Kostrikina Myroslava/iStock via Getty Images

Today I continue my coverage of Canadian Office REITs looking at Slate Office REIT (SOT.UN.CA). In this article, I will highlight several reasons why I do not think Slate Office REIT is a good REIT to purchase right now. This conclusion comes from the fact that Slate Office REIT has a high level of debt, and that they have consistently diluted unit prices by selling more units to fund acquisitions.

Slate Office REIT exemplifies what can go wrong with a REIT that doesn't find the right balance growing their portfolio. They currently have a high debt load relative to their equity, and in order to continue growing they have issued many units to fund new purchases over the years. As a result, they have been forced to cut their distributions two times in the last five years, and their unit price has plummeted each time.

Because REITs are obligated to distribute a high percentage of their earnings to unit holders each month, they can't grow through retained earnings and have to rely mostly on debt, dispositions, and issuing units to expand. It's a tough formula, and Slate Office REIT hasn't been successful in figuring it out. They are highly indebted, and that will likely continue to weigh on their bottom line going forward.

I should mention that Slate Office REIT has recently changed its CEO and that it has added new activist investors onto its board, so perhaps the changes brought in will alter the REIT's direction in the future. It is too early to tell at the moment in regards to any new direction the company may take. This current recommendation is based on recent results. Price fluctuations are by their nature unpredictable and can carry associated risks.

All dollar figures mentioned in this article are in Canadian dollars.

Too Much Debt

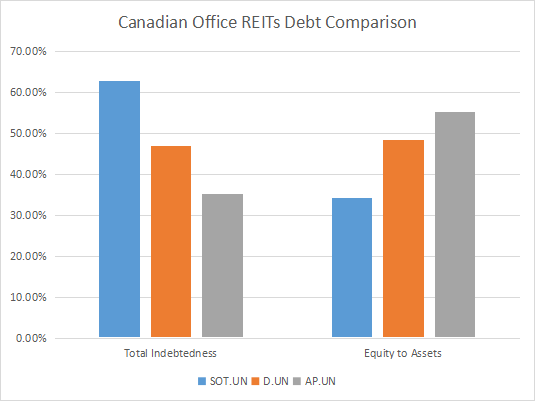

Debt Comparison of 3 Canadian Office REITs (2022 Annual Reports (Slate Office REIT, Allied Properties REIT, Dream Office REIT))

| Company | Total Indebtedness | Equity To Assets |

| Slate Office REIT | 62.8% | 34.5% |

| Dream Office REIT | 46.9% | 47.6% |

| Allied Properties REIT | 35.4% | 55.3% |

The following bar graph shows a comparison of the debt levels of three prominent Canadian office REITs. Slate Office REIT is in blue, Dream Office REIT (D.UN) is in brown, and Allied Properties REIT (AP.UN) is grey. The first group shows the total indebtedness of the REITs. I calculated this by dividing debt by total assets. The second group shows unit holder equity to assets (which is unit holder equity divided by total assets). Both clusters clearly show that Slate Office REIT has a comparatively high debt load. In fact, Slate Office has a 65% limit on total indebtedness written into their trust agreement (see Slate Office's 2022 Annual Report, p. 42). They are currently sitting at 62.8% by my calculations (they calculate it a little differently, but still close to 62%), so they are nearing that limit, at which point they would need to take immediate action to reduce debt (likely by selling buildings).

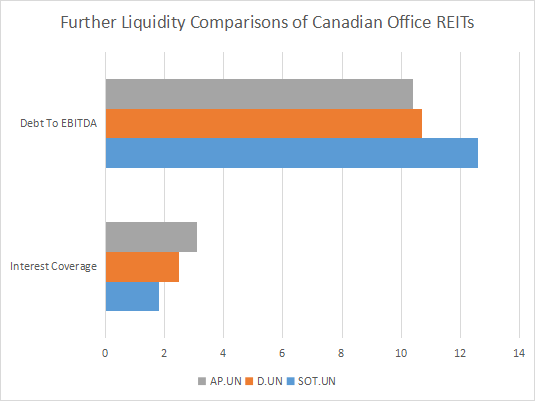

Liquidity Comparison of 3 Office REITs (2022 Annual Reports (Slate Office REIT, Allied Properties REIT, Dream Office REIT))

| Company | Debt To EBITDA | Interest Coverage |

| Slate Office REIT | 12.6x | 1.8x |

| Dream Office REIT | 10.7x | 2.5x |

| Allied Properties REIT | 10.4x | 3.1x |

Just to hammer home the point, and lest the reader should believe that the high debt load does not show up elsewhere, here are charts showing debt coverage multiples. The top one shows how many years of EBITDA it would take to pay off each REIT's debts. The second shows how many times last years interest payments were covered by the REIT's EBITDA. Again, Slate Office REIT is well behind the others on these. And when looking at Allied's numbers, one should remember that they are selling their Toronto Data Center portfolio in order to address these numbers. Which means to say that despite being well in advance of Slate Office in both liquidity measures, Allied Properties is itself not comfortable even at those lower levels.

Too Much Dilution

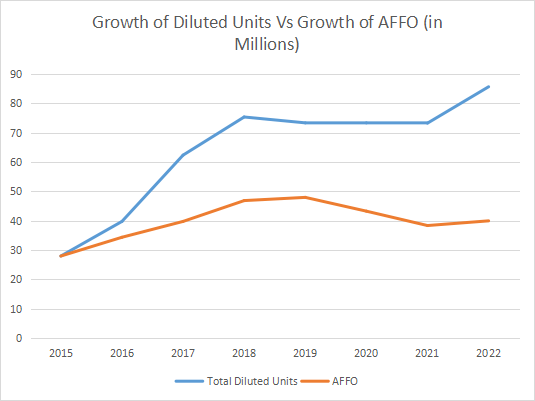

Comparison of Total Diluted Units to AFFO Since 2015 (2022 Annual Report)

| Measurement (in Millions) | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| AFFO | 27.9 | 34.2 | 39.7 | 46.8 | 47.9 | 43.2 | 38.3 | 39.9 |

| Diluted Units | 27.9 | 39.7 | 62.3 | 75.3 | 73.3 | 73.3 | 73.2 | 85.6 |

This chart compares the growth of the total number of Slate Office REIT shares outstanding to the growth of their Adjusted Funds From Operations (AFFO). I believe it pretty clearly demonstrates the movement of the stock and the distribution over the past 8 years. Because REITs are required to distribute money to unit holders each month, adding more unit holders burdens a REIT with more obligations, hurting their bottom line. For Slate Office REIT, adding so many extra units hurt their ability to grow their AFFO. As a result, they were unable to maintain their distribution amount and have twice cut their distribution in the past five years. Each time the distribution was cut, there has been a corresponding reduction in the REIT's unit price on the market.

Too Many Vacancies, Too Much Turbulence

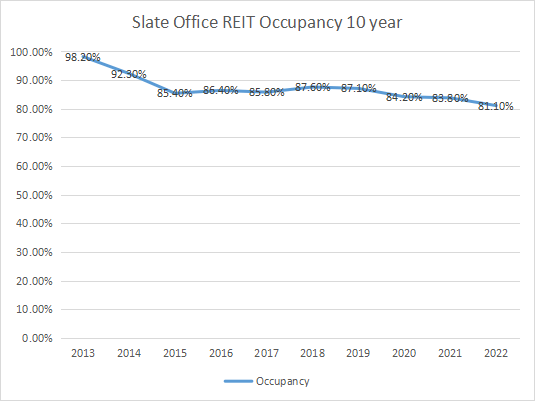

Slate Office REIT's Occupancy 10-Year Historical (2022 Annual Report)

Now no one can blame Slate Office REIT for the pandemic. But the reality is that there have been major headwinds in office real estate as companies adjust to hybrid work models. While the future of the office building at large is presently unknown, Slate Office's declining occupancy level is the general trend. If that trend were to continue in Slate's case, that could further exacerbate their debt load problem by pressuring their income stream. The current office real estate landscape will also depress their NAV valuations, since office real estate cap rates are rising and property values are falling.

In addition to the general office real estate uncertainty, a second problem facing Slate Office REIT is that their high debt load will be encountering higher interest rates as central banks have raised interest rates globally to combat inflation. This will likely cause increased interest payments for the REIT going forward, and given their high debt load, the advance will be that much quicker to affect the balance sheet.

Bottom Line

Slate Office REIT is in a situation where they need to make major changes, which they have hopefully started doing by adding to the board and changing the CEO. Their stated acquisition strategy is to purchase buildings below their replacement cost (2022 Annual Report p.2), but they will have to be much more selective in the future because many office buildings right now will be selling below their replacement cost. Office real estate is in a down cycle and it could last quite some time. Slate Office REIT is not in a good position to weather the storm, given their high debt load and stagnant growth. I would not recommend adding new units at this time, and I would recommend selling if the capital losses were needed to offset gains elsewhere, or just to preserve capital. Until such time as the new leadership demonstrates they can rein in debt and can build meaningful appreciable unit holder equity, there are better places to put one's money.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.