Support for Netcoins ETH staking: "ETH staked within the Ethereum blockchain is set to surpass the quantity held on crypto exchanges for the first time ever in the coming weeks."...

Ethereum’s Staked ETH Set to Exceed Exchange Holdings, Reflecting Growing Confidence in Decentralization

Updated: The Ethereum ecosystem is on the verge of a significant turning point, although it differs from the anticipated flippening between Ethereum (ETH) and Bitcoin (BTC) in terms of market capitalization.

Instead, the amount of ETH staked within the Ethereum blockchain is set to surpass the quantity held on crypto exchanges for the first time ever in the coming weeks.

Ethereum Nears Milestone as Staked ETH Nears Exchange Holdings

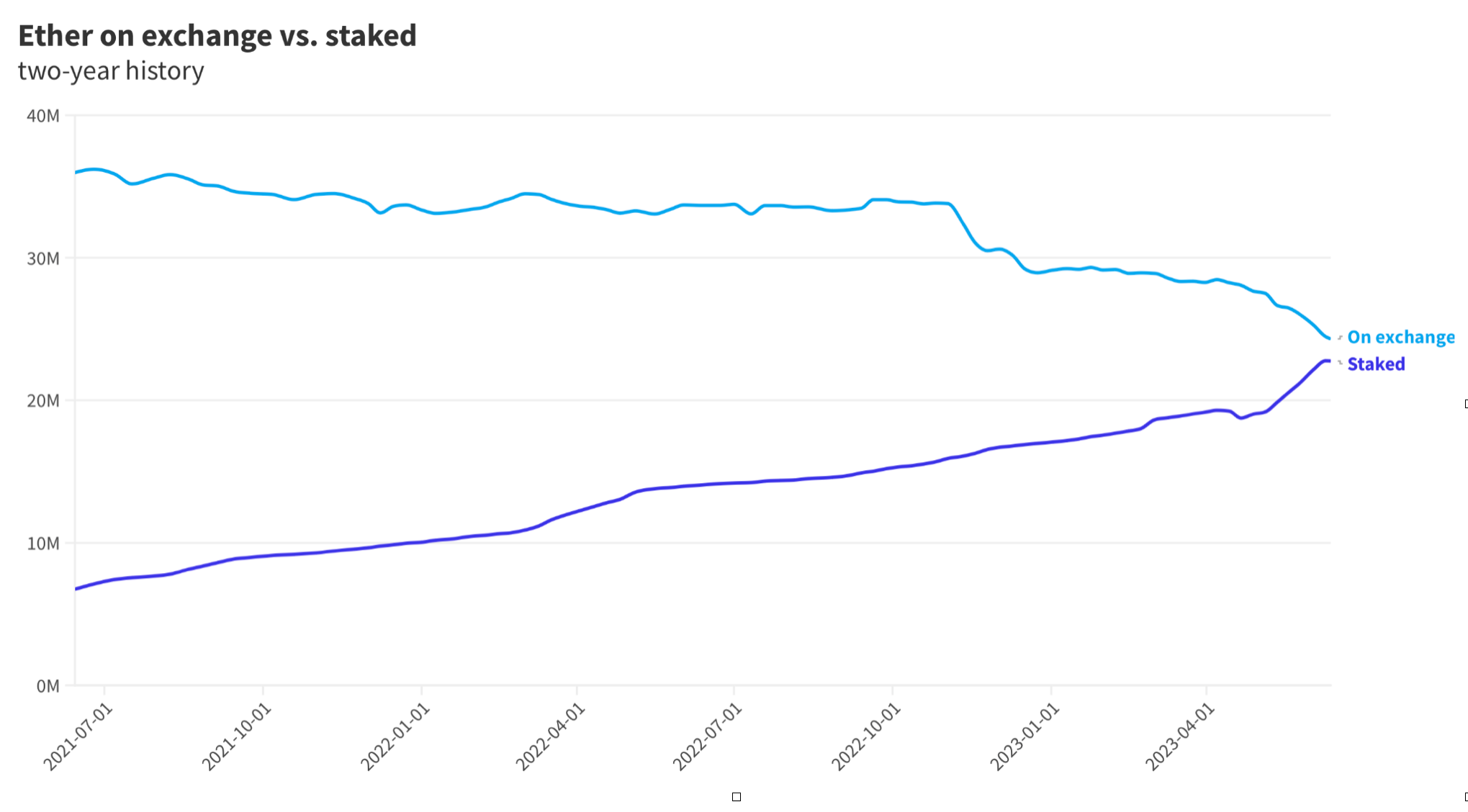

According to data from Nansen analyzed by Blockworks, as of this week, there were 22.8 million ETH ($39.75 billion) completely staked, while almost 24.3 million ETH ($42.38 billion) remained on exchanges. These figures represent approximately 20% of the circulating supply of ETH.

The difference between ETH on crypto exchanges and staked amounts to only 6.12%, a significant decline compared to previous numbers.

In contrast, at the end of May, the difference between ETH on exchanges and staked was nearly 16%, while at the beginning of the year, it exceeded 41%. This indicates a notable shift in the distribution of ETH, with a reduction of 4.9 million ETH ($8 billion) on exchanges and an increase of 5.7 million ETH ($9.4 billion) locked in the Ethereum blockchain since the start of the year, representing a one-third jump.

These statistics suggest that the ongoing criticism and scrutiny from the Securities and Exchange Commission (SEC) have influenced Ethereum users to stake their ether rather than hold it on exchanges. By staking their tokens, users participate in the network’s consensus and earn a yield, either by running validator nodes or utilizing services such as Lido.

Although some crypto exchanges offer staking-as-a-service products, these are generally considered unregistered securities by the SEC. Currently, Ethereum staking yield stands at approximately 6%.

Interestingly, during the FTX scandal last November, crypto investors withdrew a considerable amount of ether from exchanges, averaging nearly 130,500 ETH ($227.1 million) per day.

Although net outflows temporarily exceeded 200,000 ETH ($348.3 million) on June 5, coinciding with the SEC’s lawsuits against Binance and Coinbase, these outflows have since decreased. However, the exact amount of ETH withdrawn from exchanges that ended up being staked in Ethereum remains unknown.

Catalysts That May Accelerate the Flippening

Despite uncertainties, it appears that the decentralized blockchain architecture is highly favoured, emphasizing its advantages over centralized platforms that are vulnerable to regulatory pressure. This sentiment is reflected in the significant inflows of staked ETH, particularly after the activation of withdrawals following the Shapella upgrade in April.

Moreover, events such as Kraken discontinuing its staking-as-a-service program due to SEC threats and Coinbase’s Wells notice regarding similar services have further solidified the preference for decentralized technology.

The growing margin between ETH staked and ETH held on exchanges indicates a strong appreciation for the benefits of decentralized technology. In less than two weeks, the gap between staked and exchange-held ETH has decreased from over 16% to 6%.

This trend underscores the enduring value that crypto users place on decentralized principles, such as maintaining control over their assets (“Not your keys”) while still benefiting from yield opportunities.

If this trend continues, the flippening where staked ETH surpasses ETH on exchanges will likely occur by the end of this month.

EigenLayer Implements Staking Protocol on Ethereum Mainnet, Enhancing Flexibility and Yield Opportunities

EigenLayer, a DeFi platform based in Seattle, has recently implemented its staking protocol on the Ethereum mainnet. This move comes in the wake of the Shapella Upgrade that took place in April 2023, facilitating the un-staking of Ether. With this upgrade, individuals who had staked 32 ETH to become validators can now earn rewards from their staking activities.

EigenLayer now supports liquid staking tokens such as Rocket Pool ETH (rETH), Lido stETH (stETH), and Coinbase Wrapped Staked ETH (cbETH).

The DeFi protocol has established specific guidelines for liquid and native staking. Liquid staking permits a maximum of 3,200 tokens for re-staking, while up to 32 tokens can be deposited per address. However, native re-staking is temporarily on hold, restricted to a limit of 9,600 ETH.

The Ethereum Shapella Upgrade, implemented on April 12, 2023, allowed for the un-staking of 4.4 million ETH. Contrary to concerns, stakers preferred to earn passive income through staking rather than withdrawing their stake, aligning with the upgrade’s objectives.

The trend is expected to grow, as over 50,000 individuals express interest in becoming validators. The current annualized yield for staking ETH ranges from 4% to 5%, enticing ETH owners to enjoy the benefits of staking.

Previously, stakers faced the challenge of locked coins without accessing any yield, resulting in losses during price drops. The upgrade allows for flexibility in withdrawing staked ETH, stimulating deposits to exceed withdrawals for the first time. Additionally, it will provide investors with an alternative income source, beyond relying solely on holding ETH.

https://insidebitcoins.com/news/ethereums-staked-eth-set-to-exceed-exchange-holdings-reflecting-growing-confidence-in-decentralization