bjdlzx

(Note: Baytex Energy is a Canadian oil company that reports in Canadian dollars unless otherwise noted.)

When I first began covering Baytex Energy Corp. (NYSE:BTE) it was a heavy oil producer that had just made a big acquisition of Eagle Ford acreage before the big oil price decline in 2015. This was back in 2014 with the acquisition of Aurora that is listed in the third quarter Sedar financial statements. The timing could not have been worse for the debt financing chosen. Management spent the better part of the next decade trying to repay that debt with heavy oil production when low prices practically eliminated cash flow for several years.

The Raging River acquisition was an all-share deal, because Raging River was a low-debt all light oil producer, that gave the combined company some breathing room to repay debt at a decent clip. That light oil production did not suffer from expanding discounts from posted prices as did the heavy oil.

Now, management has a new very profitable discovery with the Clearwater Play. But even with that low breakeven point, there is still the danger that in a downturn, the heavy oil discount would expand to result in the need to shut-in production to preserve cash flow. However, there needs to be cash flow to preserve first. That is obviously going to be the light oil production.

Ranger Oil Acquisition

That makes the announcement of the Ranger Oil Corporation (ROCC) acquisition extremely important because the Eagle Ford is one of the lowest cost basins in North America. The light oil production will allow for more exploitation of the extremely low-cost Clearwater Play.

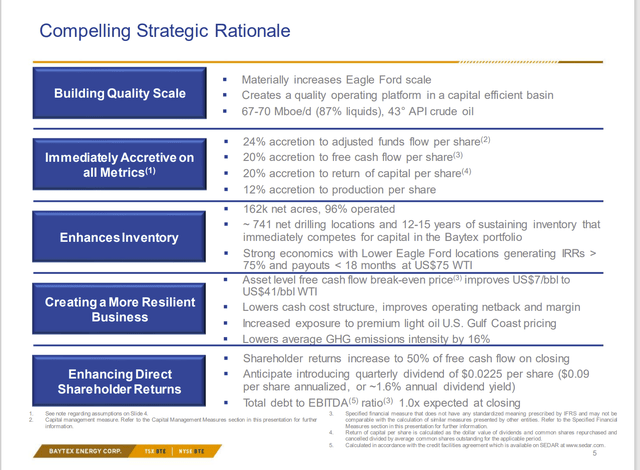

Baytex Energy Ranger Oil Acquisition Summary (Baytex Energy Ranger Oil Acquisition Presentation)

Obviously, management learned some lessons from the Aurora acquisition. This proposal is a mix of shares and cash. It is not going to hobble the company with debt in a way that the next cyclical downturn would be threatening. The very low visibility of the industry combined with the banking situation calls for a strong balance sheet so that there is access to a number of debt routes "just in case."

But a side issue is that this cash flow is more dependable in a downturn, as light oil is a relatively premium product for the company. That allows for development of the Clearwater play, which is extremely profitable EXCEPT when oil prices decline to increase the risk of the heavy oil discount widening.

Long-time readers may remember that Marathon operates the current Baytex Energy Eagle Ford properties. That means that Baytex does not control the development pace of its most profitable asset that usually produces the most cash flow. Gaining control of Ranger Oil is likely to change that market calculation because now Baytex will operate (and hence control the development) of most of its Eagle Ford holdings. That should result in a better market valuation of the company.

Clearwater Play

This play has some amazing breakeven costs. That is especially true when one considers that heavy oil is a discounted product. Therefore, the breakeven assumes a discount that results in a lower realized price for a given WTI price.

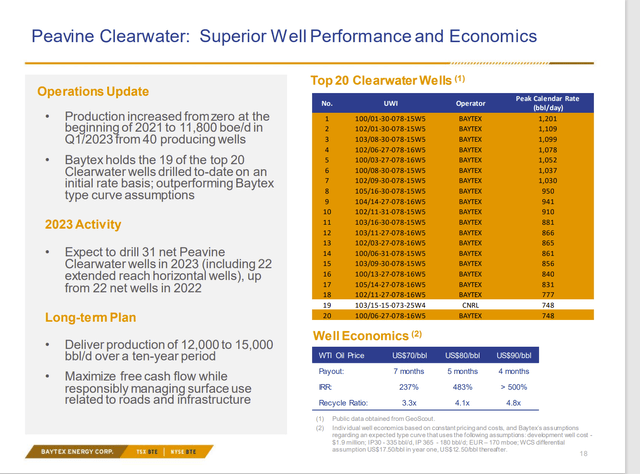

Baytex Energy Presentation Of Clearwater Profitability Characteristics And Well Performance Results (Baytex Energy First Quarter 2023, Earnings Conference Call Slides)

(Note: this one may take time to find as the latest June Presentation focuses upon the newly combined company. Therefore, this slide may or may not be on the website if you go looking for it as the company does take older presentations down.)

Now, the first issue to note is that management for a long time gave 12,000 BOED as kind of a "firm" upper limit. What is noted in the slide above is that upper limit is now becoming a little more flexible. That would be perfectly logical with the Ranger Oil acquisition.

The returns shown above make this the most profitable set of leases in the company portfolio by far. If this was light oil, nothing else in the portfolio would compete for capital. But with heavy oil, some care is needed to make sure there is cash flow in a cyclical downturn.

Therefore, these leases are likely to grow at the expense of legacy heavy oil production (although there may be some heavy oil production on legacy acreage that competes with the returns above as technology continues to advance).

Free Cash Flow Calculation

Free cash flow is rarely a number that can be compared without adjusting company to company for calculation differences. Nonetheless, there is certainly a big chunk of the market that "runs with the numbers" without taking care to make sure they are comparable in the first place. That can cause some investors some real headaches.

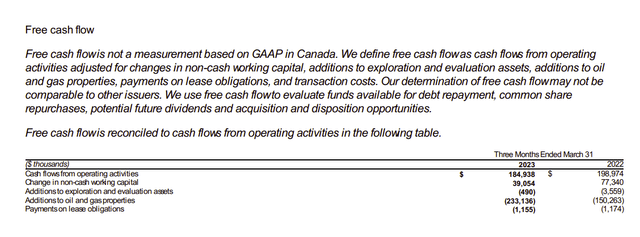

Baytex Energy Definition And Calculation Of Free Cash Flow (Baytex Energy First Quarter 2023, Earnings Press Release)

Baytex Energy has a very conservative definition in that the company includes all additions to properties as part of free cash flow. Therefore, if the company decides to grow production (and management did report first quarter production growth), then that comes out of free cash flow.

On the other hand, not everyone includes changes in working capital. In fact, some managements are very inconsistent about this in that one quarter they report it when it is to their advantage and then the next quarter, they change the definition and omit it. After all, it is non-GAAP, so those managements take full advantage of that. Clearly, Baytex Energy management is including it every time.

However, it should be noted that working capital did use cash and therefore management may have had to borrow more money than the free cash flow calculation would indicate.

Canadian companies have to work around the annual Spring Break-Up. Therefore, it is not unusual for companies to have negative cash flow in the fourth and first quarters when the majority of activity is accomplished. These managements know they cannot do much during Spring Breakup and will therefore likely run a cash flow surplus in the second quarter and maybe the third quarter as well. It all depends upon the weather.

The Future

Baytex Energy is acquiring more United States business. Note that the acquisition completed within the last few days. That acquired business will be totally in some very low-cost Eagle Ford acreage. The acquisition is very likely to lower the corporate breakeven cost significantly from the start.

More importantly, this is a company with a fair amount of United States dollar-denominated debt. It is very likely that the Unites States based Eagle Ford leases production can handle that debt. So, in real terms, regardless of the accounting gains and losses, the debt can be paid with United States dollars to result in no gains or losses for practical purposes. Note that this may not be the case when operations are combined to report in Canadian dollars.

More importantly, the Eagle Ford acquisition allows for operations in Clearwater to expand while maintaining some premium product cash flow just in case the heavy oil discount expands during a cyclical downturn. Now management will be free to shut-in heavy oil production while still servicing the debt if that is needed.

But Canadian companies also usually trade at a discount to their United States competitors. That may not be the case for a company like Baytex with material United States operations. The Eagle Ford operations are now the majority of total company production. Even better, most of the Eagle Ford operations are now operated by the company. So, this acquisition brought about a major change that could change the market valuation of the company. Chances are very good that after the acquisition, more than half the operating income will come from United States operations. That is very likely to result in more visibility for this NYSE listed company.

A higher valuation from the Clearwater growing production and the growing Eagle Ford production will likely be the result. This undervalued company is very likely a strong buy consideration. Baytex Energy Corp. is now very different from the solely heavy oil producer that acquired Aurora about 10 years or so ago. It will take time for the market to realize that. But sooner or later the market likely will revalue Baytex Energy Corp. higher.