Kittisak Kaewchalun /iStock via Getty Images

Introduction

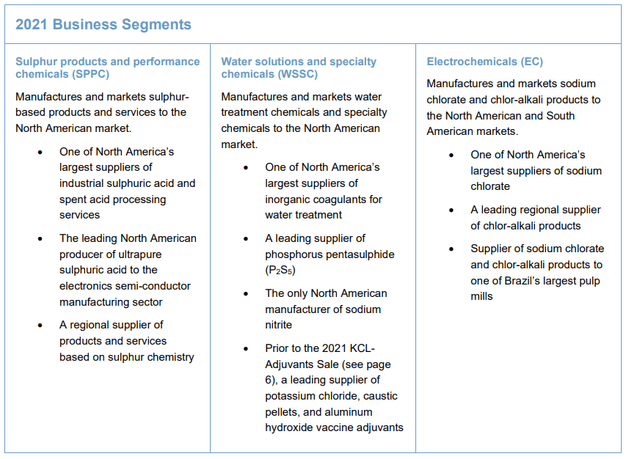

Chemtrade Logistics (TSX:CHE.UN:CA) (OTC:CGIFF) provides industrial chemicals to North American customers. The company is active in two divisions: electrochemicals and sulphur and water solutions. Until 2021, the sulphur and water divisions were separate (as you can see below on the summary) but subsequent to the sale of the potassium chloride and caustic pellets production, Chemtrade decided to simplify its corporate structure and continue to report on two separate segments.

Chemtrade Investor Relations

After a difficult 2020 and 2021 due to the COVID pandemic, the situation started to look much brighter going into 2022 and Chemtrade saw its distributable cash flow (‘DCF’) sharply increase in the third quarter.

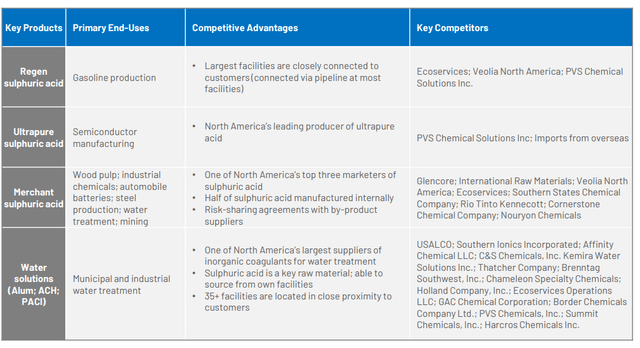

Chemtrade Investor Relations

As Chemtrade is paying a monthly distribution of C$0.05 per share, the higher DCF means the company is able to retain quite a bit of cash flow which will help to strengthen the balance sheet and fund the planned construction of a new sulphuric acid plant in Arizona. Chemtrade Logistics reports in Canadian Dollar so I will use the CAD as base currency throughout this article.

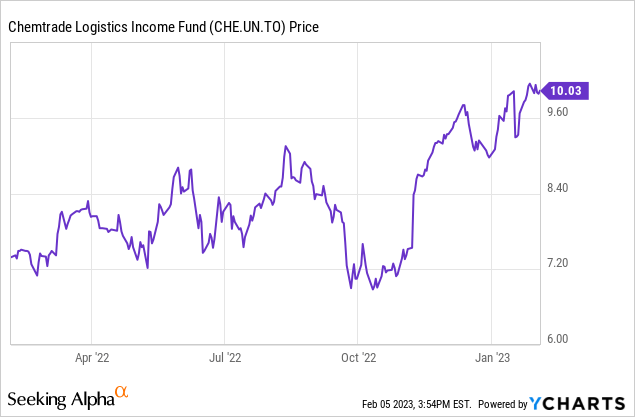

Data by YCharts

Data by YCharts

2022 will be an excellent year and the DCF should be close to C$200M

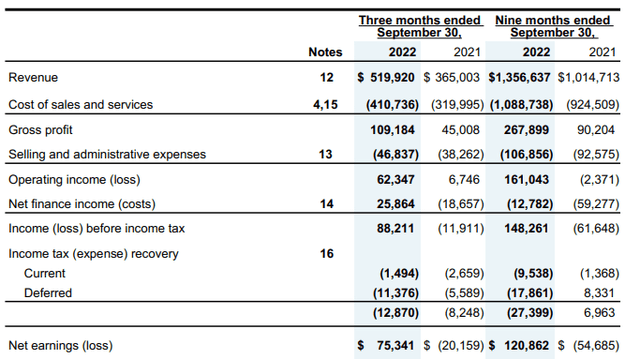

Chemtrade’s operations can be cyclical and will fluctuate from year to year. 2022 will be a good year as in the first nine months of the year, Chemtrade already reported a revenue of almost C$1.36B, an increase of approximately 35% compared to the first nine months of 2021. The third quarter was exceptionally strong with a 50% revenue increase which caused the gross profit to increase by almost 150%.

Chemtrade Investor Relations

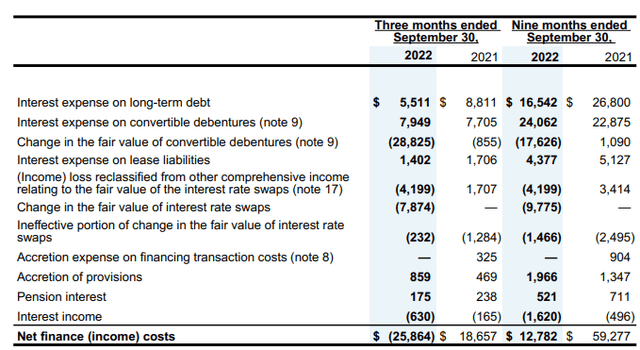

The company reported a net income of C$75M, mainly helped by the almost C$26M in finance income which was mainly related to the change in the fair value of the convertible debentures and interest rate swaps. The total interest expenses came in at C$15M.

Chemtrade Investor Relations

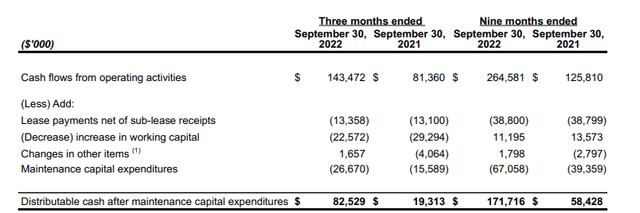

This is a good example of why looking at the company’s free cash flow (or in this case, the distributable cash flow after only deducting the maintenance capital) provides a much better impression of how the underlying business is performing. That’s why it’s useful to see Chemtrade is providing that information. As you can see below, the total DCF in Q3 was approximately C$82.5M after taking the almost C$27M in sustaining capex into consideration. The DCF in the first nine months of the year came in at almost C$172M which is almost three times as high as the result in the same period in 2021.

Chemtrade Investor Relations

As there are 115.2M units outstanding, the DCFPS came in at C$0.72 and C$1.49 based on the current share count. The reported DCFPS of C$0.75 and C$1.62 is based on the average share count.

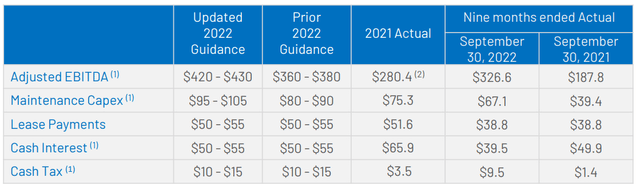

The updated guidance for 2022 now also allows us to figure out at what level the DCF for 2022 will come in at.

Chemtrade Investor Relations

We know Chemtrade was aiming for C$420-430M in EBITDA which implies a Q4 EBITDA result of approximately C$100M. That being said, the maintenance capex will increase in the final quarter to approximately C$35M. The lease payments should remain stable at approximately C$13-14M and I will use a C$15M interest expense for the final quarter of last year. I will also use a C$5M cash tax.

This means that we can expect the DCF in the final quarter of 2022 to come in at C$31M or C$0.27 per share. The full-year DCFPS will then come in at C$1.66 per share (again based on the effective share count and not on the average share count). This also means the current distribution of C$0.05 per month represents a payout ratio of just 36%.

The projections for 2023 are interesting as well

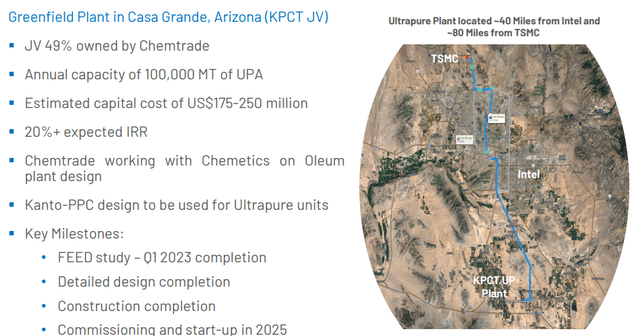

Considering Chemtrade only pays an annualized distribution of C$0.60, it basically means in excess of C$1/share will be retained on the balance sheet. That represents approximately C$120M in cash which could prove very useful in the future as Chemtrade is currently expanding its Ohio plant which requires an US$50-55M investment with an expected 25+% IRR while it will also start the construction of a new ultrapure acid plant in Casa Grande, Arizona. That plant will be able to supply the Intel (INTC) and TSMC plants.

Chemtrade Investor Relations

Chemtrade is a 49% shareholder in the joint venture where the US$175-250M capex should result in an IRR exceeding 20%. The total attributable capex for both investments (assuming the capex comes in at the higher end of the guidance) is US$177.5M, which is roughly C$250M. The C$120M in retained cash in 2022 will be very useful to fund these plans.

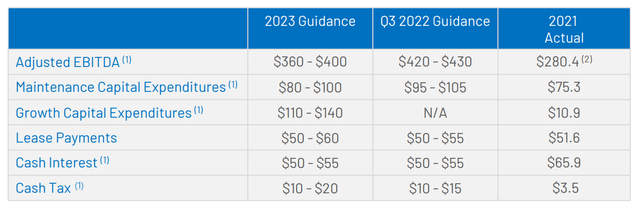

Chemtrade has already published its guidance for 2023 as well. The company anticipates a full-year guidance of C$360-400M in adjusted EBITDA, which would be a bit lower than the anticipated 2022 results.

Chemtrade Investor Relations

Assuming the midpoint of all the other elements, the DCF will come in at C$165M. We also know the distribution of C$0.60 will cost approximately C$70M which means Chemtrade should be able to retain an additional C$95M in cash in 2023 which could be spent on the growth initiatives (budgeted at C$110-140M in 2023). This also means Chemtrade would only have to generate a free cash flow after making the distributions of C$35M to fully fund the remainder of the Casa Grande capex in 2024. Knowing the combined IRR will exceed 20% on both projects, I think it’s a pretty good deal to see Chemtrade invest C$250M of its own free cash flow to boost the EBITDA by approximately C$50M further down the road. While shareholders may be keen to see a higher dividend, I’m all in favor seeing Chemtrade generating 20%+ returns on reinvesting the cash.

Using the numbers mentioned above, the payout ratio of the C$0.60 annualized distribution will increase to 42% which is still comfortably below the 50% mark.

Investment thesis

I waited too long to purchase Chemtrade and its share price has increased by almost 50% since the end of the third quarter. While I didn’t want to chase the share price, the stock still isn’t expensive as the 2023 guidance seems to imply a DCF of C$165M which is C$1.43 per share for a 14.3% FCF yield based on the current share price.

I also had a look at the convertible debentures but none of them are appealing. Two of the four debentures are currently ‘in the money’ so perhaps some of the debentureholders will start to convert debentures into shares which would increase the share count but reduce the interest expenses.

I have no position in Chemtrade, but I hope to initiate a long position on a weak market day. I like the company’s capital allocation plans and the C$840M in net debt (excluding leases) is pretty reasonable given the LTM EBITDA (excluding leases) of C$385M. Even if the adjusted EBITDA (excluding leases) drops to C$335M in 2023, the debt ratio should remain below 3 despite Chemtrade stepping up its growth investments this year. And keep in mind Chemtrade is confident the projects currently under construction and development will add C$45M in EBITDA by 2025 while it anticipates to increase its EBITDA by C$75M by 2027.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.