WWOD? (What Will Opec Do?)With about 1 week remaining until the OPEC+ meeting in Vienna June 4, there are many signs of some dealmaking going on behind the scenes.

From all I have learned from trying to speculate on what OPEC will do in a meeting, it is that you can't speculate what they will do. There are just too many individual interests from each country, different production capabilities, costs, price requirements, and politics among the cartel. The more I learn, the less I realize I seem to know about them.

It is still important to watch for signs of things going on, and listen to what narratives they put out publicly to see just where members stand and where they want to push this.

-The last 'voluntary cut' came about under a veil of secrecy and caught the watchers offguard. The announcement surprised the market as WTI quickly ran up to $80.

- There has been an in person meeting called for June 4, previously it was to be virtual. This allows delegates to have one on one discussions along the sidelines in order to build consensus. The cartel works when all members are unanimous in their decisions.

- We have the energy minister from Saudi Arabia last week warning that shorts will be 'ouching'. Saudi Arabia seems to favor and push for cuts and higher prices. They are an important and influential player, but are only one member of the group. Net long positions are at the lowest level in decades, presenting a potential violent reversal into higher prices should they act to cut Stock markets are strong, but economies are fragile and at risk. Spikes in oil could feed inflation which would cause more rate hikes, and deepen or prolong a global recession.

- Russia's energy minister says 'There is no need for further cuts'. Russia needs to ship as much of its production as possible, and does not want a cut. Did they actually cut 0.5 mbpd as promised? Is the new meeting to formalize the promised cuts and hold them to their promise to prevent them from cheating? The Russian oil discount offered has tightened substantially now with ESPO selling at a mere $7.50 to $8 discount to ICE Brent, and well above price caps. The dark fleet is working for them and busy, and China and India and others are easily absorbing this oil into their markets. They would like this volume to continue as they need to fund their war.

- OPEC secretary general is now today in Iran, meeting with Iran's president, and energy minister. Taliban are amassing forces along the Iranian border area.

- Iraq has lost 400kbpd due to the Turkish pipeline being down, and doesn't want to cut more.

- Most OPEC producers are producing as much as they can now, and still can't even meet their OPEC quotas. One would think that they would be open to actions that gets them higher prices for their oil.

- Summer demand season is here, and inventories are low and depleting. Perhaps they see with the increased demand over supply in 2H23, prices will rise in any case without any further OPEC action.

- With Mexico's production dropping, and the new Olmeca refinery opening, Mexico may soon not be an oil exporting country, and will soon leave OPEC. They have been a stick in the mud in past voting.

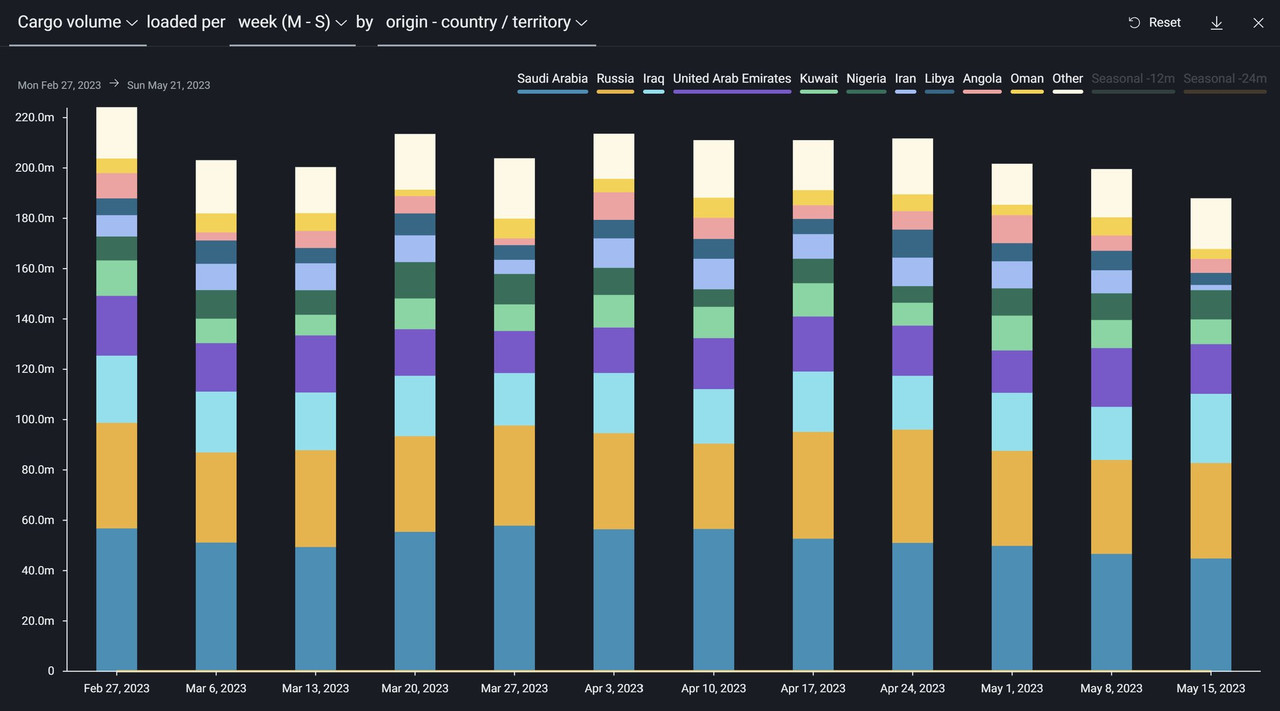

- It appears that cuts to OPEC cargo volumes has indeed happened, yet these cuts may take time to be reflected in oil prices, because they are certainly not refected at the present time.

With another week to go, keep listening for pre meeting jawboning coming from the various members.

OPEC is an odd dysfunctional family that could quickly fall apart, but powerful when they come to an agreement and unite.