Dilok Klaisataporn

The following segment was excerpted from this fund letter.

TUCOWS (NASDAQ:TCX)

| Company | Tucows Inc. |

| CN Ticker | TC |

| US Ticker | TCX |

| TCX Stock Price | 23.12 |

| Market Cap | 249.7M USD |

| Enterprise Value | 754.7M |

| 52 Week High | 61.40 |

| 52 Week Low | 16.03 |

Tucows is a Toronto based company that has been providing internet related services since 1993. They started as a simple shareware site and now have grown into a 3 business line technology utility company. The services they offer are crucial to operating a business and living in the 21st century, which leads to recession resistant revenues and a long runway for growth.

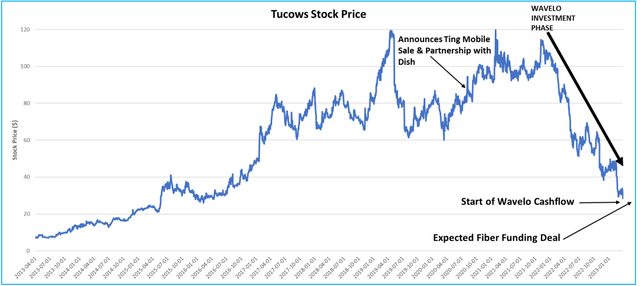

Tucows is a company we have a lot of history with. We were investors in the business for years and the stock did well. In 2020, they sold one of their business lines and began a complicated investment cycle. They began investing in two separate growth businesses and the debt on the balance sheet began to mount. We sold our position from September to December 2021 at around $100/share. The stock has now dropped to below $30/share. We have now begun to invest in the business once again because we believe all the major issues causing the decline have recently been or are about to be resolved. We now believe the business is as strong as ever and some upcoming catalysts will prove this point. We have met with Elliot Noss, the CEO, many times over the years. He is a capital allocator, a genuine straight-shooter, and someone we have referenced as an “Outsider CEO” in the past. We have full faith in Elliot’s long-term strategy.

Figure 1 - Tucows Stock Chart

Last year they restructured their business into three separate business units and now Tucows operates as the holding company. They have separated their company into 3 separate units. Think of it as a 21st century utility company. They provide the backbone and services necessary for internet, websites, and mobile.

Figure 2 - Tucows Segments

We believe the business is the strongest it has ever been. The recent stock price performance suggests otherwise. What’s the disconnect?

- For the last couple years, the company was investing in two growth companies that required a lot of capital. This stressed the balance sheet.

- Without a strong view on how Ting fiber gets funded going forward, the business is fairly uninvestable.

- The recent reported quarters have been messy because they sold a business line making year over year comparisons difficult.

- Their reported earnings are understated because their upfront investment being put into fiber masks the long-term value being created.

We believe all four of these concerns have been answered in 2023.

- Wavelo goes from investment phase to cashflow phase in 2023.

- A funding deal with an infrastructure fund is imminent which solves the balance sheet issue by shifting from using internal capital to using external funds.

- All three business lines should grow in 2023.

- The infrastructure funding details should clear the air and establish a baseline for how much the fiber business is really worth.

DOMAINS

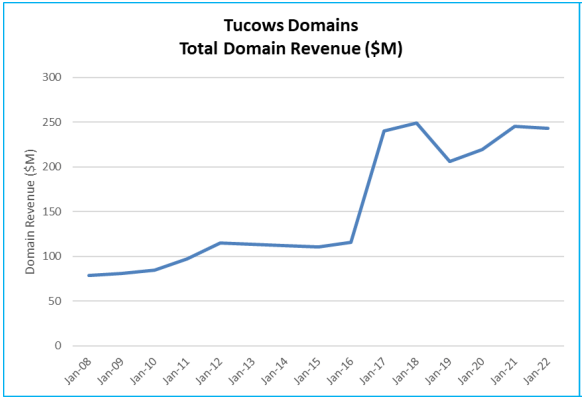

Tucows Domains is the largest domain name wholesaler in the world and the second largest domain name registrar in the world behind GoDaddy. It is a mature business, having been around since 1999 with a reseller network of over 35,000 companies and renewal rates well above the industry average.The Domains business has been a cash cow for the company for many years. That being said, they just completed a year’s long integration of multiple platforms, and they are moving back to modest growth and expect slightly higher margins in 2023.

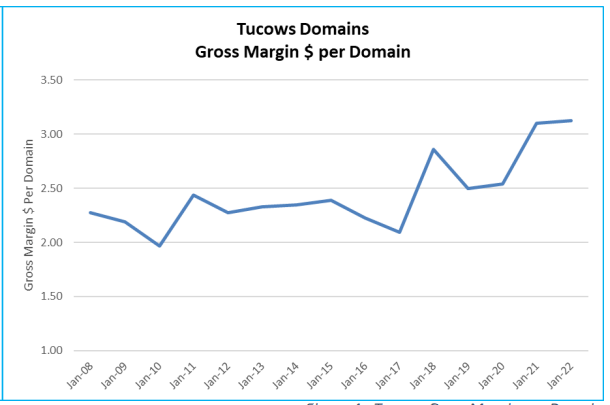

Tucows has historically acquired other domain companies. The gross margin per domain can actually vary fairly significantly, so they tend to keep the high margin domains and get rid of the low margin domains. This obviously blunts overall organic revenue growth but margins per domain continue to trackhigher (see Figure 4 below). The company runs this segment of the business with a focus on high cash returns, and the resulting cashflow to the business has allowed them to historically buyback stock, and more recently invest in high IRR fiber investments. From here, we expect the cashflows from thedomains business to be used to paydown debt and strategically buy back stock.

Figure 3 - Tucows Domain Revenue

Figure 4 - Tucows Gross Margin per Domain

WAVELO

Wavelo is a SaaS platform to handle subscriber management for telecom companies. Technically called a Mobile Service Enabler, it is built to handle all billing, account management, payments, invoicing, and product cataloging, and they reference it as the most robust migration tool on the market. The platform was officially launched last year, and they began onboarding DISH’s almost 8 million customers. This is important to the investment case because as of Q3 2022 they had 1 million subscribers, which grew to 2 million subscribers in Q4 2022, and as of February 2023 sat at 3.2 million subscribers. They expect to be at ~8 million subscribers by the middle of this year, and on their last conference call they stated how they “expect to announce a new customer sometime this year (2023) … we’re getting a lot of interest from all over the world.” This growth may have been delayed but it is now impressive and really becomes impactful this year. Wavelo has now transitioned from cash drag to cashflow and should garner a lot more attention, especially as they start to announce new client wins.

This segment of the business is currently the least impactful financially. That being said, it was the selling of the Ting Mobile business to DISH in 2020 that led to the financials being messy and hard to model.

This then led to the investment phase of building the Wavelo platform. This was a drain on cash at the same time Ting Fiber was investing cash as well. We believe this was the main cause for the recent stock decline.

FIBER

Ting Fiber partners with cities, usually smaller towns outside of metropolitan areas, sending their team in to micro trench fiber internet to the residents. This involves engineering, purchasing materials and equipment, and physically building out the network. Ting then owns the physical infrastructure (usually), and offers reliable full gig fiber internet for $89/month. The need for fast and reliable internet continues to increase. Working from home and virtual meetings have significantly increased bandwidth demand, plus the average number of connected devices is now estimated at 13 per household, pre conversations with representatives from Ting.

We were fortunate enough to be able to see a current Ting fiber buildout in person. Jennifer from Ting was very helpful discussing the marketing strategy and Jason was extremely knowledgeable explaining all aspects of the buildout process.

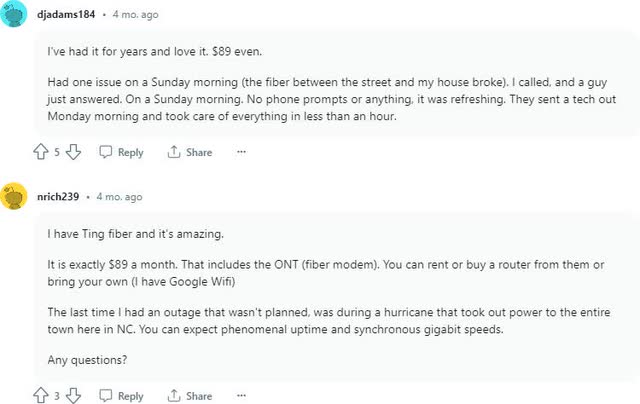

It became very evident how important it is to have a good working relationship with the city. This is a good opportunity to speak to Tucows’ main competitive advantage. In Figure 6 below we have included the first few reviews from Reddit on Ting and as you can see, customers are more than happy with Ting’s service.

Being from Toronto, I think we’re used to poor customer service from our telecom providers and take it as a given. We would suggest sceptics go online and look at employee reviews and customers’ reviews of Tucows and their segments and even give customer service a call.

There is no call routing, long wait times, or frustrating conversations. We have personally dealt with Tucows’ customer service and explaining it as above and beyond is not a hyperbole. This type of service has led to neighbouring towns of Ting Internet Towns requesting their services which significantly reduces the red tape involved. Due to word of mouth, customer acquisition costs are reduced, and lifetime value is increased. Below are the first couple of reviews that come up on Reddit.

Figure 6 - Tucows Reddit Reviews

We still get asked about the connective tissue between Domains and the mobile business, and it all boils down to our competence in billing, provisioning, and customer service for underserved technology markets. – Elliot Noss, CEO

FUNDING

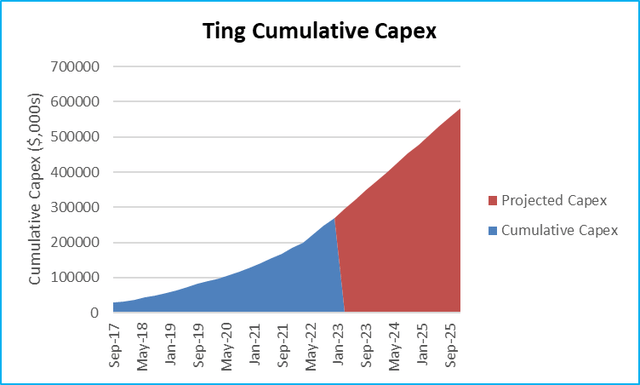

Ting Fiber is run like a utility. There are large up-front costs in exchange for reliable long-term cashflows. Since starting the fiber business over 5 years ago, Tucows has funded the buildout with internally generated capital (cashflow from Tucows Domains). Using their own balance sheet and cashflow was the right strategy at the beginning of the process. They were able to prove out the concept plus they started small and gradually scaled. They have been on a two-year journey for proper funding for this business that will take them to the next level and we’re

now at the culmination of that process. Of all the analysis written in this report, we believe the number one factor that advances this stock higher is the long-term funding of the fiber buildout. We believe this funding announcement is imminent and the main reason for the upcoming and first ever investor day. Plus, securing financing will alleviate the stress on the balance sheet and most importantly provide a real point of reference for how valuable their fiber network really is.

Figure 7 - Ting Cumulative Capital Expenditures

The long-term nature of the investment makes them a good fit for infrastructure funds that have investors such as pension funds. It can be hard for the public markets to follow and value a fiber buildout because the income statement will show negative EBITDA from their fiber business due to the ramping investment, but it doesn’t show the value being created by this investment. We believe the terms of the funding deal will make the value of their fiber infrastructure quite apparent. We have included a list of infrastructure funds in Appendix 1 with some examples of the funding deals that have been announced.

Ting Fiber is the most important segment of Tucows because it offers a long runway for growth, very attractive long-term returns on capital, and they have now invested enough capital in the business to get it to a meaningful scale.

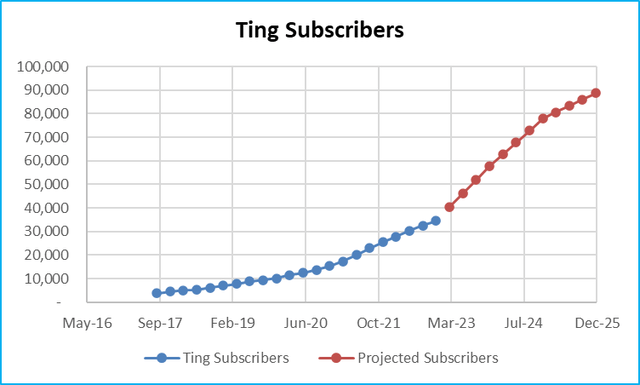

Figure 8 - Ting Subscribers

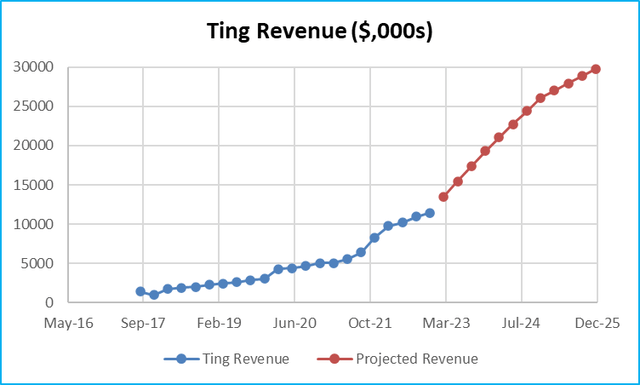

Figure 9 - Ting Revenue

RISKS

Debt

The main risk in our mind is the level of debt on the balance sheet. The company admittedly took on more debt than they wanted to in order to fund the fiber expansion. There was a syndicated loan due in June 2023 that they have recently extended to September 2024. Interest rates have now reached a level where debt costs are real and there are set monthly covenants in place on the current debt.

Management is focused on the debt level, and we believe 2023 is the year they start to pay back debt. With more cashflow from both Domains and Wavelo in 2023, and management’s commentary that they have already started to pay off debt in March 2023, we believe this risk subsides over the rest of the year.

Fiber

Fiber internet builds rely on equipment, materials, and labour. They faced supply chain issues, wage inflation, and employment supply issues. After visiting them on location, they admit these were issues but that they have mostly subsided. They made a lot of inventory purchases upfront to fight against the supply chain, but these risks are always present.

Domains

The Domains business is mature, and the main risk is on pricing power. Revenue and gross margin dollars per domain are still improving but margins and growth in this business should be continually monitored.

Wavelo

As a start-up, there are the obvious start-up risks like technology, market fit, and customer concentration. It appears like they are now integrating and scaling after taking a bit longer than expected to build out the platform.

VALUATION

To value the business, we have elected to use a sum of the parts analysis. The company has reorganized so that the parent company is now a holding company with each business line being a separate corp. It also makes sense to value each business unit independently because of the differences in growth, scale, profitability, and capital needs.

Domains

This segment is the most straightforward to value. EBITDA is reliable and stable, and management has guided toward $45m in EBITDA for 20232. This business has typically traded at 14x EBITDA (GoDaddy on 15x trailing EBITDA).

$45m EBITDA X 14 = $630m

Wavelo

Even though it is a SaaS start-up, it is projected to do $30m in revenue and $4m in EBITDA2. The company most likely deserves a high multiple based on the growth rate and profitability. We are going to be conservative on the multiple until they announce a new customer win.

$4m EBITDA X 10 = $45m

Ting

Before valuing Ting, we want to highlight that Ting is opting to build the more expensive, higher quality backbone for their fiber. They have a high rate of capex per passed address, but also have high rates of penetration and subscriber ramp. This leads to Ting having the best unit economics and deserving a premium valuation. The current market suggests that a customer on a fiber network is worth between $8-12k (see various deals in Appendix 2). This obviously varies with subscriber prices paid and retention rates. For our valuation analysis below, we value a customer at $10k. Ting charges $89/month for unlimited home gigabit internet. More reliable being fiber and even more reliable being buried fiber versus hung fiber. One could argue that their customers are worth more because their customer satisfaction is extremely high, and customers are more sticky.

Q1 2023 Subscriber 37,500 X $10k per subscriber = $375m

This valuation gets even more interesting because a majority of the cities are still under construction. An address is not serviceable until the last part of the access network is complete. Meaning there is a lot of investment that is made in advance of signing an actual subscriber. Tucows has spent over $270m in capex. This capex spend has significant value as it is necessary to establish the backbone for the overall network and subscribers are about to ramp accordingly. Based on a base case penetration of 50% and current observed gross margin per customer, we estimate a 10-year IRR of 23% on per capex dollar spent. Working backwards, we value the rest of the buildout at an NPV of $295m.

DKAM's Tucows Valuation

| Business Line | Valuation |

| Domains | $630m |

| Wavelo | $45m |

| Ting Subscribers | $375m |

| Ting Infrastructure | $295m |

| | $1,345m |

| | |

| Net Debt | -$305m |

| Preferred Equity | -$200m |

| Total Equity Value | $850m |

| Shares1 | 10.8m |

| Value per Share (USD) | $78 |

| Value per Share (CAD) | $105 |

CONCLUSION

The operations and financials of Tucows are at the “Pivot Point” across all three business lines. The “transition phase” is now coming to a close. We believe the company is set to go back to being valued like the compounder it is.