Author and StockCharts

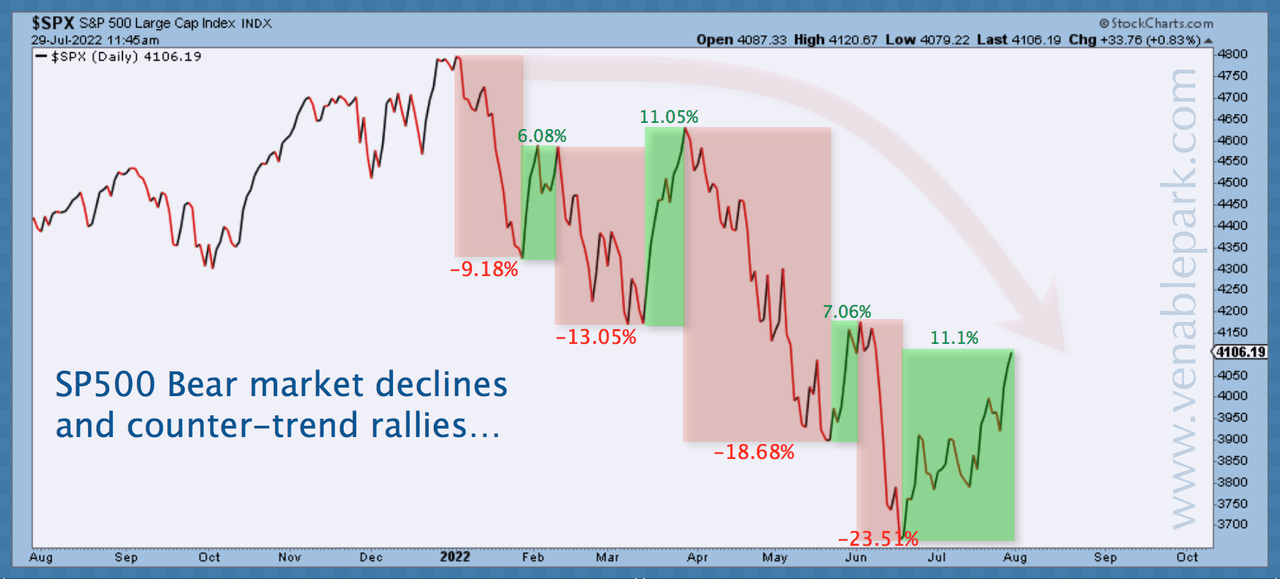

Other recessionary bears have included a series of similar rebounds (six in 2000-2003 and five in 2007-09) that all broke to lower lows before the market ultimately bottomed.

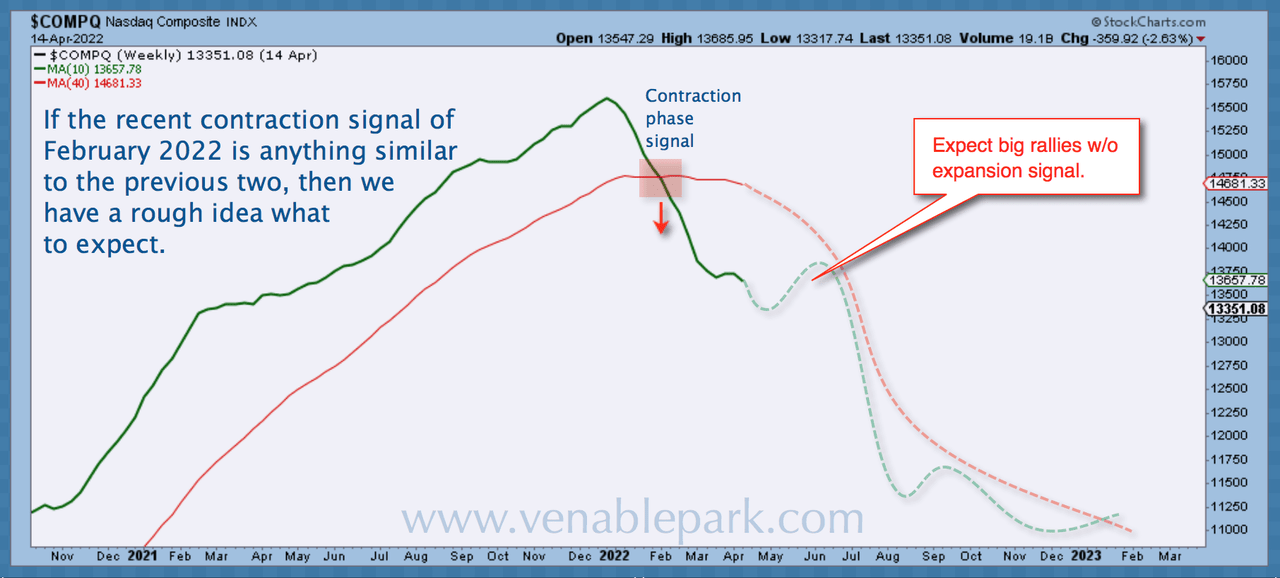

The tech-heavy NASDAQ has led the way lower since January in its own succession of ladders and snakes within an ongoing bear market.

Author and StockCharts

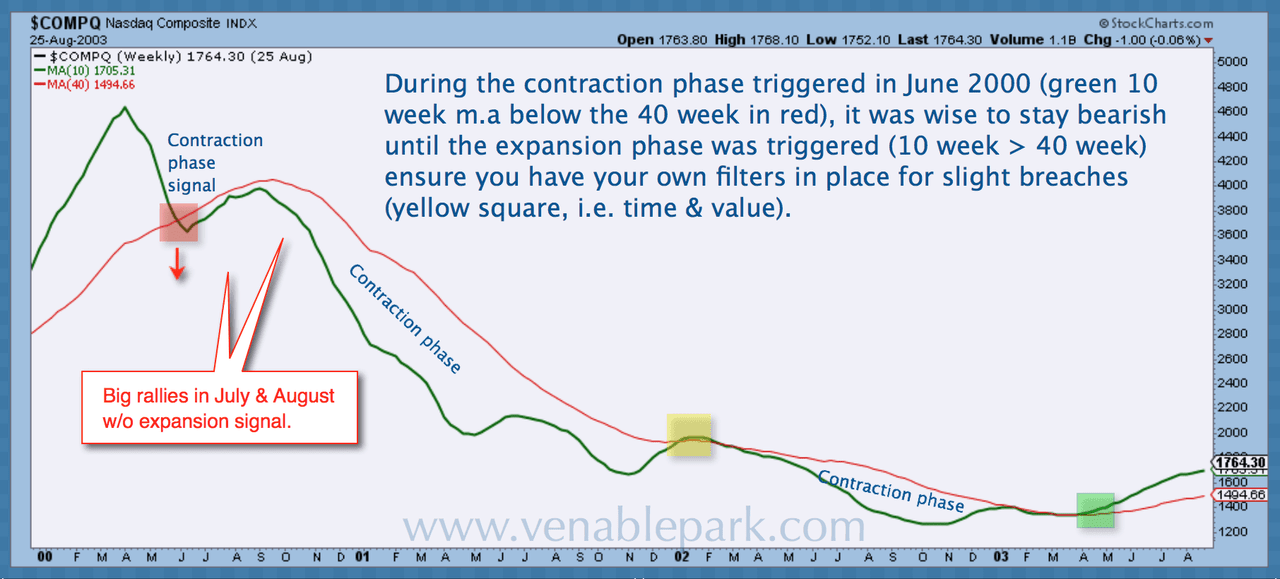

As Cory highlights below, after peaking in March 2000, the NASDAQ contracted into June 2000 before a reflex rally July through August set the stage for the next drop on route to an 80% complete loss cycle by 2003.

Author and StockCharts

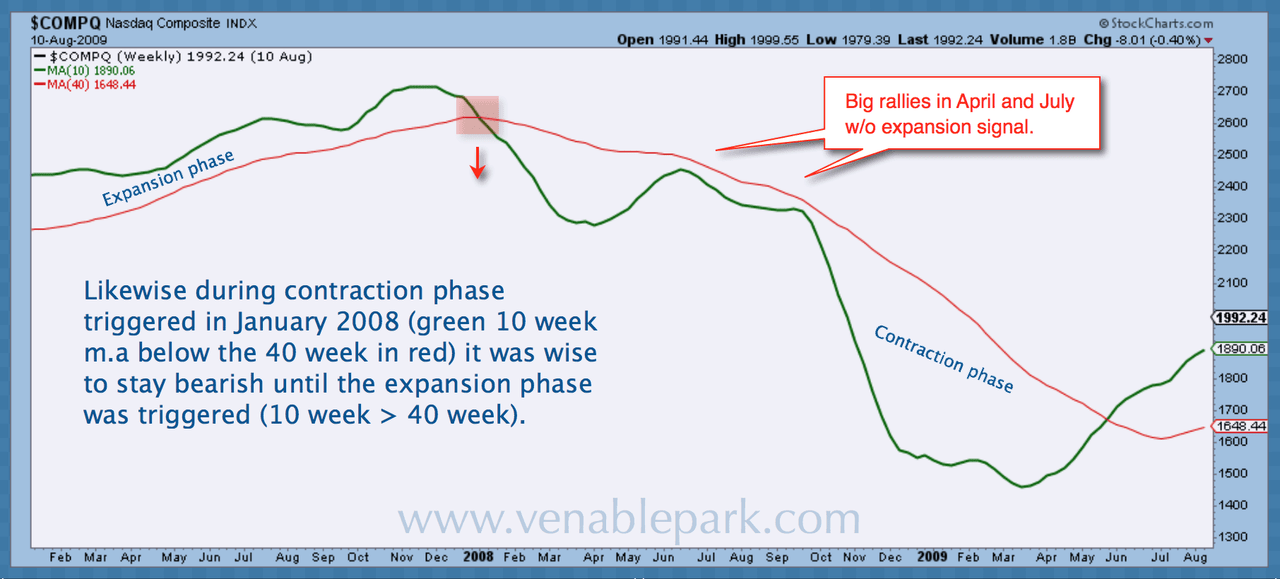

The 2007-09 bear saw similar behaviour. After entering a contraction phase in January 2008, the NASDAQ rallied sharply in April and July, still within a 44% drop that did not bottom until March 2009.

Author and StockCharts

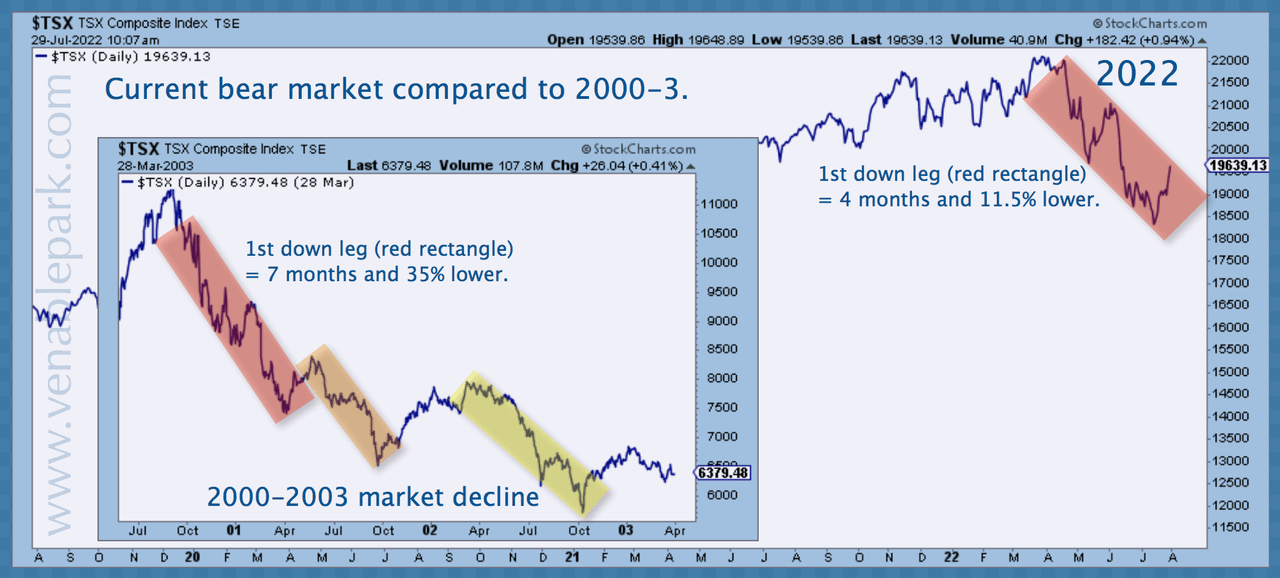

Canada’s TSX index tends to lag US large cap markets due to its whopping 65% concentration in fossil fuels (19%), materials (14.1%) and financials (31.7%), all of which peak late cycle and tumble with inflation and growth expectations into recessions. In its second bounce since March (larger box below since last August), the TSX also reminds us of price action in the early months of the 2000-03 bear market (smaller inset box below).

Author and StockCharts

Bob Farrell’s rule number 8 offers insight: “Bear markets have three stages — sharp down, reflexive rebound, and a drawn-out fundamental downtrend.”

It’s typical for risky assets to rally as central banks signal they may not tighten as much as previously believed. That happened this week as recessionary indicators mount. They also tend to rally when central banks signal the end of a tightening cycle – that could happen by the end of this year.

However, lest anyone forget, monetary policy works through the economy at a multi-quarter lag, so the violent tightening since March has barely yet registered. It’s also why stock markets and investor sentiment don’t historically bottom until after recessions have ravaged corporate profits and employment for many months and central banks near the end of their next easing cycle. We’re nowhere near there yet.

Disclosure: No positions.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.