copper fundamentals Driven by concerns of an impending global recession, copper sentiment remained bearish during the second quarter. On the other hand, copper’s short-term fundamentals became increasingly bullish. Mine supply disappointed again in the first four months of 2023, according to the World Bureau of Metal Statistics (WBMS). Chilean production continues to be particularly problematic. For the first four months of the year, Chilean mine supply fell by nearly 2% compared to last year. Codelco warned that production could hit the lowest level in twenty-five years. In June, Andr Sougarret abruptly resigned as Codelco’s Chief Executive Officer after only one year on the job. Mr. Sougarret cited the numerous “complexities” facing the Chilean copper mines. Chile supplies almost one-quarter of all copper production and, in past letters, we have discussed the issues plaguing their copper industry; in particular, declining ore grades, water shortages, labor issues, and uncertain fiscal regimes all negatively impacted production. Unfortunately, we do not expect any of these issues to improve going forward. Global copper mine supply contracted by 0.2% in the first four months of 2023 compared to last year, driven by disappointments in Chile.

Meanwhile, global copper demand remained robust in both OECD and non-OECD countries. For the first four months of 2023, OECD copper demand increased by a robust 3.7%. Despite countless bearish articles in the financial press, Chinese copper demand continues to surge, with refined demand rising by 8% year-on-year. While China always dominates the headlines, we believe the pivotal element of Asian copper demand is India. We first wrote in 2018 that Indian copper demand was set to surge, very similar to China in 1999-2000. Even though few analysts have paid any attention, India’s copper consumption grew by almost 30% during the first four months of 2023 compared to last year. Global consumption in aggregate has surged 6% so far this year. Strong demand and weak mine supply continue to drive inventories to near all-time lows.

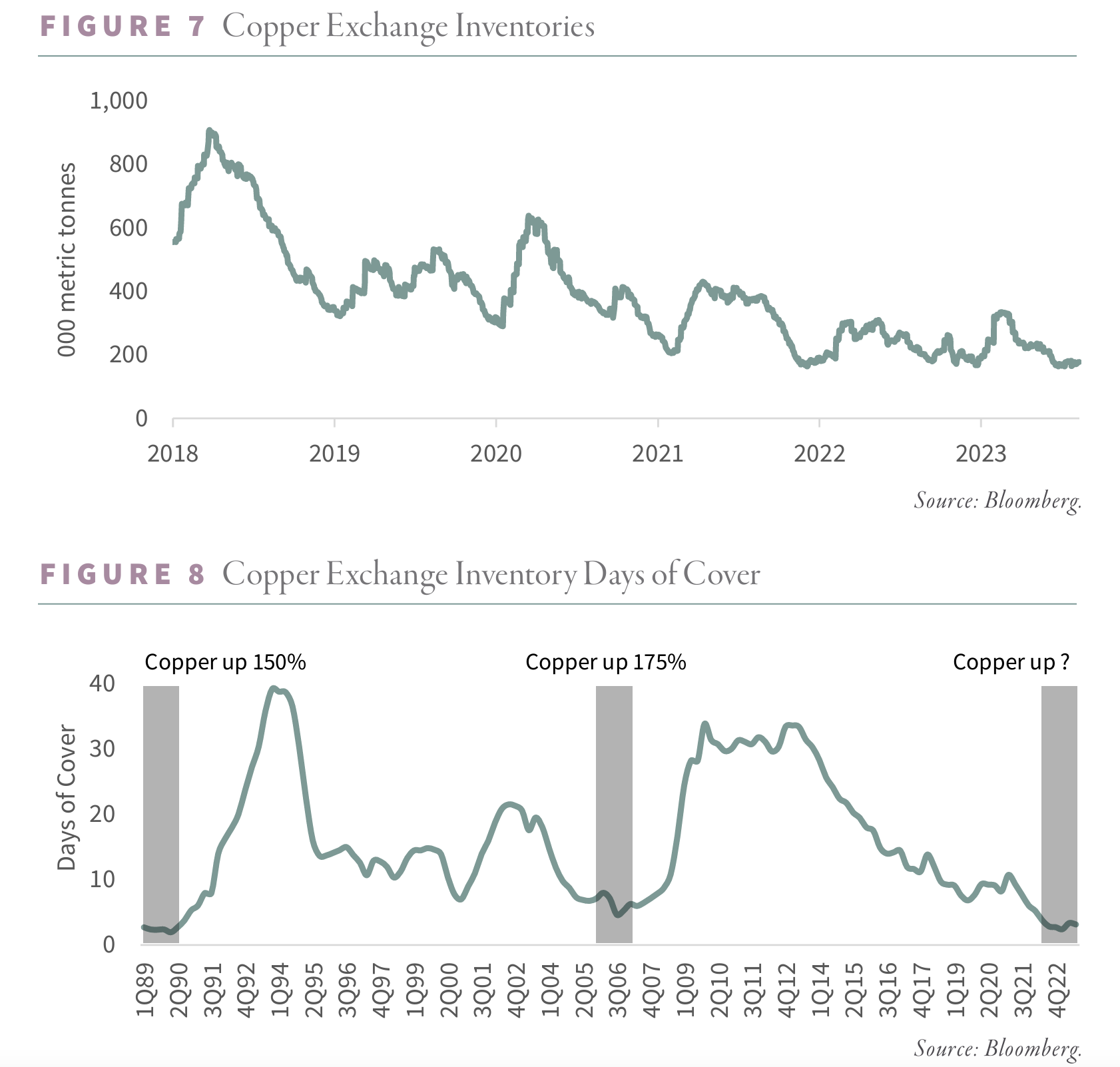

Exchange inventories on the Shanghai, London Metal Exchange (LME) and COMEX fell from a high of 900,000 tonnes reached in 2018 to only 170,000 tonnes today. Although inventories are twice as high as the all-time low of 75,000 tonnes reached in 2005, production has grown by nearly 60% over that time. As a result, when measured in days of consumption, exchange inventories are almost as low as in 2005.

Given the low exchange inventories and the bullish supply/demand trends, we believe speculators will soon panic much as they did back at the end of 2005 into 2006. Low inventories, combined with massive short covering, spiked copper prices higher by almost 200% in just six months. We are now potentially set up for a recurrence of that 2005-2006 copper price spike.

Although we remain concerned about the universally bullish outlook adopted by the global metal analytic and investment community—a topic discussed in last quarter’s letter—we believe the rapidly tightening underlying fundamentals will push copper prices significantly higher in the next six to twelve months. For those investors that have exited their copper investments on global recessionary fears, we believe the copper’s weakness in the second quarter has given investors another excellent opportunity to increase their exposure.