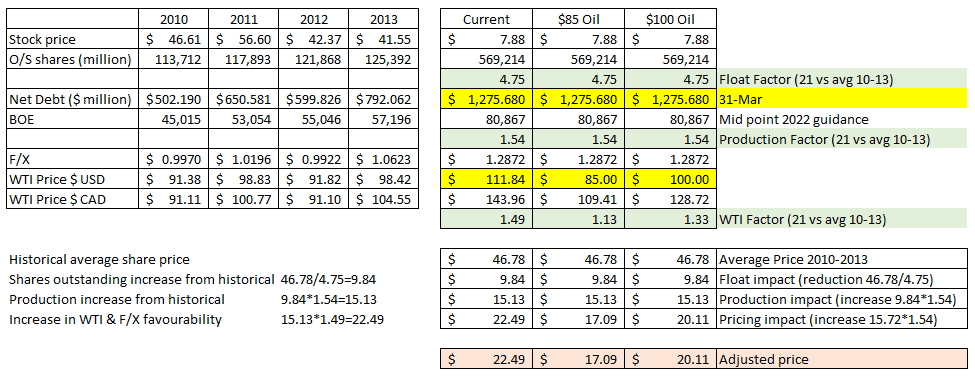

RE:RE:RE:Baytex Enercom Conference - August 7-10Hey DFC, thanks for the question. I maintain a quick analysis I have pasted in below for you which tracks

Historical vs Current

Re:

1. Share float

2. Debt

3. Increase in prodution

4. Gains on F/X vs history

Of course what most don't think about is as the float goes down the metrics improve including the a yield on a future divy...if all things remain constant in theory a dividend never grows...unless you can eliminate shares...than your yield will always climb (or the price)...

Anyhow hope this helps

BSW

DashForCash wrote: Just a reach out to BSW and/or Red as I respect your opinions...do you know - or does anybody know - back in 2014 the share price peaked around $44 and then in 2015 it was still circa $20 - before trailing down as we know....

My question is - does anybody know what the share float was back then? Just trying to gauge what this may be able to get to again one day...looking at the current float and the strategy to buyback and diminish - wondering what that float was back then when those numbers were achieved?

If anyone can assist with guidance it would br greatly appreciated...DFC