Saudis Raise Oil Prices https://www.zerohedge.com/markets/crude-hits-3-month-high-after-saudis-raise-oil-prices-more-expected-easing-chinese

Crude Hits 3-Month High After Saudis Raise Oil Prices More Than Expected On Easing Chinese Restrictions

While Biden is draining the SPR at the rate of 1 million barrels per day, which is the emptiest it has been in 20 years and will be much emptier by the mid-term election which Democrats will lose regardless, oil continues to climb with brent rising above $120 overnight, rising almost 60% this year, after Saudi Arabia signaled confidence in demand with a bigger-than-expected price increase of its crude for Asia. WTI, which has converged with Brent, also traded near $120/bbl after earlier rising to the highest level in almost three months.

Over the weekend, Saudi Arabia, the world’s biggest oil exporter, raised oil prices for its largest market in Asia more than expected as China is rapidly easing coronavirus restrictions, helping boost demand, Bloomberg reported. The increase for July shipments resumes a series of increases that began in February and were only broken when state producer Saudi Aramco cut prices from record levels a month ago.

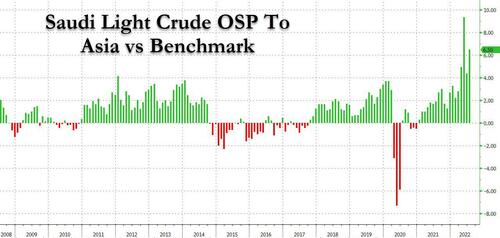

Aramco raised its main grade for Arab Light crude for Asian customers by $2.10 a barrel from June to $6.50 above the benchmark it uses, as the market expected an increase of $1.50, according to a Bloomberg survey of refiners and traders. It was the second highest premium on record.

Brent remains steeply backwardated, a bullish structure where near-dated contracts are more expensive than later-dated ones. The prompt timespread for the global benchmark was $2.70 a barrel in backwardation, compared with $2.69 on Friday. For WTI, the spread was near $3.

Aramco also raised all grades for the north west Europe and the Mediterranean region, while prices for US customers remained unchanged for the second month in a row. According to Arab News, the Kingdom also raised the prices of shipments sold under long-term contracts after the rise of futures contracts in the wake of the Russian invasion of Ukraine.

“In some places, the demand rebound is quite something,” Mike Muller, head of Asia at Vitol Group, said Sunday on a podcast produced by Dubai-based Gulf Intelligence.

“A lot of the south-eastern Asian countries, where I’m based, are very much exceeding expectations in terms of road-transportation demand. And try buying an air ticket in Singapore in the summer holidays. It’s awfully tough.”

In another sign of improving sentiment toward oil, Bloomberg's Sungwoo Park notes that net bullish bets by hedge funds are recovering, back near the levels seen before the invasion of Ukraine. What’s more, oil is effectively shrugging off some bearish news flows over the weekend around Iran and Venezuela supplies. This bullishness has more life in it, especially if those hedge funds continue to return.

OPEC+ last week agreed to accelerate output following repeated calls by the US to pump more. The cartel said it would add 648,000 barrels a day for July and August, about 50% more than the increases seen in recent months. However, the group has struggled recently to meet its supply targets, raising doubts about whether it would be able to meet the goal.

The fuel market has also tightened considerably, just as the peak period for US demand kicks off with the summer driving season. Retail gasoline prices have rallied to a record, while futures in New York hit a fresh high on Monday.

“The peak demand season is here,” said Chen Shuxian, an analyst with Cinda Securities Co. in Shanghai. The summer driving period in the US and Europe will underpin higher consumption, while China’s demand will recover with the easing of virus restrictions, Chen added.