This post documents some of my research on index front running. This trading strategy is simply buying stocks before they are added to indexes that passively managed funds are designed to track.

I initially came across this idea through a Bloomberg article, The Hugely Profitable, Wholly Legal Way to Game the Stock Market. The article made it seem like this is easy money, so I decided to do some analysis into the profitability of this trading strategy.

How Does This Strategy Work?

The principle behind why this strategy works is order anticipation. Order anticipation allows a trader to profit by correctly anticipating what other traders will do and how they will effect prices.

More and more capital is being invested in passively managed funds which are designed to track an underlying index. In fact, in every year since 2006, passively managed funds have gained market share from actively managed funds as investors have been drawn to their low fee structure and good absolute return. All indications suggest this trend will continue.

Passively managed funds aim to minimize tracking error which is the difference between the fund's return and the underlying index's return. This compels passively managed funds to respond rapidly to changes in index constituents by buying additions and selling deletions.

Changes to index constituents are usually announced one to five days in advance. This poses a problem to fund managers. In order to minimize tracking error, fund managers should purchase the security right when it's added to the index. Usually securities are added to an index after the market has closed, so this means fund managers should purchase at the close of trading on the day of the addition.

But if everyone knows that all the passively managed funds are compelled to buy at a predictable time, then order anticipators will buy in advance and you have a profitable trading opportunity. This increases the price impact of the fund's purchases and therefore increases the trading costs that they incur. So passively managed funds are in a dilemma because they need to minimize tracking error but at the same time not incur too much in trading costs.

What Does the Data Show?

For this analysis, I examined all the announced changes to the S&P 500 Index from 2014 to present. More capital passively tracks this index than any other index, so the impact of passively managed funds should be large for stocks before they are added to the S&P 500.

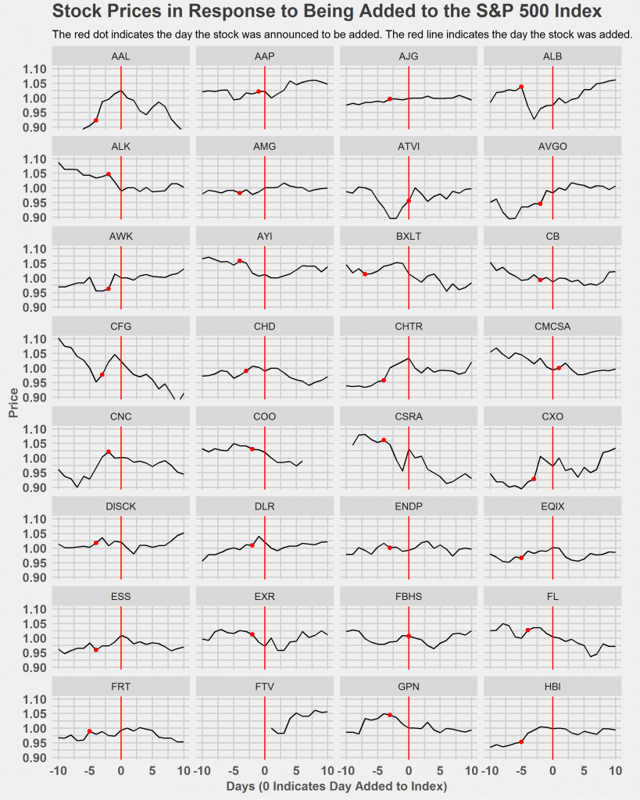

From 2014 to present, I gathered 61 additions. Below I plot how the stocks reacted. A red line indicates day 0 which is the day right before they were added to the index. Stocks are added to the S&P 500 at the close of trading on day 0 and begin trading the subsequent day.

Although the pattern is far from consistent, there is evidence that stock prices rise after the announcement day through day 0 and subsequently decline after being included in the index. AAL is an example of this pattern (the first stock in the plot below).

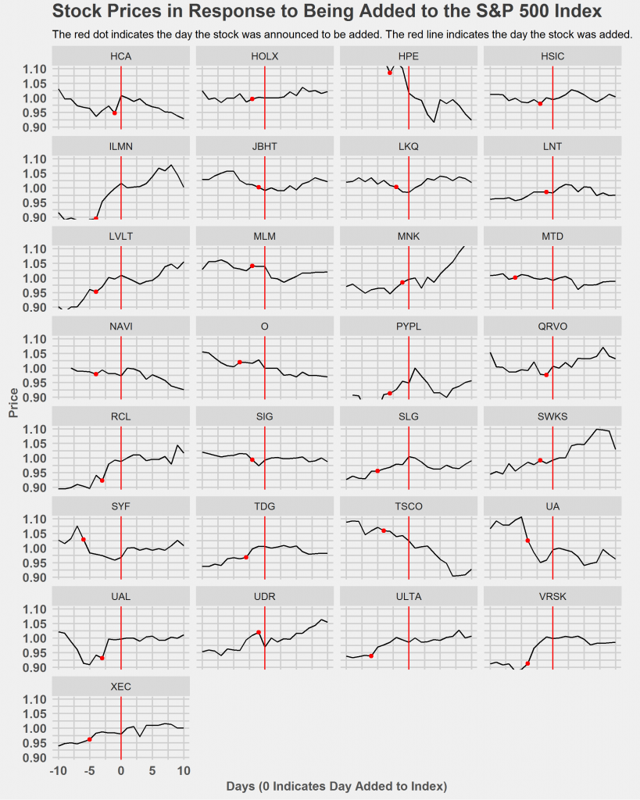

Below is the second set of stocks. I separated the stocks into two separate plots to make the visualization easier.

Here are all all 61 stocks averaged together. On average, stock prices rise in anticipation of the stock being added to the index, then falls after it becomes part of the index. This result is consistent with previous studies on this topic, although it appears that the price impact was much stronger in the past.

Why is This Strategy Still Profitable?

This phenomenon has been well studied in the past. Given how well known this is, why does this profitable trading opportunity still exist?

First, there is evidence that the impact of being added to the index is weaker than it once was. Some of the literature that I reviewed indicated abnormal returns of something like 7% from days -10 to 0 while my analysis shows a meager 1%.

Second, fund managers are well aware of index front running and some have changed their behavior to compensate. Some accumulate slowly well before or after the stock has joined the index to lower their trading costs at the expense of higher tracking error.

Still, looking at volume and intraday price data, there are still a great deal of fund managers who buy in the few minutes immediately prior to the stock being added. Their rationale is to minimize tracking error and just deliver the index return regardless of high trading costs. For some stocks, the volume on this day can be 50 times greater than average and enough capital passively tracks the S&P 500 that fund managers need to purchase something like 10% of a stock's market capitalization in just a few minutes.

The fact that fund managers are able to do this with just modest slippage means that informed traders have become well coordinated in supplying liquidity in those crucial few minutes. Informed traders have already accumulated the stock long before the stock has been added and are able to profit by supplying liquidity to these fund managers.

Third, it seems like it's difficult to profit by buying the stock immediately after the announcement. Announcements for the S&P 500 are made after the market close, and the stock price predictably increases sharply in after hours trading in response to an announcement that the stock will be added. Unless you have a low latency algorithm, it is difficult to trade this profitably because the immediate after hours movement comprises the majority of the increase in the price prior to being added to the index.

My Recommendation on How to Implement This Strategy

Given how difficult it is to profit from days -10 to 0 without a low latency algorithm, my recommendation is to short the stock at the close of day 0. This is the moment when the price impact of fund managers is the greatest, since they are all trying to buy immediately prior to the stock joining the index.

Once this artificial buying pressure goes away, the data shows that there is on average a roughly 0.8% decline in the stock price by day +4, so I recommend to close the short on day +4.

My numbers actually show that is slightly more profitable to short on day +1 and close on day +4 but shorting at the close of day 0 aligns better with the underlying theory and principles regarding why this strategy works.

Historically, around 20 such opportunities exist per year which translates into an annualized return of around 17%. Repeat this strategy on multiple indexes and this could potentially be a lucrative trading strategy.

An alternative is to build a machine learning model to predict which stocks will be added to the S&P 500. Purchase the 30 or so most likely stocks and short an equal amount of the S&P 500 to be market neutral. Sell the stocks immediately prior to the stock joining the index.