https://www.zerohedge.com/markets/commodity-trading-giant-survives-elevated-margin-calls-historic-var-shocks-post-record

What a difference three months makes.

Back in the middle of March, when the world was still stunned by the Ukraine war which sent commodity prices to record highs, snarled supply chains and sparked tens of billions of margin calls across the commodity sector which was woefully unprepared (and unhedged) for such rollercoaster moves, the CFO of Trafigura, Christophe Salmon, warned that a number of trading houses would collapse as the "margin call doom loop" popularized by Zoltan Pozsar went global, and as a group of energy companies was demanding central bank bailouts as they braced for the worst.

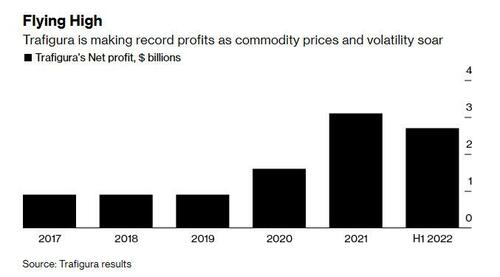

Well, fast forward to today, when instead of collapsing, Trafigura Group posted a record first-half profit, even as Russia’s invasion of Ukraine forced the commodities trading giant to pare back its activities as trading risk soared.

As Bloomberg reports, the wild price swings that have made the commodity surge a bonanza for commodity traders helped generate a net profit of $2.7 billion in the six months through March, Trafigura said in a report on Friday.

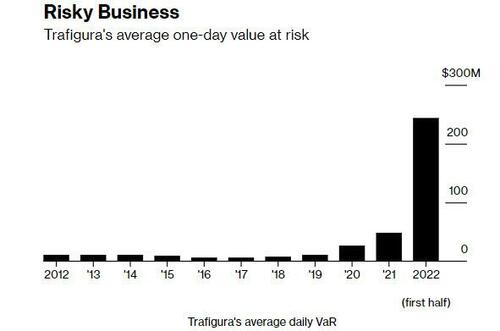

However, as Trafi's CFO had warned months ago, the war sharply increased risks as it upended markets, compelling the company to curb trading volumes and inventories. And so, as the next chart shows, Trafigura’s value at risk -- a measure of how much the company could lose on a normal trading day - also exploded higher tracking commodity prices and over the six-month period, the VaR averaged $244 million, more than five times the previous year’s average.

According to Bloomberg's Archie Hunter, Trafigura’H1 report shares a unique insight into how trading houses grappled with roller-coaster markets as the war in Ukraine and sanctions threatened to curb supplies of energy, grains and metals from Russia: "That involved taking action to limit exposure to out-sized price moves and margin calls from brokers, while maintaining the flow of the world’s key natural resources."

"Actions were swiftly taken to bring back the VaR within acceptable risk limits, including but not limited to reducing stocks and traded volumes as well as entering into backtoback trades,” Trafigura said in its results.

That said, in the immediate aftermath of the invasion on Feb. 24, when the financial sector was worried that commodity traders would not survive the wild price swings, Trafigura's risk surged even higher with the VaR rising beyond Trafigura’s target of keeping it below 1% of group equity. In fact, the figures imply "risk rose to levels uncomfortable for even the biggest of trading houses."

Before the invasion, Trafigura’s VaR had averaged just $86 million. By May, the trader said it had brought down that measure of risk to $139 million, back within what it says were acceptable limits.

"Extreme volatility, in particular after the outbreak of war in Ukraine, brought elevated margin calls and tighter position limits that made hedging activity more expensive and in some cases constrained access to commodities futures markets," Trafigura Chief Executive Officer Jeremy Weir said in results.

What did the price frenzy of the first half mean for Trafigura's business? Nothing short than sheer - if extremely lucrative - chaos. According to Bloomberg, over the half-year, Trafigura’s oil and petroleum product volumes rose 14% to 7.3 million barrels per day, while nonferrous metals volumes climbed 16%. However, with banks pulling back on commodity exposure, to finance the additional tonnages at higher prices, the company tapped credit lines for an extra $7 billion over the six months, bringing total credit lines to $73 billion. It also made approaches to private equity funds to explore other funding options.

A bigger equity base, which grew to $12.7 billion at the end of March, means the company should be able to leverage even more in the future, while the additional credit already raised could provide a cushion to manage trades if prices run even higher.

The bigger point, of course, is that the war in Ukraine is providing a highly profitable moment for commodities traders, something which the woke neocon snowflakes who believe that only the Lockheeds and the Raytheons of the world are entitled to profits, will vociferously protest. Meanwhile, as price volatility surges and physical market arbitrages open up, it’s also shining a spotlight on the predominantly private companies that transport oil, gas, copper and wheat and their links to Russia.

“Volatile commodity markets put a premium on our ability to move commodities to where they are in highest demand as efficiently as possible, producing higher margins,” Chief Financial Officer Christophe Salmon said in the report.

In the second half of its financial year, Trafigura expects profitability to remain “robust,” although geopolitical turbulence and the economic outlook will pose challenges in key markets.

“The lack of depth available in the commodities futures markets looks set to continue to be a challenge for the industry, as reduced access to derivatives for all participants in turn puts pressure on the ability to move physical commodities,” the trading house said.

And as long as commodity markets are challenged, and prices exorbitant due to the inability of the west to find a compromise with Russia over Ukraine, the Trafiguras of the world will continue to print money.