RE:Nothing to see here... but endless headwinds Obscure1, I have totally different figures than you regarding global current energy makeup.

I suggest you vet your sources. Many anti oil media spew false and misleading information with a hidden narrative and agenda, and it needs to be verified.

I see now why you are led to believe that EVs will displace all the ICE vehicles in a couple of years, and the idea that we will successfully complete a global energy transition in very short order.

I agree that EV use will grow globally, but it will not grow faster than increases in global oil demand for many years.

The EV and renewable pendulum has swung traditional energy investment so far off track, that when reality kicks in like it has with ESG, I think the over hyped movement will be a very big tailwind to oil, and not a headwind.

Now consider this very interesting fact that puts thing into perspective:

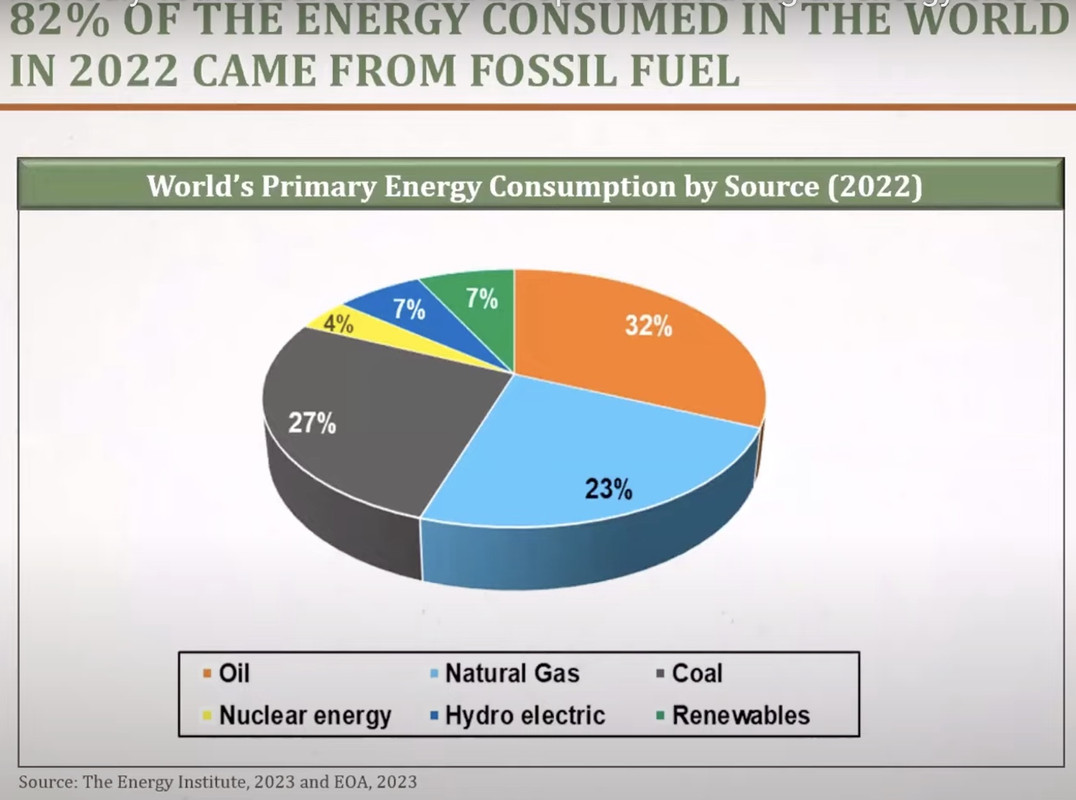

Since 2010, there has been 4 TRILLION dollars spent on renewable energy till today. So just what did that achieve? In 2010 the renewable portion of the global energy mix started at 3.5%. It has now climbed up to 7%. 4 Trillion Dollars for a meager 3.5% increase in the renewable portion of the energy mix?

One must realize that during this time, total energy demand has increased far more than the additions of renewables. Look at any chart to see we use more fossil fuels now than we ever did in 2010; coal, nat gas, and oil. This path we are on of ever increasing demand is still continuing today, albeit the growth rate will be slowed slightly due to EVs and renewables increasing their percentages in the overall mix.

Here's just a small sample of some 2022 energy figures from EOA and The Energy Institute which give a totally opposite picture to your figures, showing the most recent energy and electrical makeup:

Obscure1 wrote: A Cox survey found that

51% of consumers are now considering either a new or used EV, up from 38% in 2021. China contributed the largest share of last year's increase in renewables, adding as much as roughly 180 GW -- an annual total that exceeds Japan's entire installed capacity. Non-fossil fuel power sources, such as wind and solar power, account for 50.9% of the country's total installed capacity, marking the early completion of a government target proposed in 2021, under which renewable capacity was planned to exceed fossil fuel capacity by 2025..........looks like 2 1/2 years ahead of schedule to me The report finds that renewables are set to account for over 90% of global electricity expansion over the next five years, overtaking coal to become the largest source of global electricity by early 2025.Dec 6, 2022

I can keep going and going as the evidence builds day by day, week by week.

If it helps you sleep at night, keep telling yourself that oil demand is going to keep growing and oil prices are heading higher. You will be right at some point as the paper pushers will inevitably manipulate the market like they always do. The manipulation will deliver results similar to "a broken clock is right twice a day" kind of way. You might want to throw in a dash of hope that Trudeau or Biden will change their policies on renewables as they suddenly wake up and say it was all a bad dream.

Who knows, maybe the Liberals or Dems will lose the next election. Maybe companies will change their minds on capital spending with new political parties in power. But, will they?

The transition makes too much sense on both an economic and self-reliance basis to stop the inevitable.

Does that mean that the world will stop using oil? Absolutely not. More than 50 countries have restricted or banned the use of asbestos since the early 1970s (which means that 145 countries have not banned asbestos). Others continue to mine and consume the toxic mineral in alarming quantities. The popularity of asbestos is currently rising in developing nations.

There are still 1.3 billion smokers in the world including 36.7% of all men and 7.8% of the world's women.

I'm a "follow the money" investor. That means that I'm more interested in making money rather than focusing on ESG investments. However, the two don't have to be mutually exclusive.

Right now, qualified citizens (income under $58,000) in California can buy a brand new Tesla 3 for about $22,000 while everyone can but the same car in Colorado for $24,000. That is the same price range as a Toyota Corolla which is a massively inferior car. When you factor in the cost savings of fuel and maintenance, there is no comparison.

The Tesla deal is short term as Tesla is blowing out their Model 3 inventory to prepare for their new Highland which is expected to be more expensive than the Model 3. However, one of the Mexican politicians blabbed yesterday that all of the permits for Tesla Mexico plant are ready to go. That means Tesla will likely be pumping out huge numbers of its Generation 3 cars for $25,000 before the IRA tax incentive ($7,500) plus any State incentives by early 2025.

You can choose to believe that gas powered vehicles (Ford's average sale for Q1 was over $51,000 per vehicle) will continue to thrive going forward if it makes you happy. You may keep buying ICE vehicles in the future, but you will be in the minority before long. Who is Suncor going to sell their bitumen or SCO to? Please don't say it will be the USA or Canada or China.

Maybe Suncor can transform its 4 refineries to chemical plants??? Nope!

Maybe Suncor can sell its PetroCan stations??? Nope! Been there, tried that!

Maybe Suncor can convince Ottawa to .... Nope!

I don't care if you sell Suncor shares or buy more. I'm just offering a look into the future without blinders.