Dawid S Swierczek

Bombardier Inc. (OTCQX:BDRBF) continues to impress with consistent profit, sales and delivery growth, not letting deliveries slip out of quarter. There was even weakness in Q1 due to the banking scare, which killed some of the most active weeks for the company, but they still saw the order book remain flat YoY. Margin performance is exemplary because of mix effects, and while that might be a little extraordinary, the backlog is high quality and the secular demand effects started by COVID-19 actually seem to be sticking for the private aviation industry. The S/D dynamics remain great in private aviation, and there isn't too much reason to worry about Bombardier failing to meet targets. Finally, they are grabbing at a defense opportunity, the same way Dassault Aviation (OTCPK:DUAVF) has for some years with their Falcon series. It's always good to have more markets for your products.

Q1 Key Comments

Let's begin on some of the secular forces. Management reports in their Q1 call that fleet operators who picked up capacity during COVID-19 are still running at almost max utilization, and it seems that preference for private aviation over business class has somewhat stuck, even if worry around COVID-19 is a lot less now than it was.

Other positives are comments on the quality of the backlog. While there haven't been any pronounced changes in mix, there hasn't been enough supply for speculative activity to take hold of the backlog, as there was in 2008. This means their backlog is more defensible in a downturn since it will be less exposed to cancellation risk. Backlog remains flat even though the regional banking crisis spooked demand for private jets for a couple of key weeks in March, which sadly is where things typically start to pick up for the Bombardier jet business.

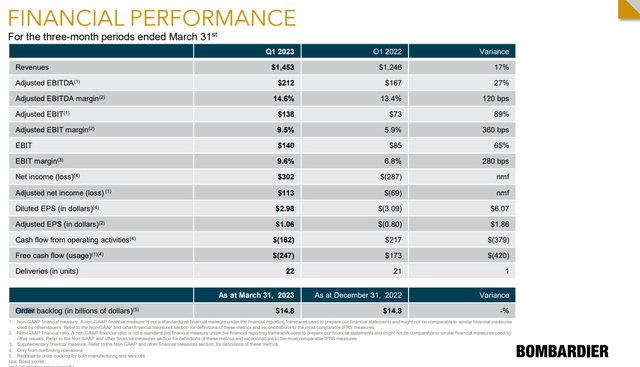

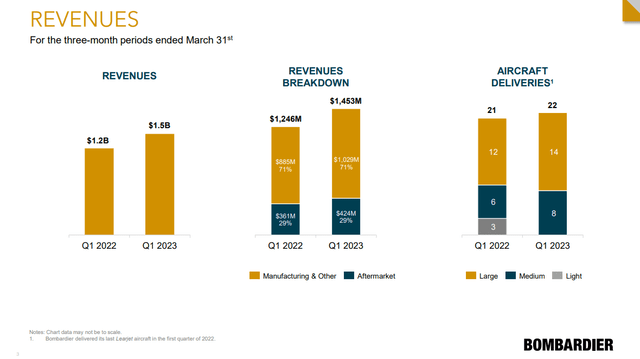

Highlights (Q1 2023 Pres)

Supply chain issues have been something of a problem for private jet businesses to fully exploit the opportunity in markets created by COVID-19 and a structural shift away from commercial aviation. However, Bombardier had been an over-performer in terms of liquidating their order book. Deliveries are continuing to climb YoY, and the shift is into their larger platforms, which also contain some of their newer platforms that are achieving better scale and are capping off the returns from learning economies, too, helping with the margin lift. While supply chain management and achieving scale have been critical for Bombardier to grow their income into positive territory, ahead of leverage effects, aftermarket overperformance has been important, too.

Aftermarket (Q1 2023 Pres)

As always, aftermarket contribution is higher than on straight deliveries, so strength in the mix despite the order and delivery pickup after the depths of the supply chain issues in Q1 2022 is extraordinary. Fleets continue to age and the circulation of used jets is historically low with 5% second-hand inventory where 10-15% is the historical average, signaling that S/D dynamics are very much in the favor of private jet makers right now. Older fleets also mean more frequent aftermarket activity.

Cash flow from operating activities took a hit, but this is because Bombardier expects a blockbuster year consistent with their strong, almost 20% revenue growth achieved in an otherwise quite beleaguered quarter. The inventory buildup hurt operating cash flows.

Bombardier is also making a foray into defense with their jets, which is what Dassault had done with their own private jet platforms in the Falcon series. This is a new market, and if Dassault can do it, so can Bombardier. It is always good to have a more market agnostic representation in the backlog, and launching this program will achieve that to defend themselves in future downturns.

Bombardier continues to deleverage rapidly with a new credit rating improvement to B2. They retired about 10% of their overall debt in Q1 alone with cash on hand, since their operations weren't cash flow generative yet, and they have $1.4 billion in liquidity. On a run-rate basis, they have the cash flow to retire about 10-15% debt annually while not sacrificing business investment. Thanks to the on-hand liquidity, they have agency to restructure their maturity profile if necessary. Overall, the debt issue is less concerning now.

Bottom Line

The second-hand market and general rationality in supply brought on by persistent supply chain pressures make this whole industry pretty defensible from a macroeconomic downturn. The backlog is higher than historical levels, and they enter into a more concerning economic environment with important resources to sustain their business performance. They have no plans to launch any major new platforms, and the only new foray is into defense which is a relatively low-hanging fruit.

From a valuation perspective and considering seasonality, Bombardier Inc. should be able to achieve around $1 billion in EBITDA in 2023. That would put their multiple at around 8.5x EV/EBITDA, which is not that high considering the industry structure and earnings direction. S/D dynamics are good enough to confidently expect further growth even if we have the recession that we expect. With a favorable deleveraging effect, we'd actually be pretty excited about Bombardier right now.