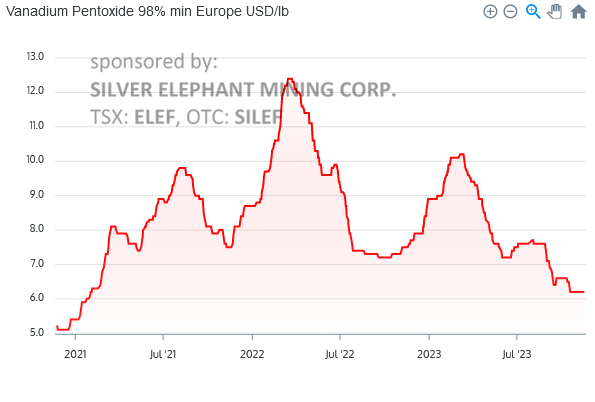

Sales prices vs Net Income (Loss) Largo financial health should align with the prices of Vanadium. The higher the Vanadium prices the better for Largo. The following table shows the correlation between Largo sale prices, revenue and net income (loss) from 2021 to Q3-23. It indicates that since Q1-22, Largo would suffer a Net Loss if its sale price = US$9.91/lb or lower. That has never happened before in the history of Largo as a producing mine. The price of US$9.91/lb is considered as "high" for the standard V2O5. What is more troubling is the fact that the standard Euro V2O5 is currently traded well below US$7/lb according to vanadiumprice.com (see chart below).

US$

| Period | Sale Prices per pound | Revenue | Net Income (Loss) | % Net Income to Revenue |

| Q1-21 | $8.67 | $40M | $4M | 10% |

| Q2-21 | $11.69 | $54M | $8M | 15% |

| Q3-21 | $9.10 | $54M | $9M | 17% |

| Q4-21 | $7.88 | $50M | $1M | 2% |

| Q1-22 | $8.67 | $43M | ($2M) | Loss |

| Q2-22 | $10.47 | $85M | $18M | 21% |

| Q3-22 | $9.91 | $54M | ($2M) | Loss |

| Q4-22 | $7.77 | $48M | ($16M) | Loss |

| Q1-23 | $9.14 | $57M | ($1M) | Loss |

| Q2-23 | $9.42 | $53M | ($6M) | Loss |

| Q3-23 | $8.34 | $44M | ($11M) | Loss |