1. Advantages of vanadium batteries: high safety, low life cycle cost, independent and controllable resources

1.1. High security and easy expansion are the biggest advantages

The all-vanadium redox flow battery is a liquid redox renewable battery with metal vanadium ions as the active material. The all-vanadium redox flow battery uses the vanadium ion solution in the +4 and +5 valence states as the active material of the positive electrode, and the vanadium ion solution in the +2 and +3 valence state as the active material of the negative electrode. in the jar. When the battery is charged and discharged, the positive and negative electrolytes undergo redox reactions on both sides of the ion exchange membrane. At the same time, through the action of the pump outside the stack, the electrolyte in the liquid storage tank is continuously sent into the positive electrode chamber and the negative electrode chamber to maintain the concentration of ions and realize the charging and discharging of the battery.

The working principle of the flow battery determines that it is the safest technical route in the current electrochemical energy storage technology route. Different from the lithium battery, the electrolyte of the flow battery is separated from the stack. Since the electrolyte ions of the all-vanadium flow battery exist in the aqueous solution, thermal runaway, overheating, combustion and explosion will not occur. At the same time, the vanadium battery supports frequent charging and discharging, and can be charged and discharged hundreds of times a day. The liquid electrolyte makes overcharge and overdischarge without causing explosion and battery capacity reduction.

Lithium battery energy storage safety problems occur frequently

Due to the dominant energy density of lithium-ion batteries and the continuous decline in cost, lithium batteries have been rapidly promoted in the field of energy storage in recent years, but at the same time, lithium battery energy storage explosion accidents are also increasing. According to our statistics, from 2011 to April 2022, a total of 34 energy storage power station explosions occurred around the world, including 1 in Japan, 1 in Belgium, 3 in China, 4 in the United States, and 25 in South Korea. From the perspective of the type of batteries that exploded, lithium batteries are still the main ones, with a total of 32 cases, accounting for 94%, and the remaining are 1 lead-acid battery in the United States and 1 sodium-sulfur battery in Japan; Explosion for lithium batteries.

The main reason for the explosion of lithium battery energy storage is that the demand for battery capacity of energy storage is significantly higher than that of electric vehicles, and lithium ion batteries are prone to short circuit inside the battery and cause spontaneous combustion, and the design of the battery itself and the external electricity and heat. Interference will affect the safety of the energy storage system. As the number of lithium batteries increases, the probability of fire increases.

Compared with lithium batteries, the water-based electrolyte properties of all-vanadium redox flow batteries make them less likely to burn and explode. Vanadium batteries use chemically reversible vanadium ions in aqueous solution, and their function is independent of the electrode structure, so they are very flexible even at high currents, and there is no safety problem with overcharging. On the other hand, the power and capacity of the all-vanadium redox flow battery are independent of each other, the power is determined by the specification and quantity of the stack, and the capacity is determined by the concentration and steps of the electrolyte. The capacity expansion can be achieved by increasing the capacity of the vanadium electrolyte, so it can still be safe on a large-capacity installed scale.

Power and capacity are independent of each other, with strong scalability

The stack of the vanadium battery is separated from the storage tank for storing the electrolyte as the place where the reaction occurs, which fundamentally overcomes the self-discharge phenomenon of the traditional battery. The power only depends on the size of the stack, the capacity only depends on the electrolyte storage and concentration, and the design is flexible. When the power is constant, to increase the energy storage capacity, it is only necessary to increase the volume of the electrolyte storage tank or increase the volume or concentration of the electrolyte, without changing the size of the stack. At the same time, the power can be increased by increasing the stack power and the number of stacks, and the power storage can be increased by increasing the electrolyte, which facilitates the expansion of the battery scale, and can be used to build kilowatt to 100 megawatt energy storage power stations. strong.

1.2. Long cycle life, basic full recovery, and low life cycle cost

Long cycle life of vanadium batteries

The positive and negative active materials of vanadium batteries exist in the positive and negative electrolytes, respectively. There is no phase change common to other batteries during charging and discharging, and it can be deeply discharged without damaging the battery. During the charging and discharging process, vanadium as an active material The ion only changes its valence state in the electrolyte, does not react with the electrode material, does not produce other substances, and still maintains good activity after long-term use. Therefore, the vanadium battery has a long service life. The all-vanadium redox flow battery has a charge-discharge cycle of more than 10,000 times, and some can reach more than 20,000 times.

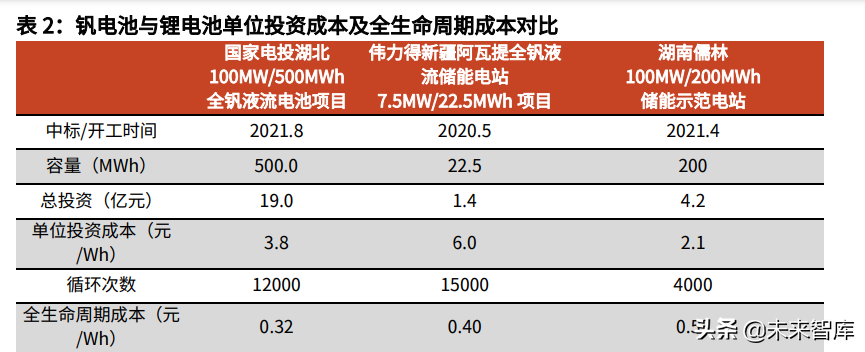

The full life cycle cost of vanadium batteries is already lower than that of lithium batteries

At present, the initial installation cost of vanadium battery energy storage is high, but due to the long cycle life of vanadium battery, the cost of vanadium battery energy storage is lower than that of lithium battery from the perspective of the whole life cycle. We compared the costs of vanadium battery projects and lithium battery energy storage projects with complete investment data. If calculated according to the whole life cycle, the cost of vanadium battery is 0.3-0.4 yuan/Wh, which is already lower than the cost of lithium battery (about 0.5 yuan/Wh).

All-vanadium redox flow battery industry research report: vanadium battery has broad space for long-term energy storage

(Report Producer/Author: Everbright Securities, Wang Zhaohua, Fang Yutao)

1. Advantages of vanadium batteries: high safety, low life cycle cost, independent and controllable resources

1.1. High security and easy expansion are the biggest advantages

The all-vanadium redox flow battery is a liquid redox renewable battery with metal vanadium ions as the active material. The all-vanadium redox flow battery uses the vanadium ion solution in the +4 and +5 valence states as the active material of the positive electrode, and the vanadium ion solution in the +2 and +3 valence state as the active material of the negative electrode. in the jar. When the battery is charged and discharged, the positive and negative electrolytes undergo redox reactions on both sides of the ion exchange membrane. At the same time, through the action of the pump outside the stack, the electrolyte in the liquid storage tank is continuously sent into the positive electrode chamber and the negative electrode chamber to maintain the concentration of ions and realize the charging and discharging of the battery.

The working principle of the flow battery determines that it is the safest technical route in the current electrochemical energy storage technology route. Different from the lithium battery, the electrolyte of the flow battery is separated from the stack. Since the electrolyte ions of the all-vanadium flow battery exist in the aqueous solution, thermal runaway, overheating, combustion and explosion will not occur. At the same time, the vanadium battery supports frequent charging and discharging, and can be charged and discharged hundreds of times a day. The liquid electrolyte makes overcharge and overdischarge without causing explosion and battery capacity reduction.

Lithium battery energy storage safety problems occur frequently

Due to the dominant energy density of lithium-ion batteries and the continuous decline in cost, lithium batteries have been rapidly promoted in the field of energy storage in recent years, but at the same time, lithium battery energy storage explosion accidents are also increasing. According to our statistics, from 2011 to April 2022, a total of 34 energy storage power station explosions occurred around the world, including 1 in Japan, 1 in Belgium, 3 in China, 4 in the United States, and 25 in South Korea. From the perspective of the type of batteries that exploded, lithium batteries are still the main ones, with a total of 32 cases, accounting for 94%, and the remaining are 1 lead-acid battery in the United States and 1 sodium-sulfur battery in Japan; Explosion for lithium batteries.

The main reason for the explosion of lithium battery energy storage is that the demand for battery capacity of energy storage is significantly higher than that of electric vehicles, and lithium ion batteries are prone to short circuit inside the battery and cause spontaneous combustion, and the design of the battery itself and the external electricity and heat. Interference will affect the safety of the energy storage system. As the number of lithium batteries increases, the probability of fire increases.

Compared with lithium batteries, the water-based electrolyte properties of all-vanadium redox flow batteries make them less likely to burn and explode. Vanadium batteries use chemically reversible vanadium ions in aqueous solution, and their function is independent of the electrode structure, so they are very flexible even at high currents, and there is no safety problem with overcharging. On the other hand, the power and capacity of the all-vanadium redox flow battery are independent of each other, the power is determined by the specification and quantity of the stack, and the capacity is determined by the concentration and steps of the electrolyte. The capacity expansion can be achieved by increasing the capacity of the vanadium electrolyte, so it can still be safe on a large-capacity installed scale.

Power and capacity are independent of each other, with strong scalability

The stack of the vanadium battery is separated from the storage tank for storing the electrolyte as the place where the reaction occurs, which fundamentally overcomes the self-discharge phenomenon of the traditional battery. The power only depends on the size of the stack, the capacity only depends on the electrolyte storage and concentration, and the design is flexible. When the power is constant, to increase the energy storage capacity, it is only necessary to increase the volume of the electrolyte storage tank or increase the volume or concentration of the electrolyte, without changing the size of the stack. At the same time, the power can be increased by increasing the stack power and the number of stacks, and the power storage can be increased by increasing the electrolyte, which facilitates the expansion of the battery scale, and can be used to build kilowatt to 100 megawatt energy storage power stations. strong.

1.2. Long cycle life, basic full recovery, and low life cycle cost

Long cycle life of vanadium batteries

The positive and negative active materials of vanadium batteries exist in the positive and negative electrolytes, respectively. There is no phase change common to other batteries during charging and discharging, and it can be deeply discharged without damaging the battery. During the charging and discharging process, vanadium as an active material The ion only changes its valence state in the electrolyte, does not react with the electrode material, does not produce other substances, and still maintains good activity after long-term use. Therefore, the vanadium battery has a long service life. The all-vanadium redox flow battery has a charge-discharge cycle of more than 10,000 times, and some can reach more than 20,000 times.

The full life cycle cost of vanadium batteries is already lower than that of lithium batteries

At present, the initial installation cost of vanadium battery energy storage is high, but due to the long cycle life of vanadium battery, the cost of vanadium battery energy storage is lower than that of lithium battery from the perspective of the whole life cycle. We compared the costs of vanadium battery projects and lithium battery energy storage projects with complete investment data. If calculated according to the whole life cycle, the cost of vanadium battery is 0.3-0.4 yuan/Wh, which is already lower than the cost of lithium battery (about 0.5 yuan/Wh).

At the same time, after the battery life expires, the vanadium electrolyte solution can be recycled and reused. The cost of the electrolyte solution accounts for 40% of the total cost of the energy storage system. After the energy storage system is scrapped, the residual value is relatively high. The full life cycle cost of vanadium batteries for long-term energy storage is already competitive. Moreover, vanadium batteries are still in the early stage of industrialization, and there is still room for further cost reduction after technological progress and large-scale application.

1.3. China ranks first in the world in terms of production and reserves of vanadium resources, and is independently controllable

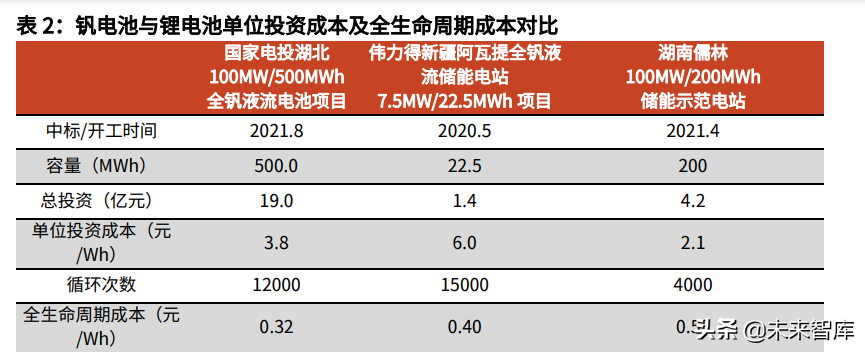

From the perspective of resources, different from lithium batteries, China's lithium raw materials are highly dependent on foreign countries. China ranks first in the world in terms of vanadium reserves and production. The resources required for the development of vanadium batteries can be independently controllable.

Comparison of resource reserves: China ranks first in the world in vanadium resources, while lithium resources are concentrated in South America and Australia

Lithium: Reserves are concentrated in South America and Australia, with China accounting for 7%. According to USGS statistics, by the end of 2021, the total lithium reserves of Chile, Australia and Argentina accounted for more than 76%, and China's lithium reserves were about 1.5 million tons, accounting for 6.7% of the global proportion, which was relatively low. Vanadium: Reserves are concentrated in China, Australia, Russia and South Africa. China has the largest resource reserves in the world. According to USGS statistics, as of the end of 2021, the global reserves of vanadium metal are 63 million tons, of which more than 24 million tons of vanadium metal reserves have been identified to meet the current mining and production requirements. More than 99% of the world's vanadium reserves are concentrated in China, Australia, Russia and South Africa are four countries; among them, China's vanadium ore reserves are about 9.5 million tons, accounting for 39% of the world's vanadium reserves, ranking first in the world; Australia, Russia and South Africa account for 25%, 21% and 15% respectively.

Production comparison of vanadium and lithium: vanadium is completely self-sufficient, and lithium is highly dependent on imports

China's lithium salt production accounts for 67% of the world's total, and resources are highly dependent on imports. According to USGS, the global lithium mine production in 2021 will be equivalent to 105,000 metal tons, of which Australia's production accounts for 53% of the world's production, Chile's production accounts for 25%, and China's only 13%. According to Antaike statistics, in 2021, China's lithium salt production will total about 355,000 tons of lithium carbonate equivalent, accounting for 67% of global lithium salt production. Lithium resources are highly dependent on imports. China's vanadium production accounts for 68% of the world's total, and the resources can be completely self-sufficient. The main countries producing vanadium in the world are China, Russia, South Africa and Brazil. According to USGS data, the global vanadium output in 2021 will be 107,000 metal tons, of which China will produce 73,000 tons, accounting for 68%; Russia, South Africa and Brazil will produce 19,000, 9,000 and 7,000 tons of vanadium, respectively, accounting for 68%. 18%, 8% and 6%, respectively.

Vanadium and lithium statically mineable lifespan is equivalent

According to USGS statistics, based on the global vanadium production in 2021 of about 107,000 metal tons (equivalent to 191,000 tons of vanadium pentoxide), the static mineable life of global vanadium resources is about 224 years; Converted to 10,000 tons of lithium carbonate equivalent), the static mineable life of global lithium ore resources is about 214 years, and the two are basically the same. However, considering the rapid growth of lithium demand, the actual exploitable life of lithium resources may gradually decrease.

2. Disadvantages of vanadium battery: initial installation cost is the biggest constraint

2.1. The initial installation cost of vanadium battery is more than 2 times that of lithium battery

At present, the biggest disadvantage of vanadium batteries is that the initial installation cost is high, which is more than twice that of lithium-ion batteries. We calculated the cost based on the vanadium battery projects that have disclosed the specific investment amount. The total investment cost of the project is concentrated at 3.8-6.0 yuan/Wh; among which, the cost of the four-hour energy storage system is concentrated at 3.8-4.8 yuan/Wh, 2-3 hours The cost of the energy storage system is slightly higher, at 4.65-6 yuan/Wh, which is still higher than that of lithium batteries.

The continuous surge in lithium prices in 2021 will lead to a continuous increase in the initial investment of lithium energy storage projects, and the unit investment cost of energy storage lithium batteries has approached 2 yuan/Wh. For example, at the end of January 2022, Yingli Wisdom released the results of the winning bid for supporting energy storage for insured projects, showing that the highest unit price of the winning bid was 1.77 yuan/Wh. According to the Zhongguancun Energy Storage Industry Technology Alliance, the average price of energy storage systems has risen from about 1.5 yuan/Wh in 2021 to nearly 1.8 yuan/Wh in early 2022, an increase of 20%, which is basically in line with the winning bid price of the above-mentioned Yingli smart project.

2.2. The rapid development of vanadium batteries may drive vanadium prices up

Rapid growth of new energy storage, vanadium battery market is expected to rapidly increase

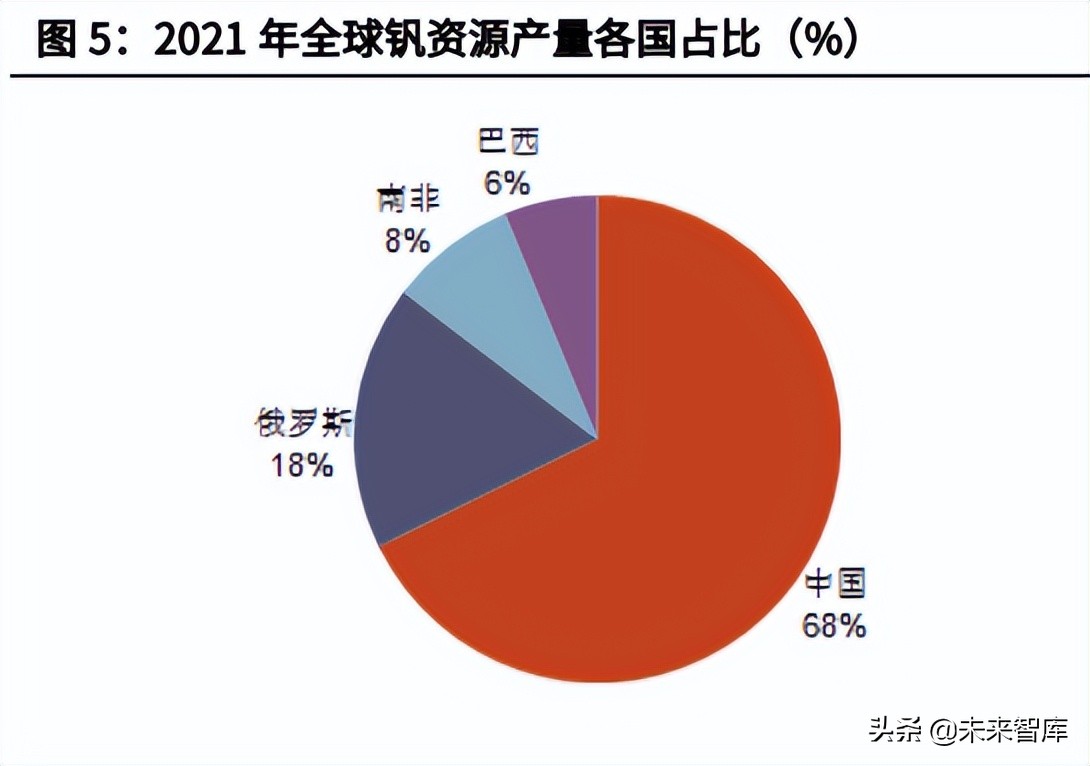

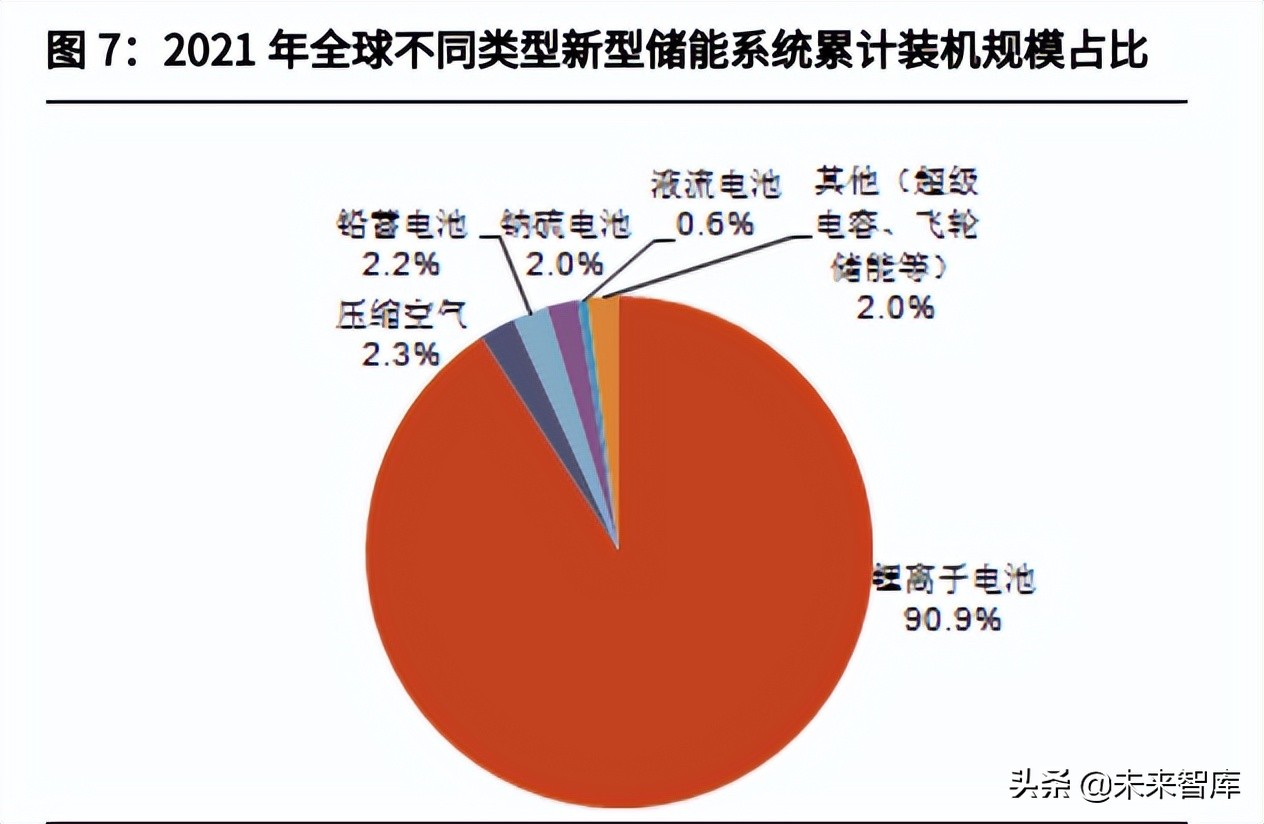

According to the "2022 Energy Storage Industry Application Research Report" released by CNESA in April 2022, by the end of 2021, the cumulative installed capacity of global energy storage projects that have been put into operation is 209.4GW, a year-on-year increase of 9%. Among them, the largest is pumped hydro storage, with a cumulative installed capacity of about 180.5GW, accounting for 86.2%, down 4.1 percentage points from the end of 2020. Accumulated installed capacity of new energy storage (energy storage methods other than pumped storage and molten salt heat storage, including lithium-ion batteries, lead batteries, sodium-sulfur batteries, compressed air, flow batteries, supercapacitors and flywheel energy storage, etc.) The scale is 25.4GW, a year-on-year increase of 67.7%, accounting for 12.2%. Among the new energy storage, lithium-ion batteries still dominate, accounting for 90.9% of the cumulative installed capacity; compressed air energy storage accounts for 2.3%, lead batteries account for 2.2%, sodium-sulfur batteries account for 2.0%, and flow batteries account for 2.0%. ratio of 0.6%.

By the end of 2021, China's cumulative installed power is 46.1GW, ranking first in the world. Among them, the installed capacity of pumped storage is 39.8GW, accounting for 86.3%; the cumulative installed capacity of new energy storage is 5729.7MW, accounting for 12.5%, and the cumulative heat storage of molten salt accounts for 1.2%. Among the new energy storage capacity, the cumulative installed capacity of lithium-ion batteries accounted for 89.6%, the cumulative installed capacity of lead-acid batteries accounted for 5.9%, the compressed air energy storage accounted for 3.2%, the flow battery accounted for 0.9%, and other electrochemical energy storage (Super capacitor, flywheel energy storage) accounted for 0.4% in total.

Policies help the development of the energy storage market. The National Development and Reform Commission and the National Energy Administration issued the "Guiding Opinions on Accelerating the Development of New Energy Storage" in July 2021. On the way to the carbon peak and carbon neutrality goal, it is necessary to build a safe, efficient, clean and low-carbon energy system . The guidance points out that by 2025, the transformation of new energy storage from the initial stage of commercialization to large-scale development will be completed, and the installed capacity will reach more than 30GW. By 2030, the new energy storage will be fully market-oriented.

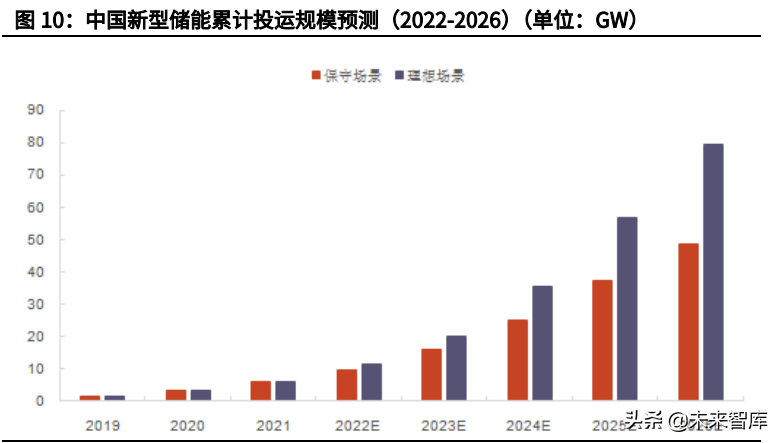

It is estimated that the cumulative installed capacity of new energy storage in my country will reach 48.5GW and 79.5GW in 2026 (conservative and ideal conditions, respectively). According to CNESA data, the cumulative installed capacity of new energy storage in my country in 2021 will be 5.73GW. According to CNESA's forecast, under a conservative scenario, the cumulative scale of new energy storage will reach 48.5GW by 2026, with a compound annual growth rate of 53.3% from 2021 to 2026; The annual compound annual growth rate was 69.2%. (Report source: Future Think Tank)

The rapid growth of vanadium battery scale may drive vanadium demand

2021 is the first year for China's energy storage to enter large-scale development. According to CNESA statistics, among the 865 26.3GW energy storage projects planned, under construction, and put into operation in 2021, only 7 100-megawatt projects have been put into operation. There are more than 70 100-megawatt projects planned and under construction. The first 100-megawatt compressed air energy storage project has been connected to the grid for commissioning and operation, and a 100-megawatt all-vanadium flow battery project is also under construction. According to CNESA statistics, the penetration rate of domestic flow batteries (basically vanadium batteries) in the domestic new energy storage field will reach 0.9% in 2021, benefiting from the multiple advantages of resources, safety, environmental protection and policy. With the gradual implementation of the battery project, the installed capacity of all-vanadium redox flow batteries will achieve leapfrog growth.

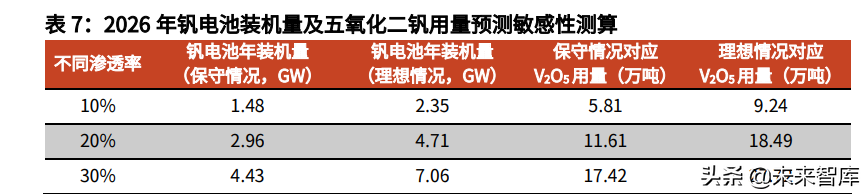

According to conservative and ideal scenarios and the penetration rate of vanadium batteries in new energy storage of 10%, 20% and 30%, the annual installed capacity of vanadium batteries in 2026 will range from 1.48GW to 7.06GW. Taking the median value of 20% to calculate, under two conservative and ideal scenarios, the annual installed capacity is 2.96GW and 4.71GW respectively. According to the estimation of the consumption of 5,500 tons of vanadium (equivalent to 9,821.4 tons of vanadium pentoxide) for a single GWh battery, in 2026, the demand for pentoxide The demand for divanadium drives about 116,100 tons and 184,900 tons (assuming a 4-hour energy storage time). According to USGS, the output of vanadium metal in China in 2021 is about 131,000 tons of vanadium pentoxide. If the follow-up development of vanadium resources is less than expected, it may have a significant boost to the price of vanadium, which in turn will affect the cost of vanadium battery electrolyte.

2.3. The energy density and conversion efficiency are lower than that of lithium batteries, and the maintenance requirements for consumables are high

1) The energy density and conversion efficiency are low. The all-vanadium redox flow battery has high requirements on the ambient temperature during operation, and also needs to use a pump to maintain the flow of the electrolyte, so its loss is large, and the energy conversion efficiency is 70-75% lower than that of the lithium battery. Limited by vanadium ion solubility and stack design, compared with other batteries, all-vanadium redox flow batteries have a lower energy density of only 12-40Wh/kg. 2) Consumables need timely maintenance. The graphite plate needs to be etched by the positive solution. If the user operates properly, the graphite plate can be used for two years. If the user does not operate properly, the graphite plate can be completely etched by a single charge, and the stack can only be scrapped. Under normal use, it needs to be maintained by professionals every two months. This high-frequency maintenance is expensive and labor-intensive.

3. Potential: long-term energy storage is an excellent place to use

3.1. Long-term energy storage is one of the keys to achieving the “dual carbon” goal

As the penetration rate of renewable energy continues to increase, the demand for energy storage time is also increasing. There is currently no clear definition of long duration energy storage (LDES). The U.S. Department of Energy defines long duration energy storage as "an energy storage system that operates continuously for at least 10 hours and has a service life of 15-20 years." The energy storage of more than 4 hours can be called long-term energy storage. Long-duration energy storage is defined by the Long-Duration Energy Storage Council as any technology that can be competitively deployed to store energy for a long period of time, and that can be scaled up economically to maintain a supply of electricity for hours, days, or even weeks. The storage energy can be connected in various ways including mechanical energy storage, thermal energy storage, chemical energy storage or electrochemical energy storage. This article discusses the definition of long-duration energy storage based on the 8-hour+ duration energy storage system in the report "Net-zero power: Long duration energy storage for a renewable grid" published by the Long-Duration Energy Storage Council and McKinsey & Company.

We believe that long-term energy storage systems are one of the keys to achieving the "dual-carbon" goal in the context of the continued global push for carbon neutrality. Under the background of vigorous development of renewable energy, long-term energy storage plays an important role in enhancing power storage capacity, ensuring peak regulation and stable operation of the power system, and power supply in extreme situations. 1) Enhancing power storage capacity: Under the background of the dual carbon goal, the proportion of energy from traditional fossil fuel sources such as thermal power generation will gradually decrease, and renewable energy (photovoltaic, wind energy, etc.) will gradually replace thermal power as the main source of power generation, and long-term storage It is of great significance to be used as a supporting construction for renewable energy. The increase in the proportion of renewable energy will gradually increase the negative impact of intermittent power generation on the power grid, increase the demand for power storage, and increase the necessity of building long-term energy storage systems.

2) Guarantee peak regulation and safety and stability of the power system: Long-term energy storage can adjust the fluctuation of new energy power generation in a longer time dimension by virtue of the characteristics of long cycle and large capacity, store clean energy when there is excess of clean energy to avoid grid congestion, and release it when load peaks Increase power supply. That is, to store electrical energy when there is excess power supply and release it when needed, so as to alleviate the contradiction between supply and demand and adjust the fluctuation of supply and demand. 3) Power supply in extreme situations: Force majeure factors (natural disasters such as wildfires, torrential rains, floods, severe cold, and conflicts between major energy supply countries, etc.) Long-term energy storage can ensure power supply in extreme situations, ensure the stable operation of the whole society's power system and reduce electricity costs. The main advantage of long-term energy storage is that it has a lower marginal cost of storing electricity, and it can decouple the stored electricity from the speed of charge and discharge. Compared with the upgrade of the transmission and distribution grid, it has a relatively short lead time and is more economical than the expensive and time-consuming grid upgrade.

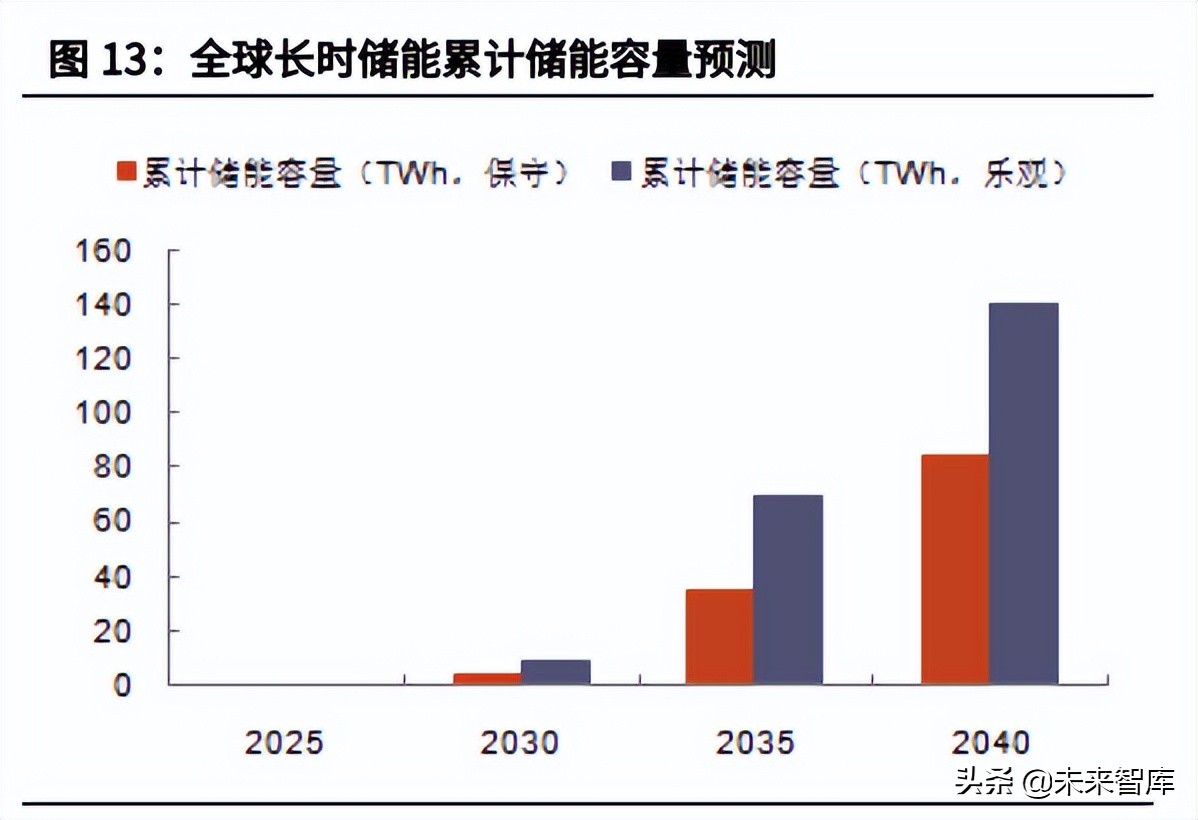

The cumulative installed capacity of long-term energy storage in 2040 will reach 1.5-2.5TW, and the cumulative investment scale will reach 1.5-3 trillion US dollars

Net-zero power: Long duration energy storage for a renewable grid (November 2021) published by the Long Duration Energy Storage Council in collaboration with McKinsey shows that more than 5GW and 65GWh of long duration energy storage systems are in operation or announced for deployment, More than 230 long-duration energy storage projects (excluding pumped hydro) in various commercial stages have been announced globally. McKinsey expects the potential market space for long-duration energy storage to grow massively from 2025. As the proportion of renewable energy increases, the global cumulative installed capacity of long-term energy storage will reach 30-40 GW in 2025 (corresponding to an energy storage capacity of about 1TWh), with a cumulative investment of about US$50 billion. From 2030, the global penetration rate of renewable energy will rise to about 60%-70%, the cumulative installed capacity of long-term energy storage will reach 150-400GW (corresponding to energy storage capacity of 5-10TWh), and the cumulative investment scale will reach 200-500 billion Dollar. By 2040, the cumulative installed capacity of long-term energy storage will accelerate to 1.5-2.5 TW (corresponding to an energy storage capacity of 85-140 TWh), which is 8-15 times the current installed capacity of global energy storage systems, and the cumulative investment will reach 1.5-3 TW. trillions of dollars.

McKinsey predicts that the proportion of energy storage capacity above 24 hours will increase rapidly after 2030. By 2030, 8-24 hour storage capacity could account for 80% of long-term storage capacity and 60% of total storage capacity. But long-duration energy storage technologies with more than 24-hour flexibility are likely to see significant growth after 2030, largely due to the increase in renewable energy. Long-duration energy storage technologies with longer durations (24+ hours) could account for about 80% of total energy storage capacity by 2040.

3.2. The application space of flow battery in the field of long-term energy storage is huge

Long-term energy storage is still in the initial stage of R&D and demonstration. Among the various solutions, the construction scale of pumped storage is relatively large. With the advantages of mature technology, high efficiency and low cost, pumped storage power plants have become the solution with the largest energy storage capacity in the world. According to McKinsey's "Net-zero power: Long duration energy storage for a renewable grid" statistics, as of November 2021, about 160GW of pumped storage power stations have been installed worldwide, and another 130GW is planned or under construction, and future deployments Mainly in Asia, China accounts for around 60% of the world's announced, planned or under construction capacity. Large-scale pumped-storage power plants can provide low-cost, dispatchable power and serve as a major solution for grid stability due to their fast response times. But the biggest limitations of pumped storage are site constraints, long construction times, and environmental concerns. In the long run, due to the promotion of the power battery industry, electrochemical energy storage is not restricted by the geographical environment, and is in a relatively favorable competitive position. In terms of electrochemical energy storage, lithium-ion batteries, sodium-sulfur batteries, sodium-ion batteries, flow batteries, etc. all have great application potential; and all-vanadium flow batteries are characterized by long life and easy capacity expansion. The application in the field of energy systems is promising.

(1) Lithium-ion batteries: Lithium batteries have the advantages of high energy density and high conversion efficiency, and are currently widely used in energy storage applications, but they also have shortcomings such as cycle life and flammable and explosive safety hazards. (2) Sodium-based batteries: Sodium-sulfur batteries have been installed with precedents. The sources of sodium and sulfur raw materials are wide, but the process requirements are extremely high, and the operating temperature is about 300-350 degrees, and the sodium and sulfur in the molten state are extremely active. , there are certain safety hazards; while sodium-ion batteries have the advantages of safety, abundant resources, and low cost, but also have the disadvantages of low cycle times and side reactions of electrode materials that affect battery life. Its advantages remain to be verified. (3) Flow batteries have the advantages of high safety and stability, long cycle life, strong capacity expansion, recyclability and environmental protection, but there are also disadvantages such as high initial installation cost.

A. Highest safety: The working principle of a flow battery is to store and release electrical energy through the mutual conversion of ions in different electrolytes. There is no phase change in the electrode reaction process, the stack only provides a place for electrochemical reaction, and no redox reaction occurs; the active material is dissolved in the electrolyte, and the risk of electrode dendrite growth piercing the diaphragm is greatly reduced in flow batteries; At the same time, it can carry out deep charge and discharge, can withstand large current charge and discharge, and has the highest safety in the current electrochemical energy storage.

B. Long cycle life: Compared with other electrochemical energy storage technologies, the most prominent feature of flow batteries is the long cycle life, which can be achieved at least 10,000 times, and some technical routes can even reach more than 20,000 times, and the overall service life can reach 20 years or more.

C. Easy capacity expansion: The energy storage active material of the flow battery is completely separated from the electrode, and the power and capacity design are independent of each other, which is convenient for module combination design and battery structure placement, and the capacity is easy to expand.

D. Recyclable and environmentally friendly: The electrolyte of the flow battery can be recycled and reused. Compared with lead-acid batteries and lithium-ion batteries, it will not pollute the environment.

Based on the advantages of flow battery with high safety and stability, long cycle life, strong capacity expansion, recyclability and environmental protection, we expect that it has a huge application space in the field of long-term energy storage, and will be closely related to pumped hydro/hydrogen energy storage, compressed air storage can compete.

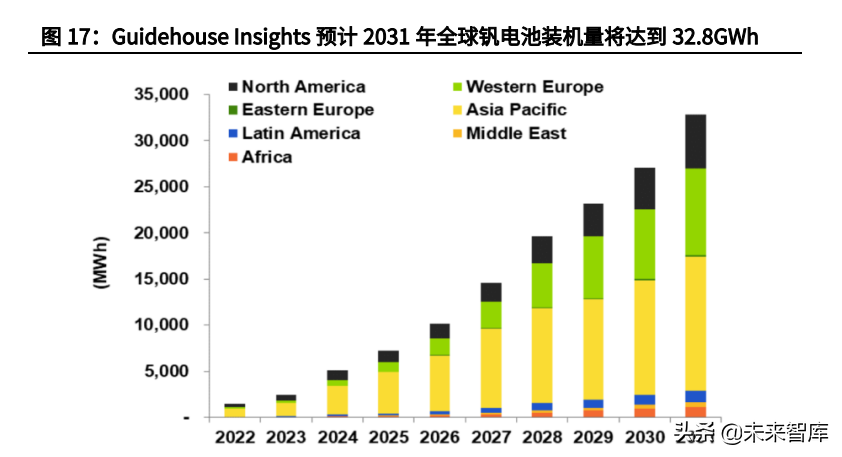

According to the "Vanadium Redox Flow Batteries: Identifying Market Opportunities and Enablers" report released by Guidehouse Insights in the second quarter of 2022, the annual installed capacity of vanadium batteries in 2022-2031 is expected to maintain a compound growth rate of 41%, and the annual installed capacity of vanadium batteries in the world is expected in 2031. Among them, the annual installed capacity in the Asia-Pacific region (mainly China) will reach about 14.5GWh in 2031, 5.8GWh in North America, and 9.3GWh in Western Europe.

3.3. The commercialization of vanadium batteries is faster in flow batteries

At present, flow battery routes mainly include more than 20 technical routes, such as all-vanadium flow batteries, iron-chromium flow batteries, zinc-bromine flow batteries, and zinc-iron flow batteries. Currently, the first three technical routes are discussed more.

Vanadium battery is a relatively mature flow battery route for commercialization. It has the advantages of years of operation of demonstration projects, gradual formation of the industrial chain, and low cost in the whole life cycle. It is expected to be widely used in long-term energy storage systems. 1) Safe operation of multiple demonstration projects: All-vanadium flow batteries have been operating for many years in the world, and the industrialization effect and reliability verification are significantly higher than those of iron-chromium flow batteries and zinc-bromine flow batteries. According to the official account of Dalian Institute of Chemical Physics, in February 2022, the world's largest 100MW all-vanadium redox flow battery energy storage peak-shaving power station has entered the single module commissioning stage in Dalian. 2) The whole industry chain is gradually taking shape: the supply chain of raw materials such as electrolyte, diaphragm, membrane electrode and so on for all-vanadium redox flow battery has been initially formed, and the process of localization has been accelerated, which has been able to support the design and development of 100-megawatt projects. Its industrial support is more mature. 3) Cost advantage in the whole life cycle: The whole life cycle cost of vanadium battery is lower than that of lithium battery, and it has the conditions for large-scale commercial application. Although iron-chromium flow and other routes have more room for cost reduction, from the perspective of technological bottleneck breakthrough, industrial chain cultivation and production capacity construction progress, the maturity and cost level of other flow battery routes in the next five years will still be difficult to match with all-vanadium. comparable to flow batteries. In summary, all-vanadium flow batteries have the advantages of high safety, long life, strong capacity expansion, and high efficiency. We are optimistic about the potential of all-vanadium flow batteries in the field of energy storage applications, especially the application space in the direction of long-term energy storage.

4. Breaking the game: policy promotion and technological progress to reduce costs

4.1. Policy support is an important driving force for the development of vanadium batteries

Formulate relevant subsidies for the development of vanadium batteries

Most of the existing vanadium battery projects are demonstration projects promoted by local governments, and a few are self-constructed projects by enterprises. The full life cycle cost of vanadium batteries is already lower than that of lithium batteries, but the initial construction cost is too high, resulting in weak investment motivation for enterprises. Follow-up or still need to promote the government level to develop an effective price compensation mechanism and long-term energy storage industry policy.

Strengthen resource development and expand production capacity of steel companies

Since the main vanadium production in China comes from vanadium slag in the vanadium-titanium magnetite steelmaking process, allowing corresponding steel companies to expand production capacity is also one of the ways to increase the source of vanadium resources. At the same time, policies to support the development of vanadium resources can also be introduced to increase the development of domestic vanadium resources. (Report source: Future Think Tank)

4.2. Technological progress is expected to continue to reduce costs

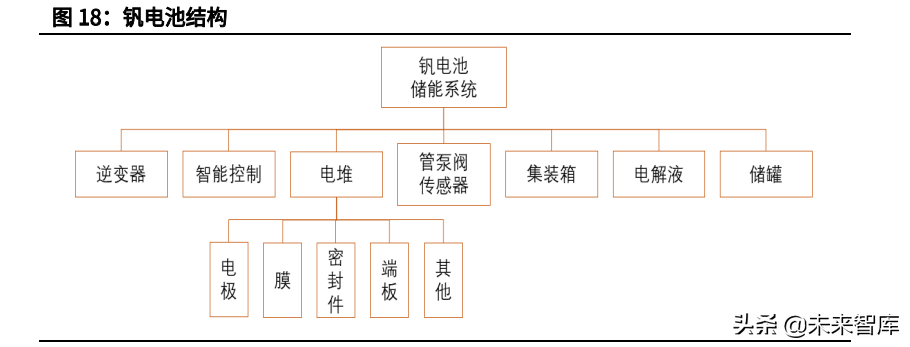

The entire vanadium battery energy storage system is mainly composed of stack, electrolyte, inverter, intelligent control, storage tank, container, tube pump valve sensor. The most important core components of a vanadium battery are the stack and electrolyte. The electrolyte is generally composed of vanadium pentoxide, which is also the main use of vanadium products in the entire vanadium battery system.

According to IRENA, the cost of vanadium batteries is mainly divided into three parts: the cost of stack, electrolyte and peripheral equipment. The stack and electrolyte are the main costs, accounting for about 75% in total; among them, the cost of vanadium electrolyte accounts for about 40%, the cost of the stack accounts for about 35%, and the cost of other components accounts for about 25%.

1) Technology promotes the continuous decline of the cost of the stack. The cost of lithium batteries dropped rapidly after commercial application, from $7,523/KWh in 1991 to $181/KWh in 2018. With reference to the cost reduction approach of lithium batteries, it can be predicted that the cost of vanadium batteries still has a large downward space after mass production.

Vanadium batteries are still in the early stage of commercialization, and there is a lot of room for cost reduction brought about by technological progress. For example, Dalian Institute of Physics and Chemistry has reduced battery costs by reducing the area used for membrane materials; in June 2020, the team of Li Xianfeng and Zhang Huamin of the Energy Storage Technology Research Department of Dalian Institute of Physics and Chemistry successfully developed a new generation of 30 KW low-cost all-vanadium flow battery stacks . The stack adopts a self-developed weldable porous ion-conducting membrane (cost <100 yuan/m2). Compared with the traditional battery assembly technology, the area of membrane material is reduced by 30%, and the total cost of the stack is reduced by 40%.

2) Substitution of domestic materials drives cost reduction. In terms of ion exchange membranes, the current global vanadium batteries mainly use Nafion perfluorosulfonic acid resin exchange membranes from DuPont in the United States. Nafion membranes use sulfonic acid groups as exchange groups and are used as standard diaphragms for all-vanadium redox flow batteries. It has high stability in the electrolyte, but is expensive. According to Alibaba 1688, the retail unit price is nearly 20,000 yuan/square meter. At present, domestic Kerun, Dongyue, Dahua Institute of Chinese Academy of Sciences, and foreign Gore have all developed lower-cost membranes through independent innovation. With the gradual promotion of domestic ion exchange membranes, there is still a lot of room for cost reduction in products such as membranes. It is expected that there will be room for cost optimization in other stack materials (bipolar plates, carbon felt, etc.).

5. Vanadium supply and demand: China has the largest production and reserves, and steel is the largest demand

5.1. Supply: China ranks first in the world in terms of vanadium reserves and production

Vanadium is a rare metal with a high melting point and refractory. It ranks 23 on the periodic table and has a relative atomic mass of 50.9415. Common valences are +5, +4, +3, +2 forms, and it is the 17th common element in the earth's crust. The melting point of vanadium is very high, the melting point is 1809±10, and it becomes a refractory metal with niobium, tantalum, tungsten and molybdenum. Pure vanadium is silver-gray in color, hard, non-magnetic and ductile; it has better resistance to gas, salt and water corrosion than most stainless steels; it is not oxidized in the air, and is soluble in hydrofluoric acid, nitric acid and aqua regia. The industrial chain is vanadium ore (solid waste containing vanadium), stone coal is processed into vanadium pentoxide and vanadium trioxide, which are further processed into ferrovanadium, vanadium nitride, vanadium-titanium alloy, etc., which are used in downstream steel, chemical and other fields.

Resources: In 2021, China's vanadium product reserves and production proportion will rank first in the world. As mentioned above, by the end of 2021, China's vanadium ore reserves accounted for 39% of the world's total; in 2021, China's production accounted for 68% of the world's total, ranking first in the world. China is rich in vanadium resources. Domestic vanadium resources are widely distributed in 19 provinces and cities (autonomous regions), mainly in Panzhihua, Sichuan and Chengde, Hebei. Among them, Panzhihua has the most abundant vanadium resources, ranking first in China and third in the world in reserves. Hunan, Guangxi, Gansu, Hubei and other provinces also have the distribution of vanadium resources.

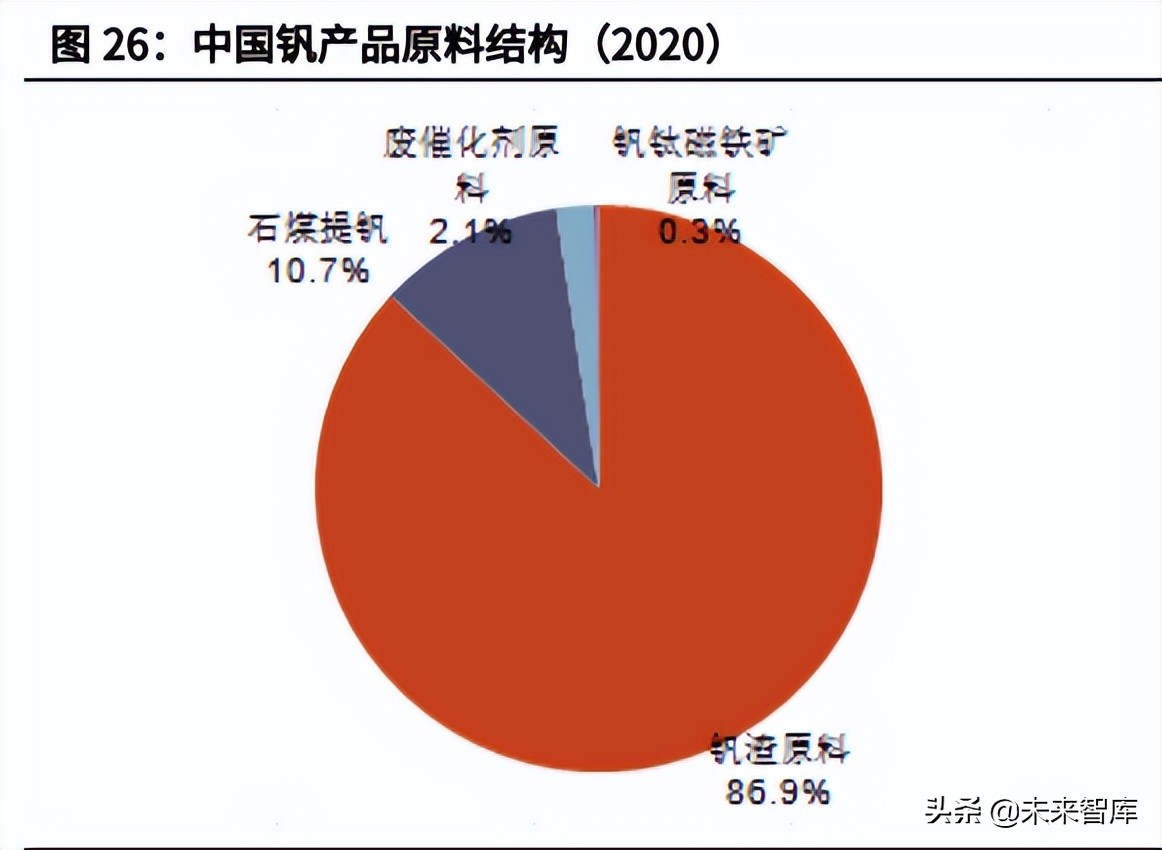

Raw materials and technology: Vanadium-titanium magnetite is the main product in the world, and vanadium slag is the main product in China. Although the crustal abundance of vanadium is relatively high, it mainly forms symbiotic or composite ores with other minerals, and independent vanadium ores are rare. At present, there are more than 70 kinds of vanadium-bearing minerals discovered in the world, and there are mainly three types of vanadium ores: (1) Vanadium titanomagnetite: Vanadium in vanadium titanomagnetite mainly exists in the form of FeO·V2O3 spinel. Contains 0.2% to 1.5% vanadium. Except for the United States, the major vanadium producing countries extract vanadium from vanadium titanomagnetite. (2) Potassium vanadium uranium ore: Potassium vanadium uranium ore is a kind of vanadate complex salt of potassium uranium, its chemical formula is K2O·2UO3·V2O5·13H2O, which is light yellow or light green-yellow, among which vanadium pentoxide The content can reach 20.16%, and the United States is the main source of this mineral. (3) Petroleum associated minerals: Petroleum associated minerals are parasitic in crude oil, mainly distributed in South America. According to the "2020 Global Vanadium Industry Development Report" released by Wu You et al., most of the raw materials for vanadium products in the world come from vanadium-titanium magnetite, and most countries use vanadium-titanium magnetite to make steel. Vanadium is continuously extracted from vanadium-containing steel slag, including China, Russia, etc., while the United States mainly extracts it from petroleum slag, coal ash, and spent catalysts. In 2020, about 74.8% of the world's vanadium comes from vanadium-rich slag obtained from vanadium titanomagnetite smelted by steel, 13.8% of vanadium is directly extracted from vanadium titanomagnetite, and 11% is recovered from vanadium-containing by-products (including vanadium titanomagnetite). vanadium fuel ash, waste chemical catalysts, etc.) and vanadium-containing stone coal extraction.

The domestic production of vanadium using vanadium slag as a raw material accounts for a higher proportion. The proportion of vanadium slag raw materials is as high as 86.9%, the proportion of vanadium extraction from stone coal is 10.7%, the proportion of waste catalyst raw materials is 2.1%, and the proportion of direct use of vanadium-titanium magnetite raw materials than only 0.3%. The proportion of output of vanadium extraction from stone coal has declined due to environmental problems. Stone coal is a low-quality anthracite coal with low carbon content and low calorific value, and is also a low-grade polymetallic symbiotic ore. More than 60 associated elements have been found in stone coal resources in my country. Among them, vanadium can form industrial deposits. However, the grade of vanadium in stone coal is very low, and the content of vanadium pentoxide is mostly below 0.8%. The utilization of vanadium-bearing stone coal in my country started early. The traditional extraction of vanadium from stone coal adopts sodium chloride roasting and acid leaching process. During the production process, chlorine gas, ammonia gas, waste acid and waste residue are generated, which seriously damages the ecological environment. The policy prohibits the use of sodium vanadium extraction. The proportion of vanadium extraction from stone coal has dropped significantly after 2017. In recent years, some companies have made breakthroughs in the process. For example, the stone coal vanadium extraction project of Subei West Mining Fan Technology, a subsidiary of Western Mining, was put into trial production in May 2020, realizing green stone coal vanadium extraction. For environmental protection production, the proportion of vanadium extraction from stone coal may increase slightly in the future.

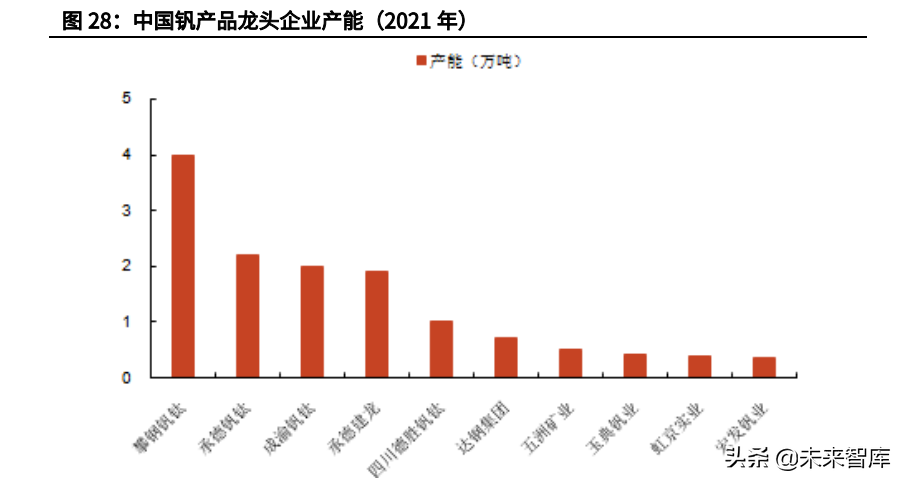

Production capacity: Panzhihua Iron & Steel ranks first in terms of production capacity of vanadium and titanium. More than 70% of the world's vanadium comes from vanadium slag as a by-product of steelmaking. Vanadium production enterprises with large production capacity (more than 10,000 tons/year) mainly include Pangang Vanadium and Titanium in China, Evraz in Russia, Hegang Group Chenggang Company, Beijing Jianlong Heavy Industry, Chengyu Vanadium and Titanium, and Sichuan Desheng Group , South Africa’s Bushveld Vametco, Austria’s Trebacher Industrie AG (processing enterprise), Glencore, Brazil’s Maracas Menchen Mine, etc. Among them, Panzhihua Iron & Steel’s vanadium and titanium production capacity is 40,000 tons/year, ranking first in the world; Russia’s Evraz production capacity is 35,000 tons/year , is the largest vanadium producer overseas.

According to Baichuan Yingfu, the total production capacity of vanadium products in China is 171,400 tons (by the end of 2021). The top ten companies producing vanadium products are Pangang Vanadium and Titanium, Chengde Vanadium and Titanium, Chengyu Vanadium and Titanium, Chengde Jianlong and Sichuan Desheng Vanadium. Titanium, Dagang Group, Wuzhou Mining, Yudian Vanadium, Hongjing Industry, Hongfa Vanadium Industry.

5.2. Application of vanadium: the application in steel field accounts for more than 90%

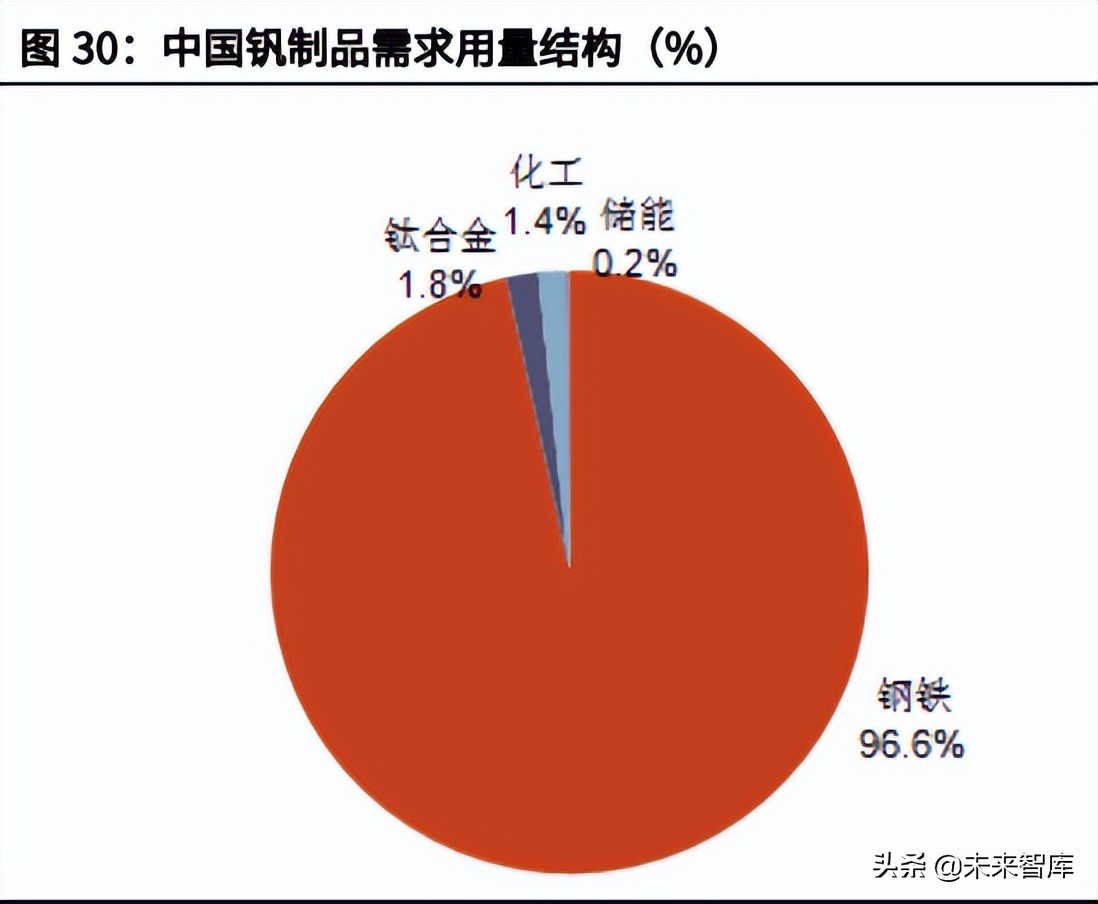

Vanadium is an important alloying element and is mainly used in steel, titanium alloy additives, catalysts in the chemical industry, and energy storage. Common vanadium compounds in industry include VO, V2O3, V2O5, FeV ferrovanadium, NH4VO3 ammonium metavanadate.

(1) Steel: Metal vanadium is added to steel production in the form of ferrovanadium and vanadium-nitrogen alloys to improve the strength, toughness, ductility and heat resistance of steel. Vanadium-containing alloy steel has high strength, high toughness and good wear resistance, and is widely used in the production and construction of oil/gas pipelines, buildings, bridges, and rails. The steel industry accounts for the largest proportion of the downstream application of vanadium, and its consumption accounts for more than 90% of vanadium consumption. (2) Titanium alloy: About 2% of vanadium forms titanium alloy in the form of titanium-aluminum-vanadium alloy. Vanadium can be used as a stabilizer and strengthening agent in titanium alloy, which makes titanium alloy have good ductility and plasticity. Mainly used in aircraft engines, aerospace cabin skeletons, missiles, steam turbine blades, rocket engine casings, etc. In addition, vanadium alloys are also used in magnetic materials, hard alloys, superconducting materials and nuclear reactor materials. (3) Chemical industry: In the field of chemical industry, vanadium is mainly used as a catalyst for the manufacture of sulfuric acid and vulcanized rubber, and is also used to inhibit the production of nitrous oxide in power plants; other chemical vanadium products are mainly used for catalysts, ceramic colorants, developers, drying agents. agent, etc. (4) Energy storage: At present, the use of vanadium in the production of all-vanadium redox flow batteries has also become a research hotspot in the energy storage industry. In the energy storage industry, in recent years, great progress has been made in the research of all-vanadium redox flow batteries in clean energy. and other fields have broad market prospects and have begun to be used in commercial energy storage systems.

5.3. Review of vanadium price trend: the average price in the past ten years is 108,000 yuan / ton

As of July 1, 2022, the price of vanadium pentoxide (98% flake, Sichuan) was 118,000 yuan / ton, a year-on-year decrease of 10.6% and a decrease of 5.6% from the beginning of the year. Since 2012, the average price of vanadium pentoxide with tax is 107,600 yuan/ton, and most of the time, the price fluctuates at 100,000 yuan/ton. The ban on import of vanadium slag and the increase in demand for vanadium due to changes in steel bar indicators are superimposed by multiple favorable factors.

(1) On July 18, 2017, the Ministry of Environment of China submitted a document to the WTO showing that from September 2017, China will ban the import of 24 types of solid waste in 4 categories, among which vanadium slag is listed. (2) In November 2017, it is planned to implement a new version of the standard for hot-rolled ribbed steel bars in November 2018, which increases the addition ratio of vanadium in steel bars, strengthens the demand for vanadium in the steel bar field, and further escalates the contradiction between supply and demand. The price of vanadium has entered an upward cycle. (3) At the end of 2018, the price of vanadium pentoxide gradually fell; from 2019 to 2022, the price of vanadium pentoxide generally fluctuated.

6. Analysis of key companies

6.1. Leading vanadium battery companies: Dalian Rongke, Beijing Puneng, etc.

(1) Dalian Rongke Energy Storage

Dalian Rongke Energy Storage Technology Development Co., Ltd. was established in 2008. The subordinate Rongke Energy Storage, Rongke Equipment and Borong New Materials (the main body of battery core material development and production) jointly build a concentric industry group, which has become a world-leading industry group. A service provider of all-vanadium redox flow battery industry chain development, complete independent intellectual property rights and high-end manufacturing capabilities. At present, a 300MW/year all-vanadium redox flow battery energy storage industrialization equipment base has been established. Dalian Rongke is jointly established by Dalian Hengrong New Energy Co., Ltd. and Dalian Institute of Chemical Physics, Chinese Academy of Sciences. Dalian Rongke leads the formulation of flow battery standards at home and abroad, and leads the development of global flow battery technology. At present, it has successfully implemented a number of commercial application demonstration projects, and has complete independent intellectual property rights in the core technology field of all-vanadium redox flow batteries, with more than 300 patents. The services provided by Rongke Energy Storage cover the supply of all-vanadium flow battery key materials, stacks, battery modules, KW to 100 MW battery energy storage systems, and customized energy storage solutions. In February 2022, the world's largest 100MW/400MWh all-vanadium redox flow battery energy storage power station built by Rongke Energy Storage entered commissioning.

(2) Beijing Puneng

Beijing Purneng acquired Canada's VRB Energy in 2009 and has become a fast-growing global cleantech innovator. Pu Neng has developed all-vanadium flow energy storage batteries and solutions that integrate high safety, large capacity, long-term energy storage and long battery life in the world. According to the official website of Beijing Puneng, its installed and developing projects around the world have a capacity of 500 MWh, and the accumulated safe and stable operation time is close to 1 million hours. The unique low-cost ion-exchange membrane, long-life electrolyte formulation and innovative stack design make Puneng different from other suppliers. The all-vanadium redox flow battery energy storage system (VRB-ESS ), patented by Pu Neng, based on the redox reaction of metal vanadium element, can store energy in the electrolyte. In 2021, a new third-generation MW-level 500KW vanadium flow battery energy storage product will be developed, and the development of a 100MW-level large-scale energy storage power station project will be launched. In 2019, it delivered the first phase of 3MW of 10MW solar energy storage in Zaoyang, Hubei and several MW-level energy storage projects in China.

(3) Hubei Lvdong China Vanadium New Energy

Hubei Lvdong China Vanadium New Energy Co., Ltd. was established on June 24, 2021. Among them, State Power Investment Group Hubei Lvdong New Energy Co., Ltd. invested 21 million yuan, accounting for 70% of the shares, and Hubei Pingfan Ruifeng New Energy Co., Ltd. invested 600 yuan 10,000 yuan, accounting for 20% of the share capital. Hubei Lvdong Zhongvanadium New Energy Co., Ltd. will focus on developing the field of all-vanadium redox flow battery energy storage. The company plans to invest 9.32 billion yuan in the construction of vanadium battery energy storage power stations and wind power photovoltaic projects in Xiangyang High-tech Zone, Hubei. Among them, 4.32 billion yuan is used to build a 100MW all-vanadium flow battery energy storage power station and a 500MW distributed rooftop photovoltaic installed capacity project; 5 billion yuan is used to build a 1GW wind power photovoltaic power generation project; of which 1.9 billion yuan is used to build a 100MW all-vanadium flow The battery energy storage power station project is expected to be fully operational within five years. In August 2021, the 100MW all-vanadium redox flow battery energy storage power station and the 500MW distributed rooftop photovoltaic installation project have signed an entry agreement with the high-tech zone, and the preliminary work such as project filing, exploration, and feasibility study has been completed.

6.2. Panzhihua Iron & Steel Vanadium and Titanium: The output of vanadium products ranks first in the world, and gradually enters the vanadium battery business

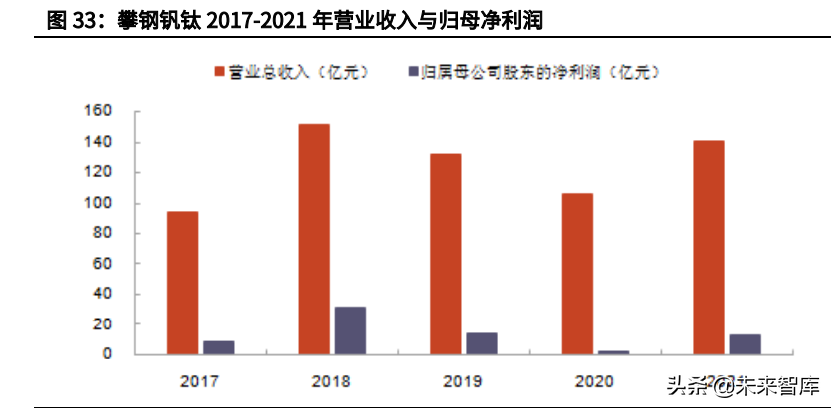

The company's current main business includes vanadium, titanium, and electricity three major sectors, of which vanadium and titanium sector are the company's strategic key development business, the main products include ferrovanadium, vanadium nitrogen alloy, titanium dioxide, titanium slag and so on. The company is an important vanadium-producing enterprise in China. At the same time, the company is one of the five domestic enterprises with the production capacity of titanium dioxide by the chloride method, and it is also one of the few enterprises with the production of titanium dioxide by the "sulfuric acid method + chlorination method". In 2021, the company will achieve operating income of 14.060 billion yuan, a year-on-year increase of 33.42%; net profit attributable to shareholders of listed companies is 1.328 billion yuan, a year-on-year increase of 248.56%.

Vanadium products: In October 2021, the company has completed the acquisition of vanadium products in Xichang. Before the acquisition, the production capacity of vanadium products (in terms of V2O5) was 22,000 tons/year, and the production capacity of vanadium products (in terms of V2O5) after the acquisition exceeded 40,000 tons/year. year. In addition, the first phase of the 5000t/a high-purity vanadium oxide production line construction project in Panzhihua Vanadium Plant is currently under construction and is expected to be put into operation in 2022. Titanium products: In terms of titanium dioxide, the company has a production capacity of 220,000 tons/year of sulfuric acid method titanium dioxide and 15,000 tons/year of chloride method titanium dioxide. The company adopts the self-developed low-temperature chlorination technology to produce chlorination titanium dioxide, and the raw material is carbonized slag. chemical construction. The company is also actively expanding its production capacity, and is building a 60,000-ton molten salt titanium chloride project. In terms of titanium slag, the company currently has an annual production capacity of 240,000 tons of acid-soluble titanium slag. In 2021, the company will produce a total of 43,300 tons of vanadium products (calculated as V2O5) (including 19,400 tons of Xichang vanadium products), the substantial increase is mainly due to the consolidation of Xichang vanadium products; 244,400 tons of titanium dioxide (including 16,400 tons of titanium chloride dioxide) ton), a year-on-year increase of 3.77%; titanium slag was 212,400 tons, a year-on-year increase of 3.20%.

Signed a strategic cooperation agreement with Dalian Borong. On September 10, 2021, Pansteel Vanadium and Titanium Announcement and Dalian Borong signed a strategic cooperation agreement in Panzhihua City. The company prioritizes the supply of vanadium products to Dalian Borong. According to the production situation and the needs of Panzhihua Iron and Steel Vanadium Titanium Vanadium Energy Storage Project, Dalian Borong can provide services such as vanadium electrolyte and vanadium battery energy storage system processing for Panzhihua Iron and Steel Vanadium Titanium. According to the development of the energy storage industry, the two parties discussed joint investment to build a vanadium electrolyte factory and gradually expand the scale of the vanadium battery industry. In the later stage, according to the growth of the energy storage market, the two parties will start cooperation in the production of vanadium battery energy storage equipment in a timely manner, and the production capacity will be matched with the production capacity of vanadium electrolyte. (Report source: Future Think Tank)

6.3. Hegang Co., Ltd.: the second largest production capacity of vanadium products in China, and mass production of vanadium electrolytes

In 2021, HBIS will produce 193,000 tons of vanadium slag, and the revenue from vanadium products business will be 1.7 billion yuan, a year-on-year increase of 31%. Hegang Co., Ltd. stated on the investor interaction platform on May 25 that the company has the independent intellectual property rights of vanadium electrolyte manufacturing technology, and has built an all-vanadium flow battery energy storage demonstration project, realizing the transformation of photovoltaic power generation and vanadium battery energy storage through equipment. For DC and AC direct application. HBIS Chenggang has researched and prepared high-purity and high-performance all-vanadium redox flow battery electrolyte with low impurity content, high product stability and low production cost, and has developed more than 10 mature technology and independent intellectual property rights suitable for all-vanadium High-purity vanadium oxide preparation technology and commercial electrolyte preparation technology for flow batteries. At the same time, a series of detection technologies for commercial vanadium electrolytes are developed to provide complete and accurate data support for the development, research and large-scale production of commercial vanadium electrolytes and vanadium batteries. Technical blank.

The commercial electrolyte series detection technology and method independently developed by the Vanadium and Titanium Engineering Technology Research Center of Chenggang Company of Hebei Iron and Steel Group have been successfully developed. In Hegang Chenggang, the 5KW/20KWh all-vanadium redox flow battery energy storage system was officially put into use, and it was applied to the lighting system of the factory area in the vanadium and titanium industrial park of Hegang Chenggang. As of the end of March 2022, HBIS Chenggang's high-purity vanadium oxide-electrolyte production line has been connected upstream and downstream, achieving a 50% increase in output and mass production of 3.5-price commercial electrolytes, and has established a strategy with top international vanadium battery manufacturers partnership. HBIS Chenggang has planned a 2MW/16MW vanadium battery energy storage demonstration project and completed the project approval.

6.4. Western Mining: The new process of vanadium extraction from stone coal has been put into operation

Western Mining is the second largest lead concentrate, the fourth largest zinc concentrate and the eighth largest copper concentrate producer in China. The 2021 annual report shows that the company has retained resource reserves including 6.5583 million tons of copper, 1.6069 million tons of lead, 3.116 million tons of zinc, 357,300 tons of molybdenum, 588,100 tons of vanadium pentoxide, 311 million tons of iron ore, and 252,400 tons of nickel. , 13.54 tons of gold, 2315.45 tons of silver (all the above are metal tons). According to China Nonferrous Metals News and the official account of Western Mining, Subei West Mining Vanadium Technology Co., Ltd., a wholly-owned subsidiary of the company, put into trial production in May 2020 the first phase of ammonium metavanadate with a production capacity of 1,239 tons; on April 10, 2022, Western Mining Vanadium Technology Reform The expanded production line successfully produced the first batch of ammonium metavanadate. After the completion of the second-phase technical renovation and expansion project, the production capacity of ammonium metavanadate will be 2,611 tons, and the total production capacity of ammonium metavanadate will reach 3,850 tons.

6.5. Anning Co., Ltd.: rich in vanadium-titanium-magnetite resources

The company is a circular economy enterprise of comprehensive utilization of vanadium-titanium resources, which uses advanced technology to mine and select polymetallic associated ores. It is mainly engaged in the mining, washing and sales of vanadium-titanium magnetite. concentrate. The company has abundant reserves of vanadium titanomagnetite resources. As of the end of 2021, the company has mining rights within the scope of 1) It has 190.8675 million tons of industrial-grade iron ore resources with a TFe grade of 29.48%, and the associated TiO2 amount is 22.9436 million tons, TiO2 The grade is 12.02%, the amount of associated V2O5 is 517,200 tons, and the V2O5 grade is 0.27%. 2) Retained 71.9058 million tons of low-grade iron ore. The company's annual report shows that vanadium-titanium iron concentrate is the main raw material for vanadium-titanium iron and steel enterprises to extract vanadium and steel, and is used in the production of high-strength steel such as heavy rail and earthquake-resistant steel bars. The company is the only 61% vanadium-titanium-iron concentrate producer in the Panxi region. In 2021, the company will produce 1.4165 million tons of vanadium-titanium-iron concentrate (61%), an increase of 10.03% year-on-year.

6.6. State Grid Yingda: its subsidiary Wuhan NARI fully masters vanadium battery technology

State Grid Yingda is a listed company under State Grid Corporation of China. Wuhan NARI is an indirect wholly-owned subsidiary of State Grid Yingda. In 2010, Wuhan NARI listed electrochemical energy storage as a strategic emerging industry and carried out research on all-vanadium flow battery energy storage technology; in 2011, it established a wind and solar energy storage R&D team, and in 2017 formed a megawatt-scale all-vanadium flow battery. Intelligent production capacity of battery stacks. At present, Wuhan NARI has fully mastered the modification and selection technology of vanadium batteries, and has the capabilities of vanadium battery body design, material development, and system integration. It has successfully developed high-power vanadium battery stacks and 250 kW/500 kWh energy storage systems. There are a total of 70 utility model patents, and more than 40 are authorized. State Grid Yingdu stated on the investor interaction platform on May 11, 2022 that Wuhan NARI, a subsidiary of the company, has accumulated core competition in energy storage design and research based on years of experience in R&D, design and construction of scientific and technological projects and practical applications. At present, projects such as "Comprehensive Energy Project (including Vanadium Battery Energy Storage) of New Construction of Charging Tower on the West Side of Hankou Railway Station" have been implemented. The project team is promoting the preliminary work of other related energy storage pilot projects, promoting the formation of a replicable and popularized model, and promoting the commercial operation of the business.

6.7. CGN: its subsidiary CGN New Energy has undertaken large-scale vanadium battery projects

China General Nuclear Power New Energy Holdings Co., Ltd. is an independent power generator with diversified power sources and geographical distribution. Its business includes wind, solar, gas, coal, oil, hydro, cogeneration and fuel cell power generation projects. In November 2010, China General Nuclear Power Group Co., Ltd. acquired the entire share capital of CGN New Energy through its indirect wholly-owned subsidiary, CGN Huamei Investment Co., Ltd., and became the controlling shareholder. The company is located in Xiangyang High-tech Industrial Development Zone to build the Xiangyang High-tech 100MW/500MWh all-vanadium liquid flow energy storage power station project, with a construction scale of 100MW/500MWh. The project will start on January 1, 2022, and it is planned to complete the project before December 30, 2022. capacity grid-connected.

6.8. Shanghai Electric: The vanadium battery business has a number of independent core intellectual property rights

Shanghai Electric's main business involves energy equipment, industrial equipment, and integrated services. Its products include thermal power generating units (coal power, gas power), nuclear power generating units, wind power generation equipment, power transmission and distribution equipment, environmental protection equipment, automation equipment, and elevators. , rail transit and machine tools. Shanghai Electric's vanadium battery business is managed by its subsidiary Shanghai Electric Energy Storage Company, and the technology is provided by Shanghai Electric Central Research Institute. Since its establishment in 2011, the Energy Storage Flow Battery Product Department of Shanghai Electric Group Central Research Institute has been actively committed to the independent research and development of flow battery energy storage products, mastering core technologies to support the development of the group's energy storage industry, and conquering battery design, battery sealing , battery automation manufacturing process, system integration and a series of key technical bottlenecks, successfully developed a 5KW/25KW/50KW vanadium flow battery stack. The stack can be integrated into a 100kW/MW containerized all-vanadium flow battery energy storage system.

Shanghai Electric stated on the investor interaction platform on March 24 that Shanghai Electric Energy Storage Technology Co., Ltd., a subsidiary of Shanghai Electric, has independent core intellectual property rights and a number of patents for flow batteries, and has developed high-performance stacks and series of energy storage products with The design, manufacturing and delivery capabilities of flow battery stacks and system products have continuously accumulated experience in flow energy storage engineering, and gradually moved from an equipment supplier to an overall solution provider. The State Power Investment Group's Yellow River upstream hydropower company's flow battery energy storage project and Changde 10KW/60KWh flow energy storage system, which are responsible for the construction, will soon be connected to the grid. Shantou Smart Energy's all-vanadium flow battery energy storage power station has been successfully completed in the first half of 2021 pass the inspection. According to the Polaris Energy Storage Network, on March 4, 2022, Zeng Lecai, chairman of Shanghai Electric Energy Storage Technology Co., Ltd., and Yang Linlin, general manager of Shanghai Electric Energy Storage Technology Co., Ltd., worked with Yancheng Science and Technology City Management Committee and Yueda Group to conduct advanced energy storage technology research and development and liquid flow energy storage. The equipment manufacturing industry project, the capital increase of Shanghai Electric Energy Storage Technology Co., Ltd., the joint venture of Shanghai Electric Energy Storage Technology Co., Ltd., and the Yancheng 100-megawatt energy storage project were signed. The signing ceremony was successfully held in Yancheng, Jiangsu. Co., Ltd. completed the Pre-A round of financing.

(This article is for informational purposes only and does not represent any investment advice from us. For relevant information, please refer to the original report.)