Company Profile

BTE is a Canadian based E&P with operations in both the U.S. and Canada. The company is primary focused on light and heavy oil.

In Canada, the company owns 710,00 net acres in the Peace River, Peavine, and Lloydminster basins where it is focused on heavy oil production. These assets are expected to have about 37,000 boe/d production in the second half of 2023, with 95% of that liquids. The area has 142 MMboe of 2P Reserves and about 900 drilling locations.

BTE also has another 440,000 net acres of light oil production in the Viking and Duvernay plays. These assets are expected to have approximately 21,000 boe/d production in the second half of 2023, with a liquids percentage of 87%. The area has 101 MMboe of 2P Reserves and about 1,600 drilling locations.

In the U.S. the company has 182,000 net acres in the Eagle Ford with expected second half production of 92,000 boe/d of which 82% is liquids. It has about 900 drilling locations with 2P reserves of 440 MMboe.

Opportunities & Risks

With a non-operating position in the Karnes Trough portion of the Eagle Ford, conventional wisdom may have been that BTE would have looked to sell the asset to focus on its Canadian properties. Given that investors have been pushing the company to focus on shareholder returns, such as dividends and buybacks, this seemed the most likely move.

Instead, the company decided to double down on the Eagle Ford, recently closing a deal to acquire Ranger on June 20th. With Ranger, BTE added 162,000 net acres in the Eagle Ford, with production of around 70,000 boe/d. Ranger shareholders received 7.49 BTE shares and $13.31 in cash in the deal. That valued the acquisition at around $2.4 billion, including the assumption of debt. The deal represented a modest 7% premium.

With the deal, the Eagle Ford will become BTE’s biggest basin, representing about 60% of its production. The company sees the basin having 12-15 years of sustainable development, with modest production growth coming for 50-55 net wells coming online each year. It will spend $440 million bringing 32 wells online in the Eagle Ford in the second half of this year.

With the deal, BTE also laid out a capital allocation program. After the deal, its net debt moved up to C$2.6 billion (or C$2.8 billion including working capital). Until debt is reduced to C$1.5 billion, the company plans to use 50% of its adjusted funds flow towards debt repayments and the rest towards dividends and buybacks. Once debt is below C$1.5 billion, 75% of adjusted funds flows will be directed towards buybacks and dividends.

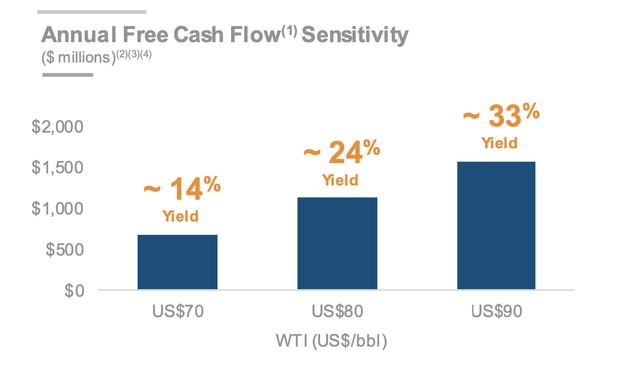

At $75 WTI, BTE expects about C$1 billion ($730 million) in free cash flow, while at $90 it's close to C$1.5 billion ($1.1 billion). WTI is currently trading at over $87. At current oil prices, BTE should be able to get to its C$1.5 billion net debt target pretty quickly.

Company Presentation

The company also initiated a modest 9-cent CAD (6.5 cents USD) annual dividend. That equates to about 1.6% yield.

On its Q1 earnings call discussing the pending acquisition, CEO Eric Greager said:

"The transaction materially increases our Eagle Ford scale, while building a quality operating capability in the premier Texas Gulf Coast basin. We believe the combined company will deliver a powerful combination of substantial free cash flow and increase shareholder returns on a per share basis. Importantly, on a pro forma basis, we will be in a strong financial position that is supported by significant liquidity and a balanced note maturity profile."

Of course, one of the biggest risks with any oil company is the price of oil. I’ve noted in other articles that I’m overall bullish on oil prices due to a number of factors, including that OPEC+ appears to be on the same page, China re-opening, a depleted U.S. strategic petroleum reserve that needs to be re-filled, and years of oil majors underinvesting in the sector. However, prices can move quickly lower if there is a bad recession or based on other geopolitical factors.

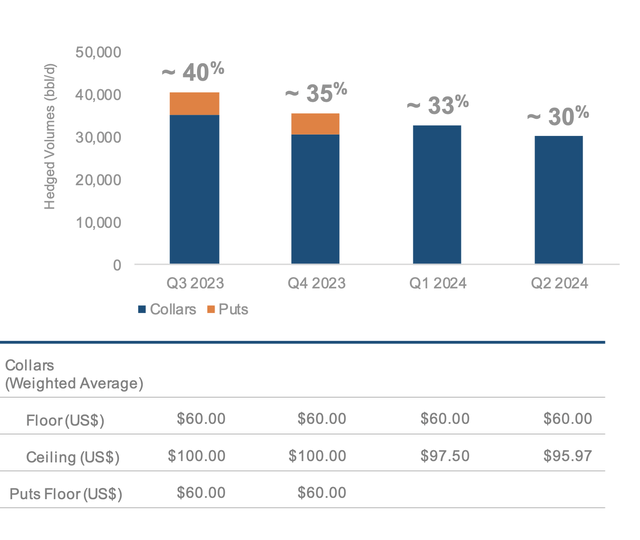

For its part, BTE does run an active hedge program, where over the next year it has floor prices of $60 on oil and a ceiling of $95 or above for over 30% of its oil production. The company estimates that a $5 change in WTI can impact its annual adjusted funds flows by $218 million. A 50-cent change in natural gas only has a $15 million impact.

Company Presentation

Being a Canadian company whose stock trades in the U.S., U.S. investors also face currency risk. A weak Canadian dollar can eat into the returns of U.S. even if the company performs well.

Meanwhile, while the Ranger deal adds a lot of scale in the Eagle Ford for BTE, the synergies from the deal could be more modest. Obviously, it will reduce corporate costs, but since its legacy Eagle Ford acreage was non-operated, operation synergies may be limited.

The company’s Canadian assets, meanwhile, face differential risk, as Western Canadian Select generally trades at a discount to WTI and that discount can move around. The company currently expects a $17.50 differential in its assumptions. Extreme weather and events such as wildfires can also cause temporary issues that hurt production as well. BTE had to curtail 20,000 boe/d of production in May due to Alberta wildfires.

Valuation

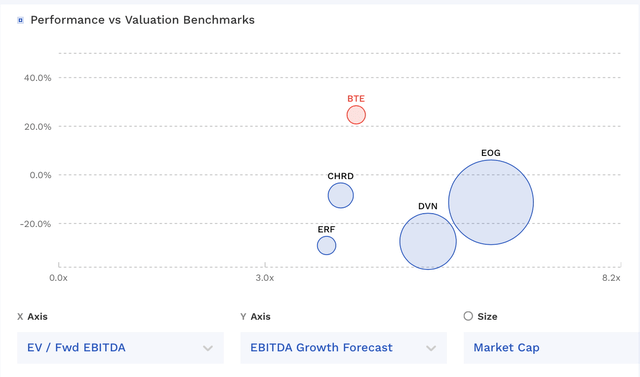

BTE trades at 3.2x EBITDA based on 2024 analyst estimates of $1.76 billion. Based on the 2025 consensus of $1.84 billion, the stock trades at a 3.0x multiple. Of course, the price of oil and natural gas can change the actual results immensely.

BTE is valued in the low-end of the pack compared to other independent E&Ps.

BTE Valuation Vs Peers (FinBox)

Conclusion

BTE made a nice move acquiring Ranger and should be able to quickly reduce debt and deleverage at current oil prices. This dynamic should give the stock a little more upside juice in the current price environment.

If the company can reduce debt by $630 million over the next 12 months, and you put an under 4.5x EV/EBITDA on the 2025 consensus from there, you can get around an $8 stock. At $85 oil prices, the company should be able to generate about $425 million in free cash flow over the next six months.

While oil prices need to remain solid, that’s a lot of potential upside for the stock from current levels with just minimal multiple expansion. As such, I’m going to start the stock with a “Strong Buy” rating.