Arizona Silver 'Could Be Sitting on 3-4 Million Ounces'Arizona Silver Exploration Inc. (AZS:TSX - AZASF:OTC)

$0.19

2022/10/2 7:42:01

Volume: 7,926

Market Cap: 12.25m

PE Ratio: -19.80

Year High: $0.48

Year Low: $0.13

Shares Out: 64,487,615

Float: 64,487,615 | Institute Hold'gs:

9.00% (as of 08/31/22)

Institutions Bought Prev 3 Mo: 1,250,000

|

Newsletter coverage

Streetwise Reports Articles

After speaking with the president and CEO of Arizona Silver Exploration Inc., editor and publisher of The National Investor, Chris Temple, shares why he believes its Philadelphia Project is compelling.

I spoke with Arizona Silver Exploration Inc. (AZS:TSX; AZASF:OTC) president and CEO, Mike Stark, last Friday morning to get an update; and was reminded again why this company’s story and specifically its Philadelphia Project was so compelling to me when I added the company to my recommendations earlier this year. This frugally-run company has quietly been adding potential resource ounces of gold and silver as it drills one of the most geologically unique projects I’ve ever seen.

Also, Friday morning, a video was released where Vice President of Exploration Greg Hahn summed up drilling success to date.

Check it out!

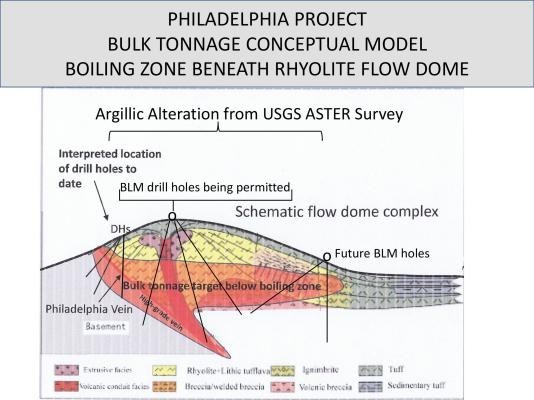

The old saying is that a picture is worth 1,000 words: and that’s especially true here, given this graphic that I shared first back in February.

What’s unique about what looks like a porphyry or similar structure the company is sitting on is that it’s been almost completely covered by a huge rhyolite dome.

Given that the overwhelming majority of historical mining activity in this area of Arizona — the Oatman Mining District — was done in decades past, little ability existed to understand what this huge dome might be covering.

Largely small-scale tinkering around the edges was done with what could be seen with the naked eye; not uncommon in most places in decades past, as you know.

The thesis the company has had is that this dome covers not only an array of vein and breccia systems, with some disseminated gold and silver also.

It’s also thought that — underneath the dome where a potential bulk tonnage, an open-pittable resource might lie (looking at the numbers to date, via drill intercepts and the like, a calculation of now just over one million ounces gold equivalent has been seen; NOT yet in a compliant NI 43-101 form, however!) there could be a FAR richer area that runs substantially higher grade than what has mostly been encountered thus far.

I say “mostly” because one recent hole that the company drilled — Hole 91 — which made it down 900 feet or so was noteworthy in that the final 15’ or so saw gold and silver grades which were respectable enough on the way, in several places, triple before the hole ended.

One global expert on such systems the company brought in concurred with the idea that they were just beginning to get into the far richer source of what’s been encountered higher.

It’s hoped that drilling in Q4 and into 2023 (among other things, of course, AZASF plans to drill a few holes in the vicinity of and deeper than Hole 91) will go a long way to demonstrating that — between the shallower open-pittable material and the higher grade source — Arizona Silver could be sitting on three-four million ounces just at Philadelphia.

With a CA$14 million market cap or so at last week’s end, Arizona Silver Exploration is hardly the only promising company priced at peanuts. But its geological model and story are more compelling than most.

Further, that most of the stock has obviously been in strong hands (notwithstanding last Friday’s drop, AZASF has still fared better than most of its peers in relative terms) is apparent.

And both Stark and Hahn have invested healthy six figures into the company’s shares from their own pockets.