Crescat: Buy Energy, Base/Precious Metals, Agri, Forestry https://www.crescat.net/may-research-letter-too-soon/

May Research Letter – Too Soon

Crescat Capital

Monthly Research Letter Too Soon to Buy the Dip, Unless It’s Commodities

The valuation of the Wilshire 5000 US Total Stock Market Index reached a historic high of 207% of GDP in 2021 in the wake of the Covid-19 stimulus and record corporate earnings. We are now entering what in Crescat’s analysis is an inflationary recession. The index is off 15% from its all-time highs but still trading at 187% of GDP. During comparable stagflations of the early 1970s and 1980s, the associated equity bear markets did not end until the total stock market capitalization traded down to an average of 35% of GDP. Even if nominal GDP were to grow a full 20% over the next two years, not out of reason in today’s historically high inflationary environment, there is the potential for a further 78% decline in stock prices from current levels to settle at the low multiples of the last stagflationary era. While the market could bottom at higher multiples this time around, we must acknowledge the downside risk if we are indeed in just the early stages of new stagflationary regime.

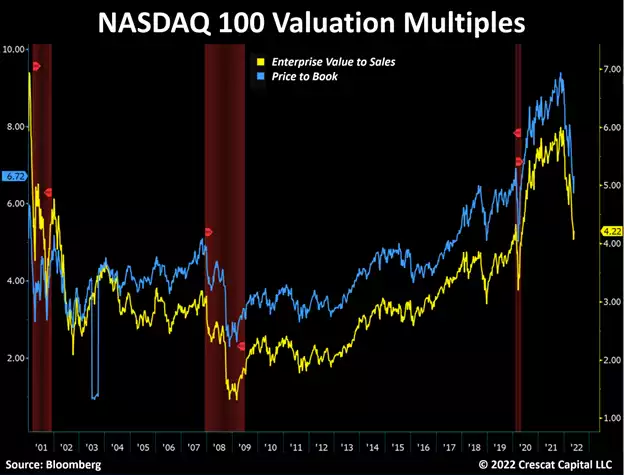

Similarly, the popular NASDAQ 100 Index is already 23% off its highs, but it is still trading at lofty valuation multiples with price to book and enterprise value to sales multiples of 6.7 and 4.2 respectively. If we look at comparable bear market regimes, there is still substantial downside risk for this large cap tech index. For instance, after the tech bust in October 2002, the NASDAQ 100 bottomed with a price to book value of 2.7 and an enterprise value to sales ratio of 2.1. And, during the Global Financial Crisis, in March 2009, the index bottomed with multiples of 2.5 and 1.3 respectively. Conservatively, if we assume flat sales and earnings over the next one to two years during a probable recession, there is another 50% to 69% downside risk. Sure, the market may bottom at higher valuations, but this is the eyes-wide-open risk based on math and history.

The Great Rotation

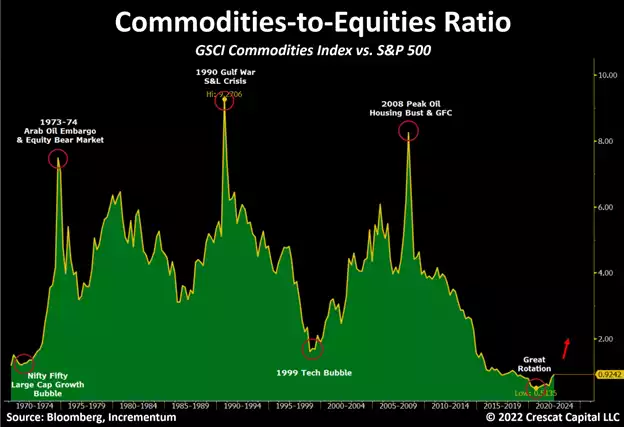

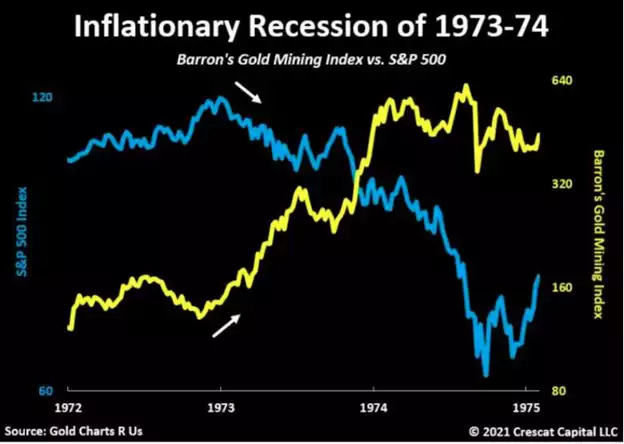

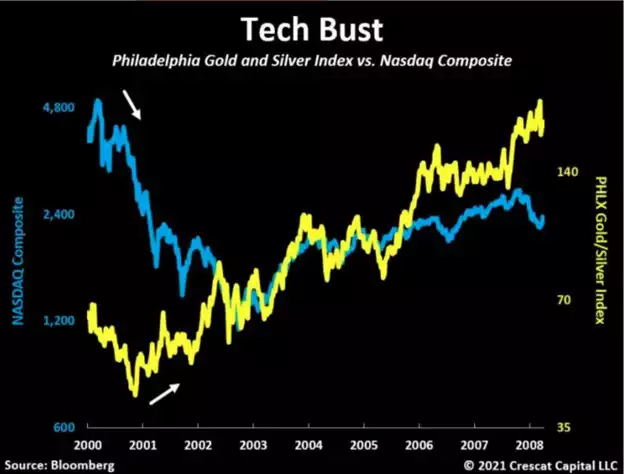

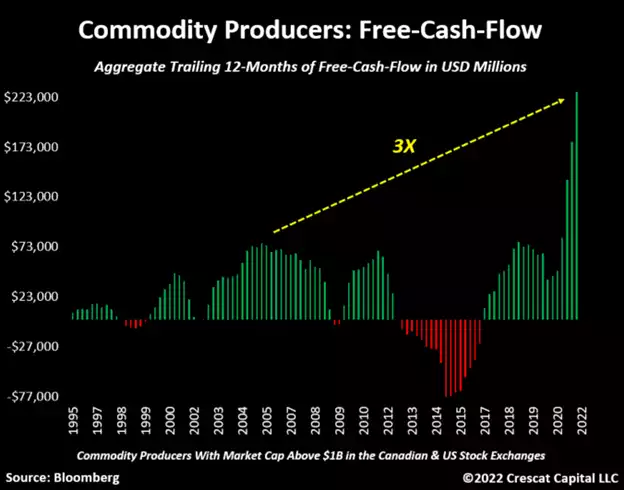

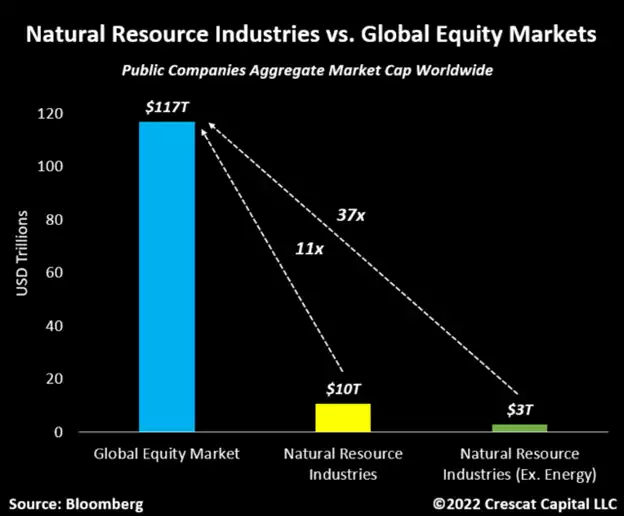

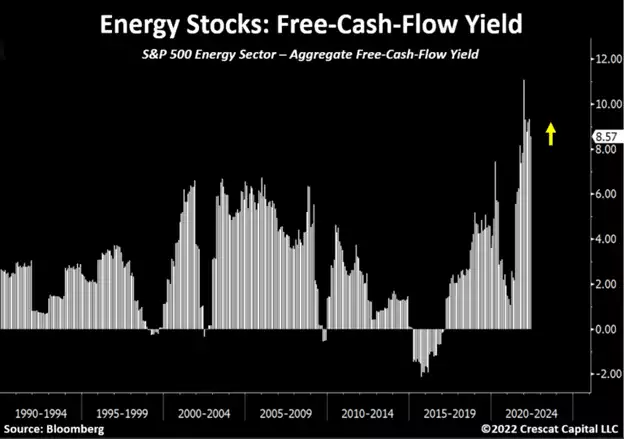

Despite the downside risk in the market at large, it is extremely important to note that there is tremendous value, medium-term growth, and upside appreciation potential in a narrow segment of the stock market today: commodity producers. It is still very early, in our analysis, in the rotation cycle out of overvalued growth equites and low yielding fixed income securities and into commodities. It is just like early 1973 and early 2001 in our view the three charts below help make evident:

It is important to emphasize that we remain short a variety of industries and individually picked equities driven by Crescat’s Equity Quant Model in our Global Macro and Long/Short hedge funds at the same time as we are long a variety of commodity related explorers and producers.

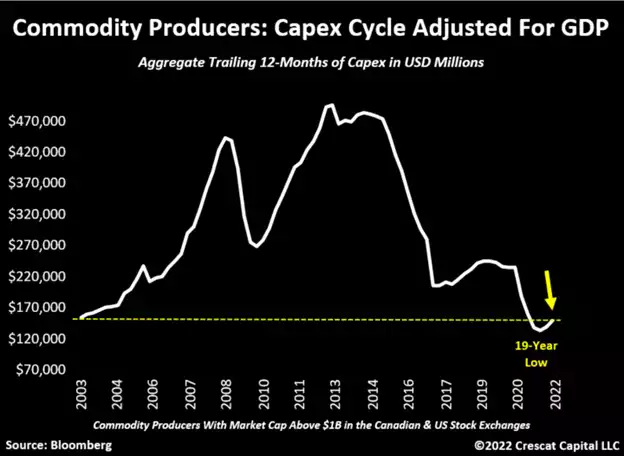

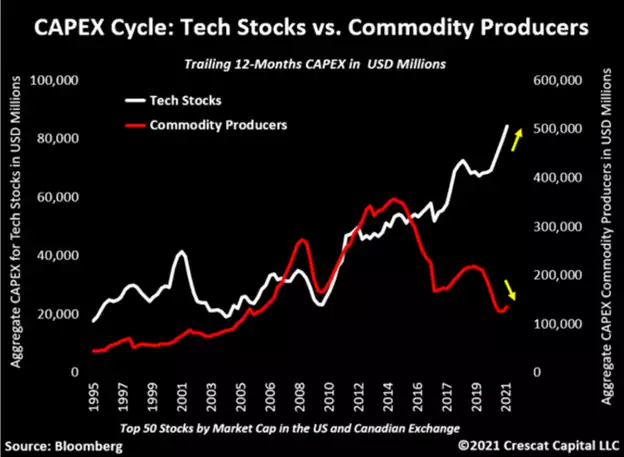

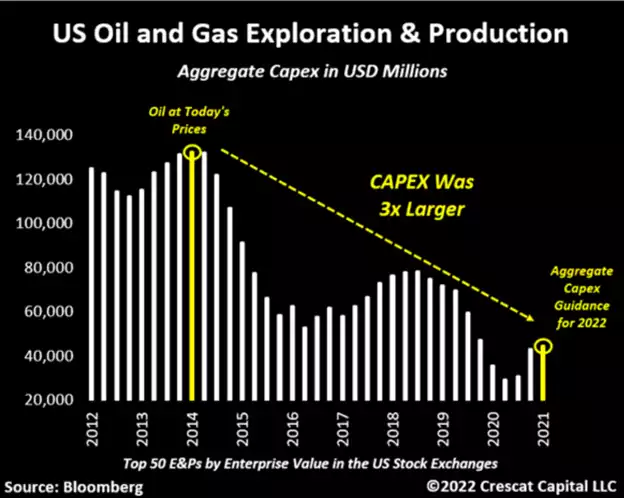

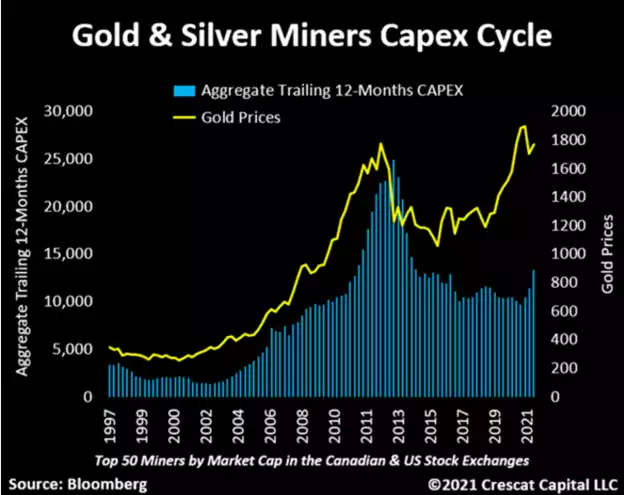

It is All About the CAPEX Cycle

The macro case for inflation being around at a higher rate for longer and contributing to a further bear market in financial assets is based first and foremost on structural commodity supply shortages today. There has been a multi-year declining investment trend in capital expenditures of commodity producers necessary to boost output. This is in large part the result of a policy error based on an aggressive green agenda that has lacked the foresight and coordination with industry for a viable clean energy transition. Instead of cooperating with companies that produce critical commodities necessary for food, energy, and basic materials, environmental, social and government policy makers have attacked these industries. The onslaught has translated into a multi-year declining trend of investment in these critical sectors of the economy despite ongoing global population growth and inelastic demand for the resources they produce. These industries have long lead times, so output cannot be ramped up without years of increased investment. As a result, the world now faces a commodity supply cliff and likely parabolic increase in energy and food prices. As the three charts below illustrate, the underinvestment in commodities has been a slow-motion train wreck. In our view, it will lead to crippling stagflation over the medium term, and it is only the beginning.

The value and fundamental medium-term growth opportunity in commodity stocks in contrast to the market at large is illustrated in the following three charts:

The Fed is Trapped

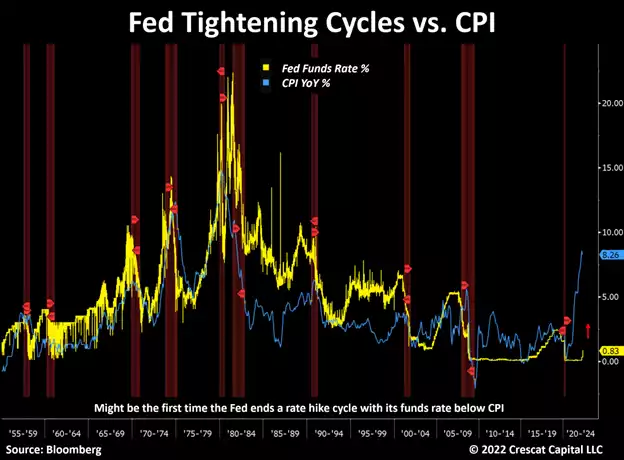

The Fed’s main policy tool for fighting inflation is to hike interest rates. This reduces the demand side of the economy by tightening credit conditions and causing financial asset prices to decline which crimps investor savings and consumer demand and increases unemployment. But raising interest rates does not stimulate commodity supplies, the core inflationary problem today. In fact, raising interest rates could have the opposite effect because it makes the cost of capital for investment in new commodity production higher.

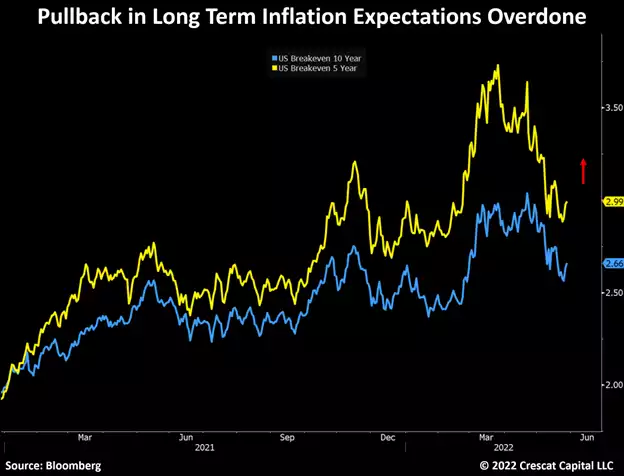

After years of money printing and interest rate suppression, policy makers have created a historic speculative environment in financial assets. But now, the inflation genie is out of the bottle, and to restore its credibility, the Fed has no choice but to burst the bubble. At the same time, it is powerless to stop commodity inflation. To illustrate just how trapped the Fed is, it has never ended a hiking cycle with the Fed Funds Rate below CPI. But the implied terminal rate in the Fed Funds Futures market is now just 2.9% in early 2023 while CPI is still at 8.3%. If the efficient market hypothesis holds, which it rarely does, CPI must drop precipitously over the next three quarters. Such is highly unlikely based on our commodity supply analysis shown above. There is a much bigger risk based on our work that inflation stays elevated, and the Fed ends up having to hike more and for longer than is currently priced in, as in all past tightening cycles. Alternatively, there is the risk that the stock market correction continues under the existing planned increases and the Fed panics and ends its hiking cycle for the first time with real rates still in negative territory. In all cases, the market seems to be in state of delusion today with the average participant still buying the dip in overvalued tech, crypto, and fixed income assets, hoping for a return to those manias, while underestimating the risk of continued high inflation in valuable, scarce, tangible resources.

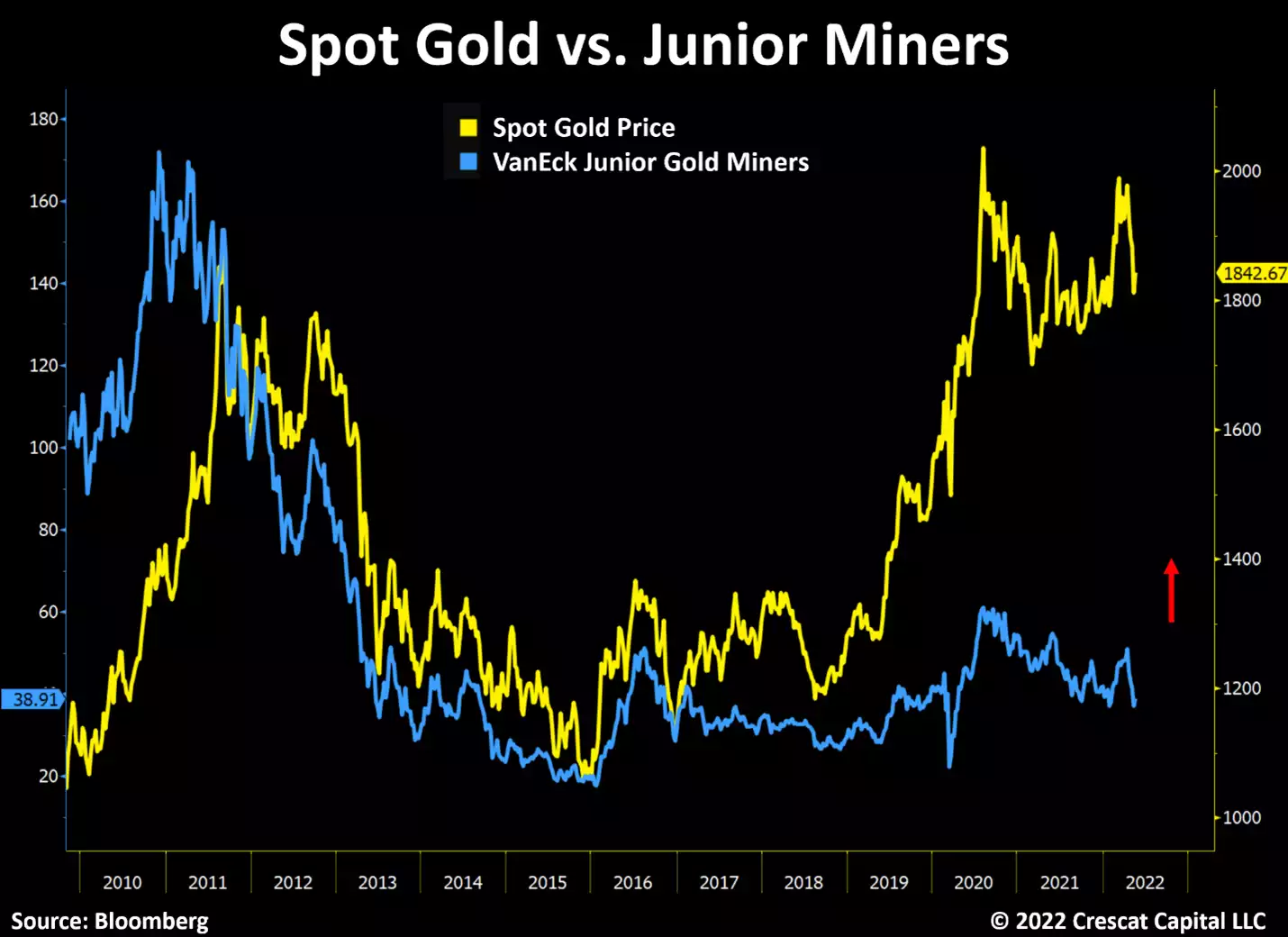

In our analysis, the overwhelming best deep value, high medium-term growth, and high appreciation potential macro investment opportunities in the market today are in commodity exploration and production equities. As a result, we believe smart money investors will increasingly seek both inflation protection and outsized real returns in fundamentally sound businesses that produce valuable scarce resources. Along with energy, base metals, agriculture, and forest products, precious metals miners are where some of the deepest value and appreciation potential lies in the market today. Look at the appreciation potential in junior gold and silver miners relative to gold based on the historical relationship below.

Gold and silver miners have had one of the longest declining CAPEX cycles ever setting up a huge macro supply imbalance. Note, the long-term trend has only just begun to turn back up.

Crescat’s Activist Metals Strategy

Crescat’s exploration heavy activist precious metals portfolio has appreciation potential of 27 times in our model compared to where the market is pricing it today, at current metals prices. Our macro call is for substantially higher metals prices. We have been buying gold in the ground for 1 to 2 pennies on the dollar relative to our probability-adjusted discovery target resource estimates. We believe our investments can appreciate multiples based on the average historic returns of companies in the industry that have delivered exploration success.