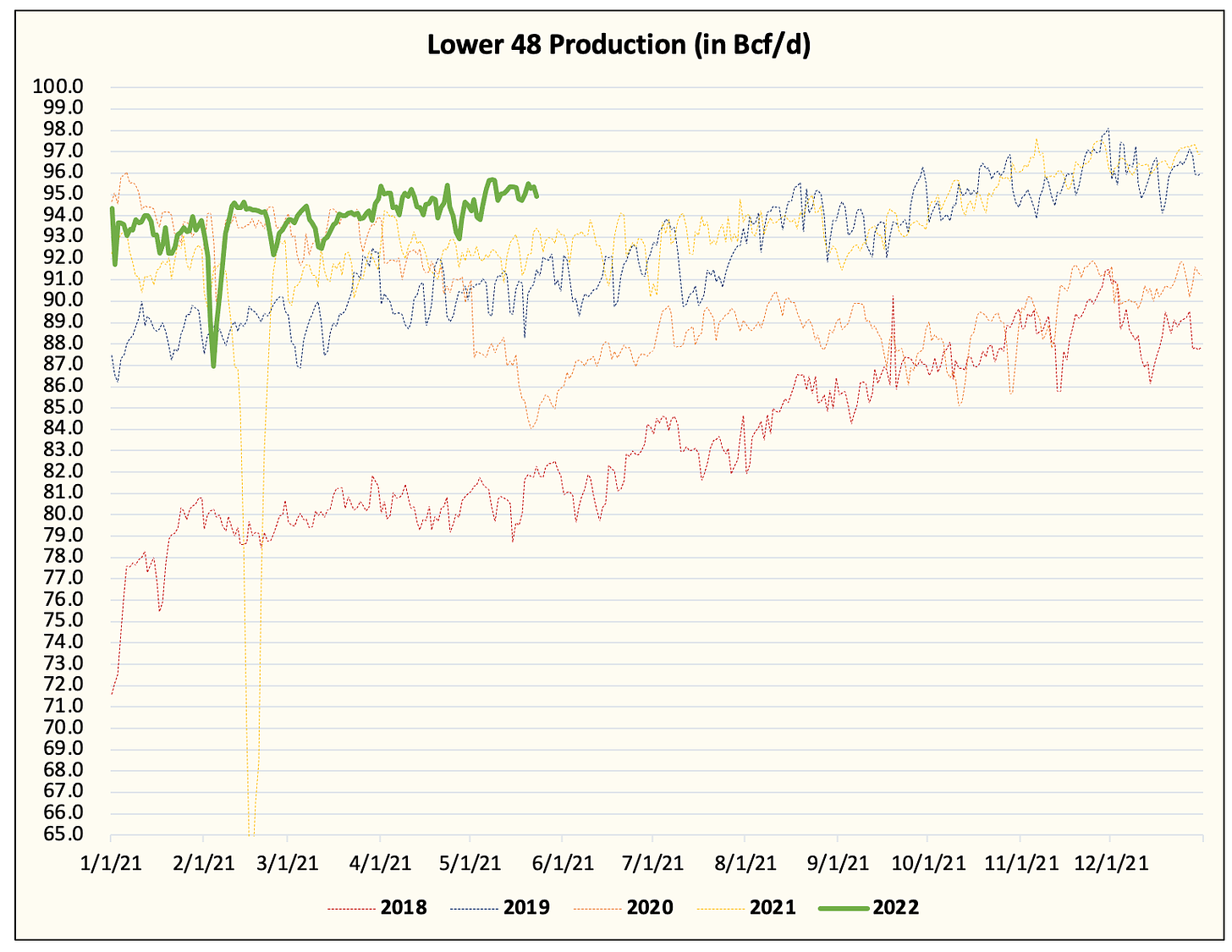

"Two words: not enough. That really sums up the reality of the natural gas market today. With power burn demand now picking up steam, natural gas prices will keep grinding higher. It's a one-way bet, so there will be a lot of unnecessary volatility from here to the destination to shake out the over-leveraged traders. But the path is set, so unless production spikes to ~98 Bcf/d to ruin the party, it's going to be hard to stop this freight train."

"If you look at total gas demand, the strength is just remarkable. On a y-o-y basis, there is a +9 Bcf/d for total gas demand. For supplies, it is +2.4 Bcf/d. This is the reason why natural gas is moving higher and will continue to until something dramatic happens."

"Based on HFI's calculation, the market is the tightest it has ever been for this time of the year. As a result, prices will likely reach double digits. There is no demand replacement this year from the likes of gas-to-coal switching. The coal stockpile is in shortage right now, so good luck finding a replacement there. To sum it all up, natural gas is going higher. Stay long AR, it doesn't get more complicated than that."