BanksPhotos/iStock via Getty Images

Author’s Note: All funds in Canadian currency unless otherwise noted.

Investment Thesis

When you think about propane distribution, you may conjure up images of the Fox TV cartoon “King of the Hill”. Instead, think of an enterprising firm rolling-up a fractured and complex multi-market supply chain that services North America’s retail heating and industrial needs, all backed by one of the world’s largest asset managers: Brookfield Asset Management (BAM).

Superior Plus Corp. (TSX:SPB:CA) (OTCPK:SUUIF) has the ambitious goal of growing EBITDA from $402M in 2020 to $700 million to $750 million by the end of 2026. Through a series of targeted acquisitions, Superior has now issued guidance that it expects to achieve this target two years earlier in 2024.

Fuel distribution is an industry where scale supports lower incremental costs. Superior’s growth by acquisition strategy is a pursuit to achieve scale in order to drive EBITDA margin expansion through cost synergies. In particular, the company has identified an opportunity to consolidate the U.S. market and extend some of its market leadership from Canada into key U.S. regions.

Company Profile

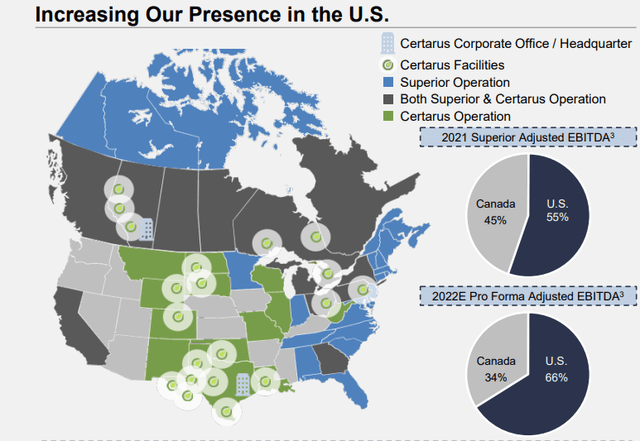

Across North America, Superior serves 890,000 customer locations in the U.S. and Canada. With a 38% market share, Superior Plus is the largest retail propane distributor in Canada. It is also rapidly growing its presence in the U.S. through acquisitions, making it the fourth largest retail propane distributor with a 3-4% market share. Despite the smaller market share in the U.S., sales in Canada contribute about one third of EBITDA, whereas the U.S. segment contributes approximately 66%.

As a leading propane distributor, Superior operates in every Canadian province and territory. In the U.S. Superior primarily operates in the Eastern U.S. and California. Recent growth has been targeting opportunities in the U.S., which has shifted revenue mix accordingly. The firm’s pending acquisition of Certarus would further extend the company’s geographic presence across the U.S.

Superior Plus Operations Footprint (Superior Plus )

Source: Superior Plus Corp.

The company trades on the Toronto Stock Exchange under the symbol “SPB.TO” with average daily volume of 560K shares. Brookfield Asset Management and its subsidiaries own exchangeable preferred shares and common shares that account for 16% ownership interest in Superior Plus. German energy and chemicals firm Marquard & Bahls also owns a 16% interest.

Growth Target and Performance

In its recent Q4 2022 results, Superior achieved a record quarter, reporting adjusted EBITDA of $182.6M. For the full year 2022, the company reported adjusted EBITDA of $449.8M, a full $51.4M increase over its 2021 result. Superior has issued guidance for 2023 of EBITDA in the range of $585M – $635M and targets $700-$750M of EBITDA From Operations by 2024.

These results put Superior within striking range of its stated 2026 EBITDA goal of $700-$750M a full two years ahead of its target. In 2020, the company had stated it would achieve this level by 2026 through a combination of “growth through acquisition initiative, organic growth, continuous improvement and commercial demand recovery”. According to Superior Plus Corp CEO Luc Desjardins on the company’s Q4 earnings call:

Superior expects to achieve $1.9 billion acquisition target at the close of the Certarus acquisition, which is three years ahead of our expectation. Superior also expect to achieve the Superior way forward EBITDA from operation target range $700 million to $750 million by the end of 2024, which is down two years ahead of expectation.

Demand Outlook

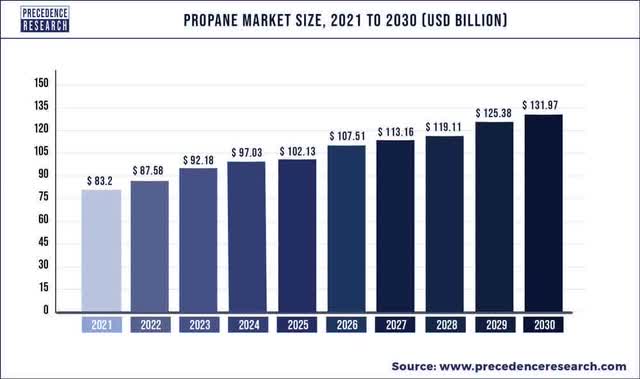

Propane, also known as LPG (Liquefied Petroleum Gas) is a fuel used for residential heating, agricultural and industrial production. In 2022, the global propane market size was estimated at $88B. Demand is forecast to grow at CAGR of 5.26% to hit $132B by 2030. Growing utilization from the agricultural sector and the demand for cleaner burnings fuels will be key drivers of growth.

Propane Market Forecast (Precedence Research )

Source: Precedence Research

Growth Strategy

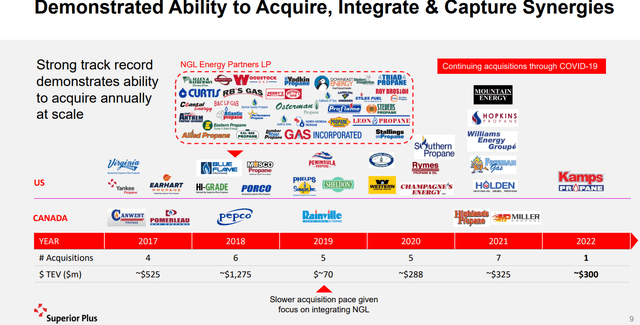

In addition to a steady recovery from COVID-related industrial slowdowns and organic growth, Superior has a proven history of growing EBITDA through M&A. Superior Plus has acquired 32 companies, including 20 in the last five years, and eight in 2022 alone. Superior’s $725M divestiture of Specialty Chemicals in 2021 has transformed the company into a pure-play fuel distribution business and freed up cash to pursue growth through M&A.

Superior has an impressive history of improving EBITDA by realizing synergies that for companies it has acquired. Superior expects a minimum of 25% improvement to EBITDA through synergies on larger transactions and even higher on smaller tuck in acquisitions. According to CEO Luc Desjardins on the company’s most recent earnings call:

The eight-propane acquisition were complete 2022 were geographically diverse, include business in U.S., Northeast, Southeast, Upper Midwest and in California, and we also had one small acquisition in Ontario, Canada. In March 2022, we closed the acquisition of Kamps and Kiva, which provide us with a platform for future growth in the attractive California, Western U.S. market. The acquisition completed in 2022, increased our customer base in the U.S. and Canada, and we expect to generate significant synergy from these acquisitions consistent with our historical experience of improving propane distribution business we acquire. So maybe I'm repeating myself a little bit here, but over 20 deals, and each of those 20 companies we've acquired have improved the bottom line by 25%.

Superior closed approximately $496M worth of acquisitions in 2022, including the ~$302 million acquisition of Kamps Propane and Kiva Energy Inc and the $145M acquisition of Quarles Delivered Fuels. These deals have helped the company grow its U.S. footprint and capture more market share by rolling-up smaller operations. As the company digests some of these transactions, unlocking synergies in 2023 should be a tailwind for Superior.

Superior Plus M&A History (Superior Plus Corp)

Source: Superior Plus Corp

The pending $1.05B acquisition of Certarus, an integrated compressed natural gas, renewable natural gas and hydrogen platform is expected to be very complimentary to Superior’s current business by reducing seasonably of revenues and offering opportunities for cross selling. While immediately accretive in 2023, Certarus is expected to contribute adjusted EBITDA in the range of $140M to $150M for 2023.

The deal has cleared regulatory approval in the U.S., with completion in Canada expected in Q1 2023. With a string of major acquisitions near completion, Superior has developed a substantial scale from which it can further invest in organic growth. With the closing of the Certarus transaction imminent, Superior has indicated a pivot to investing capital in Certarus in the near term in lieu of other large acquisition targets.

7% Dividend Yield

The Superior Plus operating model provides stable free cash flow to invest in growth while offering sustainable dividends to shareholders. Superior has paid a dividend every month since the company’s establishment in 1996. The current monthly dividend of $0.06 or $0.72 annually has been in place at its current level since 2014. Dividend growth has not been a priority for the firm as it has invested excess capital through M&A. With a yield near 7%, additional dividend growth may not be valued higher by the market.

As fuel distribution is a capital intensive business, Superior’s earnings are impacted by significant depreciation. As such, it is helpful to look at EBITDA or Adjusted Cash Flow From Operations (ACFFO) to get a sense of dividend safety. For the full year 2022, the ACFFO dividend payout ratio was approximately 60% in line with 2021, but ahead of 2020 at 43%. This works out to $163M in dividends paid on adjusted EBITDA of $449.8M. Going forward, RBC Capital Markets estimates the payout ratio at 45–50% in 2023/24.

Superior also has an open NCIB whereby it can purchase up to 10,085,599 common shares, or approximately 5% of the common shares issued and outstanding as of September 30, 2022. The company has indicated it will use the NCIB opportunistically if it generates the best return on capital for shareholders.

Potential to go Private?

With Brookfield Asset Management’s 16% interest in Superior Plus coupled with the 16% stake acquired by private German energy and chemicals firm, Marquard & Bahls, there has been significant institutional interest in Superior. According to analysts with RBC Capital Markets, factors that could lead one of these two firms to take Superior private are the planned retirement of the current CEO and a capital-constrained growth profile as the company nears its debt to EBTIDA target. A weak share price that does not seem to fully value the rich dividend yield or the market consolidation efforts being undertaken may also be a factor. Indeed, there is a precedent for Brookfield Asset Management to take private firms with weak share prices, think Brookfield Property Partners L.P. (BPY) in 2021.

Risk Analysis

Following the firm’s aggressive expansion through M&A, the company has exceeded its leverage ratio in the most recent quarter. As of December 31, 2022, Superior’s net debt to adjusted EBITDA leverage ratio for the trailing 12 months ended, was 4.1X, in excess of the company’s target range of 3.5X to 4X.This excess leverage is likely to limit the ability of the firm to pursue major M&A until the leverage ratio comes down, requiring the firm to direct capital towards debt repayment rather than growth. As is true for any growth-by-acquisition strategy, there is a risk that Superior could overpay for an asset in an effort to hit its EBITDA target.

Despite the high leverage ratio, the firm has ample liquidity with $1.05B in the form of an untapped credit facility. In its most recent quarterly report, Superior’s interest on long-term debt was approximately $64M. This is the lowest figure since 2018. The company’s weighted average cost of debt is 4.7%.

Operationally, weather is another risk factor, as a significant volume of the firm’s U.S. business is tied to residential heating. Warmer weather can lead to weak demand. The company realizes higher margins on its residential business than other business lines, so warm weather can also impact EBITDA margins.

Investor Takeaways

Thanks in part to its aggressive growth-by-acquisition strategy, Superior is on track to achieve its stated EBITDA goal of $700-$750M by 2024, a full two years ahead of its target. Superior has an impressive history of improving EBITDA by realizing synergies with the companies it has acquired. The company's nearly 7% dividend yield is very attractive and well supported. While growth is expected to moderate in the near term as the company has exceeded its leverage target, investors can get paid to wait while the firm unlocks synergies from its recent acquisitions.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.