A potential cost cutting measure

Ernest Cleave annual compensation = ~C$1.3M in 2022 (a 4% increase over 2021).

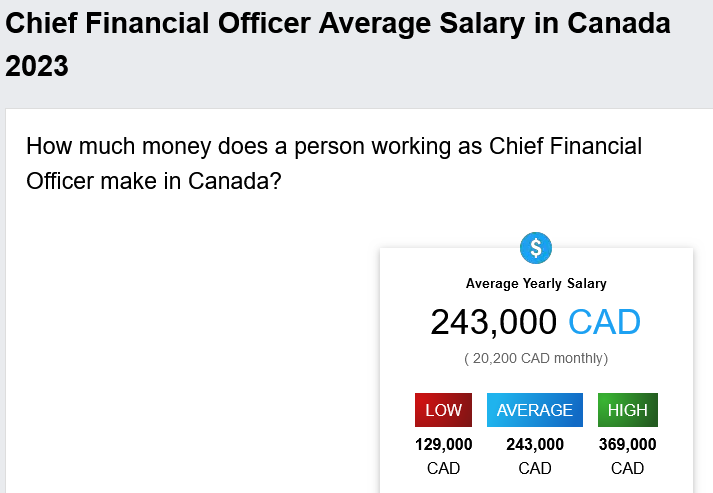

In 2022 his base salary = C$460K which is ~2x the CFO average salary in Canada.

Why are we paying that much money for a bean counter? Bean counters are a dime a dozen.

What added value has Cleave brought to Largo for the company to make him a millionaire?

About 90% of Largo's value have been destroyed in the past 2 years. What was his role during the disaster? What did Cleave do to help the company recover? Why has management failed to deliver on their promises under his tenure as CFO, the highest executive role after CEO? Why has he not been held accountable for his failure to create shareholder value?

https://www.salaryexplorer.com/average-salary-wage-comparison-canada-chief-financial-officer-c38j6256

My 2 cts