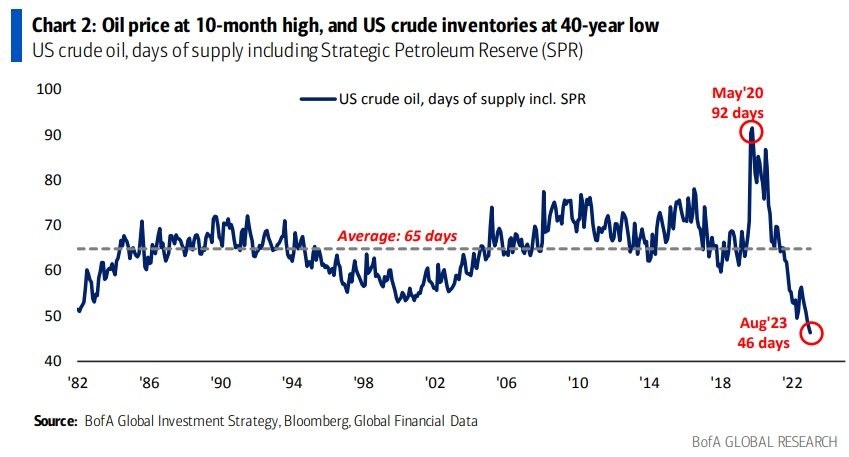

Crude Inventories: Another way of looking at itCrude days of supply is a figure based on how long will the current supply last at the current demand rate.

It is arguable whether this metric is as important as it was back in the 70's, where the US relied more on imports from the ME, and did not have as much domestic light oil production as they have today, including the reliability of today's Canadian imports.

A similar situation exists when someone retires, the kids are gone, and they are set up with a stable pension with a payment every month. Savings in the bank is not that important to have anymore.

That aside, by looking at the historical data, we can see just how far and how fast the US has rapidly depleted their crude stocks, even with current perceived low demand.

Oil prices are at a 10 month high, while crude inventories are at a 40 year low.

Now, at the same time, gasoline, diesel and heating oil inventories are also at very low levels.

Poor energy policy has contributed with the SPR drain, and restricting new and existing supply. Meanwhile demand has not fallen off a cliff, but is still strong domestically and increasing globally.

As new supply is not coming online, we had better hope that the US recession and depression comes along right away along with all those multi millions of new EVs to kill off demand, or at least another pandemic in order to at least stop the freefall shown on this chart.

Got oil?