chonticha wat

Editor's note: Seeking Alpha is proud to welcome Chatool Investments as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Using my own assumptions and assuming production of the company's measured and indicated resources, Marathon Gold (OTCQX:MGDPF) could be worth close to $2.2 per share. In my view, if the company continues to explore, it will likely report more measured resources, which would imply a higher fair price. I obviously see risks from failed forecasts, environmental disasters, and inflation. However, considering the incoming technical report to be released soon, in my opinion, MGDPF is a buy.

Marathon Gold: Measured and Indicated Resources Might Continue to Increase

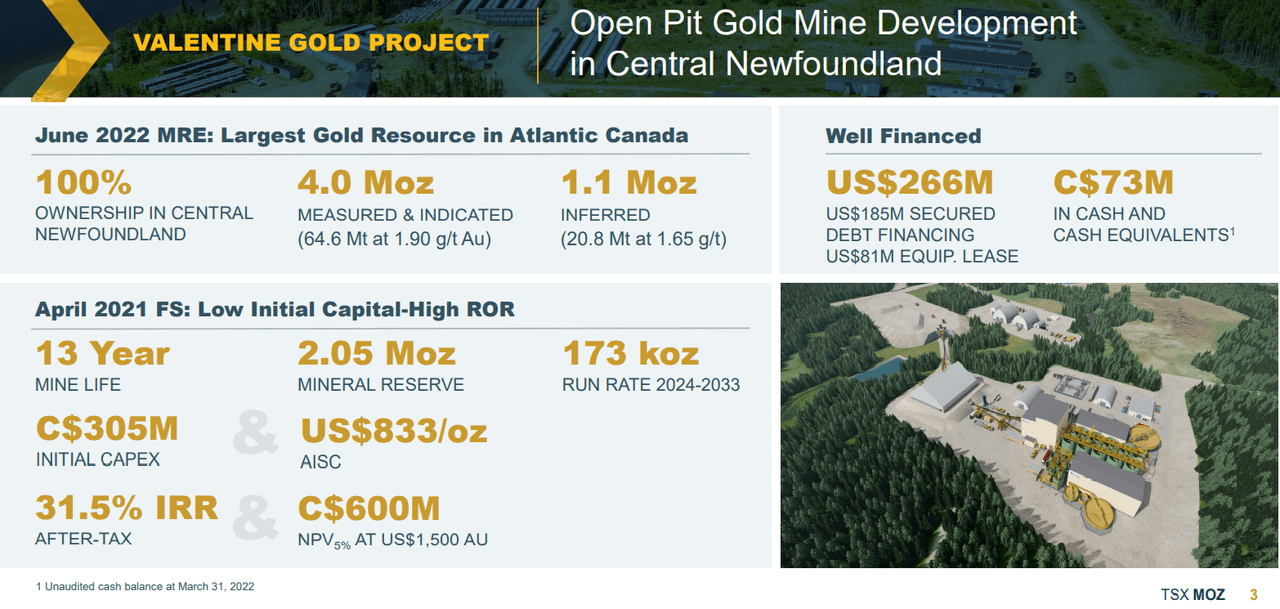

Marathon acquires, explores, and develops precious metals properties in North America. The company's main asset is the Valentine Gold Project, which is 100% owned by Marathon. Marathon also owns interests in the Bonanza Mine, the Gold Reef property, and the Golden Chest mine in Idaho. However, I believe that investors will most likely be interested in the Valentine Gold Project because it's currently receiving the largest amount of financing from Marathon.

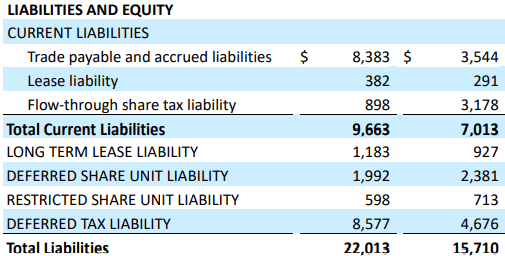

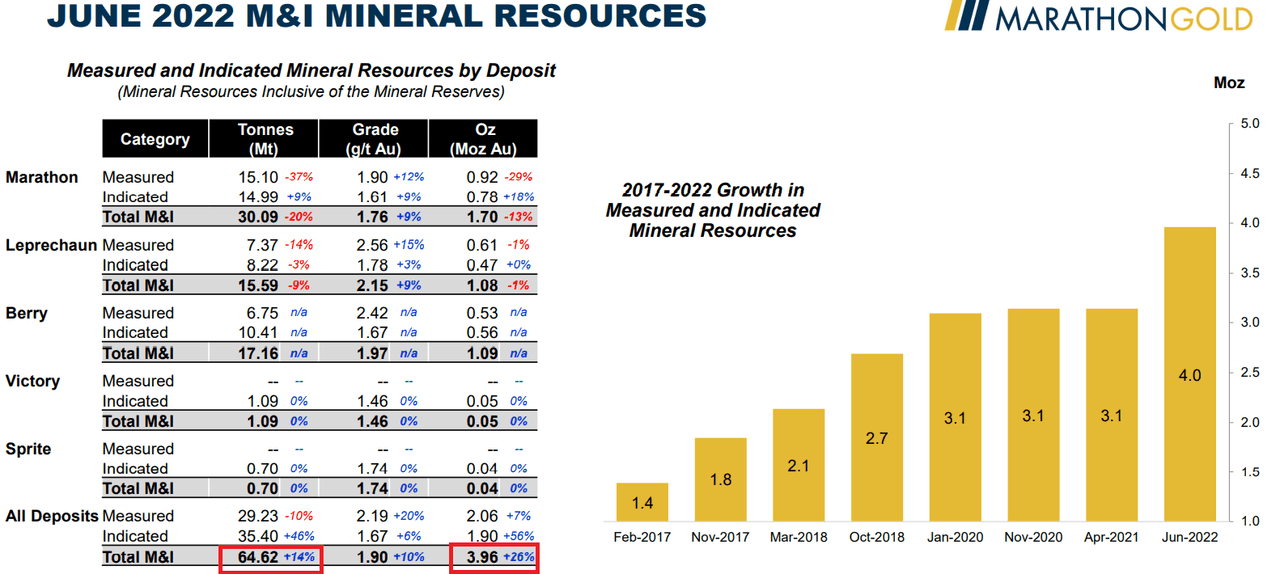

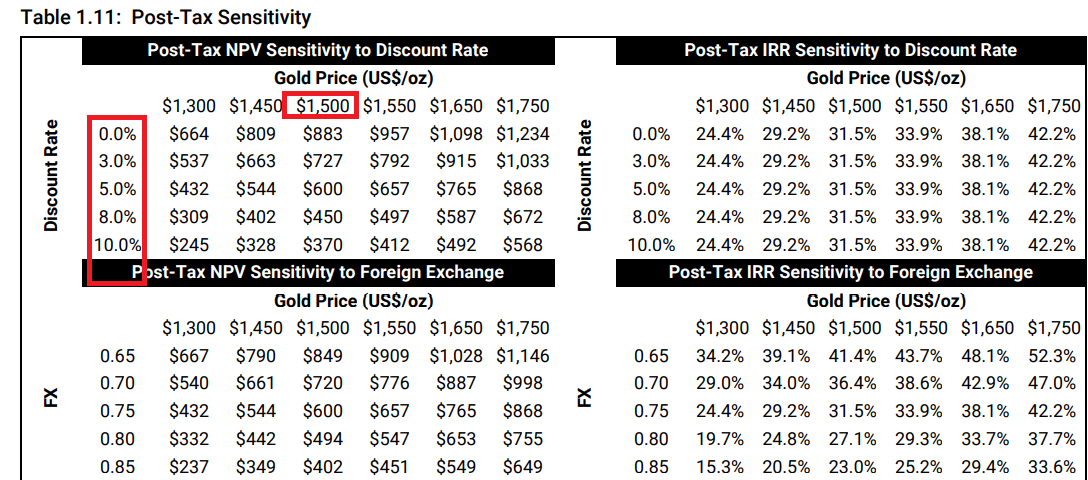

The company's flagship project is said to be the largest gold resource in Atlantic Canada, with more than 4 million gold ounces measured and indicated as well as 1.1 million inferred ounces. The expected figures reported by management encouraged me to conduct research about Marathon Gold. The company is expecting an internal rate of return of more than 31% with production of approximately 0.173 million gold ounces per year. It is expected to continue producing gold for about 13 years. With that being said, I believe that the numbers might be even better as exploration activities could enhance the amount of measured resources.

Presentation

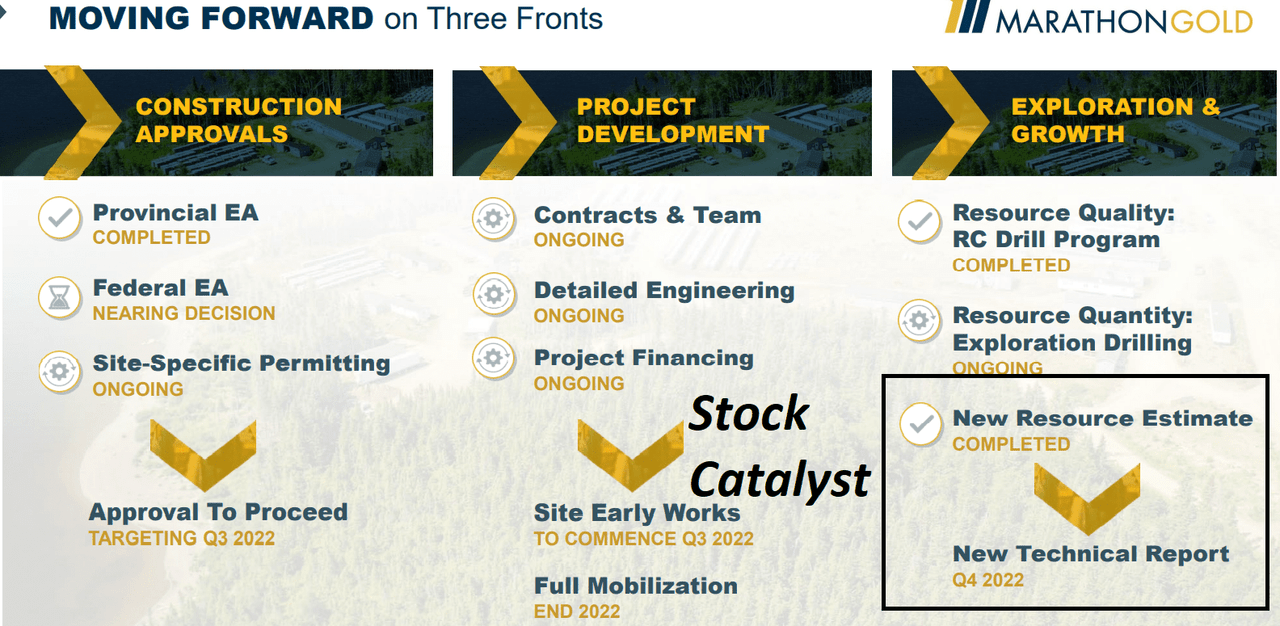

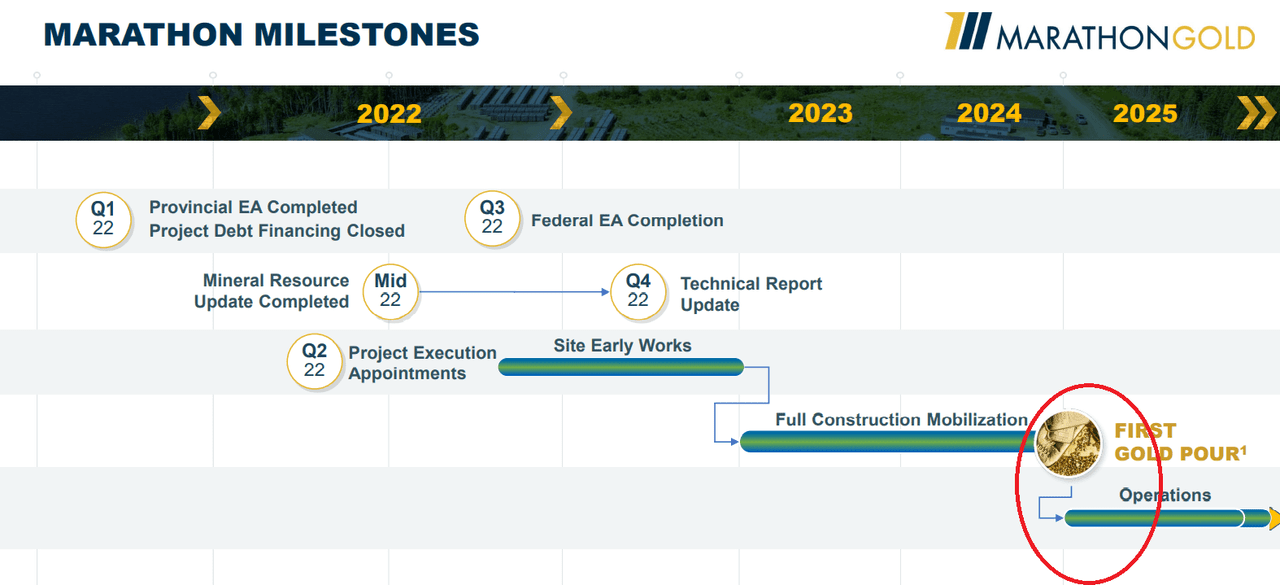

Another reason to have a look at Marathon Gold right now is the number of incoming catalysts. With most construction approvals received, Marathon noted that it may move to full mobilization by the end of 2022. It means that production of gold will commence soon.

Finally, management announced that it will deliver a new technological report at the end of 2022. In the past, new technical reports usually included more measured and indicated resources. I would bet that this time the report will likely not be different. More proven and measured reserves usually mean production and more free cash flow, which might increase the company's fair valuation.

Presentation

Presentation

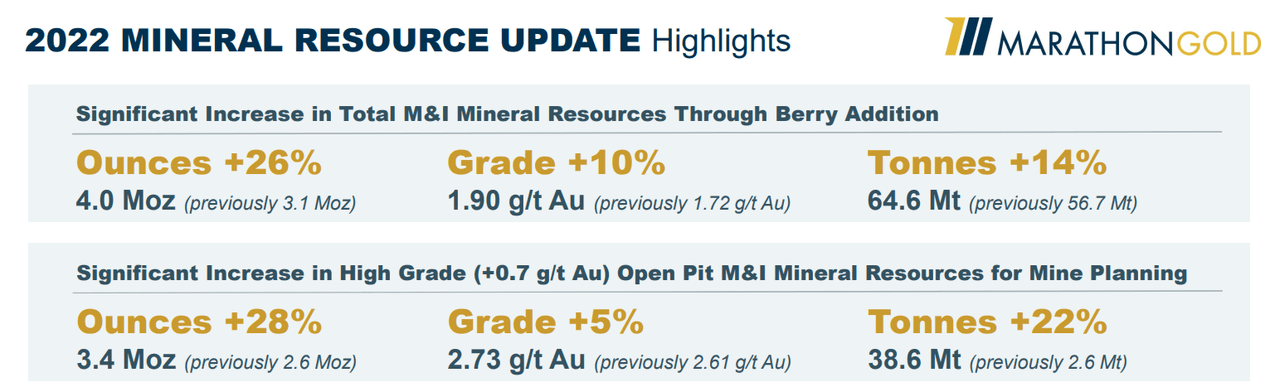

Previous increases in mineral resources included more grades and more measured and indicated resources. Right now, we are talking about 4 million gold ounces, but very recently the total amount of resources was equal to 3.1 million. The grade also increased from 1.7 g/t to 1.9 g/t.

Presentation

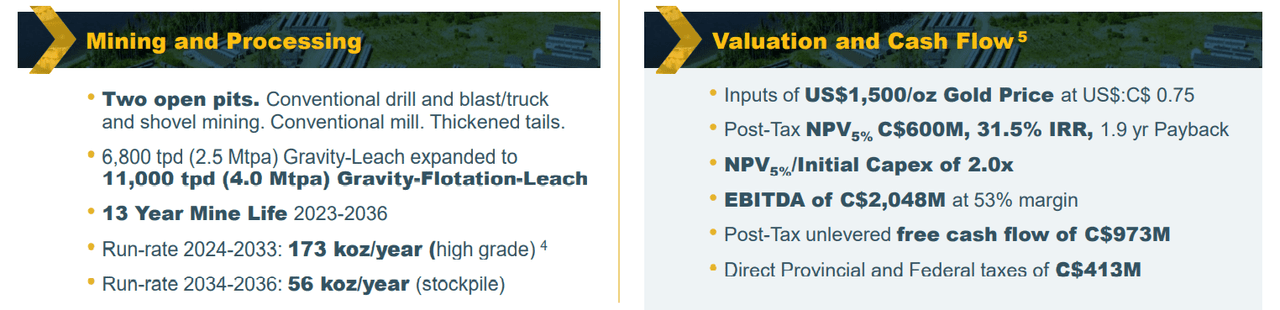

Balance Sheet: Not Significant Debts and Some Cash in Hand

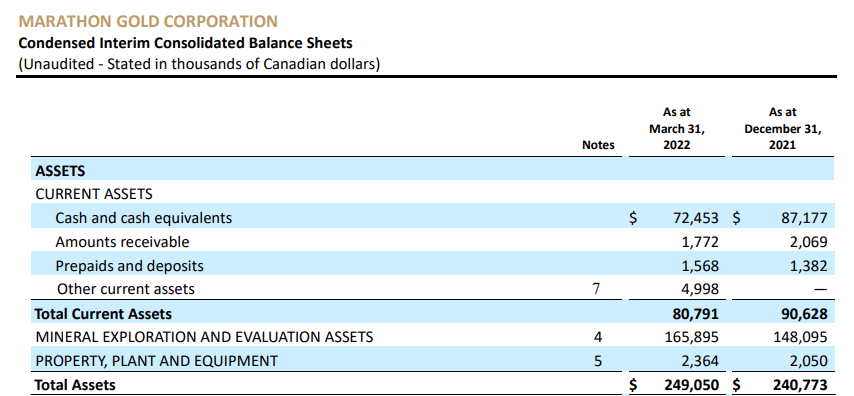

As of March 31, 2022, Marathon Gold reported CAD72 million in cash, CAD249 million in total assets, and CAD22 million in total liabilities. In my view, the balance sheet looks in great shape. Management will need financing from debt investors or equity investors to finance the Valentine Gold Project. I don't think that the current balance sheet will represent a problem for Marathon.

10-Q

Regarding the list of debts, shareholders will likely not worry. As of March 31, 2022, the company only reports long-term lease liabilities worth CAD1.1 billion.

10-Q

Valuation With 2 Million Ounces Would Lead to a Fair Price of $1.14 Per Share

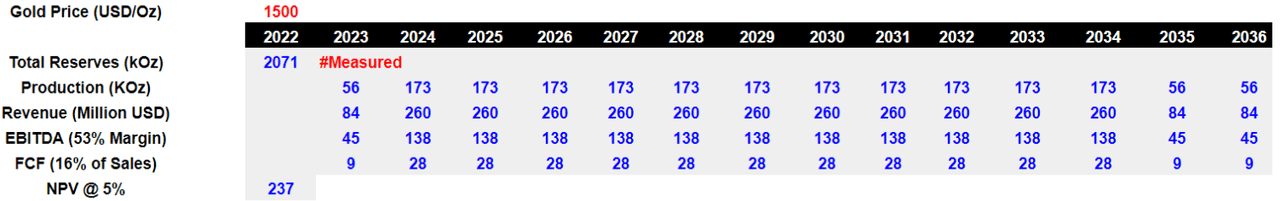

Considering that measured and indicated resources increased from 1.4 million ounces in 2017 to close to 4 million ounces in 2022, I used a valuation range. Right now, the amount of measured resources is close to 2.06 million with 1.9 million indicated resources. I assessed the valuation using the measured resources, which represents gold estimated with a high level of confidence. I also executed another possible scenario, which includes measured and indicated resources, so it's a very optimistic case scenario.

Presentation

Assuming conservative production close to 173 kOz from 2024 to 2034, net sales would stand at close to $260 million. I also used an assumption made by management about the EBITDA margin, which would be close to 53%. It means that we would talk about 2034 EBITDA close to $138 million. Note that my numbers are pretty much aligned with some of the assumptions made by management. I included a year mine life of 13 and a gold price of $1500 per ounce.

Presentation

Technical Report

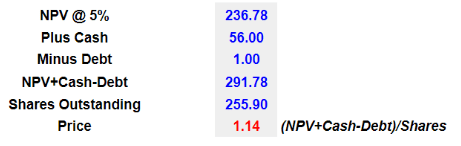

Finally, if we assume an FCF/sales ratio of 16%, which is reasonable in the mining industry, we could expect free cash flow around $28 million from 2024 to 2034. Like management, I assumed a discount of 5%, and obtained a net present value of future free cash flow of $237 million.

My DCF Model

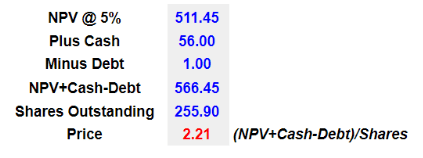

If I add the current amount of cash, deduce the debt, and divide by the current share count, the implied price stands at $1.14 per share.

My DCF Model

More Optimistic Assumptions Lead to a Valuation of $2.21 Per Share

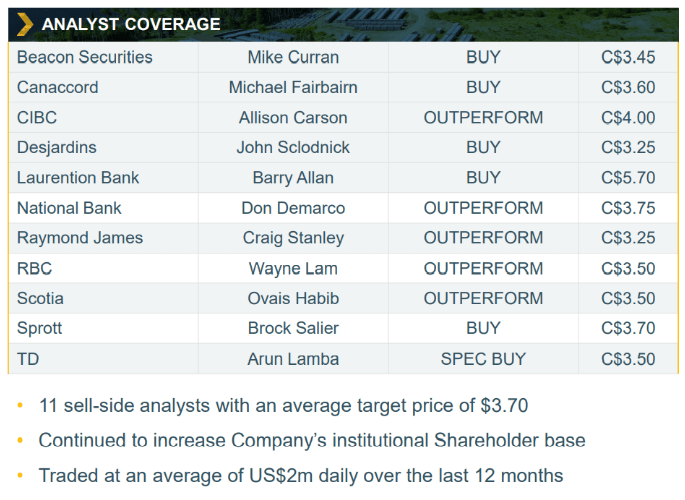

In my view, most analysts out there are using the measured and indicated resources to assess the valuation of Marathon Gold. I cannot blame them. If the company continues to explore, Marathon Gold will likely report more resources, which would imply a higher fair price. Most analysts report a fair price between CAD3.45 and CAD5.7.

Presentation

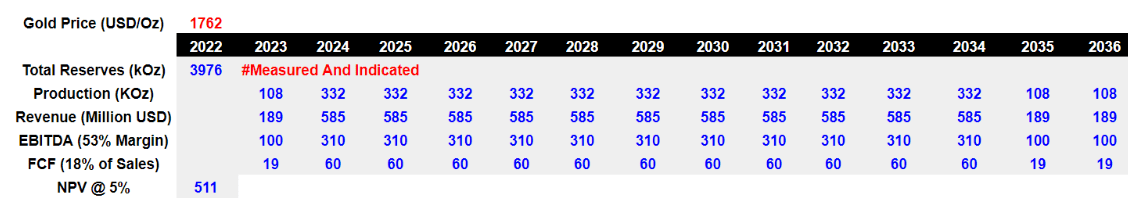

Under this scenario, I used a gold price of $1.762 per ounce and reserves of 3.97 million ounces, which would imply net revenue around $585 million. With an FCF/sales ratio close to 18%, the free cash flow would be close to $19-$60 per year. Finally, the net present value of future free cash flow from 2023 to 2036 would stand at $511 million.

My DCF Model

Adding cash in hand to the net present value, and dividing by the current shares count, the implied price would stand at $2.21 per share.

My DCF Model

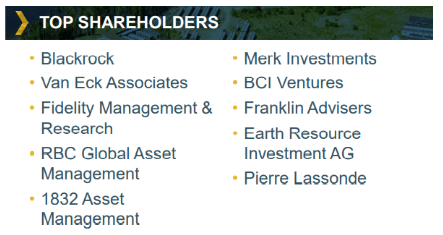

Given the current market price and the fair price given by investment analysts, I understood pretty well why well-known institutional investors bought shares of Marathon. In the light of the results of my financial model, I also believe that the shares are cheap.

Presentation

Inflation Could Increase, Possibly Leading to Lower FCF and Lower Fair Valuation

In the last quarterly report, management noted that incoming inflation may increase project costs by more than 15% to 20%. As a result, I believe that the net present value of future free cash flow from the Valentine Gold Project would be drastically reduced. If a sufficient number of journalists note the decline in profitability, the stock price will likely decline. As per company management:

Since this time significant cost inflation and construction market volatility has impacted major capital projects globally. Based on the Project's current scope and development timeline. Marathon forecasts that LOM capital costs at the Project will be between 15% and 20% higher than previously estimated principally due to higher materials costs and contractor rates. Cash operating costs and AISC are similarly estimated to be approximately 15% and 20% higher, principally due to higher consumables costs and labour rates.

Less Exploration Or Detrimental Results Could Lead to Fewer Resources, Which Would Lower the Implied Price

In 2022, management expects to explore some areas in the Valentine Lake Shear Zone. We cannot really say whether Marathon Gold will find more resources, or whether the amount of measured resources will increase. In the worst-case scenario, the company may not find more resources, which would lower the expectations of investment analysts, consequently, their target price may decrease, which may push the company's stock price down. Again, as per company management (linked above):

The 2022 exploration drilling program will also include a significant prospecting program along the approximately 13 kilometres of geological contact at the Valentine Lake Shear Zone between the Victory Deposit and the eastern boundary of the property. The above noted drilling and prospecting programs will also be supported by additional structural geological and geophysical surveys, which will be utilized to better understand the setting of the five currently known Project mineral deposits. Results from the 2022 exploration drilling program will be released throughout the remainder of 2022 as assaying is completed.

Environmental Issues Could Damage the Company's Reputation, Management Could Suffer Fines

Marathon runs a business model in which environmental regulations matter quite a bit. The company may suffer significantly from changes in the regulatory laws. If management has to pay more to restore the mining area, free cash flow could decline. Besides, environmental disasters could have a detrimental impact on Marathon's reputation. If investors decide to sell their stakes, the stock price could decline. Again, as per company management (linked above):

Marathon is developing an Environmental and Social Management System, with associated Management and Monitoring Plans, designed to govern compliance with the Project's anticipated regulatory and permitting conditions, as well as conformity with environmental and social best practice over the life of the Project.

Risks From Failed Capex or Opex Forecast

Engineers and finance professionals developed several financial models and obtained an internal rate of return of more than 30%. They could be wrong. If they underestimated the expenses and capital expenditures necessary to run the mine, future free cash flow may be lower than expected. In the worst-case scenario, free cash flow would be lower than initially announced, which may push the company's stock to fall.

Company-/Industry-Specific Risks

Like other gold miners, Marathon Gold may be affected by changes in commodity prices, the gold price, shortages of equipment, and grade changes. Not receiving financial assistance from governments may also be an issue. Keep in mind that Marathon Gold expects to receive money from the Government of Newfoundland and Labrador:

Numerous factors including, but not limited to, unexpected grade changes, gold recovery variances, shortages of equipment and consumables, and equipment failures could impact our ability to achieve forecasted production schedules from proven and probable reserves. Additionally, commodity prices, capital expenditure requirements and reclamation costs could differ from the assumptions used in the cash flow models used to assess impairment.

Marathon applies from time to time for financial assistance from the Government of Newfoundland and Labrador with respect to certain exploration and development costs.

Conclusion

Marathon Gold reported an increase in measured resources, and many analysts believe that the stock price should be much higher than the current price mark. Using my own financial model, if the company continues to explore and finds the indicated amount of gold, future free cash flow would justify a fair price of around US$2.20. Some analysts believe that the share price could even reach more than CAD3.5. I know that the risks are not small, and the company is a bit speculative. However, with very serious shareholders inside the company and the current market price, I believe that Marathon Gold is a buy.