AlbertPego

Note: All amounts discussed are in Canadian dollars.

In investing, buying into the bull case is easy. After all, there are always a lot of slides that encourage you to do so. Analysts by default, lean bullish. If you look at most comments on articles, they are also there in support of the company. But if everything does not line up, it is ok to stay out. We did the same in the case of Artis REIT (TSX:AX.UN:CA) on our last couple of articles, despite some extremely deep value surfacing.

This was our logic in February of this year.

The company will still have challenges as the weighted average debt maturity even after this recent extension is about 2 years. Rents remain strong for now but we think a recession will test the company's mettle. Debt to EBITDA was still over 9.0X and we just cannot pull the trigger.

Source: 6.4% Yield With A 50% Discount To NAV

And here is what we said in July.

The consensus NAV is closer to $13 with one brave soul thinking this is actually worth $16.80. We think there is likely more pain ahead as Artis tries to address the ultra-short debt maturity schedule. We are staying out.

Source: Now 8.5% Yield And 60% Discount To NAV

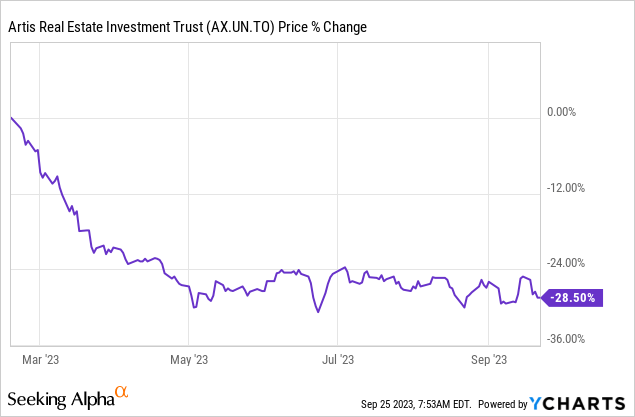

The REIT did not make us regret our stance.

Data by YCharts

Data by YCharts Well in defense of the REIT, absolutely no company in this sector has made anyone regret staying out in 2023. But the company did throw in a new wrinkle in the smooth investing case.

Artis also announced that its Board of Trustees (the “Board”) has established a Special Committee to initiate a strategic review process to consider and evaluate strategic alternatives that may be available to the REIT to unlock and maximize value for unitholders.

Source: Artis Press Release

If you got Deja vu from that, you are not alone. We had a special committee formed to explore strategic alternatives in May 2019. Well, still, let's look at the Q2-2023 results and see if we can delineate a value creation pathway.

Q2-2023

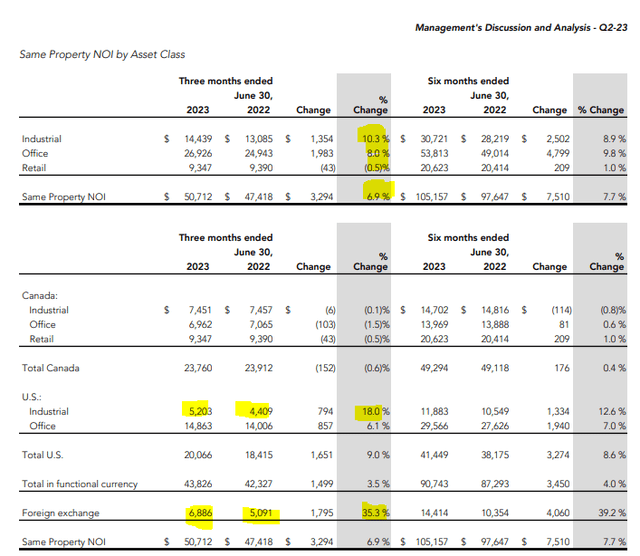

Q2-2023 results were quite strong from a net operating income (NOI) perspective, with same property NOI up almost 7%.

Q2-2023 Financial Statements

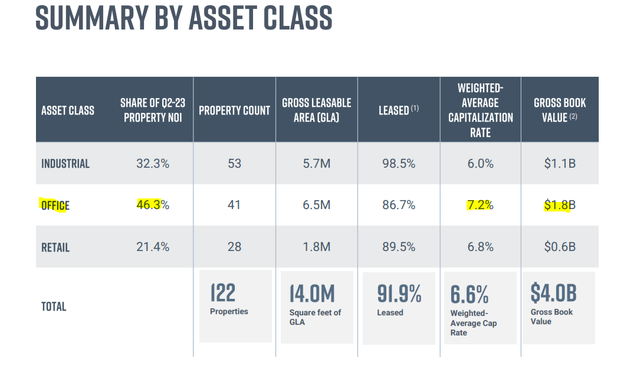

If you wanted to give one of the three segments credit, you did not have to parse through very hard. Industrial was the clear leader with the US side showing same property NOI growth of 18%. Office was not too shabby with an overall increase of 8%. What drove this strong increase in NOI?

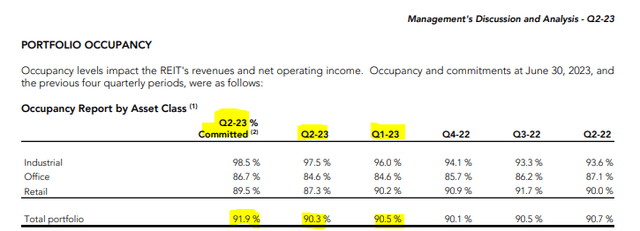

It wasn't the occupancy levels, though it was nice to see committed occupancy tick up a bit, even in the office sector.

Q2-2023 Financial Statements

It was the rent increases and the foreign exchange.

Renewals that commenced in the quarter were renewed at a weighted-average increase of 4.6% – the tenth consecutive quarter of growth in renewal rents and a clear reflection of the strong demand for high-quality, well-located space across all three asset classes.

Source: Artis Press Release

The weaker Canadian dollar added a lot of extra oomph to the results. This is similar to what we saw for H&R REIT (OTCPK:HRUFF), (HR.UN:CA).

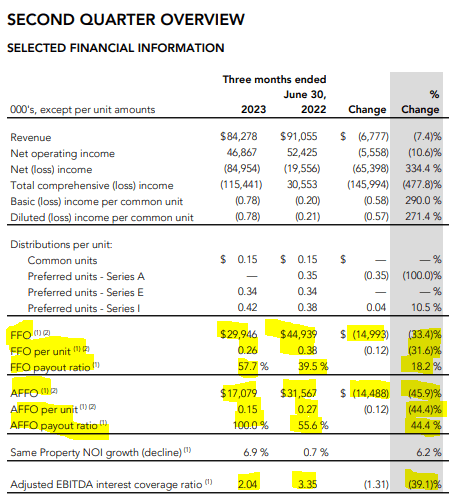

So that was a strong start, but it gets a lot stranger after that if you have not been following the company. Total funds from operations (FFO) were down 33%. FFO payout ratio bumped up to 57.7%.

Q2-2023 Financial Statements

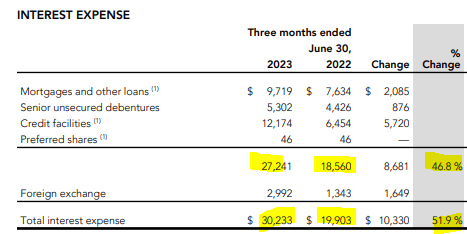

Normally, you would expect NOI gains to be amplified in the same direction when you reach the FFO. Obviously, here we went in the other direction. Adjusted FFO (AFFO) was even worse with a 45% drop and the payout ratio ballooned to 100%. What happened? Well, we have been harping about Artis having risked everything by going for an extremely short debt maturity profile. It turns out we were right. Interest expenses are going vertical.

Q2-2023 Financial Statements

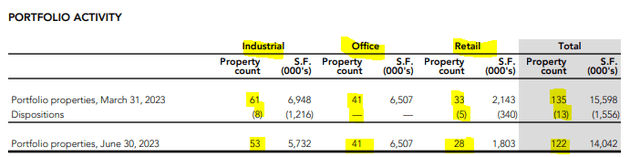

Artis did unlock a lot of liquidity with 13 property sales during the quarter.

Q2-2023 Financial Statements

None of these sales were in the office sector though.

Outlook

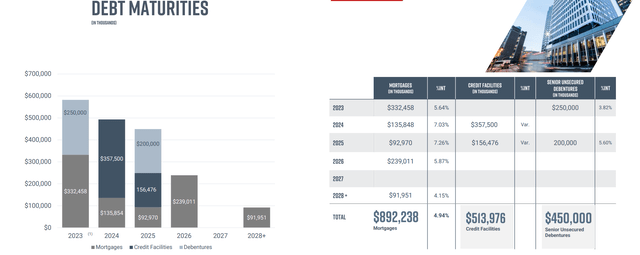

Despite some aggressive paydowns and extensions, the debt maturity profile still looks incredibly short.

Q2-2023 Presentation

The good part is that the interest rate damage has now been fully felt. The asset sales are also helping and targeting the highest cost debt (after attached mortgages) where feasible.

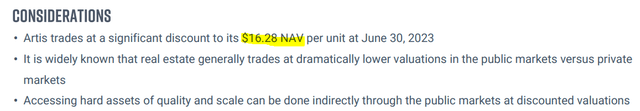

The bull case rests on the NAV of $16.28.

Q2-2023 Presentation

The bear counter is that the cap rates on office remain unrealistic.

Q2-2023 Presentation

Even the big asset sales in the last quarter completely dodged the office sector. So Artis was not able to unload a single property, or perhaps chose not to. Whatever the logic, the end result is that this increases the relative weighting of the REIT's square footage dedicated to office and that in turn likely makes the market discount the NAV even further. But let us run some math here to see what the NAV might be.

On a distressed level, we could see a worst case of around a 10% cap rate on office. This is extremely unlikely but let us run with that. So if you blow out the cap rate that far, your $1.8 billion gross book value becomes $1.3 billion. Your total gross book value drops to $3.5 billion. In some individual cases, the drop in values would be buffered by the property level debt. Artis can just hand the keys back to the lender. But let us ignore that and stick with the numbers above.

That drop from $4.0 billion to $3.5 billion does not look so scary, but remember that the debt and preferred equity remain fixed, so common equity takes a bigger hit. Total debt is $1.8 billion and preferred equity is close to $200 million. So common equity valuation drops to $1.5 billion (with the 10% office cap rate) and that gets you to a NAV of about $13.30 (with about 113 million units outstanding). It is hard to argue with those numbers, especially as Artis has shown the ability to unload industrial and retail properties at or above IFRS values. This all suggests that there might be some value here for the investor ready to go in with a longer term outlook. Artis is looking at alternatives here but there really is none outside of selling some office properties at good values to show that the market is wrong.

A great defensive way to play this would be the recently reset Artis Preferreds. The Series E (TSX:AX.PR.E:CA) were just reset at 7.198% per annum. The reset is effective from October 1, 2023. That was based on a Government of Canada 5-year bond yield of 3.898% at the time plus 3.3%. At the current price of $17.00, these yield 10.58%. We think the NAV has plenty of buffer for these and they might be the safest way that you can wade into these waters.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.