Olemedia

Frontier Lithium Inc. (OTCQX:LITOF) recently issued its Prefeasibility Study (“PFS”), and the document made for some interesting reading. Similar to Frontier’s Preliminary Economic Assessment (“PEA”), issued in early 2021, the PFS utilizes a phased development approach. Phase 1 of the project will see the construction of a mine and mill that will produce spodumene concentrate while the second phase of the project will add a downstream refinery to produce lithium chemicals.

The company’s upstream-to-midstream plans outlined in the PFS saw no material changes from those described in the PEA. However, when digging into the details of the study, one can see a number of adjustments impacting the overall valuation of the project. In this article, we'll review the company’s PFS and discuss its possible effect on the long-term prospects of Frontier’s stock price.

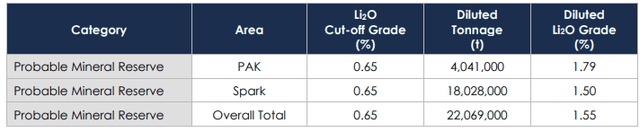

PAK and Spark Deposit

Frontier’s primary asset is its 100%-owned PAK Lithium Property located in the northwestern part of the Canadian province of Ontario. The sizeable landholding covers an area of 27k hectares, or about 67k acres, and is home to Frontier’s PAK and Spark deposits, the future sites of the planned open pit mine discussed in the company’s PFS. The Mineral Reserve Estimate for the Pak and Spark Project is 22.1Mt (Probable) grading at 1.55% Li2O.

Frontier Lithium PFS

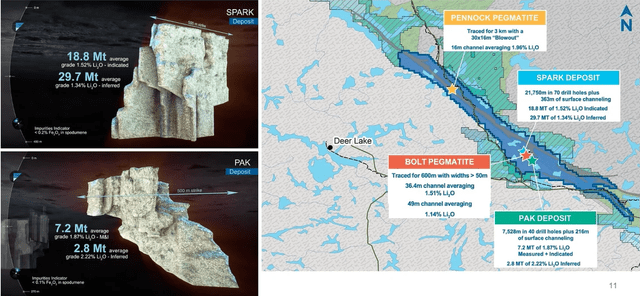

Given the size of the landholding though, it should be noted that Frontier still has plenty of room for exploration leading to the possible discovery of new deposits. Two areas often bandied about by the company are the Pennock and Bolt pegmatites where Frontier has completed some preliminary exploratory work from which it has derived some encouraging results.

Investor Presentation

It's also quite obvious that the infrastructure currently being developed to service the Pak and Spark projects would also be used in the development of any subsequent deposits, greatly reducing the developmental lead times for those secondary projects. That infrastructure includes a power line project that is currently under construction and is fully funded by the government as well as an all-season road which is currently at the scoping study phase.

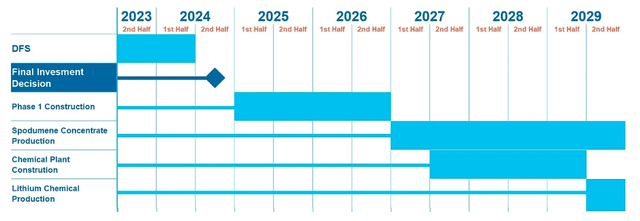

However, it should also be noted that production from any additional deposits, assuming some are eventually found, is probably many, many years away. And given the ambition of Frontier’s current plans outlined in the PFS, it’s probably safe to assume that for the foreseeable future management’s focus will be on shepherding current projects to completion. What that means is that the stock price will probably be heavily influenced by the company's ability to stick to the following schedule.

Investor Presentation

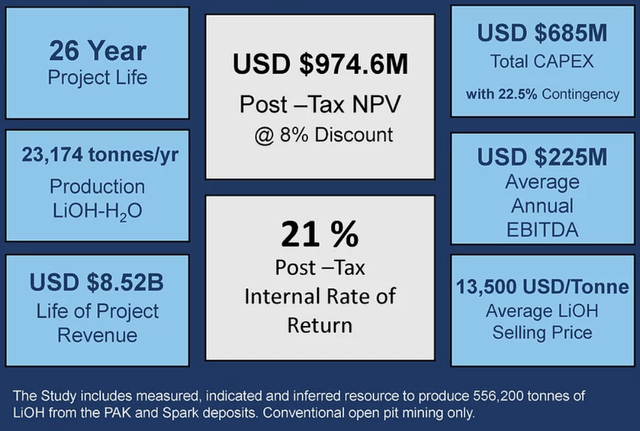

Prefeasibility Study

Frontier’s PFS, which was published only a couple of weeks ago, largely reiterates the plans that were originally outlined in the PEA. The project is for a fully-integrated lithium operation utilizing spodumene concentrate from the PAK mine to be converted at a downstream conversion facility also owned by the company. Frontier anticipates producing both technical grade concentrate required by premium glass makers as well as chemical grade concentrate to be used as feedstock in the planned refinery. This is the company's plan in broad strokes, and none of that has changed.

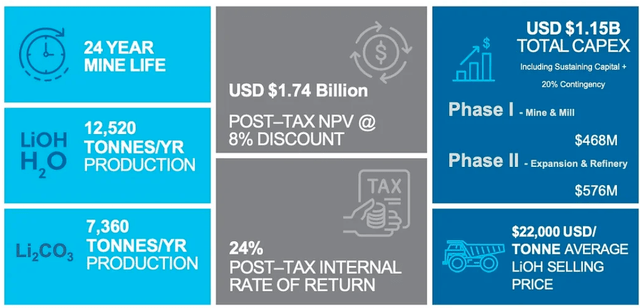

However, there are a number of adjustments made in the PFS that resulted in noticeable changes to the project NPV and IRR. Below are summaries of the PEA and PFS projections.

Frontier Lithium PEA (2021) (Investor Presentation)

Frontier Lithium PFS (2023) (Investor Presentation)

As can be seen above, the PFS’ after-tax IRR increased by several percentage points, going from 21% all the way up to 24%. That's a notable increase, but most readers probably took greater notice of the change in NPV which jumped from the PEA’s figure of ~$975 million to the PFS’ $1.7 billion. Now that is a considerable change.

The reasons for this significant adjustment are twofold. Firstly, as most readers are probably well aware, inflation rates have risen sharply since Frontier’s PEA was drawn up almost three years ago and this is reflected in the substantial increase to projected CapEx costs. The $685 million original CapEx projection did seem to be on the low side, and this upward revision to the $1.2 billion range does seem to be more in line with a project of this size and complexity.

The other major revision was to the assumed average hydroxide sales price which was adjusted from $13.5k/t to $22k/t. That's quite an increase and it does reflect the higher hydroxide and carbonate prices that have prevailed in the market for most of the period since publication of the PEA.

However, those same prices did experience a significant downtrend during the first half of the year but have since leveled off. The underlying fundamentals of the industry, that being growing demand from rising EV sales, remain solid and should continue to help support lithium demand.

Risks

In addition to the operational risk that comes from investing in any developmental stage mining company, risks discussed in previous articles about Frontier Lithium, there is also the price risk of the underlying commodity. As mentioned, lithium prices have recently been subject to a sharp correction and if that downward trend were to resume and prices were to remain at low levels for an extended period of time, it could lead to a substantial negative impact to project economics.

Takeaway

The upward revisions to Frontier’s IRR and NPV serve to remind investors of how much potential this project has. The company’s large landholdings also have potential for further discoveries and possible project expansion once this phase of development is brought to production. Granted, lithium prices have recently pulled back from last year’s highs, but Frontier’s project still remains one of the premiere development-stage hard-rock lithium plays in North America.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.