Reuters

Reuters Since November, financial advisor David Marotta has been publishing a series of blog posts on how to manage your money in the event of a financial apocalypse—as in a world of hyperinflation, governmental collapse, and anarachic mobs. You know, the standard stuff of a doomsday prepper's fever dreams. While Marotta admits he has some fears about the direction of the country (the man's not an Obamacare fan, to say the least) most of it seems to be fairly tongue-in-cheek material aimed at talking potential clients down from investing in some of the crazy, survivalist scams advertised on conservative talk radio. (Sadly, The Washington Examiner seems to have missed the humor).

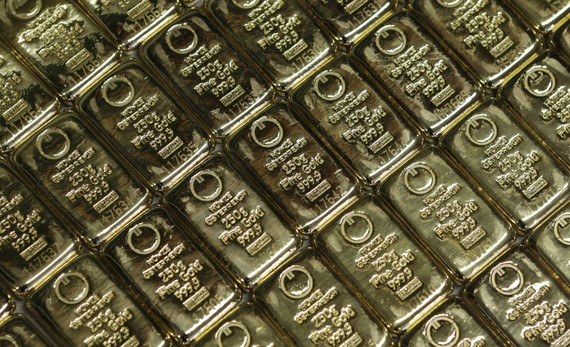

And the first scam on his agenda? Plowing all your money into gold, of course. Here's his biblically inflected explanation of why toting around a suitcase of gold come the end times—and at today's prices, a $1 million in gold coins would fit in a suitcase—would be a suboptimal strategy:

If there really is a collapse of the money supply it is difficult to believe that your briefcase of pretty coins will still have any purchasing power near $1 million. In the 1970s, Christian singer Larry Norman made popular the Apocalyptic song lyric, “A piece of bread could buy a bag of gold” based on Revelation 6:6. In The End, I’d rather not have bought as much gold as possible.

In other words, when an economy goes full-on Mad Max and we're all reduced to bartering, the survivors are going to be more interested in useful goods than in a soft metal useful mostly for ornamental purposes. Part of gold's value as a commodity is derived from the fact that it can easily be traded across borders. But if that were no longer an option, and you were reduced to using bullion to buy a baguette, it wouldn't really matter what people in China or India were willing to pay for your gold.

I would also add that, in a truly Hobbesian state of nature, it might not be wise to keep all your wealth stored in a small, easily pilfered box.

Now, in fairness to the goldbugs out there, I think Marotta is oversimplifying a bit. Let's say the United States has a bout of Zimbabwe-like inflation, but the international commodities markets stay up and running. Theoretically, if the collapse of the world's reserve currency hasn't shocked the entire global economy into paralysis, you might be able to trade your gold for Euros or Swiss Francs or whatever else the markets start denominating prices in and start a nice little import business.

The problem is that if doomsday doesn't arrive, you're probably stuck with a bum investment. As Marotta puts it: "Gold has a low expected return of just inflation and one of the highest volatilities as measured by standard deviation. That means that the optimum asset allocation to gold is always zero."

His bottom line? Keep the shiny stuff to less than 3 percent of your portfolio. And, if you're really convinced the end is nigh, I say stick with canned goods.