TSX:SOT.DB - Post by User

Post by

MARKOPOLISon Jun 16, 2023 6:01am

337 Views

Post# 35499645

TOP CANADIAN PENSION FUND WARNS CRE BLOODBATH OFFICE

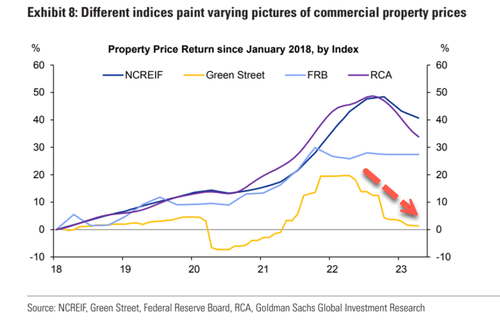

TOP CANADIAN PENSION FUND WARNS CRE BLOODBATH OFFICE t this point, we've made it clear to our readers that the next domino to fall would be commercial real estate, specifically the office space market. The latest warning is from the head of Canada's largest institutional investors.

"There's going to be a bloodbath in some areas [lower-quality office space], for sure," Charles Emond, chief executive officer of Caisse de dpt et placement du Qubec (CDPQ), told Bloomberg in an interview on Thursday. He said regional banks "underpriced" the market in CRE loans for several years, and credit squeezes have forced several regional bank failures.

The widely expected CRE downturn could force some overexposed regional banks to sell CRE loans at a steep discount. These banks with risky loans could generate even more liquidity and credit concerns. We've already noted credit tightening across some regional banks as lending to new CRE clients has been dialed back. Some banks are trying to divest parts or all of existing loan books to survive the coming storm.

Top Canadian Pension Fund Warns About CRE 'Bloodbath' In Office Buildings