Cordoba Minerals Announces Diamond Drilling Results at its 100%-Owned San Matias Copper-Gold-Silver Project in Colombia

VANCOUVER, CANADA – Sarah Armstrong-Montoya, President and Chief Executive Officer of Cordoba Minerals Corp. (TSXV:CDB; OTCQB:CDBMF; otherwise “Cordoba” or the “Company”), provides an update on the recently completed exploration diamond drilling at the 100%-owned San Matias Project.

Highlights:

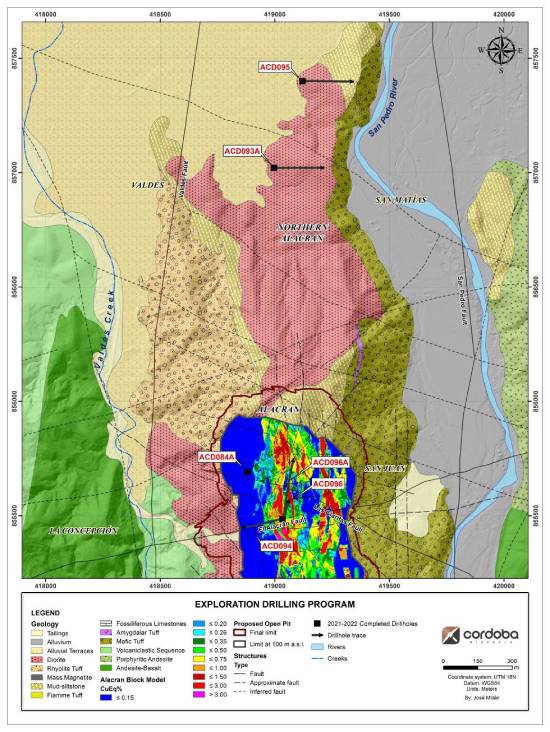

- Cordoba completed a total of 2,152.7 metres (m) of diamond drilling within four holes focused on the suspected buried Alacran Porphyry Target (below the proposed open pit) and two holes within the Alacran Northern Extension Target.

- Mineralization within drill holes ACD094, ACD096 and ACD096A within the Alacran proposed open pit was consistent with the mineral resource block model

(Figure 1 and Table 1). - ACD094 – intersected 1.11% copper (Cu) and 0.19 g/t gold (Au) and 12.35 g/t silver (Ag) over 27.35 m (1.21% copper equivalent (“CuEq”)).

- These drill holes did confirm the continuation and down dip edge of the Alacran mineralization, which provided additional support for the mineral resource; however, the deeper source of the porphyry clasts seen in the previous drilling could not be located (refer to drill holes ACD084A, ACD094, ACD096 and ACD096A in Figure 1).

- The Alacran Northern Extension Target, drill holes ACD093A and ACD095, in Figure 1, continued to intersect the barren unit 2, sterilizing this northern area of possible mineralization. The origin of the Northern Extension Target's geochemical anomaly remains unexplained.

- The mineralized porphyry clasts seen so far are “xenoliths” located in restricted portions of a late mineral dacite intrusion (dacite breccia) which has at least some evidence for phreatomagmatic activity. Since these breccias can source material some distance from where they are emplaced, they do not give clear support for the porphyry source to be immediately adjacent or below the Alacran deposit. Nor has any hydrothermal alteration suggesting a vector towards a nearby porphyry source (laterally or at depth) been seen in the host stratigraphy. Therefore, the search for the source porphyry will move outward of the Alacran deposit and will require further mapping and geophysical surveys to provide new targets.

“We have received encouraging assay results from the drill holes to further support the Alacran mineral resource/mineral reserve,” commented Ms. Armstrong-Montoya, President and CEO of Cordoba. “ We look forward to the continued advancement of the San Matias Project.”

Figure 1: Map showing the completed drill holes (black squares) at the Alacran Porphyry and the Alacran Northern Extension Targets.

2021-2022 Diamond Drill Program at the San Matias Project

As per the November 29, 2021 press release, Cordoba drilled 2,152.7 m over six holes at the Alacran Porphyry and Alacran Northern Extension Targets.

Alacran Porphyry Target Results

Four holes were drilled on the northwestern part of the Alacran deposit in search of the suspected buried porphyry target.

| Drill Hole | From

(m) | To

(m) | Interval

(m) | Cu

(%) | Au

(g/t) | Ag

(g/t) | CuEq[1]

(%) | | ACD094 | 10 | 28 | 18 | 0.3 | 0.1 | 2.3 | 0.3 | | and | 79.9 | 85.75 | 5.85 | 0.46 | 0.21 | 8.93 | 0.61 | | and | 95.15 | 122.5 | 27.35 | 1.11 | 0.19 | 12.35 | 1.21 | | ACD096 | 0 | 7.5 | 7.5 | | 0.88 | 29.41 | 0.54 | | and | 19 | 25.4 | 6.4 | 0.47 | 0.51 | 4.9 | 0.78 | | and | 36.2 | 70.3 | 34.1 | 0.42 | 0.11 | 3.52 | 0.47 | | and | 75.5 | 110.11 | 34.61 | 0.67 | 0.1 | 6.05 | 0.72 | | and | 128.2 | 132.48 | 4.28 | 0.68 | 0.84 | 5.8 | 1.17 | | ACD096A | 32.4 | 82.9 | 50.5 | 0.6 | 0.09 | 6.63 | 0.65 | | and | 87.9 | 92.95 | 5.05 | 0.56 | 0.14 | 4.13 | 0.63 | | and | 101.95 | 127.37 | 25.42 | 0.81 | 0.25 | 3.99 | 0.92 | | and | 151.77 | 170 | 18.23 | 0.37 | 0.22 | 1.66 | 0.49 | Table 1: 2021-2022 Alacran Porphyry Target significant intercepts[2]

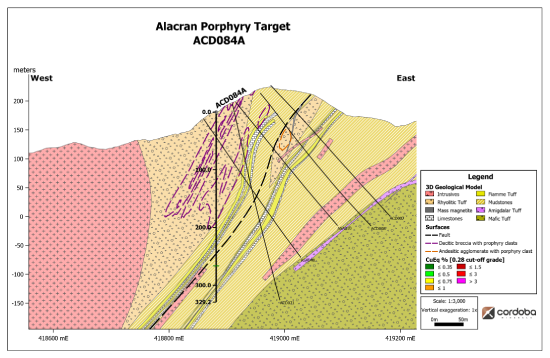

ACD084A (Figure 2) extended ACD084. The hole sampled the dacitic breccia with occasional unmineralized porphyry clasts down to around 200 m below the collar, when it entered unmineralized unit 2 mudstones. No mineralization or alteration was seen, which was expected since the hole is to the immediate west of the block model. Therefore the western edge of the Alacran mineralization was confirmed by this hole.

Figure 2: Alacran Porphyry Target section view on ACD084A

ACD094 (Figure 3) was collared in the Alacran village and drilled down dip of the ore body to determine whether the dacitic breccia truncated the Alacran deposit stratigraphy. This was not the case since continuous stratigraphy was encountered with stratabound mineralization observed with the following intersections, summarized in Table 1.

- 18 m of 0.3% CuEq from 10 m,

- 5.85 m of 0.61% CuEq from 79.9 m, and

- 27.35 m of 1.21% CuEq from 95.15 m.

Figure 3: Alacran Porphyry Target section view on ACD094

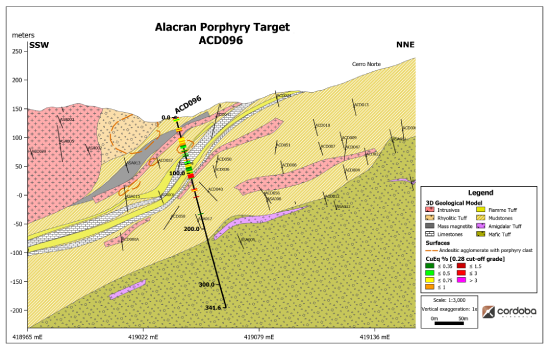

ACD096 (Figure 4) was then drilled approximately normal to the Alacran deposit stratigraphy to test whether any alteration related to the suspected porphyry could be located below a known high grade part of the deposit. No alteration was noted below the deposit, but the following mineralized intersections of unit 2 were recorded, corresponding with the Alacran deposit resource block model (Table 1):

- 7.5 m of 0.54% CuEq in saprolite from surface. This copper equivalency was calculated from gold and silver assays alone since no copper can be recovered from saprolite,

- 6.4 m of 0.78% CuEq from 19 m,

- 34.1 m of 0.47% CuEq from 36.2 m,

- 34.61 m of 0.72% CuEq from 75.5 m, and

- 4.28 m of 1.17% CuEq from 128.2 m.

Figure 4: Alacran Porphyry Target section view on ACD096

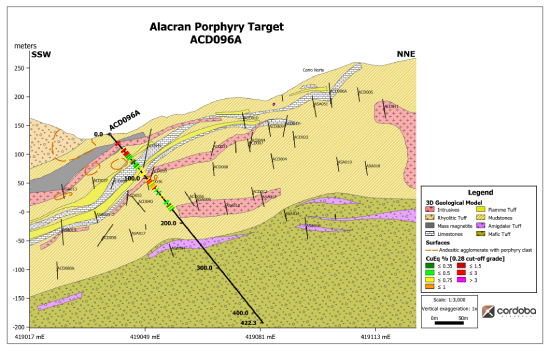

Based on the results of ACD096, a new drill hole ACD096A was proposed at a shallower dip to ACD096 to sample more of the stratigraphic host dacite breccias. This drill hole was also rotated further to the North to test whether there was evidence for the porphyry below the tonalite sill since no surface expression of mineralization would be seen below this late stage intrusive. ACD096A (Figure 5) used the same platform as ACD096 intersected mineralized unit 2 but did not return any evidence of a porphyry source (Table 1).

- 50.5 m of 0.65% CuEq from 32.4 m,

- 5.05 m of 0.63% CuEq from 87.9 m,

- 25.42 m of 0.92% CuEq from 101.95 m, and

- 18.23 m of 0.49% CuEq from 151.77 m.

Figure 5: Alacran Porphyry Target section view on ACD096A

Alacran Northern Extension Results

Two holes were completed at the Alacran Northern Extension Target.

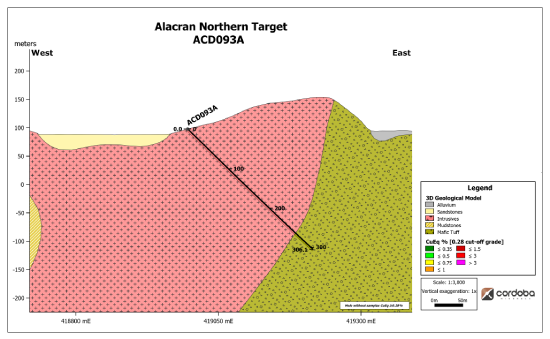

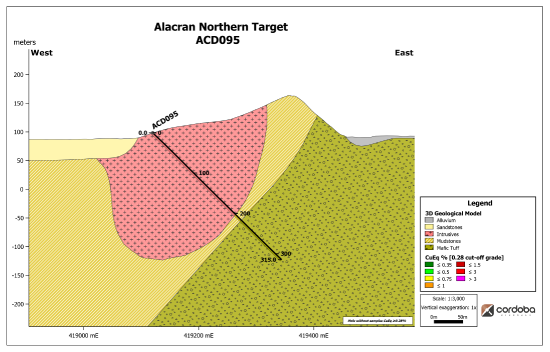

ACD093A was drilled directly below the geochemical anomaly identified on the hill to the north of the Alacran deposit. Figure 6 illustrates the hole intersected the dacite sill previously seen in drill hole ACD039 before intersecting the unit 3 mafic tuff representing the footwall of the Alacran deposit. On this basis, ACD095 (Figure 7) was collared further north, where the sill was interpreted to be thin. This was the case since ACD095 was collared in the sill and exited it at 198 m into unmineralized unit 2 before intersecting unit 3 mafic tuff at 204.1 m.

Figure 6: Alacran Northern Target section view on ACD093A

Figure 7: Alacran Northern Target section view on ACD095

Technical Information & Qualified Person

The technical information in this release has been reviewed and verified by Mark Gibson, P.Geo., a Qualified Person for the purpose of National Instrument 43-101. Mr. Gibson is the Chief Operating Officer of Cordoba Minerals and of Ivanhoe Electric Inc., Cordoba Minerals’ majority shareholder, and is not considered independent under National Instrument 43-101.

Cordoba utilizes a comprehensive industry-standard QA/QC program. PQ diamond drill core is sawn lengthwise in two halves, and one half is sampled and shipped to a sample preparation laboratory. The other half of the core is stored in a secure facility for future assay verification. All samples are prepared at ALS Minerals Laboratory in Medellin, Colombia, and assayed at ALS Minerals Laboratory in Vancouver, Canada. ALS Minerals operates in accordance with ISO/IEC 17025. Gold is determined by 50 g fire assay with an AAS finish. An initial multi-element suite comprising copper, molybdenum, silver and additional elements is analyzed by four-acid digest with an ICP-ES or ICP-MS finish. All samples with copper values over 2000 ppm are re-assayed by a method for higher grades, which also uses a four-acid digest with an ICP-ES finish. Certified reference materials, blanks, and duplicates are inserted into the sample stream to monitor laboratory performance

About Cordoba

Cordoba Minerals Corp. is a mineral exploration company focused on the exploration, development and acquisition of copper and gold projects. Cordoba is developing its 100%-owned San Matias Copper-Gold-Silver Project, which includes the Alacran deposit and satellite deposits at Montiel East, Montiel West and Costa Azul, located in the Department of Cordoba, Colombia. Cordoba also holds a 51% interest in the Perseverance Copper Project in Arizona, USA, which it is exploring through a Joint Venture and Earn-In Agreement. For further information, please visit www.cordobaminerals.com.

ON BEHALF OF THE COMPANY

Sarah Armstrong-Montoya, President and Chief Executive Officer

Information Contact

Ran Li +1-604-689-8765

info@cordobamineralscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release includes “forward-looking statements” and “forward-looking information” within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, that exploration will lead to the discovery of the potential porphyry source of the Alacran deposit and the possible Alacran Northern Extension; the exploration diamond drill program may be increased; and that ongoing exploration will lead to a potential discovery. Forward looking-statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which Cordoba operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. There can be no assurance that such statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, uncertainties relating to epidemics, pandemics and other public health crises, including COVID-19 or similar such viruses, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading “Risks and Uncertainties” in the Company’s most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law. Readers are cautioned not to put undue reliance on these forward-looking statements.

[1] Copper equivalent (“CuEq”) is calculated using the formula CuEq=((Copper%*Copper recovery)+100*((gold grade*gold recovery)/31.10305)/((copper%*copper price)*2204.62)+100*((silver grade*silver recovery)/31.10305)/((copper%*copper price)*2204.62) using the following assumptions: Metal prices of US$3.25/lb copper, US$1,600.00/oz gold, and US$20.00/oz silver, copper recovery of 92.5% (fresh and transition zone only), gold recovery of 78.1% and silver recovery of 62.9%.

[2] Saprolite sample excludes copper | |