mikdam

GCM Mining (OTCQX:TPRFF) and Aris Gold (OTCQX:ALLXF) announced a surprising deal when the two companies will be combined to create a 1 million toz gold producer over the coming years. At the first moment, I was surprised by the headline, because Aris was established only two years ago, as a spin-off of GCM's (back then known as Gran Colombia Gold) Marmato mine. However, after reading the text of the news release, things started to make sense. Although technically, GCM is the acquirer (Aris Gold's shares will be exchanged for GCM's shares), the combined company will be renamed Aris Gold Corporation; moreover, it will be led by Aris Gold's management. Namely, Ian Telfer will serve as the chair of the Board of Directors, and Neil Woodyer will be the CEO.

Under the transaction terms, Aris Gold's shares not owned by GCM (GCM owns 44% of Aris Gold now) will be exchanged for 0.5 GCM shares each. The conversion ratio was calculated based on the 10-day and 20-day volume weighted average prices of both companies. Moreover, it is a no-premium transaction. As a result, GCM's share count will increase by approximately 38.5 million shares, to 136.1 million shares.

Yes, GCM's Segovia and Aris Gold's Marmato will be under the same roof once again. However, this is where the similarities between the old Gran Colombia Gold and the new Aris Gold end. The new Aris Gold will own Segovia and Marmato, but also the Toroparu project in Guyana (already under construction), the Juby project in Canada, and 20% (soon probably 50%) of the world-class Soto Norte project in Colombia.

And the company will be led by an all-star team of experienced company builders. Neil Woodyer was the founder and CEO of Endeavour Mining (OTCQX:EDVMF) and Leagold Mining (merged with Equinox Gold (EQX) in 2020). Ian Telfer is a former chairman of Goldcorp (now part of Newmont (NEM)). The Board of Directors will include also David Garofalo, former president and CEO of Goldcorp, former CEO of Hudbay Minerals (HBM), and former CFO of Agnico Eagle Mines (AEM), Peter Marrone, the founder and executive chairman of Yamana Gold (AUY), or Serafino Iacono, the founder of Gran Colombia Gold (now GCM Mining) and several other mining companies.

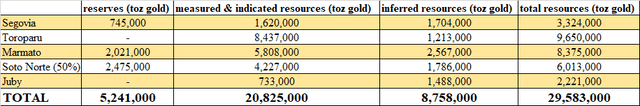

The new Aris Gold will have reserves of 5.24 million toz gold, and total resources of 29.58 million toz gold (including reserves). As can be seen in the table below, these numbers take into account a 50%-ownership of Soto Norte, as this is almost a done thing. If Aris doesn't use its option to increase its Soto Norte ownership from 20% to 50%, Mubadala will have an option to re-purchase Aris Gold's 20% interest for the original acquisition price plus some other expenditures. It is highly unlikely that Aris would risk losing its interest in Soto Norte at no profit.

Source: Own processing, using data of GCM Mining and Aris Gold

The company has also enough financial sources to push its Toroparu and Marmato development projects forward. The combined cash equals $397 million and there is also committed funding worth $260 million. Further cash should be generated by the two producing assets, Segovia and Marmato (although the current Marmato production is small and high-cost, and doesn't generate any meaningful cash flows).

Segovia and Marmato should produce slightly more than 250,000 toz gold this year. However, in 2024, both the Marmato Lower mine and Toroparu mine should be completed and the production should exceed 600,000 toz gold per year. And in 2027, Soto Norte should push the production closer to the 800,000 mark. But the news release promises a 1 million toz per year producer. According to Ian Telfer:

The combined group creates a top-in-class company with multiple tier one assets. After Aris Gold became operator of the Soto Norte joint venture, joining forces with GCM became a logical next step. Our increased scale will also broaden our future opportunities to continue building a +1 million ounce producer over the next few years.

It means that another acquisition (or several acquisitions) will probably follow. There are several potential acquisition targets. Especially Denarius Metals (OTCQB:DNRSF) is a probable target, as GCM already owns 32% of the company. Denarius has a polymetallic project in Spain, and a gold project in Colombia, directly to the east of Segovia.

Conclusion

It is no secret that I like both the companies and I suppose them to be heavily undervalued, as I wrote also in my recent articles (here and here). I am also a long-term shareholder of GCM Mining (therefore, indirectly, also of Aris Gold). Although initially I was surprised by the decision to combine the two companies, I like the idea of GCM's assets being managed by Aris Gold's all-star team. The new company has the potential to become a mid-tier gold producer in the not-so-distant future. It will have a higher debt capacity that should help to push the annual production rate over the 1 million toz per year mark. This should help to elevate also the valuation multiples the company commands.

However, not everything is rosy. The new Aris Gold will have strong exposure to Colombia (Segovia, Marmato, Soto Norte). Moreover, it looks like the dividend (GCM offers a more than 5% dividend yield right now) will be suspended. Moreover, GCM's shareholders should be prepared for some share dilution related to the Soto Norte project, because the acquisition of the additional 30% interest will cost $300 million, and 50% of the initial CAPEX amounts to $600 million. A portion of the $900 million price tag will be definitely financed via equity financing.

But the pro-forma company remains heavily undervalued. Its market capitalization would be only $395 million at the current GCM's share price of $2.9. This is a very low price for a soon-to-be 600,000 toz gold per year producer, with an ambition to exceed the 1 million toz mark in the not-so-distant future. Therefore, despite the negatives the deal brings, I am very bullish on the new Aris Gold.