Introduction

Birchcliff Energy (TSX:BIR:CA) (OTCPK:BIREF) has been one of my favorite natural gas players in the northern hemisphere for a while now. I used to own the preferred shares which I was able to pick up again during the COVID crisis and I was pretty sad to see those preferred shares being retired by the company as they were a stable and reliable source of income. Once my preferred shares were cancelled, I started writing out of the money put options on Birchcliff to start a long position in the common shares of the company, and when the share price dipped on the very first day of the new year, I rapidly bought stock on the open market to immediately establish a full position at an average price of around C$8.50.

The dividend was indeed hiked to C$0.20 per quarter

Last week, Birchcliff announced its first dividend for 2023. And in line with the company’s guidance, the quarterly dividend was ten-folded to C$0.20 per share, for an annualized dividend of C$0.80. Based on the current share price of just over C$9, the dividend yield is 8.5%.

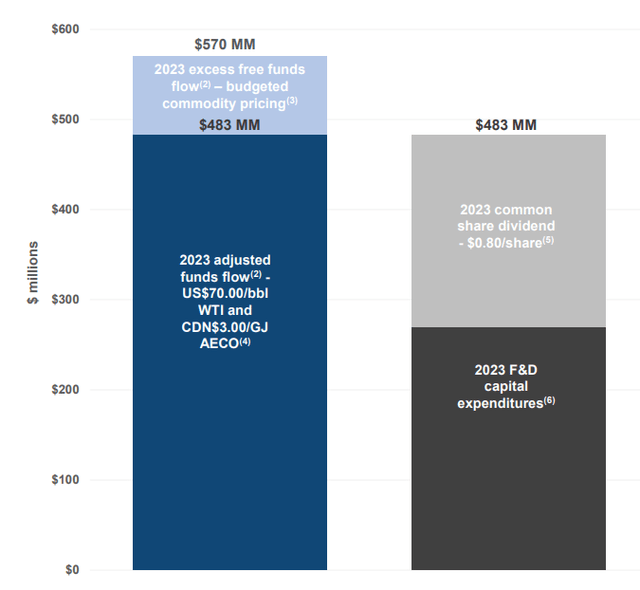

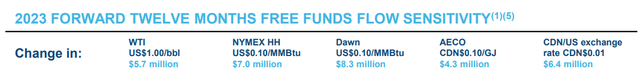

And it’s important to realize this isn’t a "sucker yield." In order to convince investors the dividend is sustainable and Birchcliff plans to become a reliable dividend payer, the company has been educating the market by providing a sensitivity analysis. Based on an oil price of US$70 WTI and an average natural gas price of C$3 on an AECO basis, Birchcliff can cover both the dividend payments as well as its capex program planned for this year.

Birchcliff Investor Relations

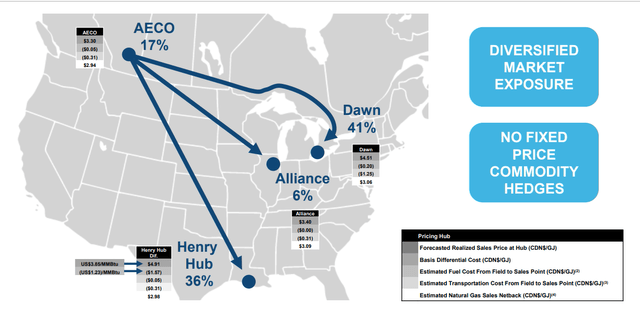

The used natural gas prices for the other markets Birchcliff is serving are also very reasonable: The guidance uses US$3.35 for Henry Hub and US$3.25 for natural gas delivered at Dawn. The C$87M in "excess" free cash flow that would be generated in 2023 is based on commodity prices that are on average about 10% higher (C$3.30 AECO, US$3.55 Dawn, US$3.85 Henry Hub and US$76 WTI).

Thanks to Birchcliff’s diversification, the majority of its natural gas will be sold based on Dawn and Henry Hub prices this year.

Birchcliff Investor Relations

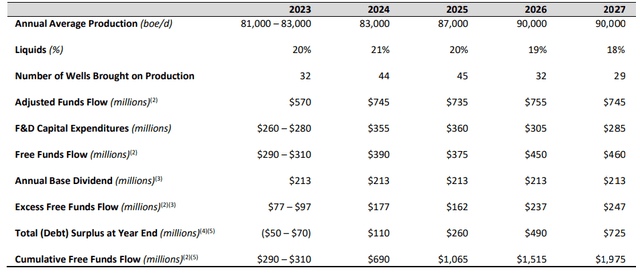

The five-year guidance looks strong - with room for flexibility

The company also released its longer-term outlook. We already know Birchcliff anticipates a C$570M funds flow resulting in C$290-310M in free cash flow after taking care of the C$260-280M in capex, and we know the dividend – which will cost the company C$213M per year – is fully covered.

Birchcliff Investor Relations

It's important to know the capex number will likely increase again in 2024 as Birchcliff will be pursuing a mid-single-digit production growth rhythm. For 2024, for instance, the company plans to spend C$355M on capex but this should still result in a C$177M excess free cash flow after paying the dividend. Granted, Birchcliff is using an average natural as price of C$4.40 AECO, US$4.45 Dawn and US$4.60 Henry Hub for this projection, so if those prices aren’t met, the free cash flow result may come in lower.

Birchcliff Investor Relations

By 2026, Birchcliff anticipates to reach a relatively stable production rate of 90,000 barrels of oil-equivalent per day and we see that in 2027, the capex drops to C$285M which we should consider to be roughly the sustaining capex to keep the production rate stable. Under this scenario, and using the aforementioned natural gas prices, Birchcliff will generate roughly C$900M in cumulative excess free cash flow (after taking the dividend payments into consideration) and end 2027 with about C$725M in net cash. That’s the theory as I do expect Birchcliff to be able to scale its capex depending on the natural gas price. Additionally, special dividends are likely as well but at the current share price I would actually like Birchcliff to buy back its own shares at a moderate pace. Buying back 11M shares per year (about 4% of the share count) would cost the company approximately C$100M per year at the current share price and also make the dividend more affordable.

Investment thesis

I have a full-sized long position and I have been writing additional put options lately with for instance a P9 expiring in April for an option premium of C$1.03. If the share price of Birchcliff trades above C$9 at expiration, I’ll make just over C$100 in option premiums. And if it trades below C$9 I am basically picking up more stock at C$7.97 with a 10% dividend yield.

I’m not married to yield, and if Birchcliff needs to cut it because natural gas prices start trading below the threshold, so be it. But looking at the futures market for the Henry Hub, prices appear to be increasing again from this summer on with US$3.54 as price quoted for delivery in July and US$4.70 for gas delivered in January 2024.