US PMI out today "Contraction"These are a great snapshot of what's happening to US Manufacturing & Services both in contraction, and it's only going to worsen with each interest rate hike being done by Central Banks to fight Inflation, and with the FED's rapid interest rate hikes over a short time the economy can go from one crisis to another and the next crisis will be Deflation and that happens when the economy starts to build momentum downward because of all the interest rate hikes to fight inflation and the economy gets into a runaway downward trend so they have to start lowering the Interest rates and add stimulus in hope to stop or slow the economic decline and this whole recession scenario can last 2+ years if we do have Deflation. Before each FED rate hike, they go over all the current data and make a decision based on that. Remember that it always takes as long to get out of trouble as it does getting into it, and the market should be worried as we head into a deep recession. During the 2008 Great Recession Oil dropped from $134 in June to $39 by Feb we also started with the highest Oil in June and are heading in the same direction COVID saw Oil drop to $16 in 2020 so heading into a recession I figure that $85 is high right now and $95+ is going to take a leap to get there but that's not on the radar for my prediction.

In the last post I put US Election Nov 4th but its 8th

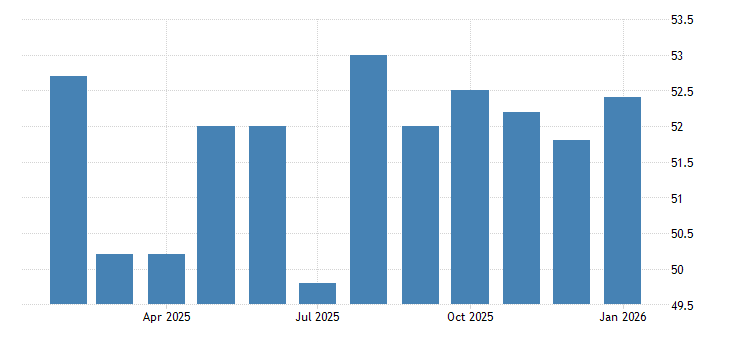

US Manufacturing PMI

US Service PMI

US Service PMI  US Composite PMI

US Composite PMI