WELL Health Technologies (TSE: WELL) owns and operates clinics that deliver healthcare-related services. It operates through the following segments: Clinical services, Digital Services, and Others. It also engages in the Electronic Medical Records business that supports the digitization of clinics.

A big part of the company’s growth strategy comes from acquiring smaller competitors at attractive valuations. In fact, WELL Health recently announced that it has entered into an agreement to purchase the assets of healthcare provider INLIV. The Alberta-based company specializes in preventative health, corporate and executive health, primary care, cosmetics, fitness, and integrated health services.

The deal appears to be very attractive. For a price tag of approximately C$1.85 million, WELL Health will receive C$7.3 million in revenue with an adjusted EBITDA margin that is in the double digits. That means that WELL Health is paying a maximum of 2.53 times adjusted EBITDA, assuming a margin of 10%.

Considering that WELL Health completed an equity raise at a much higher multiple, this move demonstrates that management is working towards keeping its promise of using those funds for value-creating initiatives. Indeed, it is expected that INLIV will be highly accretive to WELL Health, as it has over 1,000 customers, with 85% of its revenue coming from recurring membership fees.

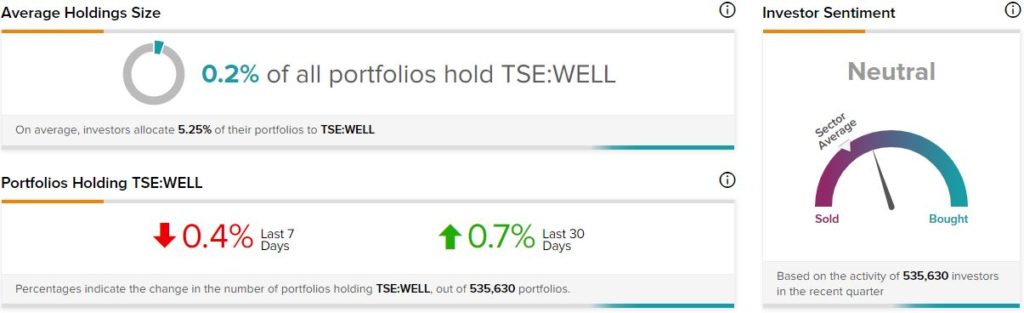

Investor Sentiment

The sentiment among TipRanks investors is currently neutral. Out of the 535,630 portfolios tracked by TipRanks, only 0.2% hold WELL Health. Furthermore, in the last 30 days, 0.7% of those holding the stock increased their positions.

Conversely, 0.4% of TipRanks portfolios decreased their holdings in WELL Health in the past seven days. Nevertheless, the stock’s sentiment is above the sector average, as demonstrated in the following image: